{{item.title}}

{{item.text}}

{{item.text}}

Companies are beginning to crack the code on how to make big, transformative deals successful: leveraging experience, early and sustained investment in integration, and a commitment to creating and implementing new long-term operating models. Here’s how they’re doing it.

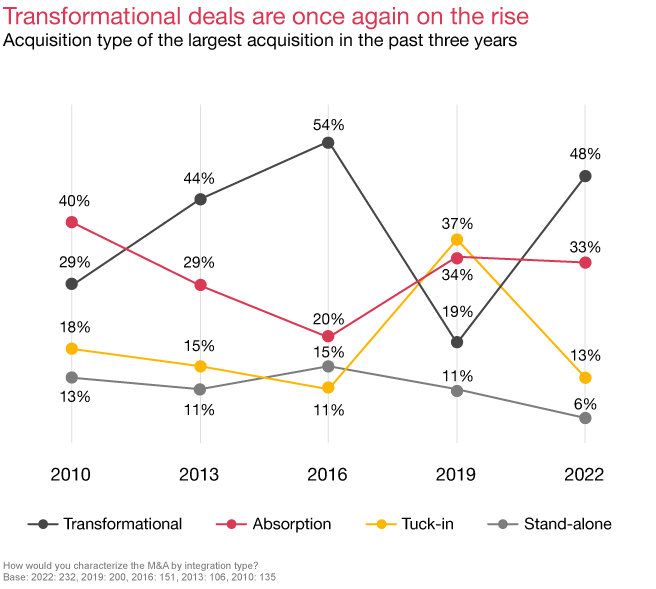

The expansionary policies of regulators and unprecedented geopolitical impact of COVID-19 shaped the size and type of transactions during the 2022 survey period — they are bigger, bolder and riskier. For the first time in our survey’s history, more than 25% of executives indicate that the purchase price of the acquired organization exceeded $5 billion. Transformational deals also increased significantly to nearly half of all deals.

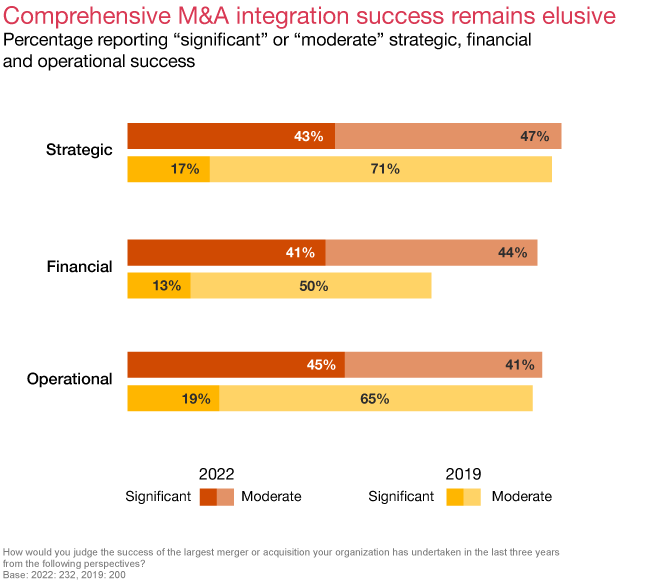

Despite the challenges during this survey period, companies report greater success in achieving M&A goals with responses of significant success in each individual measure, increasing significantly versus the 2017-2019 survey period.

However, Successful M&A Organizations, defined as reporting significant success across all three measures — strategic, operational and financial — are rare. Only 14% of the 2022 survey respondents, and none from 2019, indicated this elusive level of success.

