What if health insurers offered twice the service at half the cost?

The future of the healthcare payer: Partner for life, half

Reasons to believe: The four forces driving a new future

Economic pressure, technological innovation, medical advances, and consumerism are reshaping the payer landscape. Confronted with these powerful catalysts of change, payers should deliver greater value with fewer resources—and do so at an unprecedented pace. To succeed, they should also rapidly invest in advanced AI and digital capabilities by automating processes, personalizing member experiences, and building adaptable networks. These efforts can help free capacity and equip workers with the technology to address complex member needs with empathy and insight. Payers that embrace innovation and collaboration can secure long-term viability and become indispensable, lifelong partners to their members.

1: “The big squeeze”

Health plan margins are at their lowest in two decades, and 2025 is expected to be a break-even year overall.1 The outlook remains challenging. Commercial markets face shrinking group margins as enrollment declines, and employers seek cost-saving solutions and alternative products. Medicaid growth is likely to slow as federal policy tightens. The ACA individual market remains volatile.2 Medicare Advantage margins are under pressure.3 Across the sector, rising medical costs are a major concern. PwC projects the medical cost trend for 2026 will be 8.5% for group plans and 7.5% for individual plans, consistent with recent years.4 Without innovation, cost control, and adaptation to new regulations, ongoing margin compression can threaten payer viability.

These financial pressures are reflected in some risk-based capital projections, posing potential challenges for payers lacking sufficient reserves to weather ongoing uncertainty. As margins shrink—driven by decreases in membership volume and revenue—payers should scrutinize fixed cost investments that, due to reduced scale, may no longer be justified.

2: Technological innovation

Payers are adopting tech tools to render operations more efficient; create more personalized, streamlined member experiences; and harden cybersecurity. But the pace of the subsector’s adoption of advanced technologies such as AI lags health systems and other parts of the industry.5

Years of deferred maintenance and accumulated technology debt continue to burden many payers. Modernization is typically urgent and costly. Payers should use new technologies—whether by upgrading legacy systems or starting fresh—to help deliver high quality services at a lower unit cost per member, shifting the focus from traditional business metrics.

Generative AI (GenAI) is automating workflows, reducing costs, and enhancing productivity. Intelligent prior-authorization and claims automation, enabled by Fast Healthcare Interoperability Resources (FHIR) APIs and AI-driven tools, are streamlining decision-making and lowering administrative expenses. GenAI “digital front doors” and virtual care models are making healthcare access faster and more personalized. Strong cybersecurity and “zero-trust modernization” (continuously confirming and authenticating) are essential, as recent attacks underscore the need for high-level protection of personal health information.

3: Medical advances

Medical advances hold tremendous promise. At the same time, they also can introduce significant costs, compelling payers to rethink how they finance and manage access to breakthrough therapies. Innovative treatments such as gene and CAR-T cell therapies have led payers to pursue outcome-based agreements with pharmaceutical manufacturers, linking payments to real-world patient results. The CMS’s Cell and Gene Therapy Access Model further supports outcome-based contracts, improving Medicaid patient access, and reflecting a broader shift toward value-based care and financial innovation.

The growing use of GLP-1s (and their expanding indications) are driving up near-term costs. Payers are responding by negotiating directly with manufacturers, launching new PBM models, capping member copays, and reconsidering coverage for certain conditions. As patents expire and generics enter the market, payers should continually reassess formulary strategies. Payers also have to consider the impacts of new antibody-drug conjugates and radiopharmaceuticals, including complex logistics and new reimbursement models. Payers should possess agility, data-driven decision-making, and collaboration so they can manage patient access and costs.

4: Consumerism

Consumerism is reshaping the American healthcare landscape. While 44% of American consumers say the system will improve by 2035, more than half are critical of the healthcare system as it is today.6 Fifty-one percent describe the system as “fundamentally broken.”7 Financial worries are central, with 75% of consumers concerned about costs not covered by insurance, 71% about out-of-pocket expenses, and 70% about high premiums. These anxieties are even more pronounced among caregivers. Nearly half (44%) say they cannot afford their own healthcare needs, and 43% cannot afford mental health care, both significantly higher than non-caregivers.8

Consumers are more proactive and informed, often conducting their own research. Health technology adoption is widespread, with 80% of millennials and Gen Z, and 75% of affluent consumers, reporting that they use some kind of health tech monthly. Many are comfortable with AI-enabled services such as scheduling appointments or refilling prescriptions, and 20% would pay more for streamlined, AI-enabled healthcare. Ultimately, many consumers say they want a one-stop, integrated platform that simplifies their healthcare experience (payments included) and helps them make informed choices.9 To succeed, consumer-centric payers should outpace rising consumer expectations with rapid innovation—a challenging but essential task for the years ahead.

