An inspiring vision of the future of US hospitals and health systems

The future of providers: Empowering care, elevating outcomes

Reasons to believe: Four forces driving a new future

US healthcare is experiencing a profound transformation. Many providers are facing a future shaped by rapid technological and medical innovation, evolving consumer expectations, and persistent economic pressure. The central question for providers is shifting from “How do I maintain my target margin?” to “How do I thrive in a future that looks nothing like the labor-and infrastructure-intensive world I know today?” Exhausted from years of survival mode, many industry-leading organizations are reframing these challenges as opportunities to thoughtfully build a better system for patients, employees, and partners.

Force #1: Technological innovation: AI has flipped from something providers viewed as a compelling idea with questionable ROI to a genuinely transformative innovation with potential to help transform clinical and administrative operations. AI’s impact on providers is typically modest but growing rapidly. The infusion of AI is helping streamline revenue cycle processes and enable more precise coding and billing. Reducing administrative burdens and earning praise from clinicians, ambient listening is considered a key capability. New technologies are connecting patients and families to care and information, laying out the foundation for a more integrated health ecosystem. As AI-powered intelligence advances, providers will likely see greater precision, faster diagnoses, and improved outcomes. Providers are grappling with how best to govern AI (and not whether to embrace it), balance citizen-led innovation and top-down enterprise governance to help manage risk and data sharing.

Force #2: Medical innovation: Breakthroughs in AI-powered drug discovery, genomic risk scoring, and predictive biomarkers are helping to accelerate development of therapies that can treat—and even cure—conditions once considered untreatable. Pharma companies are evolving from medicine makers to lifespan partners that use data, digital health tools, and real-world evidence to deliver personalized, preventive care. Wearables, biosensors, and digital twins can enable continuous patient monitoring and adaptive treatment plans. Intelligent clinical trials and hyper-efficient operating models help compress time from discovery to market delivery. Providers should have tight collaboration with pharma and medtech companies as the industry topples siloes between subsectors.

Force #3: Consumerism: According to PwC’s 2025 US Healthcare Consumer Insights Survey, 51% of consumers believe the healthcare system is fundamentally broken1 while 44% say they believe the system will be better in 10 years.2 Many Americans are willing to share health data for more personalized care and are open to AI-enabled services. Providers should quickly adapt to new consumer needs and preferences. Providers should place special emphasis on supporting caregivers, who often experience significant stress due to the financial burdens of care and the responsibilities of looking after both children and aging parents. Looking ahead, providers can empower caregivers by providing access to clear information and tools that can efficiently manage and coordinate care, including in the patient’s home.

