{{item.title}}

{{item.text}}

{{item.text}}

Authors

David Linich, Sustainability Principal, PwC US

Tensie Whelan, Tensie Whelan, Distinguished Professor of Practice at NYU Stern and Founding Director of NYU Stern Center for Sustainable Business

The Trump administration’s tariffs announcements have led to significant uncertainty in global markets and forced companies to rethink their approach to international trade. Public debate has largely centered on the economic and political fallout — volatile stock markets, inflation risks and employment concerns. Yet a less examined but crucial side effect is how sustainability, and in particular circular business models, are being considered as part of companies' responses to tariffs.

The tariffs aim to protect domestic industries and curb reliance on imports — especially from China — but they've done something more by exposing the vulnerabilities of global supply chains enhanced for efficiency, not resilience. Many rely heavily on a few key suppliers or regions now subject to tariffs.

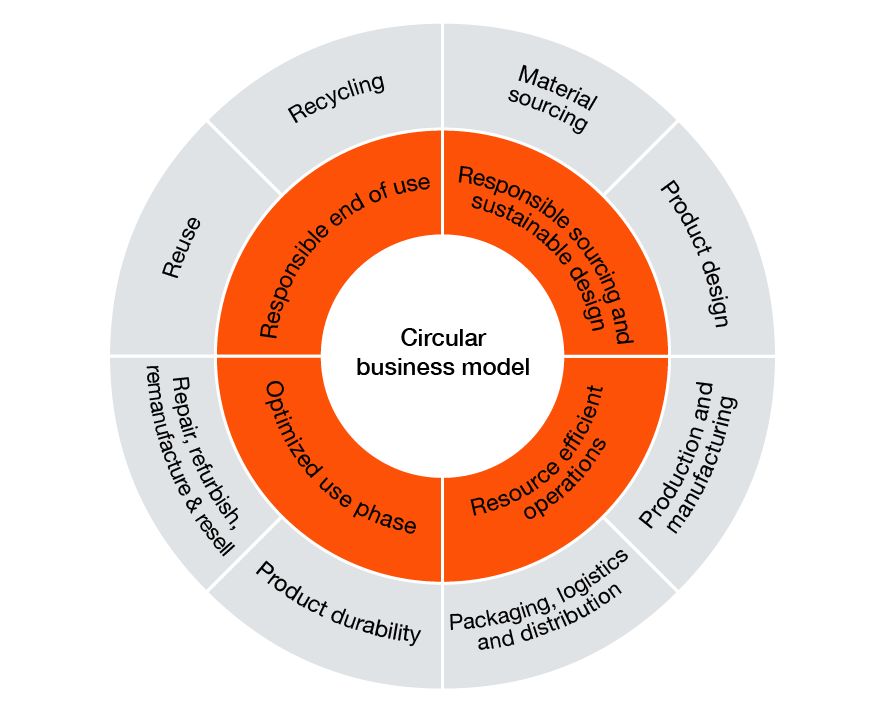

As a result, many businesses are taking a hard look at material sourcing, product design, manufacturing processes and where goods are sold. In turn, that is leading them to reexamine circular business models that focus on putting used products back into new goods, reducing purchases of virgin material and decreasing waste. Instead of winding up in a landfill, circular business models give a variety of materials a second life — and can reduce costs for the manufacturer.

Circularity isn’t new — many companies have explored it before but may have found it too costly or complex. Now, though, shifting market forces are changing the equation. AI, robotics and other technologies are transforming everything from product development and inventory control to the breakdown, sorting and recycling of used materials. At the same time, consumer demand for sustainable goods is surging.

And there is the breakthrough: Amid this disruption — and with a timely trade resolution uncertain — many companies are considering whether circular business models can help them avoid tariff costs while simultaneously sparking innovation, reducing operating costs, building brand value and driving long-term growth.

Companies are assessing the structure and composition of their supply chains and that should serve as a catalyst for circular business model principles. This approach is more than just localizing operations. When companies move production closer to where their goods are consumed to avoid tariff costs, it's an opportunity to re-examine the operational viability of implementing more effective, closed-looped systems such as reusing materials in new products, recycling components and parts, and refurbishing and reselling used products. This can extend product life and help companies avoid purchasing virgin material. In such a model, your sold products eventually become part of your local supply chain, reducing risks inherent in a globalized supply chain. Keep in mind, though, that such a system may require new construction, new operations or new suppliers and vendors that have the capabilities your organization likely does not have.

We see circularity having a profound effect on key stages of a company's supply chain:

True circularity requires coordination, technology and data sharing in each corner of the value chain.

Engagement up and down the value chain can be imperative to a company’s success. Companies will likely need to build new capabilities into their value chain. Start by talking with existing suppliers, vendors and customers to assess if they can source sustainable materials such as recycled fabrics, plastics, metals and bio-based alternatives. Such an assessment may lead companies to a new slate of business partners that can disassemble old products and sort the components for eventual reuse in new goods.

Companies that act can potentially realize significant benefits, especially those in the electronics and consumer goods sectors. AI and digital twins can help companies innovate by reimagining how their products are designed, manufactured and sold. Data analytics can provide valuable insights into how to reduce costs inside a facility or help identify new product opportunities. Our upcoming research shows that products marketed for their sustainability features realize strong sales growth and command price premiums.

Circular business models also offer operational gains such as cutting reliance on costly imported materials, reducing transportation disruptions from extreme weather events and lowering waste at a time when extended producer responsibility laws are an emerging risk.

From cost savings and tariff avoidance to brand differentiation and reduced environmental impact, the case for circularity is strengthening. The companies leading the charge will show that circularity is both practical and profitable.

1. Apple surpasses 60 percent reduction in global greenhouse gas emissions. Apple Inc. April 16, 2025.

2. Environmental Progress Report 2025. Apple Inc. April 16, 2025.

3. Apple expands global recycling programs. Apple Inc. April 18, 2019.

4. At-Scale, Hard Disk Drive Rare Earth Material Capture Program Successfully Launched in the United States. Western Digital. April 17, 2025.

5. Renault Group, world leader for sustainable industry in 2030. Renault SA. March 26, 2024..

6. Accelerating the circular economy to reduce waste. Dell Technologies webpage.

7. Dell Reconnect celebrates 20 years of recycling. Dell Technologies. November 15, 2024.

8. 2024 Sustainability and social impact report. The Boeing Company.

9. ESG topics A-Z: Water. PepsiCo webpage.

10. Gear for a Good Time and a Long Time. Patagonia webpage.

11. The activities of The Future is Neutral. Renault SA.

12. Thrifting Can Help Solve the Fashion Waste Crisis. ThredUp webpage.

{{item.text}}

{{item.text}}