A flurry of policy proposals, new regulations and investigations into biopharmaceutical drug pricing practices are changing the way medicines are bought and sold around the world. New scientific discoveries are helping patients overcome longstanding health problems – e.g. curative drugs are emerging in new therapeutic areas – but the cost of innovation and the global assessment of product value is creating barriers to treatment. Biopharmaceutical companies will need innovative financial models, robust data strategies and organizational changes to successfully navigate the changing global market for medicines, and to balance product prices and value with affordability and medication access.

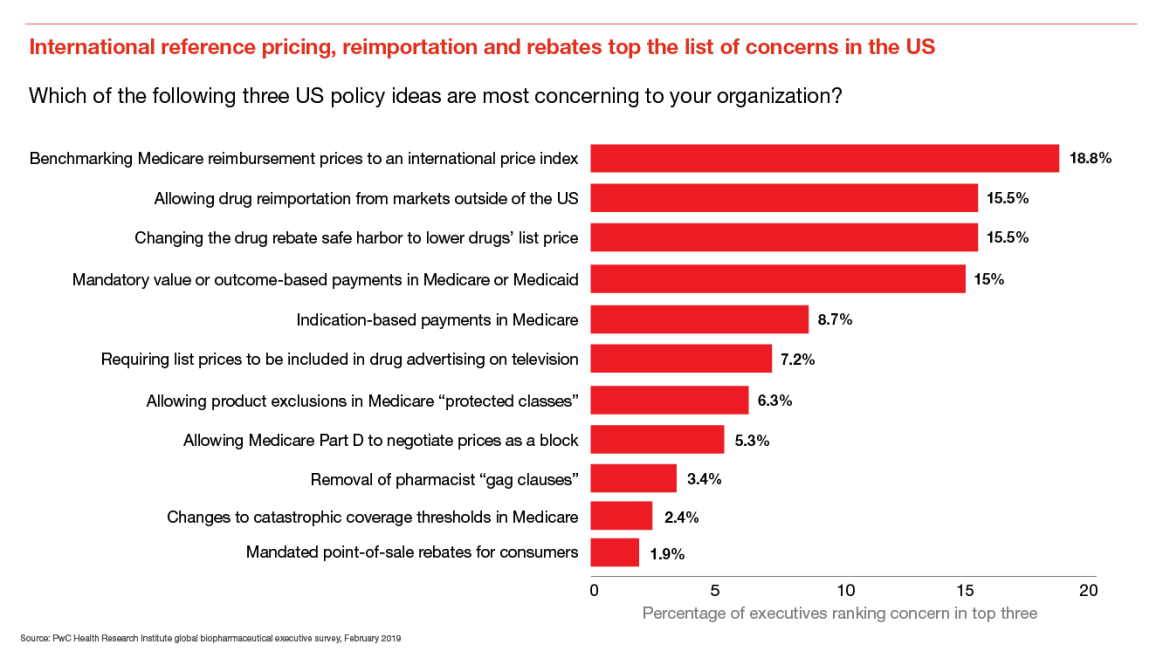

New policy proposals most concerning to biopharma executives include international reference pricing, reimportation and rebate reform

Industry executives were most concerned about the adoption of an international price index (IPI) for physician-administered drugs in Medicare Part B, which could lead to hundreds of millions of dollars in lost revenues annually, according to an HRI analysis.1

If the proposed rebate rule is finalized and implemented, drug wholesale acquisition costs, or list prices, are expected to come down. Actuaries from the Centers for Medicare and Medicaid Services estimate an $83 billion saving in out of pocket costs for patients across Medicare plans between 2020 and 2029.2

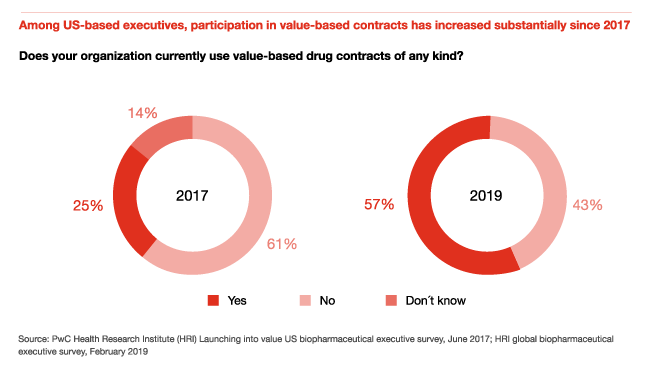

Participation in value-based contracts has increased substantially since 2017

In 2017, HRI conducted a survey of US biopharmaceutical executives to better understand the prevalence of value-based contracts, including contracts tied to patient clinical outcomes, economic outcomes, or both. Only 25 percent of surveyed US executives in 2017 had participated in a value-based contract.

