How to balance a digital banking strategy with the banking branch

Distribution, not channel, is key to a digital and branch strategy.

US banks continue to reduce the number of branches as they address expense, but branch count doesn’t tell the whole story. Rather it is the sum of all products and interactions—ATMs, digital adoption, branch visits—that now establish the primary bank relationship.

For basic banking products, most new digital accounts today are savings or spending (credit or loan) as opposed to primary deposit accounts. And digital-only accounts tend to have lower balances or are single-purpose in nature. But as digital account opening and other functionality improves, it will bring a tipping point for digital to become a primary channel.

Success will ultimately involve finding the right balance between building deeper banking relationships with digital customers while persuading branch customers to take advantage of digital capabilities. However, there is no single strategy. Each institution, whether national or regional, will have different strengths to best manage overall customer distribution and servicing.

“In branch evaluation discussions, it will be increasingly critical to a) identify the purpose of the branch—whether it be experience, marketing, deposits, or complex advice, and b) identify proper KPIs for branch measurement. Should bank branches evolve into “marketing outposts” where sales then occur through digital channels? How will the branch be measured and how will marketing dollars be allocated?”

We see three factors that determine how banks can evolve their branch strategy to balance with digital.

1. Customer choice and convenience rather than digital versus physical

In an environment with many different paths and unknowns for digital banking adoption, the best strategy might be to focus on convenience. An easier path to achieve customer satisfaction is by providing immediate assistance or the ability to open any type of account through a mobile device or a branch visit (or both), rather than trying to determine the right channel strategy for each.

2. Workplace barriers need to be addressed at the outset.

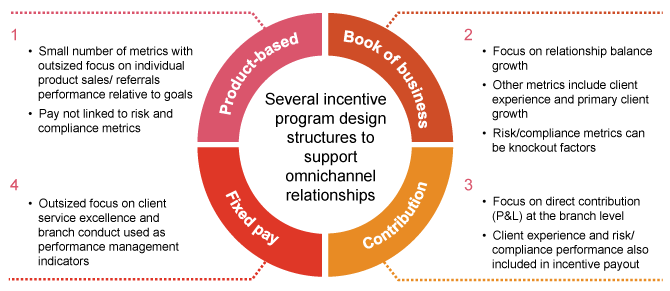

Traditional compensation and branch operational targets may prove to be the biggest hurdles banks face when planning an omnichannel strategy. For example, avoiding the conflict that could arise between digital sales targets and the branch employees who are still focused on in-branch product sales.

3. Demographic shifts require multiple tiers of branch design.

Widening demographic shifts such as population, job and income growth have had a far larger impact on deposit growth than technology or branch investment. With roughly half of all US deposits coming from the top 25 markets, the ability to tier branch design to various demographics and geographic regions will prove critical in developing the role and profitability of a branch in a bank’s ecosystem.

Program design structures to support omnichannel relationships

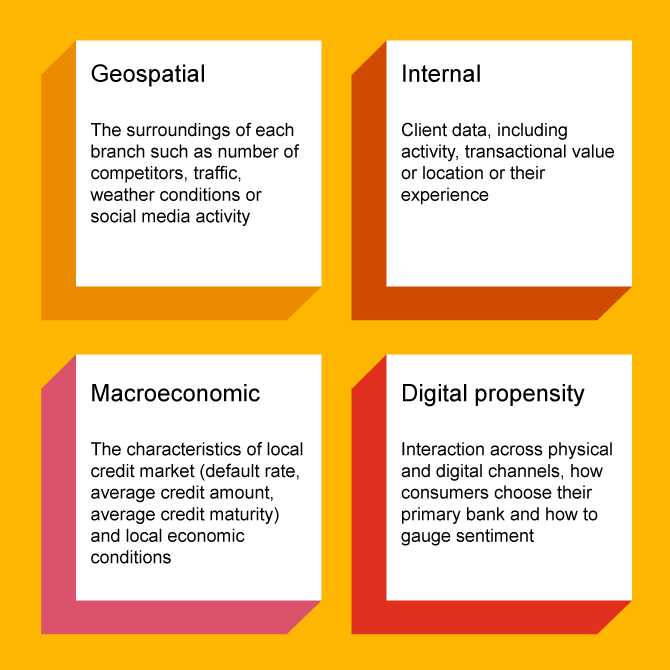

Specific data factors for branch performance

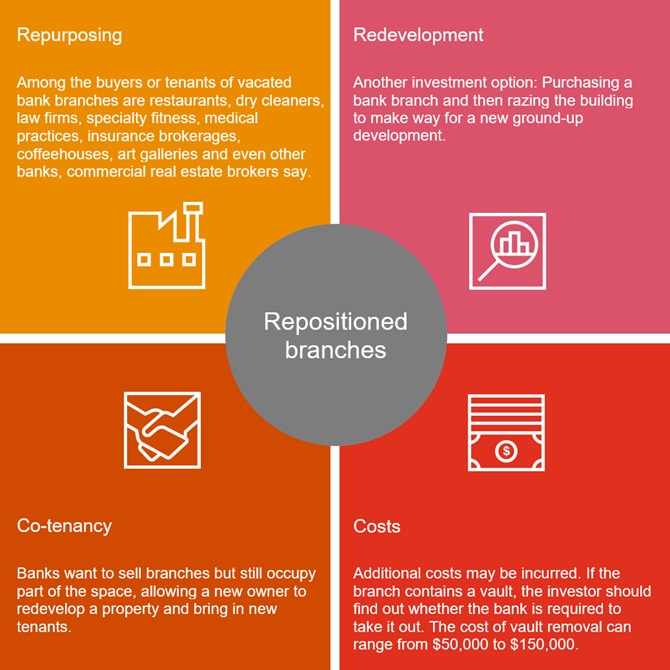

Customizing branch strategies to specific markets

The bottom line on digital banking and the branch

The future of the branch is not just about real estate. In an ever-changing world — where consumer propensity for digital and omnichannel tendencies fluctuate on an individual and demographic level — the best strategy will be relationship-driven. This may involve new top-of-funnel customer acquisition strategies, deposit-tiering (based on strength) and new methods of “trial” conversion. But these steps could ultimately result in deeper relationships, lower attrition and better performance.