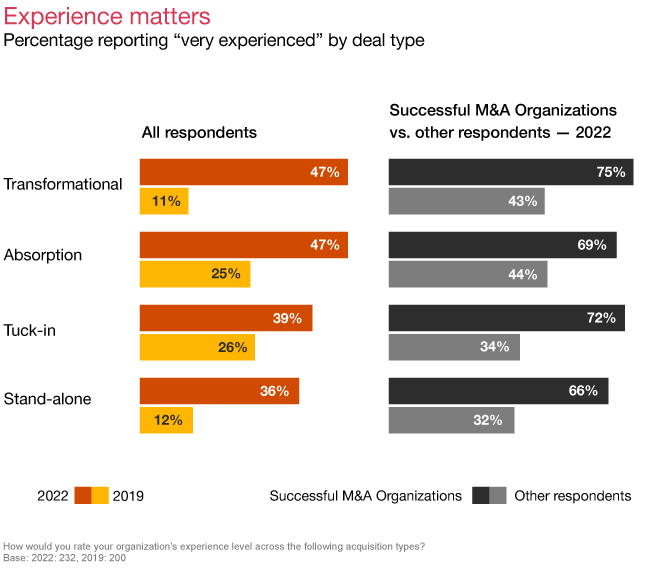

M&A integration is an enterprise-wide business process with a steep learning curve. Companies with the most institutional and managerial experience have the greatest chance for success. There’s been a major increase in experience across all deal types in the 2022 survey data compared with 2019. Successful M&A Organizations are especially more experienced in the most important transactions — transformational deals — where 75% are very experienced compared with 43% for other respondents.

Experience in isolation doesn’t automatically produce success, but it often brings a commitment to invest sufficient time, money and talent to the integration process.

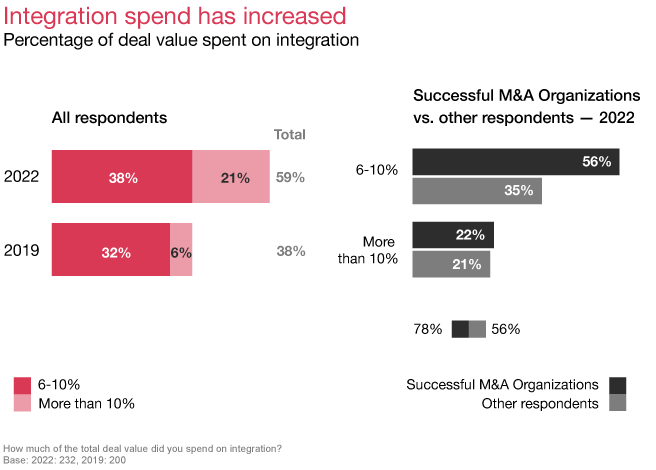

With a growing number of organizations spending more on transactions, corporate executives also report spending more on M&A integration than ever before — with improved results. Fifty-nine percent of companies spent 6% or more of deal value on integration in 2022 compared with 38% previously. Seventy-eight percent of Successful M&A Organizations spent 6% or more of deal value on integration. By comparison, only 56% of other respondents spent at that level.

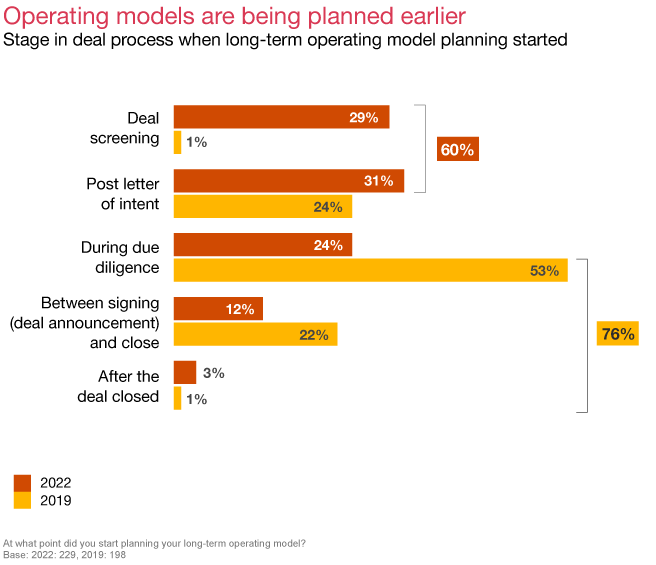

Companies are also investing in integration much earlier. Long-term operating models are in development earlier in the deal cycle, with 60% of companies planning before due diligence, compared with 25% in 2019. Almost a third plan during deal screening, up from 1% in 2019. Among Successful M&A Organizations it was even more, with 41% planning during deal screening compared with 27% of other respondents.