Building a partner for life: Half the cost, twice the service

The transformation begins with a bold first step—dramatically cutting administrative costs and reinvesting in next generation AI-led capabilities. This newfound capacity sets the stage for the second step—building the capabilities required to deliver twice the service. Only by executing both steps can payers evolve into true partners for life, ready to meet the demands of tomorrow’s healthcare landscape.

Partner for Life: Half the (administrative) cost

Half the cost, in theory

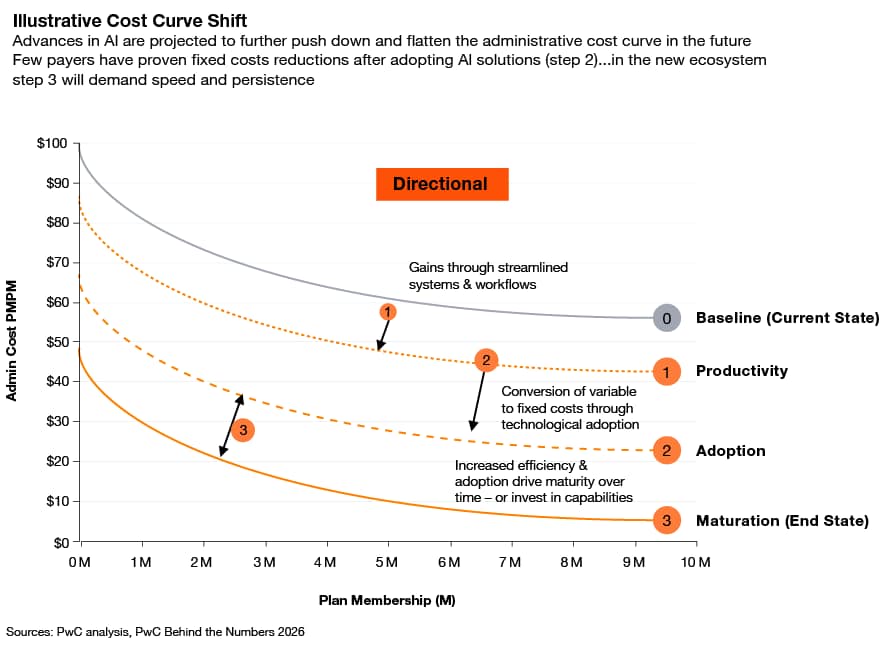

AI and other tech innovations are projected to dramatically lower and flatten the administrative cost curve for health plans over time. This reduction is not possible overnight. Rather, a transformation of administrative costs is possible in four phases: baseline, productivity, adoption, and maturation.

- Baseline (current state): Health plans face high fixed and variable administrative costs. This is largely due to fragmented systems, manual processes—fax/phone utilization management decisions, outdated back-office systems—and years of accumulated or acquired technology and process debt. Large plans tend to have lower PMPM administrative costs by spreading fixed costs across a larger membership base, benefiting from economies of scale.

Productivity: Streamlined systems and workflows—such as centralized enrollment and billing channels, and digital sales management—would reduce manual effort and drive down both fixed and variable costs.

Adoption: The next phase involves implementing AI and modern platforms—predictive care management models, personalized agile marketing—to begin replacing manual tasks. This would shift more variable costs to fixed costs, further lowering the overall cost curve.

Maturation (end state): As legacy systems are retired and AI-native platforms enable rapid scale, fixed costs would decrease even more. The industry would transition from labor-heavy operations to AI-enabled platforms, flattening the cost curve and making administrative costs less dependent on scale.

Payers can achieve fixed cost reductions after adopting AI solutions (the adoption phase). In the new ecosystem, maturation can demand speed and persistence to realize the full benefits. Gains can be won through streamlined systems and workflows, conversion of variables to lower fixed cost structures via technological adoption, and increased productivity and maturity over time.

Half the cost, in action

Payers can expect to cut administrative costs by half, requiring platforms and systems to deliver more effectively. One scenario modeled below illustrates the likely magnitude of the challenge and the opportunity.

- Front office

Through 2035, an estimated 40% to 50% reduction is expected in administrative costs, mostly due to cuts in agent and broker commissions and sales and marketing. New AI based reasoning models can help members select plans that are right for them, reducing the archaic agent-based plan selection model that is infested with biases. Underwriting spending will likely shrink modestly, even after shifting today’s significant manual work flows into AI-powered processes such as automated risk scoring, reinsurance triggers, and decline decisions. Payers should remove intermediate dependencies across consumer- and sponsor-facing eligibility and navigation, with tools such as AI agents streamlining enrollment and reducing administrative burden.