In 2019, 57 percent of US executives surveyed had used value-based contracts, compared with 56 percent of all global executives surveyed. In Europe, single-payer health systems and managed entry agreements pushed drugmakers to participate in risk-based or outcomes-based contracts several years ago, and those practices are being adopted in other geographies, especially for innovative specialty drugs and orphan products.

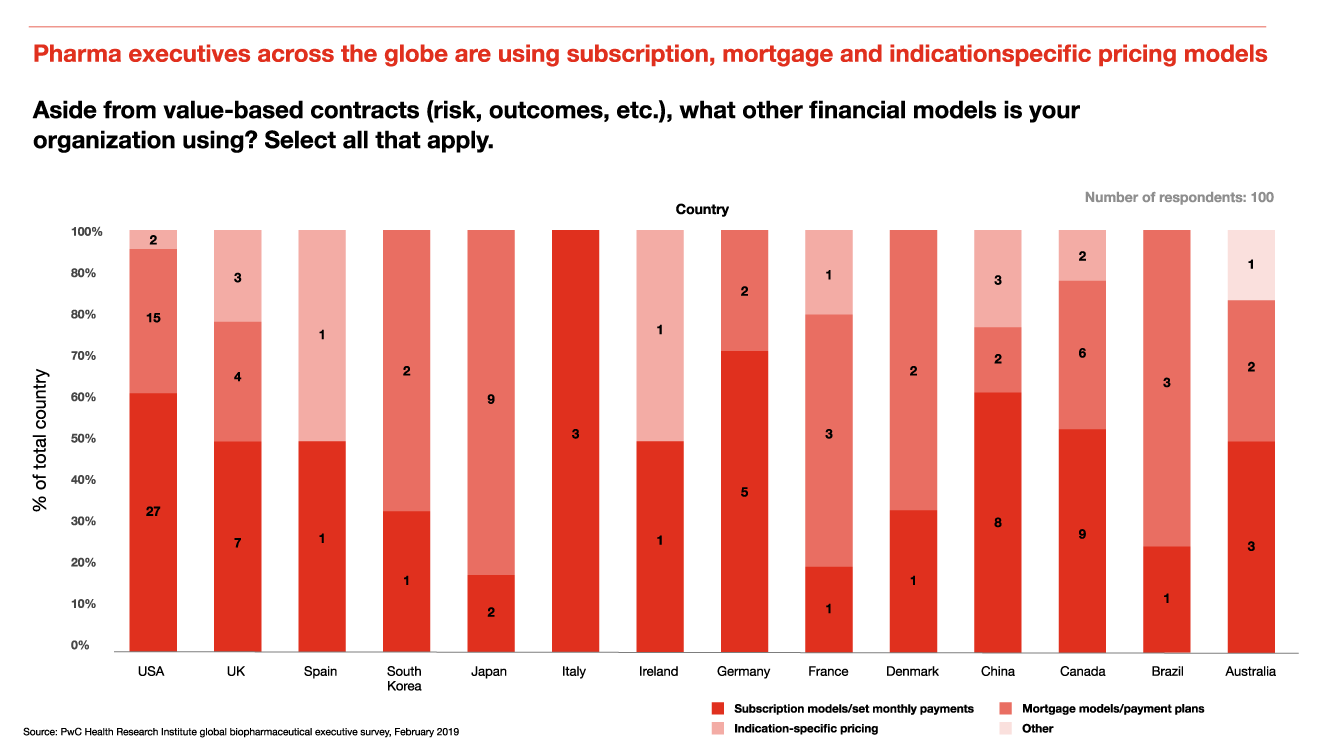

Pharma executives across the globe are using subscription, mortgage and indication-specific pricing models

Pricing models for drugs have become more segmented and nuanced to reflect unique product characteristics, competitive dynamics and patient needs. HRI survey data shows that the use of mortgage models, subscription models and indication-specific pricing is spreading to new geographics and markets.

