From smartwatches that measure your heart rate to artificial intelligence (AI) that monitors your bank account, digital technologies are changing our lives at home and at work. Consumer and employee comfort with—and trust in—4IR technologies will likely determine the potential opportunities for growth and efficiencies that these technologies can offer businesses. Indeed, PwC’s Consumer Intelligence Series found that while Industry 4.0 or the Fourth Industrial Revolution (commonly known as 4IR) may be everywhere, not everyone is yet fully on board.

Key findings

.png)

When it comes to sharing data, consumers are highly discriminating

Businesses need to assess whether the experience offered is greater than any potential risks consumers assume. For example, consumers are more apt to share personal data in exchange for improved quality of life and safety than they are to save money.

57% of consumers will share personal medical data to improve their health; 25% will do so to save money.

Consumers want more transparency and control in 4IR products

Consumers want assurances of how their data will be used and to be notified when their data is breached. They also want more choice and control over how a 4IR product or service is used.

64% of consumers say assurances their data won’t be shared would make them more comfortable using 4IR-driven technologies

Employees are jittery over 4IR’s impact on job security and changing roles

Businesses need to be more clear to workforces on how 4IR will impact current jobs and create altogether new ones. This will both help allay employee concerns surrounding job security and support successful 4IR adoption strategies.

45% of employees say 4IR technology creates job security concerns; 69% of business leaders see 4IR as jobs creators

.png)

Most business leaders believe 4IR can help proof against economic downturns

Businesses are looking to 4IR technology to protect from economic slowdowns via greater efficiencies and productivity as well as new revenue opportunities and accelerated R&D and product development.

63% of business leaders say 4IR provides protection against economic downturn

4IR has come of age. Smart products are flooding the market and entering our workplaces. Not drinking enough water? How about a Wi-Fi connected water bottle that provides hydration stats and alerts? Or a refrigerator that knows which foods are past their expiry dates? From artificial intelligence and the Internet of Things (IoT) to collaborative robots and digital assistants, products and services powered by 4IR technologies are blending our digital and physical worlds, and are swiftly becoming embedded in the fabric of our lives.

And, it’s apparent that we’re past the tipping point. An estimated 7 billion IoT-connected devices are now deployed worldwide, and about $560 billion has been invested globally in 4IR technologies via mergers and acquisitions and venture capital funding over the 2012-2018 period.[1],[2]

To get a clearer picture of how this revolution is changing how we live and work, PwC surveyed 6,000 consumers and 1,800 business leaders around the world.

What is 4IR?

The Fourth Industrial Revolution (4IR) is the unfolding age of digitalization—from the digitally connected products and services we consume, to advancements in smart cities and factories and increasingly common automation of tasks and services in our homes and at work. Also known as Industry 4.0, this era of digital transformation ushers in new, real-time data gathering analysis and algorithmic decision- and prediction-making capabilities, thus creating a digital twin of our physical world. 4IR comes on the heels of the third industrial revolution (driven by electronics and information technology), the second (fueled by electricity) and the first (fired by steam).

This 4IR is enabled by a melding of both established and emerging technologies—including artificial intelligence, the Internet of Things (IoT), advanced data analytics, robotic process automation, blockchain, robotics, cloud computing, virtual and augmented reality, 3D printing and drones.

1 “State of the IoT 2018: Number of IoT Devices Now at 7B – Market Accelerating,” IoT Analytics, 8/8/18

2 PwC analysis, including Thomson Reuters and CB Insights data

“Data analytics is being used everywhere, whether we are conscious of it or not, even if we are not personally familiar with it. It’s in everything we consume.”

4IR adoption is ubiquitous, but comfort levels lag

Our survey found 90% of consumers are using at least one form of 4IR technology and nearly half (46%) are using at least three 4IR technologies regularly. We also found that most consumers are excited about the improvements that 4IR technologies are making in their lives. Positive impacts include saving time, improved productivity and personalized experiences. Most businesses, meanwhile, are scaling up 4IR technology, with 84% having fully or mostly implemented at least one 4IR technology into their operations or business.