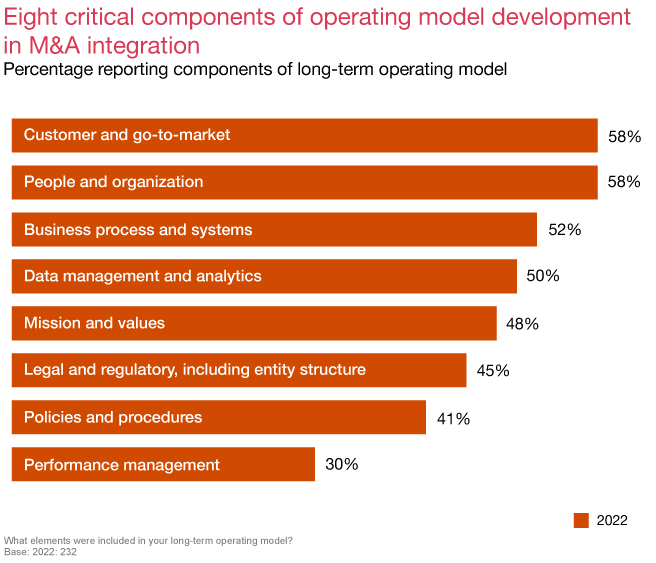

More companies are developing holistic, long-term operating models across eight critical components. Historically, these operating models included only two or three components and were often static theoretical frameworks focused on competitive differentiators, organization design and supporting processes — and not executed at an operational level. Companies did not have the experience, technology or data analytics to execute complex, interdependent operating model components simultaneously across the enterprise. They were certainly not able to move from completing the transaction to carrying out a large-scale transformation at speed.

Savvy dealmakers are using large, transformational M&A as catalysts to reposition their companies for future success. A thorough, multifaceted operating model enables enterprises to jump-start critical integration activities with clear direction and purpose. Successful M&A Organizations plan and execute on value creation, change management, technology and other integration elements.

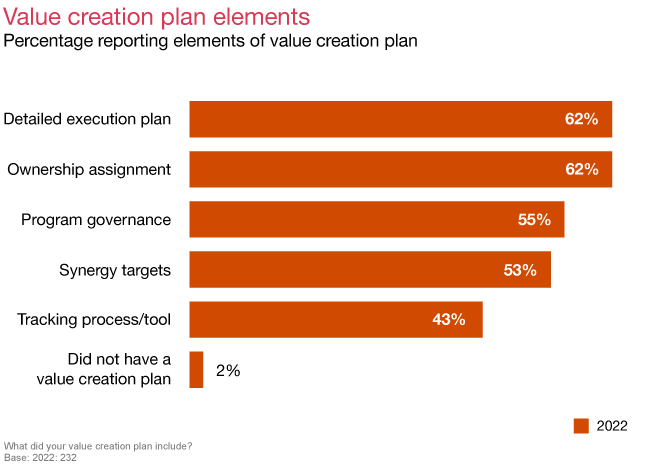

Survey respondents were almost unanimous in recognizing the importance of a value creation plan to help underwrite M&A success. But these plans often lack some of the critical elements of a value creation plan. Only 24% of the respondents had more than three of the five elements — resulting in fragmented plans lacking the hard metrics required to drive execution. Only 55% of respondents had program governance, only 53% had synergy targets and just 43% had a tracking process in place.

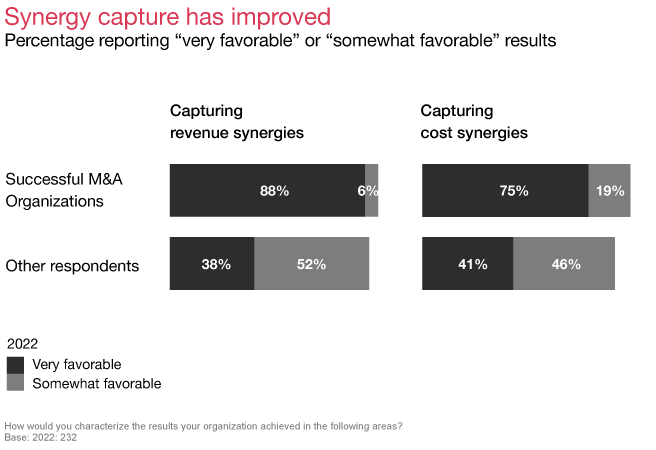

Despite missing some elements, respondents improved synergy capture as compared with our 2020 survey report. This reflects market expectations, the importance of experience and an increasing focus on execution.

Successful acquirers are getting better at building the institutional muscle to achieve results. But there’s still room for improvement. Companies should improve the identification of revenue and cost drivers supported by a holistic value creation plan in order to manage execution throughout the acquisition and integration.

