{{item.title}}

{{item.text}}

{{item.text}}

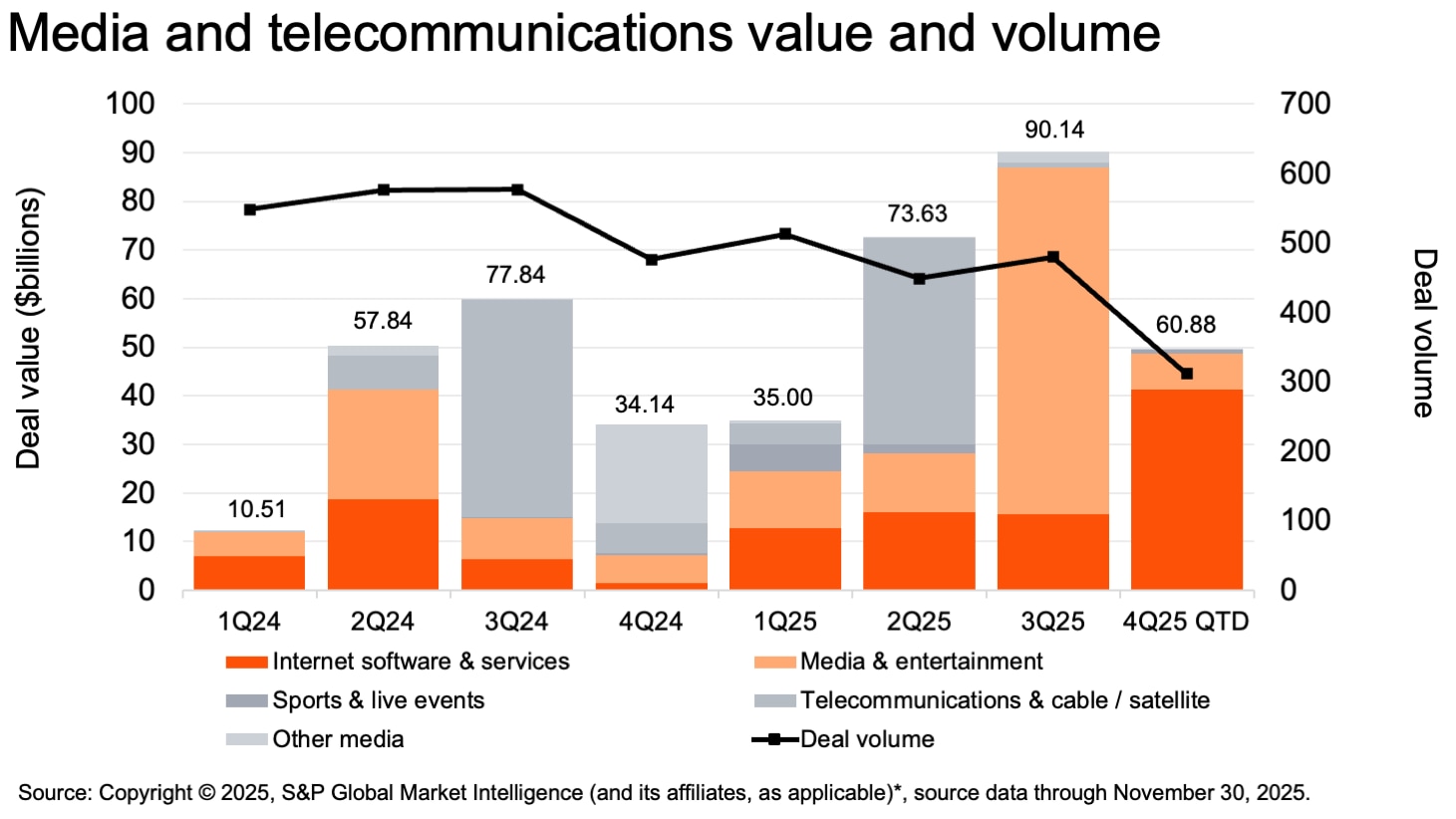

For media and telecommunications M&A, the past six months have been characterized by headline-grabbing megadeals, increased consolidation within streaming, and a pronounced shift toward profitability and scale—underscoring a renewed confidence among both strategic and financial buyers in deploying capital. Sector M&A activity saw a marked uptick in the second half of 2025, driven by more favorable financing conditions, strategic portfolio realignments, and a rejuvenated investor appetite for premium intellectual property.