The demonstrated benefits that 4IR technologies bring to our everyday lives make them must-haves for many—even those who may still be a bit wary of their overall impact. That’s especially true of the most commonly embraced technologies, such as smartwatches and fitness trackers, with 73% of consumers saying they use them now or expect to start doing so in the next three years, compared (in a separate survey question) to only 63% of consumers saying they were comfortable with such devices. Likewise, there exists a gap between use of and comfort levels in other 4IR-driven products and services, including smart home devices such as connected thermostats and appliances (69% vs. 59%) and even smartphone and tablet apps (69% vs. 61%).

The right value exchanges increase consumer comfort with 4IR

Consumers understand that 4IR technologies involve a trade-off: is what’s being given up—personal data or privacy—worth what 4IR can offer in return: convenience, saved time, personal well-being? This tension, which is at the heart of a global conversation around trusted tech, is mirrored in the conflicting consumer perceptions around 4IR technology. For instance, 70% of consumers agree that 4IR technology makes their lives easier, while 67% say it makes them worried about the data collected about them and 68% harbor concerns surrounding data privacy and security.

But our survey found that there are some trade-offs that make sense and have real impact on consumers’ lives. People are much more likely to feel comfortable with technology that leverages their data in the right circumstances. For example, 57% of consumers agreed they would share health information—such as blood pressure, pulse and temperature—if it enabled services or features that made them healthier or improved their overall quality of life. Meanwhile, only 25% were willing to share health information to save money.

Consumers can also be wary of technologies that track or monitor their personal behaviors, too, but will use them if the pay-off is important. For example, while consumers are generally uncomfortable with technologies that track their locations, they are nonetheless willing to share this information in cases in which it would improve safety and security for themselves or their families (59%), compared to, for example, just 22% agreeing they would do so to improve their quality of life or increase personalization (26%).

“In terms of security, I am worried that since everything is being recorded, my personal information may be leaked at any time. Whenever I think about my privacy being breached, I become nervous.”

Control is consumers’ killer app

Overall, consumers say they would be more comfortable adopting 4IR products and services if they were allowed greater control and were provided with more transparency and communication from companies. Specifically, they are asking for more of the following to make them more comfortable: being able to turn off features (72%), having at least two levels of encryption (64%), assurances that they would be immediately notified in the case of a breach (64%) and assurances that their data will not be shared (64%). Interestingly, providing a more personalized experience—which businesses identified as one of the key ways that 4IR technology adds value to their products and services—is a comparatively low-priority option for consumers, with just 51% saying that it would make them more comfortable with using 4IR technology.

These are determinations consumers say they want to make for themselves. Less than half of consumers in our survey, for instance, said the extent to which their peers were using a feature mattered much when it came to their comfort level with it.

Employees worry more than bosses when it comes to 4IR’s workplace impact

Both employers and employees agree that 4IR can improve day-to-day activities in the workplace. Eighty-one percent of business leaders agree that 4IR technologies lead to greater efficiencies, and 78% agree that they replace tedious tasks. Likewise, employees agree that 4IR tech is contributing to a better work experience, including time savings (71%), improved data accessibility (69%), increased organization and productivity (each 68%) and more control over their work-life balance (59%).

However, business leaders and employees do not share the same outlook for the future impact of 4IR on jobs. Nearly half of employees (45%) in our survey say that 4IR tech causes them “concern over their job security,” and roughly the same percentage (49%) are concerned about “machines and software making decisions humans once made.” Meanwhile, 69% of business leaders see 4IR technologies as a driver of new jobs creation.

While the verdict is still out, there’s room for both businesses and employees to be right: the World Economic Forum estimates that, through 2022, 75 million jobs will be displaced by a shift of human labor to machines, but that another new 133 million jobs will be created and needed to adapt in increasingly digital workplaces.

“The first problem 4IR solved is the unlimited growth of labor costs. The most visual embodiment [of 4IR technologies] is to reduce human cost.”