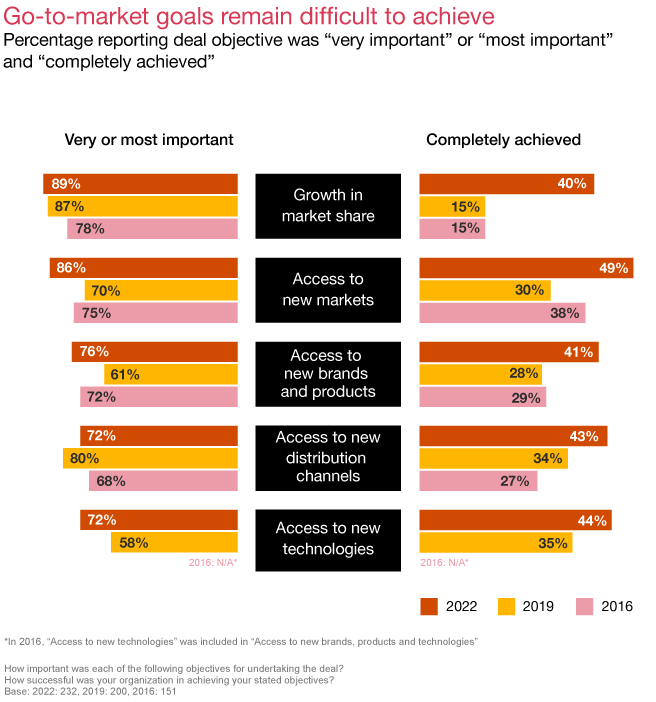

There’s a dynamic that has changed in an era of transformational deals where the importance of go-to-market goals is increasing. Growth in market share, access to new markets, access to new brands and products, and access to new technologies have all grown in importance over the past decade, a period of significant economic growth and quantitative easing.

Similarly, remote working and different ways of working drove companies to focus on access to enabling technologies. Despite increasing importance, achieving go-to-market goals remains difficult, with less than half of respondents completely achieving these objectives. Successful M&A Organizations in the 2020-2022 survey period, however, were more than twice as effective in completely achieving go-to-market goals versus other respondents.

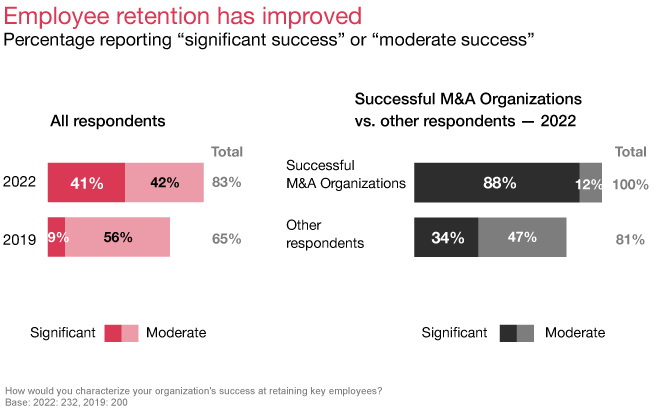

Corporate executives understand that people are crucial in M&A, and the companies that concentrate more time and resources on people early in the deal life cycle tend to reap the rewards. Even in the face of COVID-19 challenges and the battle for talent, these companies reported more success with employee retention.

While companies are doing better at retaining and motivating key talent during M&A, there’s still room for improvement. Our 2022 survey found more companies launching change management programs earlier in the deal life cycle, with 43% of respondents kicking them off before due diligence, compared with only 23% in 2019. More than 60% included a culture assessment during due diligence and made it part of the go/no-go decision. And 71% of survey respondents launched change management initiatives prior to signing.

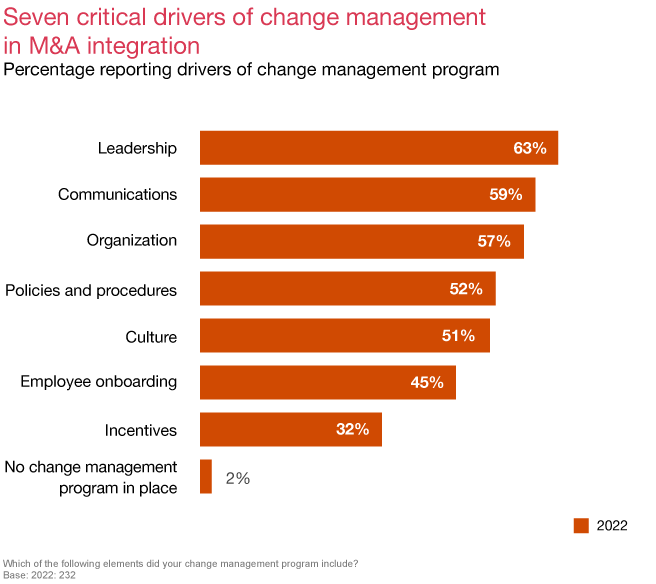

The value of experience shows up here as well. Our 2022 survey respondents are implementing more robust change management programs, with more than 50% using five of the seven critical drivers of change compared with just one in 2019.