Mortgage model: Products that aren’t facing direct competition, such as new immunotherapy products for oncology, orphan drugs targeting rare diseases, or emerging gene and cell therapies, are all good candidates for the mortgage model.

The subscription or Netflix model: Subscription models may become useful for other curative therapies beyond hepatitis C, such as gene and cell therapies, because they promote patient access by removing benefit design restrictions.

Indication-specific pricing: Monoclonal antibodies often receive approval for multiple indications, and have helped to push the use of indication-specific pricing to major drug markets across the globe. The FDA has approved over 80 monoclonal antibodies for use, spanning therapeutic areas including cancer, asthma, macular degeneration, arthritis and Crohn’s disease, among others.

Recommendations

- Prepare for potential challenges to list prices in the US by calculating true net price trends

- Design pricing models that maximize product access in local markets

- Look past the next quarter when creating a new product pricing strategy

- Build capabilities to enable effective use of evolving pricing models

Prepare for potential challenges to list prices in the US by calculating true net price trends

John Shakow, partner, FDA and life sciences at King & Spalding, a corporate law firm, recommends calculating a public/private net price, or PPNP, to have at the ready when questions about list prices arise. The PPNP is net of all discounts, including government rebates, 340B prices and other required deductions from gross that are not captured by the figures reported to Medicaid and Medicare. Several biopharmaceutical companies already publish aggregate net prices for some products.

Companies should invest in data collection and analysis – beyond what is required for regulatory approval – to more effectively accommodate the differing requirements and needs of patients across the globe. Pharmaceutical and life sciences companies should focus on out of pocket costs for patients, and use the contracting process to minimize out of pocket costs, which can help to improve adherence rates and health outcomes.

Design pricing models that maximize product access in local markets

As industry pipelines continue to shift toward rare diseases, oncology treatments and gene or cell therapies, an understanding of access issues in key global markets is essential. New financing models may help patients get access to drugs, especially in countries or states where new policies have been created to handle innovative new therapies. For example, Louisiana’s “All you can treat” agreement with Gilead subsidiary Asegua Therapeutics will provide unlimited access to the authorized generic version of Epclusa, a curative treatment for hepatitis C, to Louisiana’s Medicaid patients for five years.[3] Organizations should also consider leveraging a portfolio of products in a subscription model, or offering subscription access to a suite of products.

An increase in the use of health data and analytics – catalyzed by the adoption of electronic health records – is making it easier for companies to engage in value-based contracts. An understanding of different patient populations living in different geographies, and covered by different health plans and different kinds of insurance, is needed to select the right financial model for a given purchaser.

Look past the next quarter when creating a new product pricing strategy

Asked about which industry group is most responsible for the increase in public and political pressure on drug prices, 71 percent of executives said that biopharmaceutical shareholders are “very responsible,” the highest response for any of the 10 selection choices. Shareholders focused on price growth as a key lever of financial performance risk causing a public backlash against their companies. Reputational harm can take much longer to repair than a quarterly report with flat product growth due to price stabilization or changes in the market.

Organizations must continue to build product lifecycle management programs that anticipate new products entering the market, and affordability issues unique to individual patient groups. Financial assistance programs will continue to be an important aspect of patient access, but drug prices will continue to receive the most attention in the public and policy realm.

Build capabilities to enable effective use of evolving pricing models

Planning for future pricing scenarios (e.g., a world without rebates) and developing the capabilities to enable these and other evolving pricing models is becoming increasingly important as stakeholders across the value chain align on the need for change. Working to build these capabilities now so they are ready for use when needed can create a competitive advantage, or at the very least a de-risking strategy, for companies that take the lead. Successful planning for what comes next in pricing, contracting and market access will take a real commitment to build the right organization, data and technology, policies and processes, and development of skill sets.

Managing a single or small number of innovative contracts is feasible in an incubator type setup; companies will need a scalable, repeatable and efficient capabilities system to manage dozens of different types of emerging pricing models across a diverse portfolio and pipeline of products.