Put insights into focus, faster, with a holistic view of your overall portfolio. Goodbye, data wrangling. Hello, value.

Outsourced accounting and reporting for private wealth

Help manage the complexity that comes with wealth—so you can focus on what matters

By outsourcing your accounting and reporting, you can gain peace of mind knowing that experienced professionals are handling your bookkeeping and financials with care and precision. Our solution helps simplify complex data by consolidating information from multiple sources and delivering clear, actionable insights—so you can make smarter decisions and manage risk. With a holistic view of your total net worth, you can stay aligned with your goals and confidently change the game.

What it does

Portfolio insights

Stay on top of your holdings, track performance and secure your transactions with easy access to cash flow analysis, document management and income allocations across ownership structures. Get net worth reporting, liquidity management and robotic processing automation for seamless custom reporting.

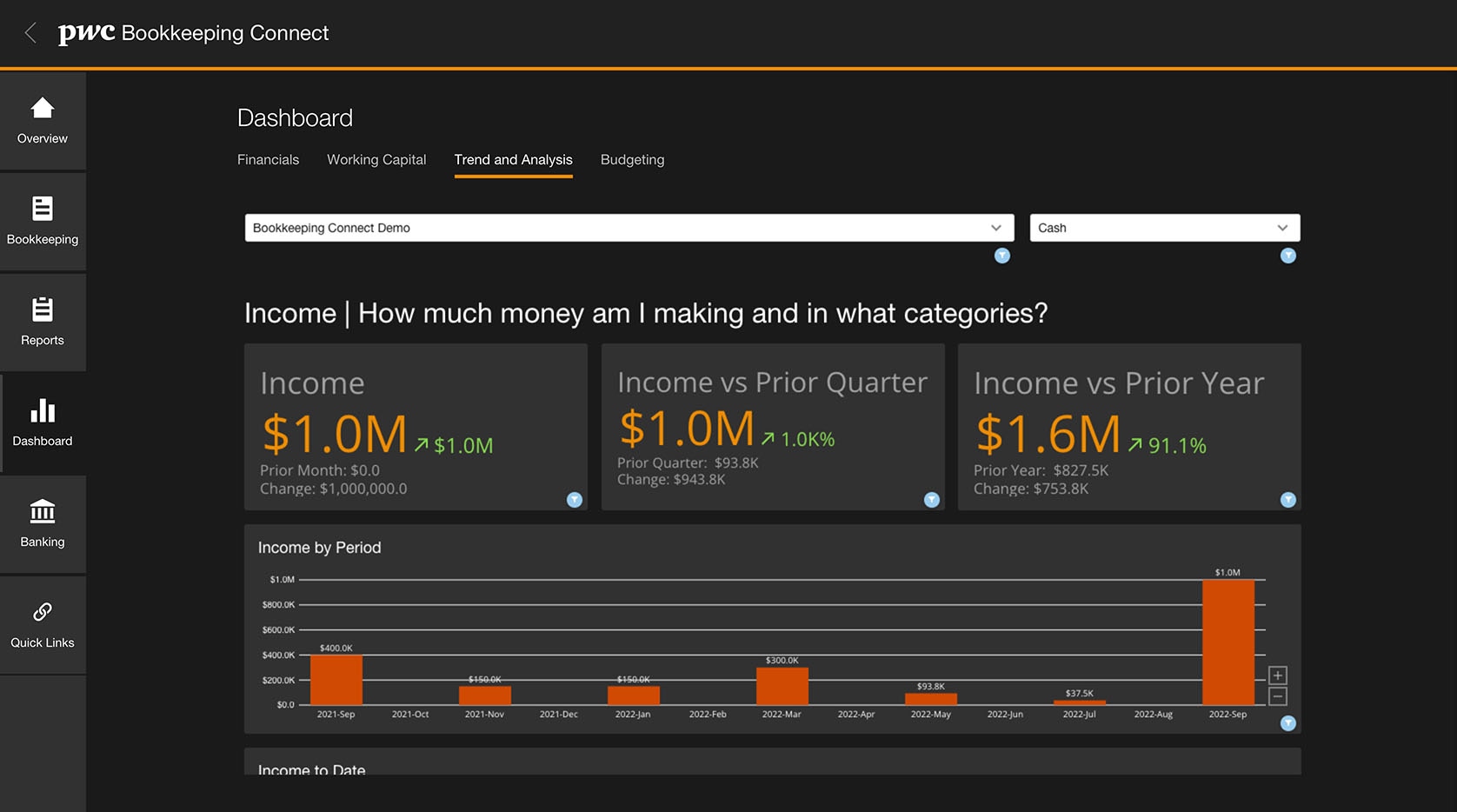

Bookkeeping

Simplify budgeting, forecasting and expense management with the help of PwC’s CPA-led team, who can also assist with dual entry accounting transactions, reconciliations and tax reporting. Track spending, manage financial statements and gain insights into spending analysis with ease.

How it helps

Ease the workload of administrative tasks

Outsource time-intensive tasks, access custom reports and dashboards, and leverage industry-leading practices and technology to help scale your operations and improve efficiency.

Gain foresight with better insight

Revolutionize investment management with clean, trustworthy data, instant access to net worth reporting and advanced analytics, so you can understand risk, return and performance across multiple dimensions.

Complement your existing tech stack and team

Our versatile solution can easily integrate with the technology and platforms you have in place—assisted by a team that can scale based on your existing staffing model.

Who we serve

Whether you're an individual with significant private wealth, a multi-family office, or a private partnership, our solution can be tailored to fit your needs. Let us match our skills to your requirements and move from complexity to outcomes.

- High net worth individuals

- Single family offices

- Multi-family offices and registered investment advisors

- Private equity founders

- Private partnerships

High net worth individuals

