{{item.title}}

{{item.text}}

{{item.text}}

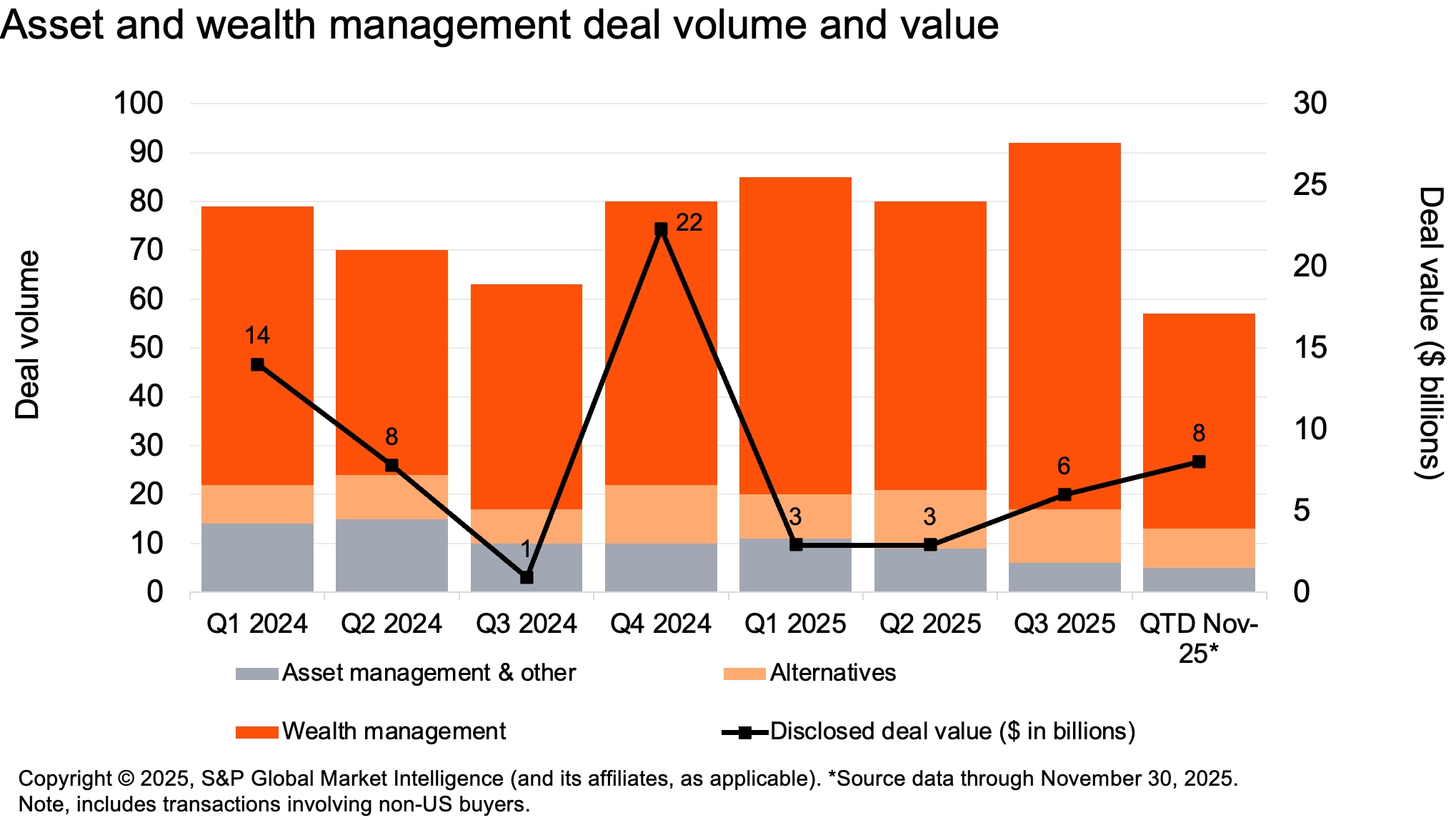

Dealmaking momentum remains strong in asset and wealth management (AWM). The third quarter’s 15% increase in activity from the prior quarter was led by a 27% jump in wealth management transactions (75 announced versus 59 in the second quarter). The Federal Reserve’s interest rate cuts are reducing financing costs, increasing the appeal of dealmaking for both strategic and financial acquirers. Buyers are both deploying capital and employing leverage to get deals done. Also propelling activity is the confidence investors have in the benefits of consolidation.

Optimism about the transaction pipeline for the next 12 months is growing amid signals of additional Fed rate cuts. While the number and size of future cuts remain uncertain, further easing is anticipated. Deal momentum also remains strong despite closing timelines that are longer than those seen during the 2021–22 deal activity surge. Dealmakers continue to pursue growth and consolidation opportunities to scale their platforms, acquire new assets under management, and protect operating margins.

Top themes include:

Shifting investor preferences, rising costs, and fundraising headwinds are converging to create a powerful catalyst for dealmaking. For example, investors are seeking diversified managers offering exposure to infrastructure, real assets, and credit. This shift is spurring a wave of consolidation, minority stake sales, and platform acquisitions to strengthen fundraising competitiveness and operational efficiencies.

“Shareholders are demanding higher returns, investors want more choice, and technology spend requires greater capital investment: these pain points will likely spur more AWM dealmaking.”

Greg McGahan,US Financial Services Deals Leader and AWM Deals LeaderDeal activity in AWM remains robust, underscored by rising transaction volumes and improving financial conditions helped by expected interest rate cuts. The market’s momentum reflects a broader focus on asset growth, product innovation, and consolidation to combat fee pressure. These drivers, plus the potential for expanded retail access to alternative assets, will remain key trends as managers look to access new sources of AUM while maintaining or improving firm profitability.

{{item.text}}

{{item.text}}