CX in M&A: What consumers think when companies combine

Understanding how customers view M&A can help companies capture deal value

Every year, tens of thousands of companies across the globe engage in M&A—in every industry, for millions or billions of dollars. The typical M&A announcement highlights what companies and their investors could gain. Due diligence tries to bring value into focus, yet often hinges on financial, legal and operational issues. Less evident but also crucial is the impact on the consumers who are a company’s customers.

These customers include the millions of people who buy from an automaker, subscribe to a cable TV or on-demand video service or visit a healthcare system. The tens of millions who use a particular smartphone, patronize a bank, benefit from an insurance plan or shop at a retail chain. The hundreds of millions who use a social network.

Keeping those customers happy is essential for a company’s survival, and understanding how M&A affects consumers can increase the chances of a deal being successful.

How consumers view M&A

As part of PwC's Global Consumer Intelligence Series, we asked more than 7,800 people in the US, Canada, China, Japan, South Korea and the UK to provide their views on M&A.* Consumers of different ages, income ranges, education levels and employment status shared not only their opinions but also their actual experiences as customers of companies that went through M&A. We also conducted interviews with several dozen M&A professionals who collectively have been involved in hundreds of deals over their careers.

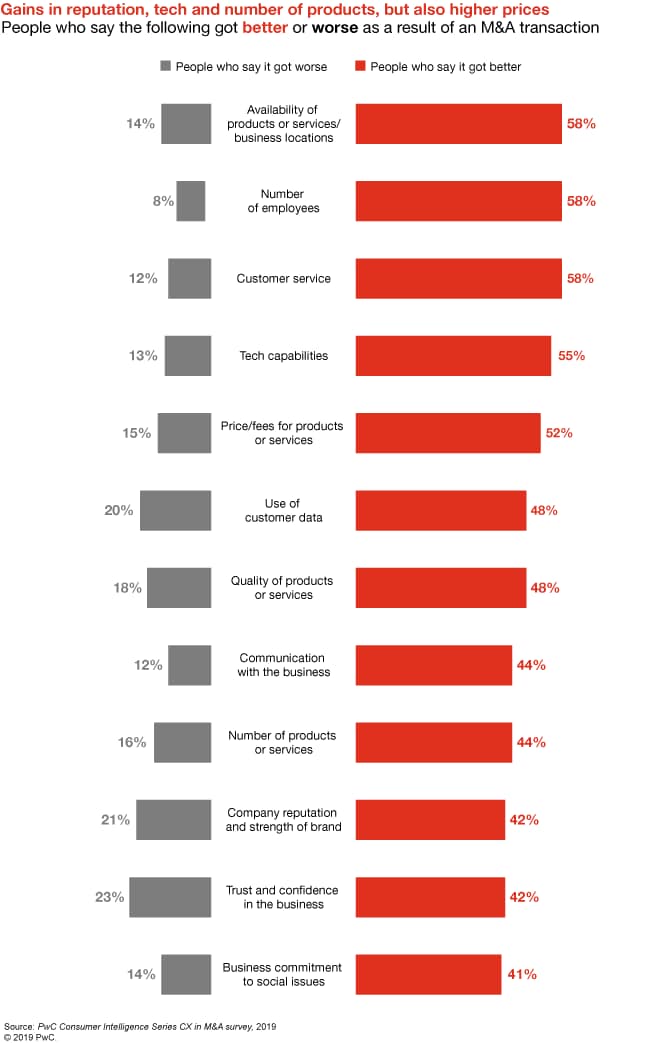

We found that companies clearly have opportunities to strengthen relationships through M&A, as consumers are open to the potential benefits. But while only one out of five people said their M&A experience has been negative, less than half said it was positive, leaving room for improvement. Also, while they recognize the desire to grow revenues and reduce costs through M&A, consumers largely don’t regard job cuts, shuttered locations and other efforts to improve efficiency as signs of success.

The good news is customers are sticking around. Only a fraction did less business with a company post-deal, and a larger percentage did more. In recent years, companies have expanded M&A strategy, due diligence and integration beyond hard assets to such areas as workforce and culture. But PwC’s CX in M&A survey shows how the deals process can further evolve to better serve consumers in times of transition.

M&A more often made things better than worse for a company's customers

Among those who said they were customers of businesses that went through a merger or acquisition, the types of companies most often mentioned were consumer businesses banks and telecommunications companies.

Three out of five consumers said they were customers of companies that went through M&A.

Consumers see positives about M&A but don’t think customers are a priority

Consumers do have some positive views of M&A: they aren't confused and don't assume the worst. They may have questions but, for the most part, appreciate why a company might want to buy or sell to another.

More than half of consumers say a company's customers can benefit from a merger or acquisition.

That said, many consumers don't think companies consider their customers during the M&A process. That should be a focus, they say, but this has not been the case in past transactions, leaving room for improvement. “As companies become larger, they have a tendency to lose a grip on the feelings of customers, and measures should be put in place to improve this point,” one woman in Japan said. A man in South Korea was more pointed: “Consumers can all tell which companies are just thinking of their own profit and do not care about their customers. In the long run, the company will suffer.”