Getting 4IReady: peering through the business—and human—prisms

Clearly, business leaders see 4IR’s potential upsides. And, as concerns over an economic downturn persist, businesses are making bets that 4IR technologies could help them through difficult times. Indeed, our survey found that 63% of business leaders agree that 4IR technology "provides protection against economic downturn.” Even more business leaders (80%) agree that 4IR technology gives them a competitive advantage, creates new revenue streams (76%) and accelerates research and product development (76%). They’re also bullish on the impact of 4IR technologies on their products and services, agreeing that they increase the value of their company’s products and services (81%), create efficiencies for customers (79%) and enhance customer experience (79%).

However, while businesses overwhelmingly acknowledge the potential of such bottom-line benefits, they will also need to be keenly observant of how their customers and employees accept, use and trust 4IR technologies in order to fully capture those benefits.

Here are some concrete steps to consider:

- Champion workforce transformation

- Design trust as a feature

- Make good on 4IR’s promise

Champion workforce transformation

More executives identified upskilling as a top-three priority (36%) than any other option for ensuring 4IR’s successful integration into their workplaces, followed by hiring new employees with 4IR tech skills (35%) and implementing a cultural change to deploy 4IR technologies (33%). That’s a good start, but 4IR effects could be so large and pervasive that businesses should also rethink the jobs they offer: redesigning the workflow for greater performance, combining some jobs, adding others and probably eliminating some as work flows and roles shift.

It’s also important to appreciate that some human skills cannot be automated or replicated with a software update—including communication, leadership, judgement, ethical instinct, to name a few—and to acknowledge that such attributes will always be highly valued and needed, especially as businesses ramp up their machine-human hybrid workforce.

To participate wholeheartedly in a transformation of this sort, employees need to get involved in shaping their own futures. Invite them to voluntarily gain new skills with a citizen-led approach to innovation so they’re equipped to drive their own success and help others around them.

Assess first what the business needs to accomplish, provide personalized learning and give people true upskilling opportunities to use new skills in day-to-day work right away. Then listen to their concerns.

Our survey revealed that one in four business leaders agree that establishing mechanisms for employees to share concerns about such technology should be top of mind in deploying 4IR technology. Yet, only one-fifth of those leaders cited evaluating employee satisfaction with 4IR at work among their highest priorities when doing so.

Design trust as a feature

Whether at home or at work, people want to feel that they’re in charge of the technology that increasingly pervades nearly every aspect of their lives. Our findings suggest that they trust 4IR-enabled products and services more when they have the ability to turn potentially worrisome features on and off, when they have confidence that any misuse or misappropriation of their data will be brought to their attention immediately and when any personal information being collected is closely linked to the benefits they feel they’re receiving. They want to feel that they’re being encouraged to use a technology (whether as consumers or employees) because it will make their lives better, and that any tradeoffs involved are easily understood.

The message for business is clear: trust can be a differentiator when it comes to technology, but it must be earned. Companies increasingly recognize this, but disconnects remain. When asked to identify their top three 4IR investment priorities, only 40% cited alerting consumers to data breaches—yet consumers ranked this second-highest among steps most likely to increase their comfort with 4IR.

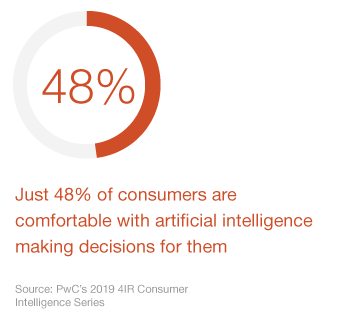

However, consumer privacy and data security are only two aspects of a multi-faceted picture when it comes to trusted technology. AI presents an emerging challenge—and opportunity—for business, with consumers more likely to predict they’ll use the technology more in the coming years (59%) despite feeling discomfort with some AI-driven technologies. For instance, just 48% of consumers say they are comfortable with artificial intelligence making decisions for them and just 40% of consumers are comfortable sharing space mobile robots in the home or workplace.

Therefore, a heavier onus will likely be placed upon both companies and developers to follow stringent data protection design principles, including embedding privacy and data security into technology infrastructure and devices and maintaining transparency into what data is being collected and how it is being used.

