{{item.title}}

{{item.text}}

{{item.text}}

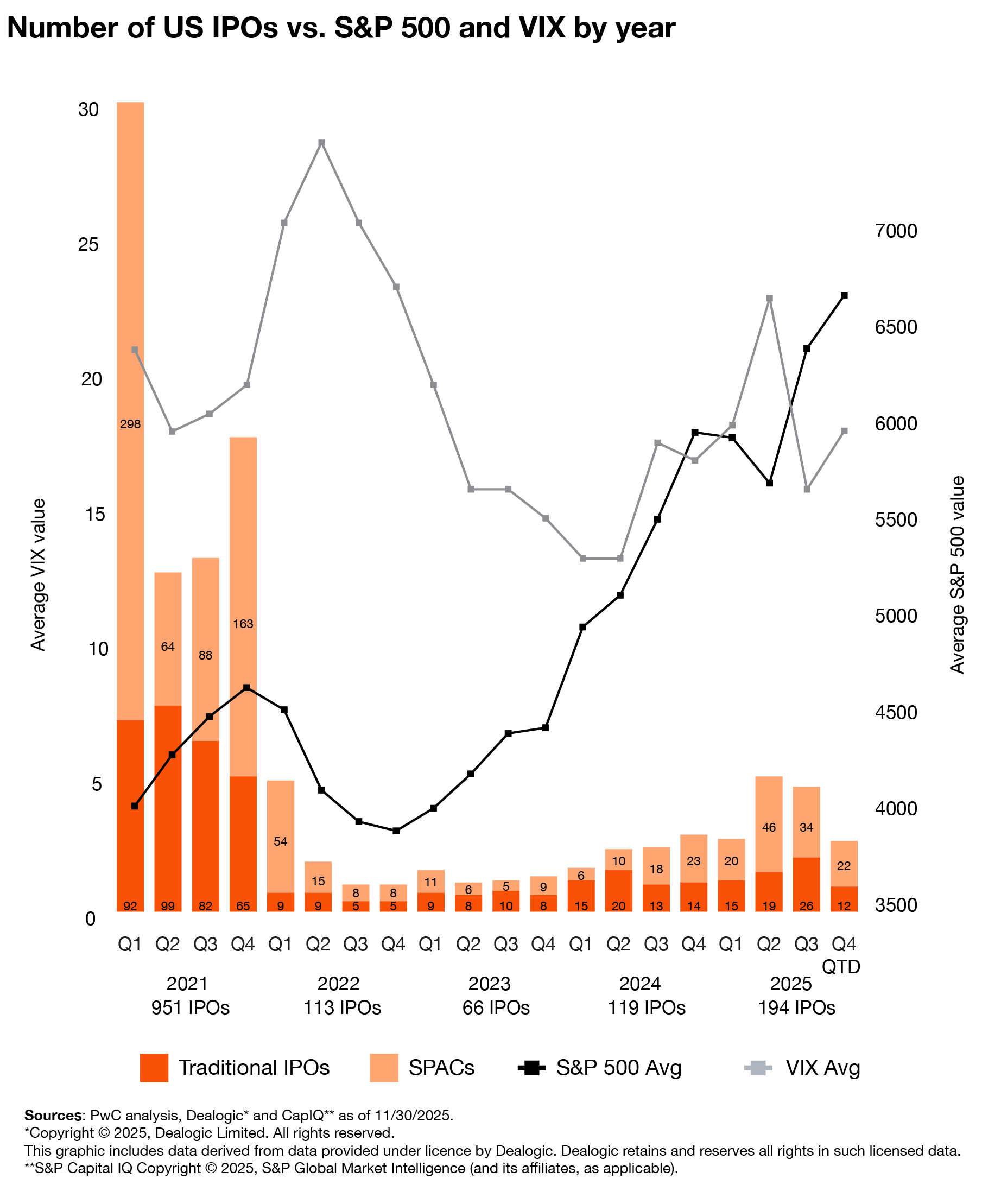

US public markets are set for another big year in 2026, driven by moderating inflation, anticipated interest rate cuts, and a significantly expanded backlog of IPO-ready companies. After three years of intermittent issuance windows, hundreds of late-stage private companies—including more than 800 unicorns—enter 2026 with stronger balance sheets, improved operating discipline, and clearer paths to profitability.

Traditional IPOs raised $33.6 billion in 2025, their best year since 2021. Momentum that had been building through the year was interrupted when the government shutdown halted SEC operations. Many issuers considering an offering shifted their plans into 2026, which is expected to meaningfully increase activity—particularly in the first half of the year.

Despite the disruptions, 2025 demonstrated that investors have a healthy appetite for high-quality IPOs. Many traditional IPOs priced within or above their revised ranges, with several technology, fintech, and digital infrastructure issuers delivering strong first-day and post-pricing performance. Sponsor-backed companies also experienced solid demand. That’s encouraging news for private equity firms that need to return capital after an extended slowdown in exits.

The macro environment is increasingly supportive. Inflation continues to ease and markets expect the Federal Reserve to continue its measured rate-cutting cycle. A more predictable tariff policy environment could further strengthen risk sentiment.

Looking at which sectors will lead IPO activity in 2026, interest is strongest in AI infrastructure, where continued investment in chips, data centers, and power capacity is driving a robust pipeline. Insurance and specialty risk companies also remain well positioned after strong 2025 debuts and software—particularly AI-enabled platforms—continues to be a top investor preference.

Momentum is building in industrials and the manufacturing sector, including reshoring, aerospace and defense, supported by policy and supply-chain realignment. Energy transition and grid and storage infrastructure are attracting increased attention as well due to the predictability of their cash flows. Healthcare remains more selective, with improving interest in AI-enabled healthtech and medtech, while biotech activity is expected to center on later-stage companies with less perceived risk.

Still, selectivity will remain a defining feature of the market. IPO candidates that are already prepared to operate as public companies and that have credible paths to profitability are likely to attract the strongest investor support. By contrast, issuers with high debt, unclear cash-flow trends, or undifferentiated business models may continue to face valuation pressure. To stand out in a crowded field, issuers will want to showcase a history of disciplined growth and cash generation. IPO candidates should try to use their equity story to explain how AI enhances their business model in efficiency, product innovation, or customer value.

Activity in 2026 may unfold more steadily than in prior “open window” periods. Companies are increasingly thoughtful about timing and market conditions, especially since many are supported by deep pools of private capital that allow them to be patient. We see the IPO market as open for companies with the right fundamentals—appropriate scale, strong growth prospects, profitability (or a clear path to it), and the operational maturity to function as a public company from Day One.

Even so, market windows can open and close quickly, making readiness and flexibility essential. Companies that have completed their governance upgrades, strengthened their financial reporting, and refined their equity stories will be best positioned to take advantage of the opportunities ahead.

“2026’s IPO window is open—but selective. A shutdown-driven backlog and easing rates are bringing supply, yet investors are paying a premium for scaled, cash-generative stories with clear profitability paths—especially in AI infrastructure, software, and specialty risk.”

Mike Bellin,IPO Services Leader, PwC USAfter a decade of expansion, the venture market in 2025 stands at an inflection point. The rebound in exit activity and megadeal volume suggests a return of confidence, but liquidity pressures and concentration risk continue to define the market. Investors remain selective, with capital consolidating around AI leaders and proven later-stage companies while early-stage fundraising faces headwinds amid constrained distributions.

To create a clear path forward, you need the confidence that comes from working with a team of straight-talking advisors and actionable insights from a team of dedicated professionals. Find out how we can guide you through each step of the readiness assessment process and beyond.

{{item.text}}

{{item.text}}