{{item.title}}

{{item.text}}

{{item.text}}

The existing Valuation Manual (VM) 22 under statutory reporting specifies interest rate requirements for reserves on single premium immediate annuities (SPIA) and similar contracts. This will become VM-V starting in 2026. A new VM-22 framework has been established and has significantly broadened the scope of the regulation to serve as the Principle-Based Reserving (PBR) framework for all non-variable annuities (e.g., fixed indexed annuities (FIA), fixed deferred annuities (FDA), SPIA, pension risk transfer (PRT), etc.). While the framework draws on foundational elements from Life PBR (VM-20) and VM-21, it also includes unique provisions which are specific to the non-variable annuity business. These refinements aim to better align reserving practices with the underlying risks and product features.

VM-22 includes a three-year transition period, with an optional effective date of January 1, 2026, and a mandatory effective date of January 1, 2029. Currently, it is intended for prospective adoption only, but discussions are underway regarding the potential for retrospective adoption for business issued on or after January 1, 2017.

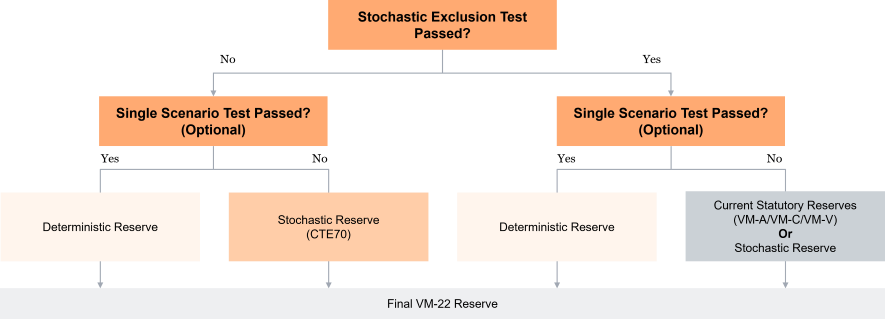

VM-22 calculation framework shares similarities with VM-20 and VM-21, such as the stochastic exclusion test, stochastic reserves, and deterministic reserves, but also introduces unique elements like single-scenario testing.

The final VM-22 reserve can be the deterministic reserve (DR), the stochastic reserve (SR), or the current statutory reserve methodology (Commissioners Annuity Reserve Valuation Method or CARVM), depending on the outcomes of the stochastic exclusion test (SET) and the single scenario test (SST), as illustrated above. The SST can be applied to blocks of business where contract holder behavior is not materially influenced by economic conditions (e.g., payout products without surrender benefits), allowing them to be valued under a DR if they pass the test. If a group of contracts fails both the SET and the SST, the SR should be calculated as the VM-22 reserve. Conversely, blocks of business that pass the SET have the option to continue valuing reserves under the current statutory framework. For year-end 2026 reporting, the standard projection amount (SPA) will be used solely for disclosure purposes and not as a minimum reserve floor for the SR and DR. For any given scenario, the reserve should not be less than the total applicable cash surrender value (CSV) at the valuation date. VM-22 permits aggregation across payout and accumulation products, enabling companies to achieve diversification benefits between these categories. To do so, companies should manage the risks associated with contracts in both categories through an integrated risk management process, where the contracts are managed within a single portfolio or across portfolios adhering to a consistent asset-liability management (ALM) strategy.

Implementing VM-22 presents a complex array of challenges for companies. By proactively planning for these difficulties, companies can help facilitate a smoother transition. Anticipating the potential operational, actuarial, and data-related obstacles outlined below allows companies to allocate resources more effectively and reduce the risk of costly delays.

We conducted a case study on various products, including SPIA, PRT, multi-year guaranteed annuities (MYGA), FDA without guaranteed minimum withdrawal benefits (GMWB) and FIA with GMWB, featuring representative designs with a valuation date of December 31, 2024. The study results examine the relationship between different types of reserves, including the current CARVM, best estimate liabilities (BEL), and the components of the VM-22 reserves. Additionally, a detailed step-by-step attribution analysis illustrates the transition from CARVM to VM-22 reserve. Throughout this case study, several modeling lessons emerged:

VM-22 represents a pivotal shift in the reserving framework for non-variable annuities, offering a more dynamic and market-aligned approach to reserve requirements. While its principles aim to modernize outdated methodologies and enhance regulatory consistency, the path to implementation brings many challenges. From interpreting evolving guidance and establishing credible assumptions to navigating model validation, documentation, and asset and reserve optimization, each stage introduces its own set of technical and operational hurdles.

Successfully adopting VM-22 will require not only actuarial expertise, but also strategic planning, cross-functional collaboration, and a commitment to maintaining compliance. Those who invest early in readiness and infrastructure can be better positioned to manage the transition and realize the benefits of a more forward-looking reserving framework.

Gina Meng and Gary Ng contributed to this piece.

{{item.text}}

{{item.text}}