Since talent is vital to unlocking value and achieving transformation, smart acquirers will continue to evolve their approaches. Acquirers can include more or, ideally, all of the seven critical change drivers and sustain those investments throughout the entire deal, integration and transformation life cycle.

Complicated cross-functional workstreams in large transactions can be difficult to orchestrate and execute. Multiple teams need to collaborate to achieve their goals. Companies using M&A to transform their organizations have the added complexity of delivering on integration goals in parallel with transformation objectives.

Our surveys have consistently shown that many companies lack commitment to long-term integration completion, which makes transformational objectives harder to accomplish. The 2022 survey was no exception, with most respondents reporting difficulty in completely integrating key cross-functional areas.

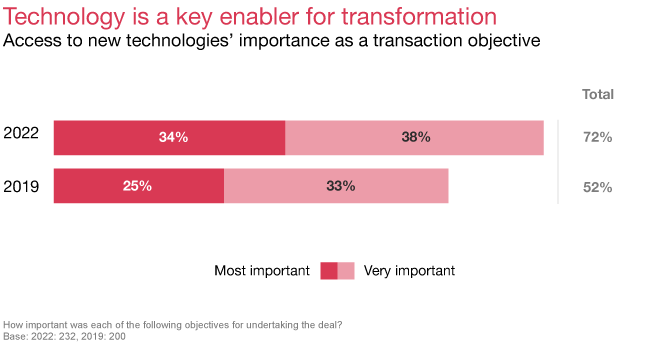

A growing percentage of organizations are undertaking technology-driven transformation deals as part of their integration strategy. Access to technology is emerging as a critical transaction objective across all industries. Seventy-two percent said that access to new technologies was the most important or a very important transaction objective. And 88% view the target’s technology capabilities as a mechanism to accelerate their own digital transformation.

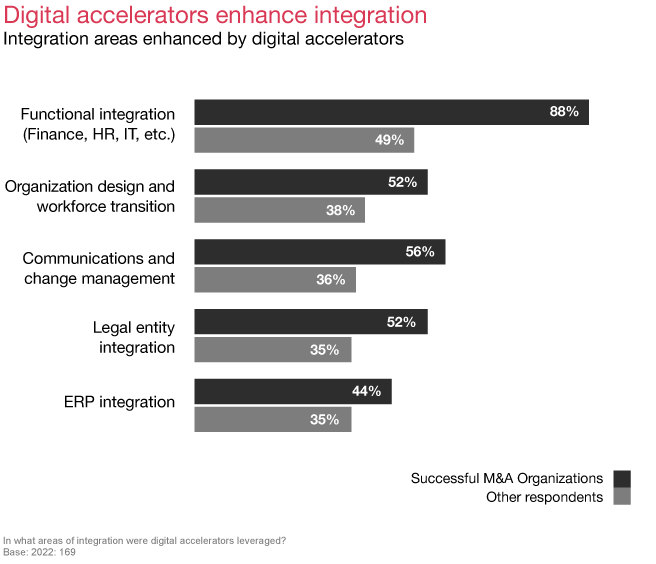

Rapid growth in hyperscalers and other cloud infrastructure and software as a service (SaaS) solutions have brought data analytics, machine learning and other enabling technologies to the mainstream. So it is no surprise that all 2022 survey respondents are focusing on adopting new technology and developing new digital capabilities — both internally and customer-facing — to compete effectively. More companies are using these technologies throughout the M&A process to model complex go-to-market synergies, manage cross-functional work and implement long-term operating models — all in parallel. They’re also digitizing the M&A integration process in order to transform the new, larger organization. In fact, Successful M&A Organizations use digital accelerators across functions and activities more often than other acquirers.

The stakes during acquisitions and integration are higher than ever. For many companies, successful M&A integration will be a key strategy as they reposition themselves for long-term, sustainable success in a more volatile and competitive marketplace.

This study captures what makes M&A integration work, and the challenges leaders must navigate in the deal life cycle, from target screening to integration and transformation. A coordinated approach to M&A integration is critical, as the future of a company can be determined by how well it integrates an acquisition.

Taking early, deliberate steps can enable a smooth transition in the weeks and months after closing. Companies that can execute on the key challenges detailed in our full survey report will likely be better equipped to execute M&A integration in a challenging environment and position themselves for long-term success.

{{item.text}}

{{item.text}}