A simpler way to see ahead

Sightline

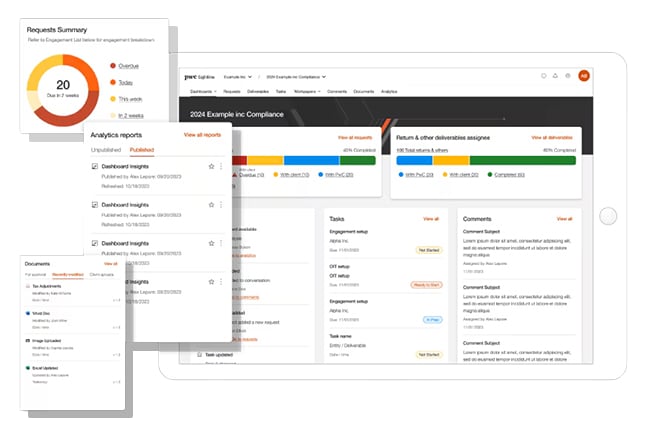

One globally connected tax technology platform

Working with PwC on your tax priorities has never been easier. Sightline seamlessly connects multiple tax workstreams in one intuitive platform to help simplify your process and supercharge your client experience.

Sightline helps you and your PwC tax team uncover more opportunities across your tax footprint — while laying the tech foundation for continuous growth. As a global platform, it brings together connected tools and a collaborative space for teams worldwide.

Get a centralized, end-to-end view of your entire tax process — with secure data transfer, real-time insights and effortless document sharing. Collaborate without email, stay connected to your deliverables and rely on a platform that evolves with your needs.

Sightline: collaboration during the tax process has never

Smart features to help empower your team

Work smarter with AI

We continuously evolve Sightline so you can work smarter. With AI features that can help you analyze and compare documents, identify potentially at-risk tax filings, understand global tax law and regulations, or get real-time technology assistance, Sightline helps keep you ahead with the latest tech developments.

Our multi-AI agent architecture will identify the right agent for job and then help you with next steps through actions like sending you an email summary of your analysis or keeping you as the human in the loop to approve suggested actions like approve suggested actions like sending you an email summary of your analysis.

Visibility across your tax workstreams

Sightline offers one seamless interface for local and global workstreams — creating a fully connected experience. Its centralized dashboard gives you real-time visibility into engagement status, requests, and deliverables. With a clear audit trail of every query, response, and document, we stay aligned with your team to boost productivity and focus on what matters.

Work your way with flexible collaboration

In-platform communication helps reduce email volume and prevents critical detail loss. Collaborate directly in Sightline or take advantage of several innovative tools that offer options for how you want to work. For added ease, take advantage of Sightline’s collaboration with SharePoint to help streamline document uploading and management. Sightline’s integration with Microsoft Teams further enhances communication and provides key tools and functionality within the Teams environment. Stay informed and take action on your tax priorities on your terms, from your desired location.

Drive to the leading edge

Our strategic alliances with industry-leading technology firms enhance Sightline by integrating advanced tools in data analytics, AI and automation. These strategic alliances enable Sightline to remain innovative, offering stronger and more efficient tax solutions with improved data efficiency and deeper insights so you can make more informed decisions and enhance your tax strategies.

Value through connected tax data

In addition to streamlining and centralizing the management of tax engagements, Sightline serves as a hub that integrates a wide range of PwC capabilities — enhancing the entire engagement lifecycle from data intake to final delivery.

...elevates your tax processes into a tax strategy

- Gather data

- Transform data

- Activate data

- Insights anywhere

Gather data

Pull your data only once. Sightline’s flexible data acquisition tool can connect directly to your systems and adapt to structured and unstructured data environments. Once transformed into a common model, we can reuse your data across engagements to help reduce manual effort, increase efficiency and create more value through our services.

Transform data

We standardize and enrich your data through a common data model, making it accessible across your entire tax process. With a secure, cloud-based environment, your data becomes reusable, driving consistency and efficiency.

Activate data

Sightline performs complex analysis and computations to automate the reporting and planning experience. Sightline is also continually evolving with tax legislation to meet your needs today and in the future. Model for Pillar Two and manage tax controversy all in one platform.

Insights anywhere

Explore and interact with your data with insightful reports that can highlight what matters to your business. Utilize predicative analytics enabled by AI, choose from a thorough library of dashboards or work with your PwC team to define custom reports to help meet your needs. Identify trends, risks and opportunities from data that already exists in Sightline.

On the move? Sightline meets you where you work and is integrated with Microsoft Teams. Results, insights and analytics are customized to your needs and delivered in a user experience that fits your working style.

Sightline for Microsoft Teams

PwC brings the power of Sightline to Microsoft Teams, helping to provide seamless visibility and real time collaboration. Share files, respond to requests, see the status of deliverables (and much more!) directly in the Teams interface.

Major topics shaping the tax executive’s agenda

For today’s tax executive, the only certainty is the need to proactively manage a changing tax policy world. In 2025, key individual provisions of the Tax Cuts and Jobs Act (TCJA) of 2017 expire, and changing TCJA international provisions could result in US corporate and individual tax increases. Pillar Two, an expected uptick in controversy and mounting compliance demands will further pressure tax teams with insufficient bench strength. But these evolving issues also create an opportunity for you to expand your C-suite influence by demonstrating how tax factors into business decisions, from tariffs to credits and incentives to private equity and M&A.