{{item.title}}

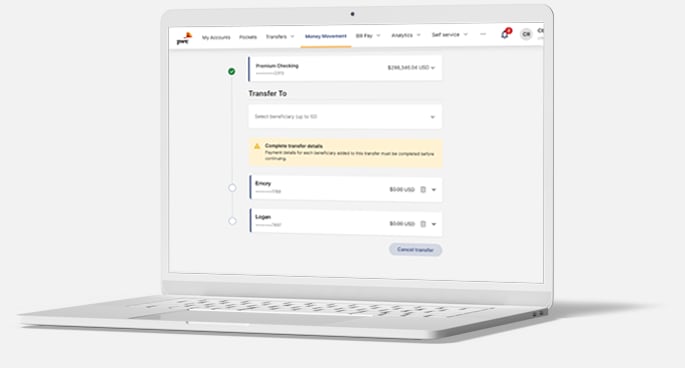

Customers can initiate payments from one or more core accounts, and pay multiple beneficiaries simultaneously in domestic or international currencies—all in a single transaction.

Provide customers with auto-recommendations of the optimal payment rail—based on minimal information about their priorities (speed, cost, etc.)—plus full fee transparency.

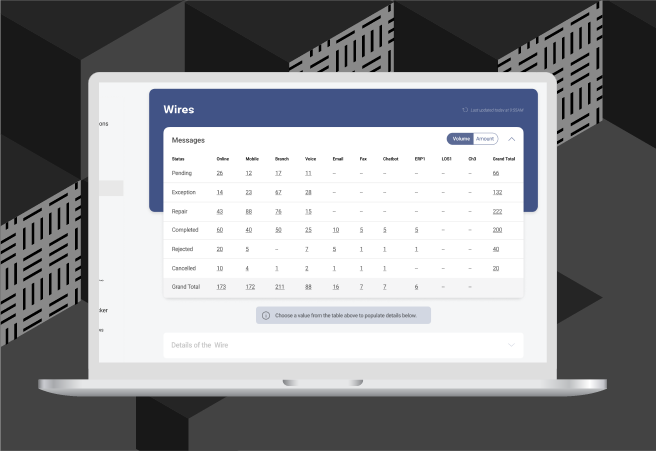

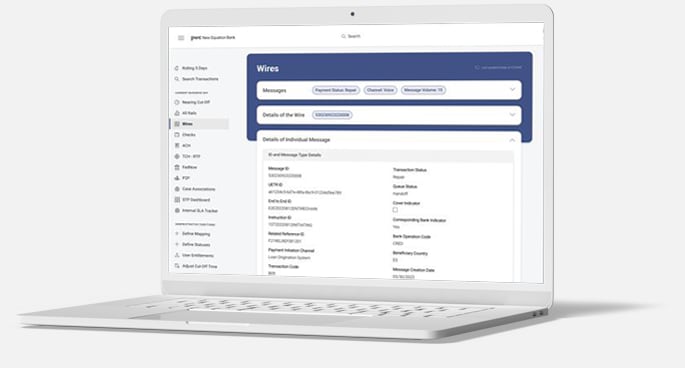

Get detailed insights about payment transactions across multiple channels and rails—and uncover root causes of issues to enable seamless repairs within the integrated payment processing engine.

Enable maximum flexibility and convenience: Offer customers the option to split a payment across multiple transfer methods within the same transaction.

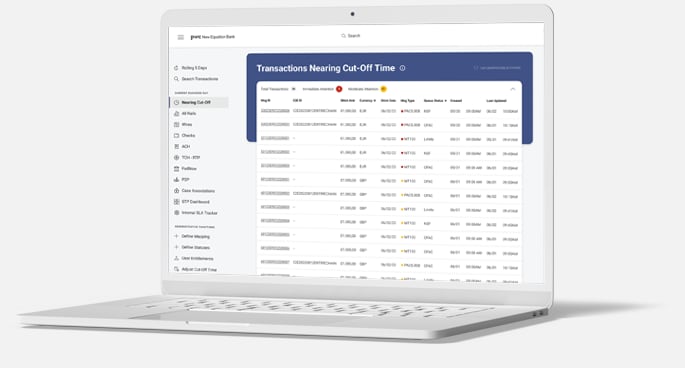

Leverage the "Transactions nearing cut-off" view to identify issues and take prompt proactive actions, preventing potential risks and exposure for your bank.

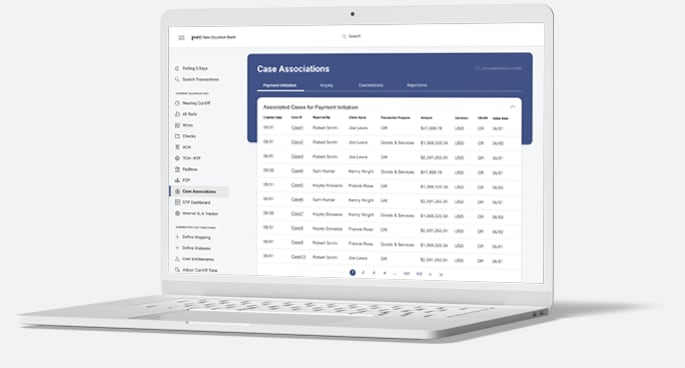

Allow your clients to request a payment initiation, cancellation or return as required through integration with treasury management services.

Allow users to easily trigger the repair workflow in the integrated payment processing system for payments that require manual intervention.

© 2017 - 2026 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.