{{item.title}}

{{item.text}}

{{item.text}}

An infusion of capital can provide financial stability, accelerate growth or transform the way a company operates. Accessing the right debt instruments and markets to support these capital needs is key.

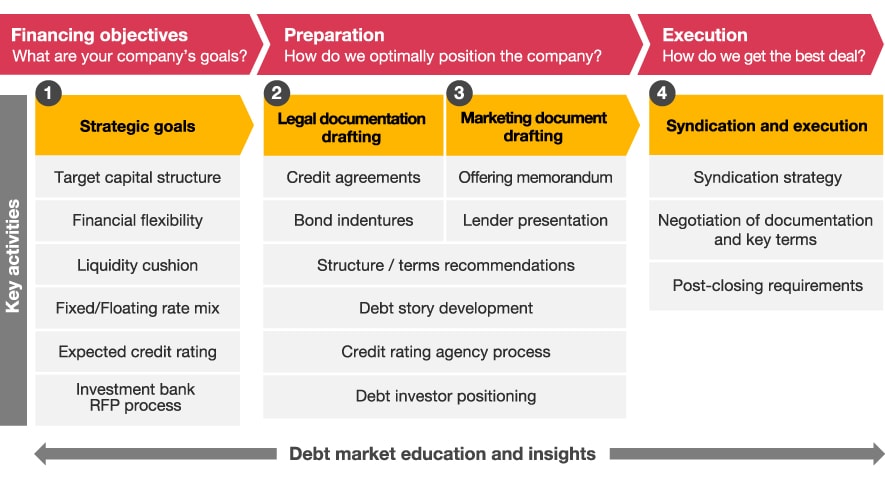

PwC brings together an integrated set of multi-competency capabilities to advise on all stages of the debt financing life cycle. We can help borrowers evaluate alternatives across the debt capital markets spectrum to achieve the best financing solution and address funding challenges.

Our focus is always on providing a comprehensive, holistic approach to the debt capital raising process. While each offering can be executed on a standalone basis, utilizing the full breadth of PwC’s capabilities facilitates an enhanced outcome for the client’s capital raise. Our debt advisory offerings include:

There are many options when it comes to raising capital, and many avenues companies can take when it comes to choosing types of debt. We can advise and assist with the analysis, assessment, and selection of financing options, aligning with corporate strategic objectives.

After an issuer has decided on a path forward, additional complexities arise around how to best structure and obtain financing for the transaction. We can provide a comprehensive exploration of the committed financing process for both private equity-sponsored and corporate transactions. We also advise and develop strategies for:

Positioning a company to attract investors can require extensive preparation and thoughtful consideration. We can advise and assist borrowers with:

The credit agency rating process can seem complicated and ambiguous in times of volatility and for first-time issuers. We can provide insights to issuers on obtaining a credit rating and guide issuers through the formal process by advising on:

Once an issuer has decided to pursue a debt offering, syndication and execution can seem like large hurdles to overcome. We can advise on syndication preparation and lender management, including:

Launching an ESG offering or understanding the landscape of ESG debt markets can be a daunting task. We’re here to help provide insights on the current status of ESG in the debt financing markets, as well as advise on ESG financing strategy, including the structuring of key terms related to green, sustainability-linked or social debt.

{{item.text}}

{{item.text}}

IPO Services Leader, PwC US