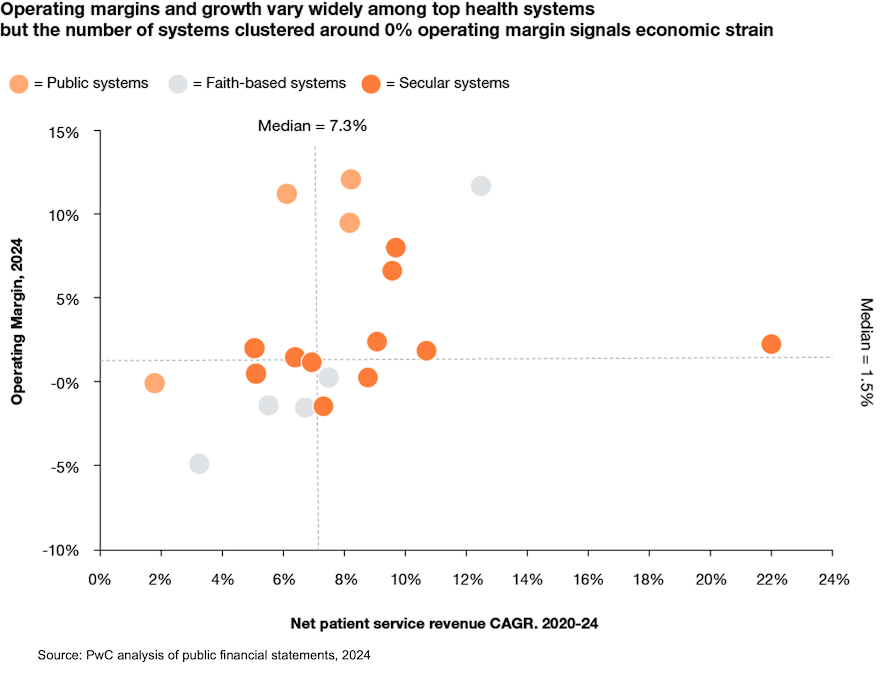

Force #4: Economic pressure: Many providers are worse off than they were in 2019, the one-time pandemic payments notwithstanding. The median operating margin of the top 20 health systems by net patient service revenue in 2024 was 1.5%, according to a PwC analysis of financial and industry reports. Shifts in health policy, reimbursement, and payer mix are forecasted to cost providers tens of millions to hundreds of millions in margin in coming years. Given the scale of change, providers can no longer rely on tweaking annual budgets or cling to legacy models like 340B and HOPD to remain financially viable. Rather than relying on incremental adjustments, providers should thoughtfully reassess their physical footprint and workforce and determine which elements are key to meet the evolving requirements of their communities. They should prepare to make difficult but necessary decisions.

How to thrive in 2035

Provider leaders should fundamentally rethink where care is delivered, how it is delivered, who is responsible for providing it, and how it will be funded. These efforts should start now.

Build a future forward footprint

Facility and infrastructure costs are likely to fall as the over-bedded state of US healthcare finally comes to a head. Many hospitals can inch closer to being primarily critical care and surgical hubs creating greater investment and capacity creation in ambulatory, micro-hospital, home, and virtual settings. Care sites can shift from offering every service to everyone to targeted offerings that balance community needs with the volume required to maintain high quality standards. Lower acuity care can be continually provided by community settings allowing central hubs to focus on higher acuity services through streamlined care pathways and communication with local care teams.

Start now by boldly modernizing your digital foundation. Transition to a fully cloud-based platform that seamlessly unifies financial and operational data at each level. With this single source of truth, a centralized command center can quickly generate actionable insights and enable care and patient placement—consistently delivering patients the necessary care in the proper place at the ideal time. Hospital care should be the last resort, reserved for the most severe cases and for diagnostic testing and specialized services that cannot be delivered elsewhere.

Caution: Providers should assess their footprint to strike the proper balance between expansion and contraction to stay locally relevant and competitive while avoiding unsustainable growth. Consider relinquishing locations and service lines that no longer offer strategic value.

Embrace care engineering

Hospitals and health systems have been slow to adopt process engineering principles. These approaches can offer significant potential to streamline operations and help organizations operate sustainably within Medicare rates. Providers can pinpoint and address the causes of usually needless and potentially risky variations in care through greater data transparency and AI-enabled diagnostics. These improvements can help prevent excess utilization and improve outcomes. Clinical teams often lead patient care. With access to stronger, holistic data, these teams can be empowered to make faster, more informed decisions drawn from a vast reservoir of patient information.

Start now by developing a nuanced cost baseline with shared data. Use a centralized data repository that is the one trusted source of truth. Break down cost categories by DRG and provider to understand the drivers of variation within top service lines. Care teams can use data-driven insights to design the necessary pathways and work out the variation (length of stay at different levels of care, diagnostics ordered, care team composition, etc.).

Caution: Under-resourced and rural care venues may lack access to technology, worsening resource disparities. Heavily resourced health systems may require setting up partnership models to share tools and data.

Caution: Providers seeking true interoperability and strong AI governance help develop the proper culture, governance, and infrastructure. These are complex projects to execute, especially across multiple vendors and legacy systems.

Free the clinical workforce

The clinical workforce shortage can be eased by AI and automation that remove administrative tasks and allow care team members to operate at the top of their licenses. As new roles may appear in alternate care settings and AI and automation redefine entry level positions, providers should consider how to upskill and retool care teams so each caregiver can operate on a higher level.

Start now by harnessing AI to help transform burnout into engagement. Reimagine workflows using AI to take over routine tasks. This can relieve clinical and nonclinical staff of administrative burdens and help address labor shortages and burnout. By integrating AI into daily routines, clinicians can operate at top of license levels, achieve sustainable work-life balance, and expand patient reach. This can also help clinicians strengthen relationships and sustain trust with patients and their caregivers.

Start now by investing more time and resources in people and culture. The scale of change, combined with a new generation of leaders and staff who bring diverse priorities and expectations, requires a renewed focus on supporting, engaging, and developing your workforce.

Caution: Change management when adjusting clinical practices is often key. Care teams may resist new workflows without early engagement, collaboration, and adequate training.

Work toward a collaborative reimbursement system

Providers and payers have been locked in costly, counterproductive payments tug-of-war, each investing heavily in technology, personnel, and processes to gain an advantage. Soon, both sides may wind up with AI agents battling over claims. The current reimbursement system—determining costs after care is delivered—inevitably leads to disputes, turning patient encounters into zones of conflict and failing to serve the interests of payers, providers, patients, or their families.