A streaming megadeal is reshaping the industry. Netflix’s announced acquisition of Warner Bros. Discovery, valued at $82.7 billion total enterprise value, marks the largest streaming transaction to date and a defining moment for the sector. Add to that Paramount Skydance’s sweetened offer and as of the date of this report, you have all the ingredients for a protracted battle over one of the most storied studios in Hollywood.

Gaming is solidifying its place as a core pillar of the entertainment ecosystem. The $55 billion take-private of Electronic Arts by PIF, Silver Lake, and Affinity Partners underscored investor confidence in scalable gaming intellectual property and recurring digital revenue streams. Beyond this landmark transaction, deal activity is broadening across mid-market studios, AI-driven development platforms, and esports ecosystems. Collectively, these developments highlight how interactive entertainment has risen to stand alongside film, sports, and streaming as a principal force in driving engagement, monetization, and M&A momentum.

Sports valuations are surging across the ecosystem. Capital continues to flow into the sports value chain, from team ownership and stadium assets to media rights and women’s leagues, as investors pursue durable, fan-driven returns. The $10 billion Los Angeles Lakers sale set a new benchmark, reinforcing that sports intellectual property (IP), live rights, and venue infrastructure now sit at the intersection of media, entertainment, and private capital.

Telecom M&A is gaining momentum around network scale and capital efficiency. Operators are pursuing fiber carve-outs, tower divestitures, and regional consolidation to fund 5G and AI-driven upgrades. AT&T’s $5.75 billion acquisition of Lumen’s mass-market fiber business, covering about 1 million existing and 7 million planned locations, exemplifies this trend. The deal, expected to close in early 2026, reflects the industry’s focus on capital recycling, asset monetization, and partnership-driven expansion to meet surging connectivity demand.

After years of expansion, the streaming market is decisively shifting toward scale and sustainability. Netflix’s acquisition of Warner Bros. Discovery confirms that the stand-alone platform era is ending, with scale becoming the primary determinant of competitiveness. An $82.7 billion price tag sets a fresh high-water mark for streaming valuations and redefines what “strategic premium” means for content libraries and global distribution footprints. The landmark transaction also spurs a new wave of portfolio rationalization and puts pressure on other players to streamline operations, shed non-core assets, and secure partnerships for content, distribution, and technology.

For dealmakers, this moment signals the need to prepare for a significant market realignment once the transaction sets a new valuation benchmark. Companies should begin identifying opportunities for bundling and cross-platform partnerships that can strengthen margins and improve subscriber retention. At the same time, they should consider divesting underperforming linear or regional assets to unlock capital for investments in premium IP or complementary platform extensions, such as video games. These moves can help solidify platforms as “must-have” destinations, driving higher average revenue per user (ARPU) and reducing churn.

Consistent with our past recommendations, media organizations should also explore creative deal structures—including minority stakes, joint ventures, and content-sharing alliances—to secure access to essential assets and technologies without overextending their balance sheets. These strategies are also key for telecommunications as we expect M&A activity there to focus on consolidation and infrastructure buildout, as companies pursue joint ventures, long-term leases, and vertical integration to secure critical compute and power capacity needed for AI and data-driven growth.

“We’ve been expecting streaming consolidation for several years at this point––and now our prediction is finally coming to fruition.”

Bart Spiegel,Partner, Media & Entertainment, PwC USThe adage that “content is king” continues to assert itself even in the most recent of times. Whether it's content libraries, video games, or even sports assets, we continue to see capital invested in vehicles that own this IP and can monetize it across the flywheel. For telecommunications organizations, the path forward is defined by strategic consolidation, network modernization, and innovative partnerships—enabling operators to unlock capital, scale infrastructure for AI-driven growth, and meet surging connectivity demands in an increasingly digital economy. With a favorable M&A backdrop to 2026, we’re expecting a robust M&A market that should outpace the last several years.

{{item.text}}

{{item.text}}

Lori Driscoll

Technology, Media and Telecommunications US and Global Consulting Leader, PwC US