Make good on 4IR’s promise

Disruptive technology’s evangelists can make high-minded pronouncements about how their product or service’s mission is to “change the world,” while their true purpose—whether delivering pet food, renting electric scooters or sharing snapshots—could actually hug closer to the quotidian. Indeed, some 4IR technologies will be more disruptive, more needed and more attractive than others. In any case, our research found consumers hold lofty ambitions when it comes to 4IR’s promises. Interviews with survey respondents reveal that consumers clearly expect that 4IR technologies can—and should—help make the world a better place and should be applied to tackling global challenges such as education, hunger and the environment.

How can businesses make good on the promises that consumers perceive them to have made? How can they rise to customers’ challenge to tap into 4IR’s transformative potential? The truth is that many 4IR technologies are capable of changing the world for the better. For example, PwC is already helping businesses meet sustainability commitments by using IoT-connected sensors to turn off lights and adjust heat or air conditioning in office spaces that aren’t in use—and saving money, to boot. And, we’re creating digital tools that let companies better detect and stop fraudulent financial transactions that can support criminal activity and terrorism. By sharing these powerful stories, companies can help forge a strong connection between the 4IR’s world-changing impact and the digital products and services consumers rely on everyday.

“Governance standards are not being raised, particularly around cyber security. Things are more reactive than proactive.”

“There has to be a way to use these technologies for the betterment of the environment and feeding people.”

“There’s a huge water crisis going on, and if we use technology to our advantage, it could be improved.”

Asian and Western perceptions differ on 4IR’s impact on society and job security

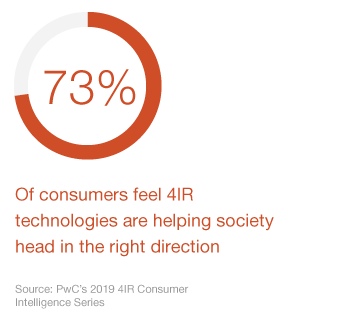

Overall, our survey found that consumers in Asian economies (South Korea, China and India) are more optimistic than their counterparts in the West (US, UK and Germany) that 4IR-driven products and services are helping society move in the right direction. Interestingly, only 55% of German consumers agreed 4IR is contributing positively to society, compared to 92% of consumers in India.

Given their relatively positive outlook on the societal benefits of 4IR technology, it is interesting to note that Asians also harbor concerns over its effects on them on a personal level—particularly manifested by deep worries over job security—and to a greater degree than Westerners. Additionally, employees in Asia are more discomfited by the prospect that machines and software will be doing tasks humans ought to be doing (India: 73%, China: 51%, South Korea: 49%), compared to those in Western economies (US: 42%, UK: 37%, Germany: 36%).

Global perceptions of 4IR:

Greater China

$21,075m

Market Cap (31 March 2019)Alibaba Group Holding-Sp ADR

7

Rank$471.7m

Market Cap(31 March 2019)

1.7%

% Change MktCap (19-18)

Tencent Holdings Ltd

7

Rank$471.7m

Market Cap(31 March 2019)

1.7%

% Change MktCap (19-18)

Ind & Comm Bk of China-A

7

Rank$471.7m

Market Cap(31 March 2019)

1.7%

% Change MktCap (19-18)

PwC’s 4IR Consumer Intelligence Series methodology

PwC fielded a quantitative survey among 6,000 consumers and 1,800 corporate technology decision makers. A subset of 4,338 employed consumers were also asked about their experiences in the workplace. Additionally, 12 focus groups were conducted (with four to six participants in each) and 36 in-depth interviews were carried out with corporate technology decision makers. Research was conducted in the United States, the United Kingdom, Germany, India, China and South Korea.

Disclaimer: PwC has exercised reasonable care in the collecting, processing, and reporting of this information but has not independently verified, validated or audited the data to verify the accuracy or completeness of the information. PwC gives no express or implied warranties, including but not limited to any warranties of merchantability or fitness for a particular purpose or use and shall not be liable to any entity or person using this document, or have any liability with respect to this document. This report is for general purposes only, and is not a substitute for consultation with professional advisors.

Contact us