PwC and SAP S/4HANA Treasury: Enabling Treasury to become a true strategic business partner

Driving results with PwC and SAP

Today’s Treasurer is expected to push their organization from transactional overview to a strategic partner providing value-add activity outside of treasury. Technology is a key driver for improving efficiency and transparency, and SAP S/4HANA Treasury is one of the technologies available that supports the evolution of the treasury organization of the future. SAP S/4HANA Treasury comes with machine learning, artificial intelligence and process automation, which enables better performance and a simplified user experience.

Key benefits include:

- Affordability: Reduced total cost of ownership

- Transparency: Increased visibility and control over key processes

- Speed: Simplification and automation provide unparalleled speed

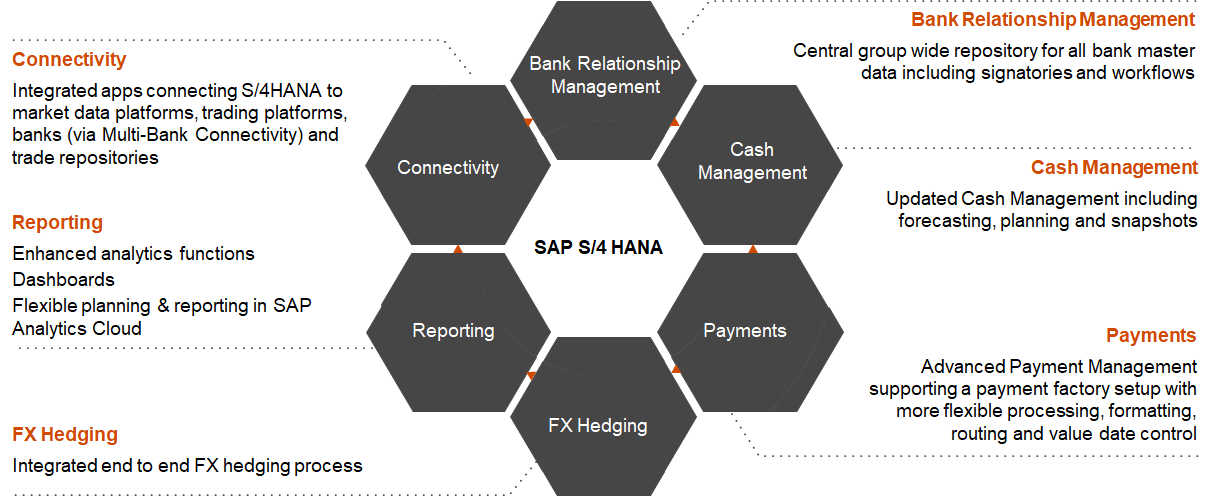

What’s New in S/4HANA Treasury

We can help you on your journey

At PwC, we are laser-focused on ensuring that our clients successfully transform their Treasury organization. With PwC’s global partnership with SAP focused on enhanced analytics and reporting, along with the development of specific SAP Treasury add-ons, we have the breadth and depth of experience and global resources to help you create lasting competitive advantage with cloud solutions.

Our integrated approach addresses the effort required to cleanse data, decommission existing IT architectures, prepare and train users, and coordinate overall change management.

© 2017 - 2026 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.