Confidently oversee your wealth with total net worth reporting, effective bookkeeping and seamless bill pay solutions. We can work alongside your estate planners, lawyers, wealth advisors, bankers and other advisors to provide a trusted, independent point of view and unparalleled service.

Improve your financial potential with portfolio insights. Gain control over your diverse portfolio and precisely track performance with our streamlined cash flow analysis, meticulous document management, and detailed income allocations across various ownership structures. Experience the convenience of net worth reporting, effective liquidity management and effortless custom reporting.

Streamline your bookkeeping processes and conquer the challenges of budgeting, forecasting, and expense management with our CPA-led team. We can take care of the intricate dual entry accounting transactions, meticulous reconciliations, and detailed reporting, allowing you to focus on what matters most. Stay in control of your expenditures, effortlessly manage your financial statements, and gain valuable insights through our intuitive spending analysis solutions. Let us help simplify your financial journey and provide you with peace of mind.

Single family offices

We can seamlessly integrate into your family office team, leveraging technology to unlock the overall potential of your investments and enabling effective portfolio management. With our experience, we can enable you to navigate complex financial matters, improving data organization, effective tax strategies and a smooth transition of wealth.

Elevate your portfolio management as a single- family office executive with our industry- leading solution. Stay ahead of the game by effortlessly monitoring holdings, tracking performance and consolidating data. Enjoy seamless access to cash flow analysis, streamlined document management, and detailed income allocations across ownership structures. Experience the convenience of net worth reporting, effective liquidity management, and the efficiency of AI automation tools for customized reporting. Let us enable you with unparalleled insights and solutions to help improve your portfolio performance.

Streamline your bookkeeping with the assistance of our experienced CPA-led team. Simplify budgeting, forecasting, and expense management while we handle the intricacies of dual entry accounting transactions, reconciliations and financial reporting. Effortlessly track spending, effectively manage financial statements, and gain valuable insights through our intuitive spending analysis solutions. Let us help reduce your bookkeeping challenges and provide you with the peace of mind to focus on strategic decision-making.