The future of reimbursement offers hope. Built on collaboration through shared data, prospective payment models support quality engineering or global budgeting (agreed upon payments per admission). Under these models, payers and providers agree in advance on reimbursement terms using shared data, measurement approaches, and evidence-based guidelines. These approaches help offer greater transparency and predictability. With the adoption of AI, predictive analytics, and advanced technologies, payment disputes can be decreased and administrative costs reduced. This can help patients gain clarity about the costs of care before it happens.

Start now by equipping teams to thrive under new payment models. To succeed in value-based and other future payment models, providers should identify performance gaps, then strengthen data analytics, performance management, and risk stratification. Advanced predictive analytics can help spot high-risk patients sooner, enable proactive intervention, reduce costs, and improve utilization for better outcomes.

Caution: Precise, real-time data capture and validation are key but often require significant investment.

Develop a deep understanding of consumers—and act on it

The US population is projected to segment into under-resourced, mainstream, and super consumers. Providers should deliver personalized, tech-enabled experiences for super consumers, affordable digital care for mainstream Americans, and partner with communities, government agencies, and other organizations to support under-resourced consumers. Gen Z and millennials are leading the shift to nontraditional care. More than 40% in our 2025 survey told us they have used virtual visits and many chose retail or urgent care clinics—higher rates than other generations.3 Providers will be tested as consumers grow more accustomed to virtual-first experiences, and others are forced to drive further for high-acuity care.

Start now by creating personalized experiences for patients and their caregivers. Enable on-demand access to care teams, scheduling, and health data. With a connected network of wearables and diverse data sources, providers can anticipate individual needs, preferences, and potential health issues. AI-based cumulative learning can empower providers to deliver proactive, tailored care that helps build trust and improve outcomes.

Caution: The synthesis of data from wearables, EHRs, and social calendars raises privacy, cybersecurity, and ethical concerns. Providers should thoughtfully address these and establish governance processes early.

Form innovative partnerships with competitors, pharmaceutical and medtech companies, tech firms, and new entrants

Providers should use these collaborations to expand access, manage capacity, balance specialty capabilities, and strengthen financial sustainability. These benefits should be pursued to establish more holistic, preventive, and home-based care for patients and communities. Providers should seek deeper partnerships in non-clinical functions that are outside their core capabilities. These collaborations help yield economies of scale and more advanced technology than internal investment can buy alone.

Start now by thinking creatively about partnerships. Providers should invest in their core strengths and pursue collaborations that confer key capabilities. They also should divest those that conflict with their future vision. Thoughtfully build capabilities that advance organizational goals while meeting patient needs in a more cost-effective way. These partnerships may include provider competitors, pharmaceutical and medtech companies, new entrants, and organizations from across the broader industry.

Caution: None of these are easy. Leaders should keep in mind the time and resources required to align incentives when writing data sharing policies and developing operational standards across diverse partners.

Big bets on value creation: tailored strategies for providers

Providers should invest selectively, not universally, in new capabilities. Unbundled care models, advanced technology, and virtual-first strategies require significant resources. Judicious bets allow for alignment with organizational strengths, avoid wasted investment, and enable differentiation. Big bets can help providers deliver value, remain agile, and sustain revenue in a rapidly evolving healthcare landscape.

Big bets often vary based on provider type—such as academic medical centers, regional health systems, or physician groups—as well as market characteristics and the specific organization’s unique positioning. Many of the academic medical centers will lean into digital hubs, strategic partnerships with disruptors to diversify revenue, and AI-enabled care pathways and digital twins to reduce variation and cost. Regional health systems can also lean into lower acuity and virtual care venues, administrative and scale play partnerships, and AI enablement of analytics and reimbursement. While there may not be a one-size-fits-all, no regrets actions can help providers thrive in the future creating the capacity and resources for investment in the big bet areas.

The time to build the provider of the future is now

Healthcare’s future won’t wait. Providers who act now—modernizing, partnering, and embracing digital transformation—will lead the way. Don’t just adapt. Redefine care, empower your teams, and deliver what patients truly need. Ready to shape tomorrow? Connect with us and be the catalyst for change.

The future of healthcare

Over the next decade, we expect $1 trillion of annual healthcare spending to shift.

The consumer-first era of health

PwC’s 2025 US Healthcare Consumer Insights Survey