Some dealmakers understand this concern. “To me, the first step is no impact. Don't lose the momentum,” one dealmaker in Canada said. “Can we slide from one company to another company—different ownership, different culture—and no impact to the customer?”

Employees are at risk in deals, and that’s not good for customers

Companies and their M&A advisors have given more attention to the importance of employees and culture in deals, and they should double down on these efforts. Consumers don’t think employees benefit from M&A nearly as much as the companies and their shareholders. More than a quarter say it’s negative for workers, and that can affect customer experience. “Jobs were slashed, wait times increased and remaining employees sounded stressed,” one customer of a health insurance provider said.

For consumers, job losses aren’t a sign of M&A success. That’s a challenge for companies that expect cost efficiencies through deals. One UK dealmaker said staff reductions often are “the harsh reality.” Another in China acknowledged that employee instability sometimes means “the experience of customers after the acquisition will become less good.”

But M&A also should be a shared journey to be successful, other dealmakers said, and it’s understandable that consumers identify more with employees than executives and shareholders. “The numbers and the legal documents are one thing,” a UK dealmaker said, “but you're talking about human beings.”

Customer data has promise but needs to stay safe

Consumer data is seeing a critical convergence. Companies in many industries want to use it to better understand customers and win more business. Consumers want to know their data is safe from a breach, but they also see opportunities for a better customer experience.

Nearly two-thirds of consumers say if companies going through M&A use customer data to improve offerings, they’d consider the deal a success. Of those who have experienced M&A, many more say use of customer data improved than got worse. But security remains paramount: nine out of ten surveyed consumers say companies need to keep customer data safe during M&A.

Dealmakers recognize customers may want a say in their data, but it also “may be one of the key reasons why you're acquiring that business,” one UK dealmaker said. Another in China agreed, citing consumer data as key in digital transformation. “Many companies now attribute the value of the consumer's data to the valuation "process in deals,” he said. New legal protections such as the General Data Protection Regulation in Europe and the California Consumer Privacy Act may help, but those vary by location. If companies are transparent about the safe transfer of personal information, one South Korean woman said, “they should gain trust.”

Keep what customers appreciate and work to preserve their trust

When a consumer starts doing business with a company, it's probably because something about that company appealed to them. That appeal factors into whether the customer stays and does more business. So while some dealmakers like having the opportunity to transform a business, a company going through M&A needs to keep in mind why customers first walked through its doors and keep coming back.

A majority of consumers are willing to wait and see what a combined company will be like, but just as many say keeping the most popular aspects of each business would lead to success. And issues arise when a company that customers trust combines with one they don’t—to the point that many customers could leave. One UK woman said her experience with a financial services acquisition would have been better if the two companies had understood each other’s markets and customer needs.

While some companies may see M&A as a shortcut to new customers, dealmakers realize there could be aversion to a new owner. A dealmaker in South Korea said an acquirer doesn’t necessarily need to “bring everything to a brand name under a single, unified flag just because you have done an M&A.” And a UK dealmaker recalled the sale of a beloved food brand to a multinational consumer goods company being seen as “a betrayal.” Keeping customers meant working “very, very hard to make sure that it ran (the acquisition) as a separate entity.”

