Our Take: financial services regulatory update – February 07, 2025

Change remains a constant in financial services regulation. Read "our take" on the latest developments and what they mean.

Current topics – February 07, 2025

- 1. Bessent dual hatting as Acting CFPB Director while Congress eyes funding

- 2. Debanking: Hearings, legislation and documents

- 3. Stablecoin legislation rises again

- 4. On our radar

- 5. Appendix A

1. Bessent dual hatting as Acting CFPB Director while Congress eyes funding

- What happened? On January 31st, President Trump designated Treasury Secretary Scott Bessent as Acting Director of the CFPB. Separately, House Financial Services Committee (HFSC) Chairman French Hill (R-AR) said that changing the CFPB’s funding, which comes from the Fed rather than Congressional appropriations, is a “principal focus” of potential legislation to attach to a budget reconciliation bill.[1] In addition, head of the Department of Government Efficiency (DOGE) Elon Musk posted "CFPB RIP" amidst reports that DOGE personnel have been placed at the CFPB.

- How has the CFPB been affected? One of Secretary Bessent’s first actions as Acting CFPB Director was to order staff to stop all rulemaking, enforcement, litigation and public communications. On February 2nd, lawyers for the CFPB filed an emergency notice with the Fifth Circuit Court of Appeals seeking a pause in proceedings in the lawsuit against the small business lending data collection rule to implement Section 1071 of the Dodd-Frank Act as well as a lawsuit against the CFPB’s 2022 announcement that discrimination qualifies as an “unfair” act or practice.

Bessent also called for the effective dates of rules that have not yet gone into effect to be suspended. CFPB rules that have not yet gone into effect include those on medical debt in credit reporting and overdraft limitations.

- What’s next? Bessent will serve as Acting Director until a permanent Director is nominated and confirmed. See Appendix A for a timeline of agency leadership terms.

Our Take

CFPB is on thin ice but consumer protection laws are still on the books. Although Secretary Bessent is nominally taking on a second role, it appears that his responsibilities – as well as those of most CFPB staff – will be significantly limited. Industry critics of the CFPB, including the financial institutions it supervises, have cheered the agency’s activities coming to a standstill. However, behind those cheers the sudden cessation of enforcement raises numerous questions about how banks should proceed with compliance activities and implementation of programs to comply with pending rulemaking. While banks will make their own legally-informed choices on how to proceed, there are several factors to consider. The 2010 Dodd-Frank Act (DFA) gave rulemaking and enforcement authority for consumer protection laws to the CFPB along with the mandate to educate consumers, conduct research, and collect consumer complaints. This statute remains on the books, as do the consumer protection laws the CFPB is charged with enforcing, which largely predate the DFA. Laws in place before the CFPB’s existence were previously enforced by other agencies including the Fed, OCC, FDIC and NCUA, along with state attorneys general and through civil litigation. It is increasingly likely that Republicans will succeed in cutting CFPB funding through budget reconciliation, but it would take a further act of Congress to revert consumer protection rulemaking, as well as full examination and enforcement authority, to other agencies. In the meantime, banks are still required to comply with consumer protection laws and the question on enforcement of those laws is a matter of who and when, not if.

Banks are not off the hook. In addition to banks having a continued obligation to comply with existing laws, it is also important to remember that actions by financial institutions and new CFPB leadership are subject to both actual courts and the court of public opinion. Consumers alleging harm can sue financial institutions and consumer groups may file a suit against the order to freeze CFPB activities. There have also been prominent cases of consumer harm hitting the headlines and damaging the reputations of financial institutions as well as receiving criticism from both sides of the aisle. With all of these factors in play, the CFPB freeze does not mean that banks are free to abandon their consumer protection compliance programs. They should still maintain policies, procedures and controls to minimize the risk of consumer harm as pausing, deferring or eliminating compliance activities could increase both legal and reputational risk. Although the ultimate fate of rules that are not yet effective and undergoing legal challenge remains to be seen, those that are a statutory requirement of the DFA may survive with modifications.

1. Congress can attach policy changes to budget bills that pass with a simple majority through the reconciliation process.

