Divestitures are an excellent way to increase a company’s focus on core assets and future vision for the company. Divesting any part of a company’s assets will impact employees and management on both sides of the transaction, making the people side of a divestiture one of the most important factors to consider.

Employees constitute one of the largest operating expenses of a company. The HR function plays a pivotal role in helping to drive the transformation that comes from confidently divesting the right assets at the right time to secure value. The ability for HR to accelerate closing, manage costs and secure employee retention hinges on close collaboration with the finance, tax, legal, IT and corporate development departments. It is imperative to drive employee processes and articulate human capital strategies in operational, financial and legal terms.

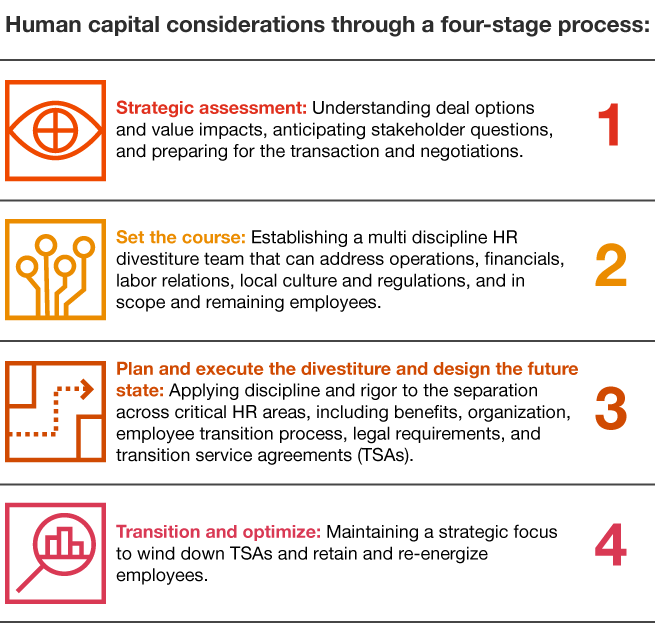

Learn more about how HR partners with other functions and stakeholders in every phase of the deal to manage the people side of divestitures—and help turn complexity into confidence.

Conclusion

Divestitures can be a valuable tool to increase shareholder value, optimize capital and regain focus. Though HR and employee challenges can be complex and difficult to manage—particularly in cross-border deals that navigate multiple cultures and regulatory requirements—HR teams should collaborate across functions and geographies to deliver in some critical areas.

- Building a strong negotiation position early

- Understanding the financial implications of decisions

- Minimizing disruption to the business

- Communicating early and often

- Making employee retention and engagement a priority

Teams that are able to anticipate human capital issues early and help position employees for the separation can increase deal value and drive the transformation that comes from confidently divesting the right assets at the right time to secure value.