{{item.title}}

{{item.text}}

{{item.text}}

August 2023

For the past 30 years, companies have used non-GAAP measures (NGMs) and other metrics as an important part of the financial reporting process when pursuing an initial public offering. NGMs and key performance indicators (KPIs) provide an opportunity for management to tell a story to the readers of the financials and give them additional insight into the company.

Most companies establish a set of NGMs and KPIs at the time of the IPO. By doing this they get a full picture of their business drivers and help set the stage for future performance. It is important for companies to spend time ensuring that the chosen NGMs and KPIs authentically reflect how the business is managed, and that the company will have no hesitation continuing to provide such metrics once listed as a public company.

NGMs continue to be in the spotlight for creating and driving an effective equity story. More companies use NGMs now as compared to ten years ago and the majority of the time the results, as captured in the NGMs, are better than those reported under US GAAP metrics.

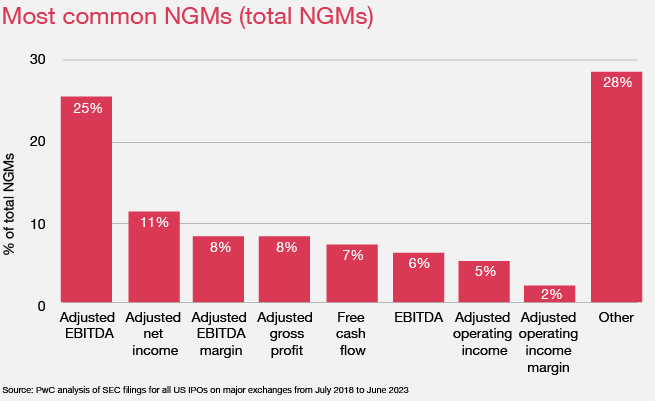

But not all NGMs are created equal, and depending on a company’s industry and based on the story the company is trying to tell investors, certain NGMs may have a higher efficacy.

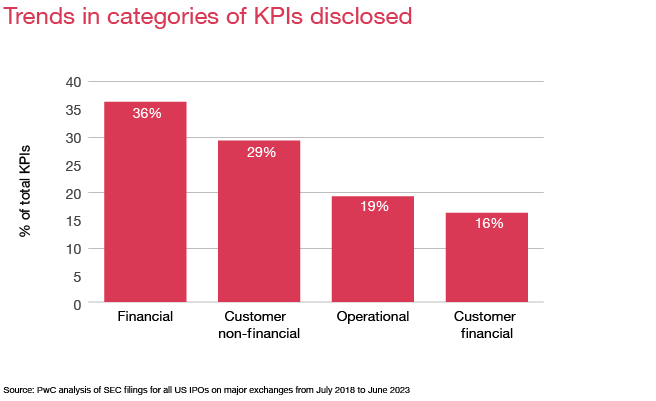

A wide range of KPIs have been reported in recent IPOs. Although there is no perfect method for categorizing these KPIs, they can be thought of as broadly falling into one of four categories.

Companies generally tend to gravitate towards reporting more KPIs related to financial and customer non-financial categories. Often such drivers are used to highlight the strength and longevity of a company’s customer base in order to lend further credibility and proof points to the equity story.

Companies should keep in mind that these metrics are not static and management should continue to evaluate the usefulness and purpose of each metric even after the initial public filing. This guide provides foundational knowledge to both understand the basics and select appropriate measures for your company while ensuring the quality of underlying data and processes.

To create a clear path forward, you need the confidence that comes from working with a team of straight-talking advisors and actionable insights from a team of dedicated professionals. Find out how we can guide you through each step of the readiness assessment process and beyond.

{{item.text}}

{{item.text}}

IPO Services Leader, PwC US

I’m the national leader of PwC’s IPO Services practice — and a husband, dad to an energetic 3-year old girl, travel aficionado and active cyclist, runner and swimmer.