Our experience radar for consumer lending

We asked borrowers about their consumer expectations for auto, home, student, and personal loans. We learned that borrowers’ expectations are being shaped by other industries that focus on customer satisfaction and operate in a collaborative environment.

We found disruptors continue to make inroads, particularly amongst millennials. These new entrants have joined the market with better technology—including mobile apps and financial management tools—that simplify the loan process and provide the fast loan experience that consumers want.

To stay ahead, lenders need to adapt to changing customer expectations, borrower trends, and new technology before new entrants can extend their customer footprint. Below, you can download the full report or explore some of our findings around specific features lenders should consider for each loan type.

Key findings

- Online all the way

- Keep things quick and simple

- Reaching younger borrowers

- Cross-selling works

Online all the way

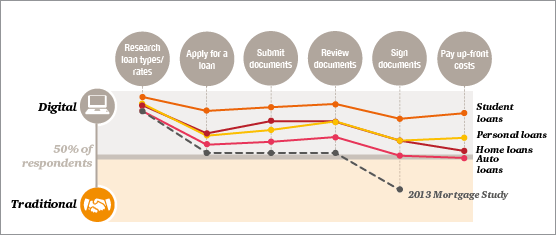

The majority of consumers now prefer to apply for loans online, especially young borrowers. While some segments still prefer human interactions for certain parts of the process, a viable digital process is now mandatory for lenders wishing to compete across all consumer segments.

Keep things quick and simple

Other than economic factors or having an existing relationship, borrowers believe the most important factor in choosing a lender is the speed of the process. More sophisticated features such as automated status updates and financial literacy tools are popular but ranked lower in importance.

Reaching younger borrowers

In addition to a stronger preference for a digital application process, younger borrowers are less satisfied with their current application experience than other consumer segments surveyed.

Cross-selling works

For each asset class, having an existing relationship with a lender was seen as a key referral source for the loan in at least one-in-five cases. While traditional marketing and referral sources remain important, the cheapest way to generate new business may be to target the customers lenders already have.

A fast end-to-end application process is the largest differentiator in auto loan financing

While flexible products and low closing costs are very important factors that consumers consider when looking for auto loans, these are largely driven by product strategy and economics. By far the largest differentiator for auto lenders is a fast end-to-end process, which is likely why dealer financing proves so popular.

Home borrowers value lenders that combine digital tools with knowledgeable advisors

While it's true that home borrowers prefer a more digital process today than they did two years ago, much of the data shows that digital and traditional channels have to be equally adept at servicing mortgage borrowers. In other words, many consumers want to research and apply for a home loan online, but when it comes time to the closing stage, consumers want to be able to talk with someone knowledgeable to address their concerns, if needed.

An efficient application process is an imperative in student loans

As the younger generation heavily values a digital process and instant gratification, it is important for lenders to provide a fast end-to-end process, quick decisions, and frequent status updates to student borrowers. There is an opportunity for mobile apps to be successful if they have features that allow the customer to lock in an interest rate, check an application status, and compare loan products.

Offering flexible products and terms is a sweet spot in personal loans

Personal loans are typically short term in nature and paid off relatively quickly, making the customer experience—a simple and seamless application process—more critical than interest rates in many cases. Quick decisioning by lenders, combined with flexible products and terms, is the sweet spot that consumers search for when looking for a personal loan lender.