Multi-family offices and registered investment advisors

Enable your multi-family office (MFO) or registered investment advisor (RIA) practice with a holistic support model that can provide confidence in data and valuable insights into client portfolios. Easily access cash flow analysis, stay up to date on holdings and track performance for each of your clients. Let us help you simplify the complexities with our people and technology that can be customized to meet the unique needs of the families you serve, so you can focus on providing exceptional client service.

Streamline your bookkeeping processes as a MFO or RIA to meet the back-office needs of your clients with the assistance of our CPA-led team. Simplify budgeting, forecasting and expense management while our team handles the complexities of dual-entry accounting transactions, reconciliations and tax reporting. Our spending analysis solutions can effortlessly track spending and effectively manage financial statements. Let us help reduce your bookkeeping challenges so you can focus on being your clients’ trusted advisor.

Private equity founders

Unveiling the holistic financial picture, we can provide unprecedented visibility into general partners' (GP) consolidated balance sheets and net worth statements. From personal liquid assets and GP interests to carry, and a substantial range of personal and business assets, we leave no financial stone unturned.

Stay informed and in control of your diverse holdings, effortlessly tracking performance and securing transactions with portfolio insights. Seamlessly access cash flow analysis, streamline document management, and precisely allocate income across ownership structures. Enhance your decision-making with precise net worth reporting, effective liquidity management, and valuable insights into your portfolio. Let us enable you to improve your portfolio's performance, safeguard your wealth, and help drive success in your private equity ventures.

Streamline your bookkeeping processes with the dedicated assistance of a CPA-led team. Simplify budgeting, forecasting, and expense management while our team handles the intricacies of dual entry accounting transactions, reconciliations, and tax reporting. Effortlessly track spending, effectively manage financial statements, and gain valuable insights through our intuitive solutions for spending analysis. Let us help reduce your bookkeeping workload and provide you with the peace of mind to focus on the buy side and growing your investment portfolio.

Private partnerships

Our industry-leading fund accounting solutions can equip finance and investment teams with a financial overview, encompassing both fund-level and partner-level details, including profits interest allocations. From liquid assets to a diverse array of private assets like real estate and operating companies, our solution can provide detailed and dynamic reporting. Stay one step ahead with our powerful solutions, enabling you to effectively manage and track the financials of your asset classes.

Improve your portfolio insights with real-time visibility into your firm's financial portfolio and customizable reporting capabilities. Better manage expenses, allocate resources, and make informed financial decisions with convenient access to cash flow analysis, streamlined document management, and precise income allocations across ownership structures. Let us handle the investment data aggregation and performance reporting, so you can focus on more important things.

Streamline your bookkeeping processes with the assistance of our CPA-led team. Simplify budgeting, forecasting, and expense management while our team handles the complexities of dual entry accounting transactions, reconciliations and financial reporting. Proficiently track spending, effectively manage financial statements, and gain valuable insights through our user-friendly solutions for spending analysis. Let us help reduce your bookkeeping challenges and provide you with the peace of mind to focus on strategic decision-making and driving the financial success of your private organization.

The PwC difference

Quality and independence

Feel confident knowing you have an independent point of view to help manage the complexity that comes with wealth. With a long-standing presence in the industry, you can rely on us to provide continuity of services for you and your family, businesses and future generations.

Customized for you

Our versatile solution can easily integrate with your existing systems and staffing model, providing flexible assistance where you need it the most. By seamlessly integrating with what you already have, we can provide a smooth and effective experience for your family office operations.

Specialist access

Gain access to a dedicated team of professionals that focuses thoroughly on the ultra high net worth and family capital sector, bringing you the benefit of leading practices and innovative operating models. Our team is backed by a global network of PwC specialists that can help address your most complex needs.

Recognized excellence

PwC is recognized by the WealthBriefing WealthTech Americas Awards and the Family Wealth Report Awards 2025 for our human-led, technology-driven approach to serving family offices and high net worth individuals.