{{item.title}}

{{item.text}}

{{item.title}}

{{item.text}}

For corporate executives and directors, 2023 should probably have felt calmer than it has, given the events of the last several years. But the ride remains a rocky one. Russia’s war on Ukraine persists, exacerbating global tensions and trade conflicts. Extreme weather events have not only strained power grids and forced emergency action but ramped up pressure for companies to accelerate their net-zero timelines.

Stakeholders are looking to corporate leaders to address major social issues, notwithstanding strong disagreement on how those issues should be addressed. All of this points to the fact that the business community must embrace the need to change. And that change imperative is top of mind in every boardroom. In a time of change for corporations, boards have the opportunity to lead the way, setting the pace for C-suite leaders. This year's survey not only shows where directors may need to confront roadblocks, but also indicates a path forward.

Over the last five years, directors’ criticism of the performance of their peers hasn’t necessarily translated into changes in board composition. It seems that the board assessment process, which should identify performance issues, is not being leveraged to its full capabilities. In fact, only 11% of directors say their board’s assessment processes resulted in the decision to not renominate a director.

Just over half of directors say their board is sufficiently prepared to oversee forthcoming mandatory ESG disclosures, up from 25% in 2022. But ever fewer directors feel that ESG issues are linked to strategy.

Despite nearly every director surveyed telling us they think their board is prepared to guide the company through a crisis, 70% say they haven’t participated in a tabletop exercise, 48% haven’t agreed upon a written escalation plan and 32% haven’t defined board leadership’s role in a crisis.

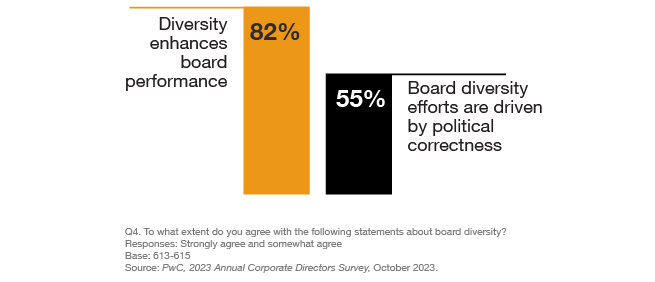

While most directors agree that diversity brings unique perspectives and enhances board performance, more than half believe that diversity efforts are driven by political correctness; about one third suggest that diversity efforts put less-qualified candidates on the board.

Fewer directors feel that executives are overpaid, compared with six years ago. Companies seem to be getting better at connecting executive pay to performance outcomes. Shareholder support for executive compensation increased during the 2023 proxy season. This suggests that companies may be figuring out the balance between compensation program design and shareholder expectations.

The percentage of directors who feel cybersecurity oversight is a significant oversight challenge for their boards went down from 59% in 2022 to 49% in 2023. In the wake of focus from regulators and other stakeholders, boards and management teams have been stepping up the frequency and depth of cybersecurity-related discussions and disclosures.

Directors feel they have sufficient time to prepare for meetings and for committee responsibilities. They face high expectations from shareholders and others regarding their performance. But boards meet a limited number of times each year, and their agendas are increasingly crowded; efficiency is critical.

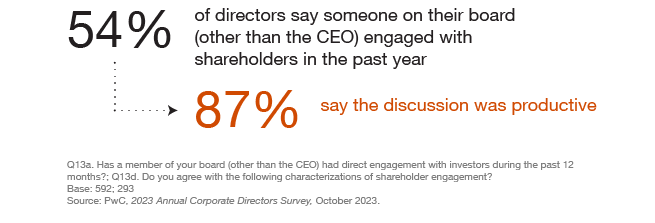

Directors are regularly engaging with shareholders and the vast majority consider those interactions “productive.” Shareholder engagement is important because it allows shareholders to express concerns about the company and hear directors’ perspectives; they can test the rigor of the board’s oversight and gain insight into the company’s strategic plan. For their part, directors can learn about shareholders’ priorities and concerns.

PwC’s Annual Corporate Directors Survey has gauged the views of public company directors from across the United States on a variety of corporate governance matters for more than 15 years. In 2023, 619 directors participated in our survey. The respondents represent a cross-section of companies from over a dozen industries, 72% of which have annual revenues of more than $1 billion. Seventy-two percent (72%) of the respondents were men and 28% were women. Board tenure varied, but 64% of respondents have served on their board for more than five years.

Ray Garcia

Leader, Governance Insights Center, Houston, PwC US

Principal, Governance Insights Center, New York, PwC US

Director, Governance Insights Center, New York, PwC US