R&D Tax Credit Services

Our approach to R&D tax credit services

At PwC, we bring industry-leading expertise, decades of experience, and advanced AI-driven technologies to revolutionize your R&D tax incentives process and enable rapid identification of tax saving opportunities and can support you with subject matter specialists through each stage of your journey.

Our global network of specialists combines deep domain knowledge with innovative tools to simplify, enhance and substantiate your claims. By aligning with your business goals and leveraging advanced insights, our R&D tax credit services help deliver an enhanced, tailored, and seamless experience that can increase your incentives.

Transforming the R&D journey

Our specialist-led, tech enhanced process

Navigating your R&D incentive journey

1. Identify R&D tax credits across the world

Our R&D tax credit specialists utilize the power of technology to identify and assess global R&D tax credits and other incentive opportunities across your business, saving you time. This allows your business and our global network to collaborate on future investment strategies that can deliver ongoing cost savings.

2. AI-enhanced R&D credits built on software management system data

Our capabilities can leverage data from your existing software management systems, such as Jira, GitHub, Azure DevOps, and others, to help streamline PwC preparation of quantitative and qualitative R&D documentation and reduce the time needed with your researchers.

Our AI-enabled technology helps increase data transparency and can provide direct insights into available contemporaneous project data to assist in identifying and documenting qualified R&D activities, business components, and costs.

By tracing insights from your existing data into R&D credit support, we can help:

- reduce manual engineering time

- strengthen your supporting information

- defend QREs with data-based evidence

- map allocations and write-ups back to tasks

- establish a repeatable process for future years

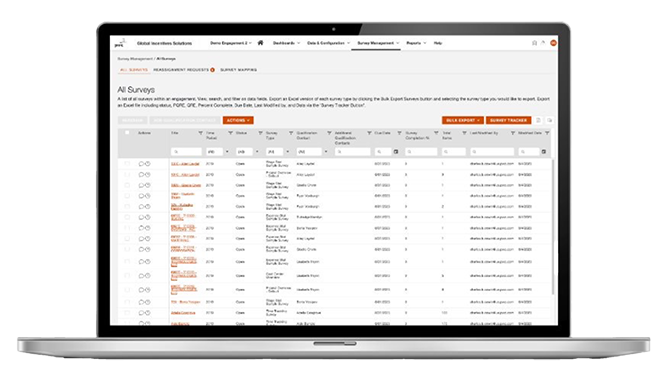

3. Streamline data collection with Global Incentives Solutions

Our innovative and web-based Global Incentives Solutions helps enhance time savings and simplify the data collection process. By leveraging automated surveys and interactive dashboards, we can facilitate seamless monitoring and effective progress tracking for your R&D tax credit study. This approach helps reduce the administrative burden inherent in this process and can help free up time to focus on key qualification areas.

4. Accelerate documentation review with advanced e-discovery technologies

PwC leverages innovative e-discovery technologies and a team of experienced specialists to effectively and thoroughly review documentation for R&D tax credit qualification. By combining industry-leading technologies with specialists' insights, we can accelerate document analyses by rapidly flagging relevant documentation, standardizing processes, and building holistic support and documentation for R&D claims. Quality results can now be effectively delivered in a thorough and reliable manner.

5. Achieve specialist-led, exam-ready results

Our experienced specialists use AI-enhanced documentation processes to help streamline our ability to provide exam-ready R&D tax credit deliverables. By leveraging AI to improve the consistency and quality of project narratives, we help confirm that claims are well-documented, substantiated, and aligned with regulatory expectations—supporting a smoother claim and exam process.

Contact us