2. Debanking: Hearings, legislation and documents

- What happened? On February 5th, the Senate Banking Committee held a hearing on “debanking” and on February 6th, the HFSC Oversight and Investigations Subcommittee held a hearing on alleged actions by the Biden Administration to prevent banks from providing services to digital assets companies. In concert with the hearings, Senator Kevin Cramer (R-ND) reintroduced his Fair Access to Banking Act.

Separately, on February 5th, Acting FDIC Chairman Travis Hill issued a statement and released 175 documents related to the FDIC’s supervision of crypto-related activities by banks.

- What was covered in the hearing? The hearing covered allegations that financial institutions cut off law-abiding customers, including those dealing with energy, firearms and digital assets, from accounts and other financial services in response to actions from Biden Administration regulators.

- Regulatory risk: A witness representing a digital asset company said that banks refused to work with his company due to perceived regulatory risk. Senator Bill Hagerty (R-TN) raised confidentiality requirements that prevent banks from disclosing supervisory communications on service denials.

- Reputational risk: Witnesses and Senators also described cases of bank supervisors invoking reputational risk to discourage banks from serving certain customers.

- Anti-money laundering (AML) regulations: The hearing featured comments on increases in the volume of suspicious activity report (SAR) filings without clear benefit and the lack of adjustment of the $10,000 currency transaction report threshold set in 1972. Senator Elizabeth Warren (D-MA) stated that there is further work to be done by banking regulators to clarify AML The original email said that employees should consider forthcoming changes to federal workforce policies including the termination of remote work, updated performance standards, downsizing, and “enhanced standards of suitability and conduct” prioritizing reliability, loyalty and trustworthiness.

- What did Hill and the FDIC documents say? Hill repeated his criticism of the FDIC’s past restrictive approach to crypto assets and said he has directed staff to review all supervisory communications with banks that sought to offer crypto-related products or services. The documents released include “pause” letters and additional correspondence with 24 banks. Hill noted that the documents demonstrated resistance through requests for information, delays, and instructions from supervisors to pause, suspend, or refrain from crypto-related activities. He also said that the FDIC would replace past guidance for banks to notify the agency if they engage or intend to engage in crypto-related activities.

- What would the fair access bill do? The Fair Access to Banking Act would penalize banks and credit unions with over $10 billion in total consolidated assets that refuse services to creditworthy, legally compliant customers with disqualification from using the discount window, terminating insured depository institution or credit union status, or civil penalties up to $10,000 per violation.

- What’s next? The FDIC will release more documents related to crypto activities by banks and Congress will seek to advance fair access legislation.

Our Take

Debanking not debunked. The hearings featured rare bipartisan agreement on the existence of debanking on top of Acting Chairman Hill releasing documents to back up claims of supervisors discouraging banks from working with crypto companies. There is also bipartisan agreement that banks need clearer guidelines for legitimate reasons to deny services, such as AML risk and connections to illegal activity. Given the momentum around this issue from Congress and President Trump, it is likely that we will see new guidance and directives emerge, whether it is from legislation or policies instituted by new agency leadership. With bipartisan support, chances of amendments to AML rules are even higher – and they may be combined with fair access legislation to get Democrats on board. As legislators and regulators consider formal fair access rules, banks will likely comment on the necessity of acknowledging their strategic prerogative to approve or deny customers as they see fit.

Banks still need to manage risks and make careful decisions on customer acceptance. While waiting for new regulatory guidance, banks should review both operational processes and risk assessment standards to ensure that acceptance processes and assessment criteria are objective, consistent across the organization, and clearly tied to the risk presented by a particular customer segment or transaction type. They should also keep in mind that the renewed attention on debanking shows that banks can be “named and shamed” for refusing services to certain customers. However, this does not mean that banks cannot decline to work with customers that present heightened AML, credit, legal, or other risks. Effective consideration of these risks can be managed through a comprehensive framework that incorporates applicable risk categories, including any reputational risk of granting or denying services. Assessments following such a framework need to be thoroughly documented with objective reasons for declining services beyond the customer’s business profile.

