{{item.title}}

{{item.text}}

{{item.text}}

Introducing our latest quarterly industry insights for the pharmaceutical, life sciences, medtech, healthcare, and not-for-profit sectors. This edition features our Deals 2026 Outlook for Health Industries, reminders for 2025 year end and Q1 2026, an update on regulatory and accounting topics, and additional insights on FASB pronouncements. Additionally, we explore other pertinent topics that significantly influence the health industry.

Just launched, PwC’s Deals 2026 Outlook for Health Industries, offering fresh perspectives on next year’s M&A environment.

These outlooks offer a grounded view of where the market is heading and what leaders should be preparing for in the year ahead.

With the year-end fast approaching for calendar year-end companies, we highlight key reminders on accounting and reporting considerations that may impact the financial statements in the near term. We also include highlights from the AICPA & CIMA Conference on Current SEC and PCAOB Developments held December 8-10.

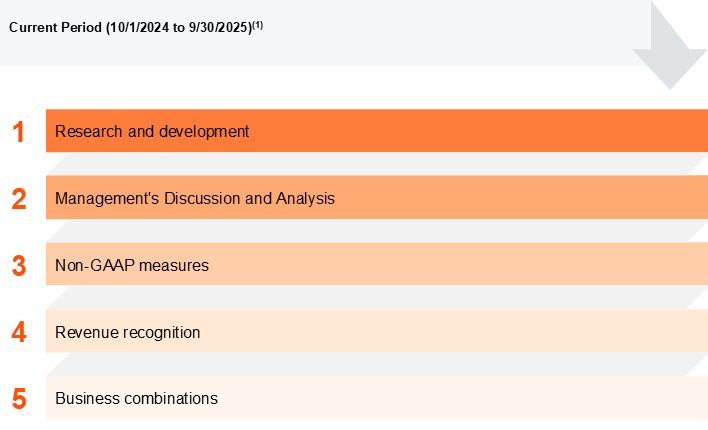

Our analysis of SEC comment letters has been updated for letters made public through September 30, 2025. There has been no change in the top five comment letter themes for health industries registrants compared to the prior quarter.

1. This analysis was performed based on topical areas assigned by research firm Audit Analytics for comment letters publicly issued in the 12 months ended September 30, 2025 (Current Period) and the 12 months ended October 1, 2024 (Prior Period) in relation to Form 10-K and Form 10-Q filings.

The transformation of healthcare is accelerating, driven by advancing technology, shifting expectations and evolving consumer behavior. PwC’s 2025 US Healthcare Consumer Insights Survey explores this dynamic convergence, from ongoing affordability and access challenges to the growing adoption of digital health tools and the increasing role of artificial intelligence.

Four findings from the survey highlight both the persistent barriers consumers face and the opportunities to better support, educate and engage them:

To read the full report, click here.

Were you unable to attend our December 17 Health industries accounting and reporting year-end webcast? Don’t worry, we’ve got you covered. Watch the webcast replay to catch up.

Note: Watching the webcast replay is not eligible for CPE credit.

Learn how leading medtech companies are redefining growth by pairing breakthrough technologies with smarter, more agile business models.

Discover how payers can transform traditional compliance functions into strategic capabilities that strengthen operations, improve efficiency and better support members.

Catch up on recent Next in Health podcast episodes you may have missed — featuring timely insights on the trends shaping the future of health.

We also have featured publications here which offer deeper insights into the Health Industries sector.

{{item.text}}

{{item.text}}