- Middle office

A 20% to 30% reduction in administrative costs is expecteed through 2035, mainly through network management reductions. Medical management spend can shrink as organizations shift away from manually heavy prior authorizations and utilization management processes and toward member analytics and behavioral change. Future middle office capabilities perform intelligent sensing, authorizations at point of service, precise patient navigation, and real-time data exchanges within the healthcare ecosystem with providers and employers, making possible real time performance monitoring. The human-led, workflow-based care management model can be replaced with a newer, more intelligent patient and physician behavior change model.

- Back office

A significant cut to shared services, IT, claims, customer service, and enrollment is predicted, removing more than half of back-office costs by 2035. The back office is highly invisible, somewhat antiquated, and plagued with systems that were built in the prior century. Payers can create novel infrastructure to help reduce IT and shared services costs like banking where real time verification and transactions take place, and native rich communications systems (RCS) enable customer service models.

Partner for life: Twice the service

The elements defining the business model of today are reshuffling to establish four new models for the future: the lean operator, the risk clearinghouse/marketplace for care, the value/market integrator, and the consumer health partner for life.

Delivering twice the service by building, buying (and shelving)

Health organizations face a daunting array of potential technology and capability investments, and limited resources often making it impossible to pursue them all. Each of the four payer models demands distinct capabilities, requiring leaders to carefully prioritize which to develop, acquire, or defer—enabling strategic focus and sustainable transformation.

Next steps: No regrets, big bets

Cost cutting measures are no regrets

In the short term, payers should focus on foundational actions that are essential for survival in a rapidly changing healthcare landscape. These no-regret moves can include:

- Simplifying the back office by replacing legacy systems and embracing cloud-enabled platforms.

- Automating administrative tasks.

- Driving zero-friction operations.

- Modernizing core operations by building scalable technology and AI into the backbone of their business to secure structural cost advantages.

- Pursuing strategic deals to acquire or partner for digital and other relevant assets that help accelerate transformation and keep payers at pace with market demands.

Big bets are archetype-defining choices

- Deliver value chain orchestration. Decide whether to vertically integrate (VMI) or stay lean and hands-off.

- Redefine the product model. Choose between offering stripped-down, ultra-low-cost coverage or becoming a platform for configurable, consumer-designed benefit bundles.

- Invest in lifetime health. Choose whether to become a CHPL with prevention, genomics, and long-term ROI models. Consider new partnerships and products like life insurance or financial services.

The future of reimbursement: An end to the payment struggle

Payers and providers are entrenched in costly and counterproductive payment disputes, each side investing heavily in technology, personnel, and processes in an effort to gain an advantage. These adversarial dynamics foster suspicion, with both parties believing the other is manipulating the system for their own benefit. At its core, the current reimbursement approach requires payers and providers to determine the cost of care only after services have been delivered, which inevitably leads to disputes over payment. These ongoing battles transform every patient encounter into a potential conflict, ultimately failing to serve the interests of payers, providers, and consumers.

Looking ahead, the future of reimbursement holds the possibility of a truce—a collaborative shift from adversarial negotiations to a mutually beneficial prospective payment framework. By sharing access to data and evidence-based standards of care, payers and providers can near-instantaneously assess the likely course of a patient’s treatment. In a global accountability model, both parties agree in advance on detailed reimbursement terms based on patient presentation and evidence-based clinical guidelines. Alternatively, a global budgeting model allows payers and providers to set per-patient payments for broad categories of care, such as an inpatient admission, using mutually agreed-upon data and standards. This would allow the more effective providers to create a margin for those that deliver better care.

In both models, the consumer wins. Survey after survey reveals that many consumers find healthcare costs confusing and unpredictable. For example, a 2023 KFF survey found that three out of ten adults struggle to understand how much they will have to pay out-of-pocket when using health insurance. By introducing AI, predictive analytics, and other advanced technologies, payers and providers can move past payment disputes, create genuine transparency and predictability for various parties, and focus resources on building capabilities that enhance consumer experience, transform business models, deliver better outcomes, and reduce administrative costs.

Seize the future

US payers have a chance to shape the health ecosystem—including reimbursement—through thoughtful reinvention of their business. They have the chance to use technology to deliver more service for less. They can underwrite the development of a health ecosystem that is more productivity, more affordable, and more effective.

Payers should act now, accelerating personalization, building adaptable networks, deploying automation, and experimenting with new models that underwrite care, expand access, and empower consumers as active managers of their health to meet the 2035 benchmark. By seizing this moment, payers can start down the path of delivering twice the service at half the cost and setting themselves up as a partner for life for their members and for the healthcare system.

The future of healthcare

Over the next decade, we expect $1 trillion of annual healthcare spending to shift.

The consumer-first era of health

PwC’s 2025 US Healthcare Consumer Insights Survey