3. Stablecoin legislation rises again

- What happened? On February 4th, Senators Bill Hagerty (R-TN), Tim Scott (R-SC), Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY) introduced the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act. On February 6th, Representatives French Hill (R-AR) and Bryan Steil (R-WI) released a discussion draft of the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act in the House. Separately, a number of government officials commented on the regulation of digital asset activity.

- What would the legislation do? The GENIUS Act would:

- Codify the authority of banks and other entities to issue stablecoins

- Define a payment stablecoin as a digital asset from a permitted issuer used for payment or settlement that is pegged to a fixed monetary value; it would clarify that a stablecoin is not a security or commodity and therefore exempt from SEC and CFTC oversight

- Establish procedures for institutions seeking licenses to issue stablecoins

- Set regulatory standards for permitted issuers including reserve, disclosure and audit requirements

- Designate supervisory, examination and enforcement authority for stablecoin issuers:

- Depository institution (or subsidiary) stablecoin issuers would have their stablecoin activities supervised by their current primary Federal regulator

- Nonbank stablecoin issuers would be supervised by the OCC

- Issuers under $10 billion in market capitalization could be regulated by states and there would be a waiver process for those over the threshold that want to maintain state regulation

The STABLE Act would establish a similar framework to the GENIUS Act with the addition of a two year moratorium on endogenously collateralized stablecoins (i.e., those backed by an internal source or algorithm rather than a fiat currency).

- What have officials said? In addition to the statement by Acting FDIC Chairman Hill discussed above, several other officials have recently commented on the regulation and supervision of digital asset activity:

- White House AI and Crypto Czar David Sacks held a press conference in which he announced a joint House and Senate working group on crypto legislation, commented on the feasibility of a U.S. digital asset stockpile, and the importance of fostering domestic innovation.

- SEC Commissioner Hester Peirce outlined 10 areas she expects the new SEC Crypto Task Force to work on, including scoping out jurisdiction, modifying paths to registration, clarifying custody rules, and providing clarity on crypto-lending, staking and exchange-traded products.

- Fed Chair Jerome Powell said in a press conference that “banks are perfectly able to serve crypto customers, as long as they understand and can manage the risks and its safe, safe and soundness.”

- What’s next? The HFSC Digital Assets, Financial Technology, and Artificial Intelligence Subcommittee will hold a hearing on the path forward for digital assets on February 11th.

Our Take

Stablecoins lead the way for bipartisan legislation. After several years of stops and starts on stablecoin legislation despite bipartisan agreement on the need for regulatory clarity and codified standards, these new efforts offer renewed hope. A structured regulatory framework for stablecoin issuers with clear standards for reserve requirements, licensing and interoperability would clear the way for both traditional financial institutions and nonbanks to advance new stablecoin products and services. Even with bipartisan support, it will take time to negotiate the final details of both Senate and House versions of a bill and for ensuing regulations to be implemented. In the meantime, comments from Hill, Powell, Sacks and Peirce send a signal that financial institutions will not have to wait too long for a more permissive posture towards crypto activities from their current primary regulators. However, it is important to note that regulators will still expect and call for thorough consideration of financial resources supporting stablecoins’ liabilities as well as controls to manage risk and protect consumers.

4. On our radar

These notable developments hit our radar recently:

Fed releases 2025 stress test scenarios. On February 5th, the Fed released the scenarios for its 2025 stress test and exploratory analysis. This years scenario, which will apply to 22 banks, features 5.9% increase in unemployment to a peak of 10%, severe market volatility, widening of corporate bond spreads, a 33% decline in house prices and 30% decline in commercial real estate prices. The increase in unemployment and declines in prices are less severe than those in the 2024 scenarios. Eight banks with large trading operations will also be tested against a global market shock component that stresses their trading and certain other fair-valued positions and 10 banks with substantial trading or custodial operations will be tested against the default of their largest counterparty. The exploratory analysis, which does not affect capital requirements, includes nonbank credit and liquidity shocks as well as the failure of five large hedge funds for the largest banks.