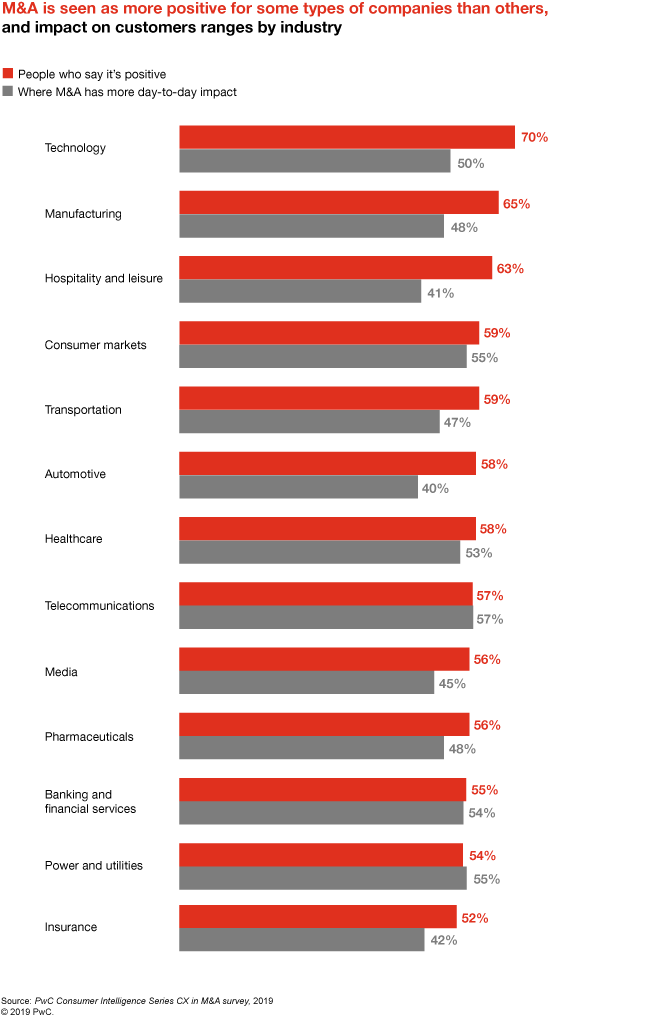

M&A has more impact in some sectors

Concerns about cross-industry deals, but also a monopoly

Whether it’s a company buying a major competitor or national corporation buying a regional business, M&A within an industry remains a large part of deal activity. But as digital transformation accelerates in some sectors, acquisition aspirations often expand beyond industry lines. “Many companies will be unable to survive if they stay with their existing business models,” one dealmaker in Japan said.

Consumers see more challenges in M&A by companies in different industries. One US woman said a deal by a telecom company and a consumer business didn’t make business sense and seemed “more for political and environmental reasons.” Dealmakers also see more complexity in cross-sector deals. “You're not just talking about difference in human culture,” a dealmaker in Canada said. “Now you're talking about difference in the industry culture and how it affects its financials.”

Consumers worry less about acquisitions within industries, but not if they result in a monopoly. “I just don't like when a big corporation hijacks the market,” a Canadian man said. One UK dealmaker thinks that’s less likely than in the past, thanks to previous consolidation: “The sizes of some of these businesses that are thinking of combining are so large, and their market shares are so large, that it's just hard to see it happening.”

Improving customer experience in M&A

- Sentiment analysis: What do people really think?

- Cyber due diligence: Get ahead of data risks

- Communications strategy: From leaders to the front line

- Integration management office: Building a new ecosystem

- Test and learn: Include customers on the journey

Sentiment analysis: What do people really think?

The ability to capture and analyze unstructured data to identify patterns has increased in recent years. Artificial intelligence-powered tools such as natural language processing can pull common themes, key trends and other valuable insight from massive amounts of information that otherwise would be labor-intensive to review. This can include consumer reviews of companies and their products and services, employee comments on companies and management and other collections of text that could better inform companies on how they’re viewed by stakeholders.

Cyber due diligence: Get ahead of data risks

Companies need to incorporate cybersecurity and privacy issues into their assessment of any M&A target. Between a deal's announcement and closing, an acquirer has to assess the cyber capabilities of the target, its vulnerabilities and how they can impact operations, customers and ultimately the transaction value. Key risk indicators include the resiliency of a company’s IT operations and which parts are in danger of attack, the amount and nature of customer data a company has, what data is most sensitive and valuable and how well it is protected. Having the right talent with experience in these and other cyber issues is crucial.

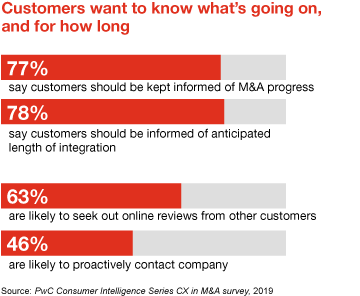

Communications strategy: From leaders to the front line

Announcing the deal is just the beginning—a comprehensive communications strategy ensures key audiences, including customers, will understand and appreciate how the transition is going. Communication is a stabilizer, and this is crucial after Day One of the new, combined entity, when integration begins in earnest and the parts of the two companies come together. To ensure customers aren’t left wondering, M&A communications should include both broad outreach on the company brand and specific messaging on opportunities resulting from the transaction, articulated by customer-facing employees.

Integration management office: Building a new ecosystem

Many companies have experience in creating a central project management office (PMO) for major initiatives. However, a merger or acquisition, especially one that transforms a company, is more than a “project.” An integration management office (IMO) converts the integration strategy into actions by aligning people, processes and systems with M&A objectives. An IMO can provide both discipline and flexibility to adapt to a transaction’s unique circumstances and evolving needs. Coordinating activities across teams in both companies pays dividends—not only with employees of the combined organization but also customers, who will then see a smoother transition.

Test and learn: Include customers on the journey

M&A is often a big investment with big expectations. It makes sense to consider investing time to go deeper with consumers on what they’re concerned about and would appreciate as the company evolves. Whether it’s through an IMO or another process, surveys, focus groups and pilot programs can yield useful insight on a small level that can better guide the larger transition.

The bottom line

Customer satisfaction can contribute mightily to company success, and keeping customers happy in times of change can be challenging. M&A professionals have plenty of stories about deals that didn’t deliver the anticipated value. A company exploring a merger or acquisition can take steps to avoid that by adjusting its deal process to better account for consumers’ needs, and ultimately position itself for a stronger future. “If you've got customer success, you're going to have the financial returns,” one dealmaker said, “and your investors would see that.”

Explore the data

Select up to five options from below:

Countries

Contact us