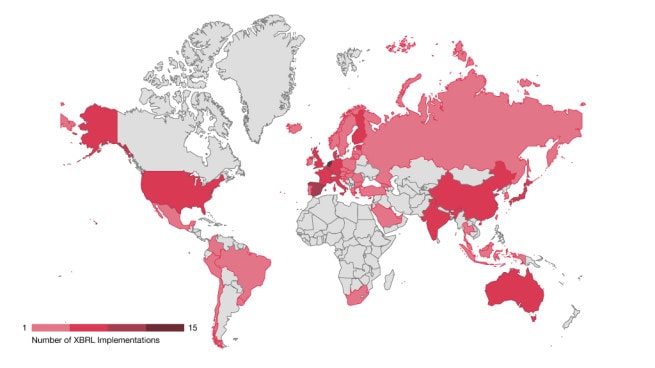

XBRL is a digital language and framework used to communicate business information that is mandated by many regulators around the world. The number of implementations of XBRL globally exceeds 214 and continues to increase.

Financial analysts, regulators, corporations, academics, and others worldwide consume XBRL data to gain insights on the performance of companies with a ‘touch of a button.’ Traditional time intensive data gathering techniques are often manual, and the breadth of the data collected is typically limited. Users of XBRL can focus on data analysis and finding meaningful insights versus consuming, standardizing, and aggregating the data.

Source: XBRL International.

The future of XBRL is bright

PwC, as a data-driven organization, is excited about the benefits of XBRL providing timely and useful information to the capital markets to facilitate decision making. We continue to observe global mandates and uses for XBRL increasing, such as the recent XBRL mandate for EU listed companies. XBRL plays a crucial role in further streamlining financial reporting. We look forward to engaging on this topic globally, as XBRL International welcomes Wes Bricker to its board of directors.

“I have seen the importance of XBRL and the positive impact it can have on the usefulness of business reporting through digitization and standardization. This globally important standard helps promote an information environment that can lead to better decision making. XBRL can also help management and auditors in promoting quality, credible information in the markets.”

SASB engages PwC to support build of XBRL taxonomy

Read the full announcement by SASB

With an increased need for structured, high quality non-financial information, investors and regulators have articulated the need for comparable and reliable company environmental, social, and governance (ESG) data. By providing a common language for disclosing sustainability information, SASB Standards facilitate the communication of comparable, consistent, and reliable data. By providing a common, machine readable language for business reporting, XBRL can further enhance the quality and usefulness of SASB disclosures.

PwC is engaged with SASB on a pro bono basis to convert its 77 Standards into an XBRL taxonomy, and to help craft a data preparer’s guide that will support companies and consultants by providing guidance on tagging ESG information in a structured data format and disclosing it through regulatory and non-regulatory channels.

Accurate XBRL tagging is key

Companies can spend significant time ensuring that their HTML financial reports such as their 10-Ks are communicating information accurately; however, many do not devote the same attention to the quality and usability of the underlying XBRL information, and may not realize that the underlying XBRL data is what is being consumed by third parties. Those that formalize their controls and build stronger processes to review and refine their XBRL filings may remain in better control of their message used by the analysts, regulators, academics and competitors consuming their financial performance data.

Some risks arise if insufficient attention is given to XBRL filings, including:

Reputational risk

Companies often perform a cursory review of their XBRL filings, ticking and tying the values, but missing the underlying XBRL data elements, prior to submission. They may be unknowingly carrying tagging inaccuracies errors period to period. There are third parties that have publically reported tagging inaccuracies on websites and social media which could affect the reputation of the organization.

Investor stock purchase risk

Market participants make investment decisions in part using algorithms and analytics that use publicly filed XBRL data, oftentimes unknowingly. XBRL filing inaccuracies could lead to a disadvantage to the organization within the capital markets.

Credit risks

It’s not just investors and regulators combing through company data: other users are taking note, including credit rating agencies. The models that credit rating agencies use to determine a company’s credit worthiness may be negatively impacted by data inaccuracies.

Enhancing quality and realizing benefits

There are a number of ways companies can enhance quality, such as:

Clear ownership of the quality of the XBRL filings

Quality control process

Communication and engagement with external XBRL specialists

Companies that ensure their XBRL filings are accurate through strong internal controls and processes can mitigate the above-mentioned reputational, investor and credit risks. Additionally, companies that start to harness the power of XBRL data internally are able to garner further benefits from the data, including:

Democratization of data and decreased cost of consumption

Enhanced insights and benchmarking capabilities

Decreased regulatory burden and cost of reporting

Standardized information recognized and understood by all recipients

Degree of transparency required by regulators

Enhancement of informed investment decisions and recommendations, if investing performed in house

How we can help

Manage key risks by increasing the quality and usability of your XBRL filings prior to submission with the U.S. SEC or other regulators. We combine our suite of XBRL tools and subject matter expertise to deliver services to assist you in improving the quality of your XBRL submission. To find out more, please contact your PwC engagement team or one of the individuals listed below.

PwC’s XBRL services include assessing and providing observations and high level recommendations on the following:

- Tag selection - assessment of usage of standard tags and extensions against leading practice

- Peer tag comparison - comparing your tags to your peers, and vice-versa

- Duplicate tagging - instances where the same accounting concept is tagged using different elements

- Fact properties - completeness and accuracy of fact properties (e.g. sign, value, balance, unit, data type, etc.)

- Calculations - completeness and accuracy of calculations

- Processes and controls - processes and controls in place to create the XBRL submissions against leading practices