OCC leadership change. On February 7th, Secretary of the Treasury Scott Bessent announced his intention to appoint former NCUA Chairman Rodney Hood as First Deputy Comptroller, resulting in him becoming Acting Comptroller of the Currency.

CRA resolution to roll back OCC bank merger review update. On February 4th, Senator John Kennedy (R-LA), introduced a resolution of disapproval under the Congressional Review Act (CRA) to roll back the OCC’s September 2024 update to its procedures for reviewing bank merger applications.

Hawley and Sanders introduce bill to cap credit card interest rates. On February 4th, Senators Bernie Sanders (I-VT) and Josh Hawley (R-MO) introduced bipartisan legislation to cap credit card interest rates at ten percent. If passed, the bill would immediately cap rates for five years.

Powell scheduled to testify to Congress. Fed Chair Powell is scheduled to testify in both chambers of Congress on the semi-annual monetary policy report that was published on February 7th. Chair Powell will appear before the Senate committee on Banking, Housing and Urban Affairs on February 11th and the HFSC committee on February 12th.

Treasury nominations announced. On February 5th, Secretary Bessent announced the nomination of Luke Pettit, a senior adviser to Senator Hagerty (R-TN), to be Assistant Secretary for Financial Institutions and Wall Street veteran Jason De Sena Trennert to be Assistant Secretary for Financial Markets.

Deferred resignation offer deadline delayed. On February 6th, the U.S. District Court for Massachusetts granted a temporary restraining order forcing the Trump Administration to delay the deadline of its deferred resignation offer to midnight on February 10th.

5. Appendix A

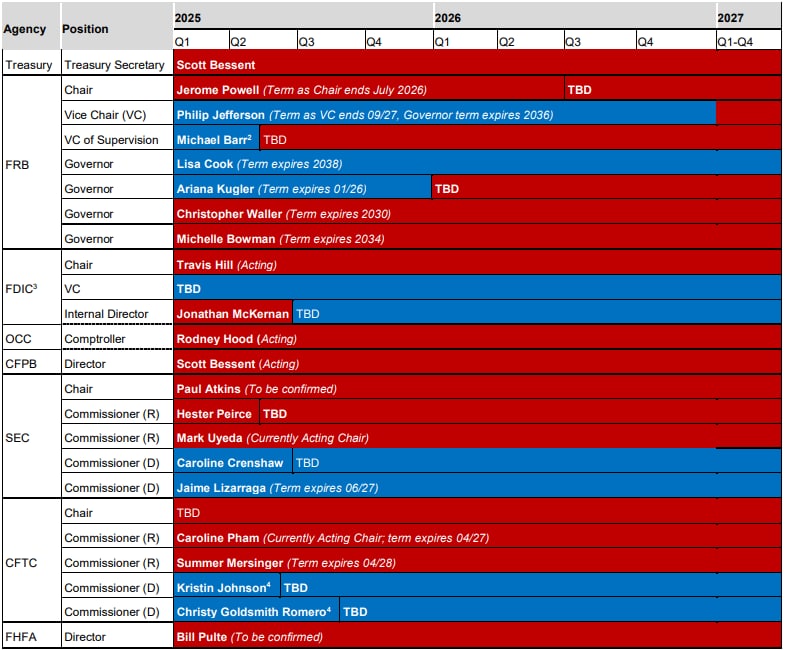

The following chart is an approximate projection of financial services agency appointments and term lengths.

2. Michael Barr will step down as VCS on February 28th, 2025 but will remain on the Fed Board as a Governor. President Trump will need to choose another existing Governor as the new VCS or move them to a position at another agency to create a vacancy at the Fed.

3. The Comptroller of the Currency and CFPB Director are members of the FDIC Board. Because FDIC bylaws prohibit more than three members of one party on the Board, the Vice Chair and Internal Director cannot be Republicans if Trump’s nominees to lead the OCC and CFPB are Republicans. Jonathan McKernan’s term technically expired in May 2024.

4. Johnson’s and Goldsmith Romero’s terms have expired but they may remain on the Commission until their replacements are confirmed.