Emerging Trends in Real Estate® Europe is a joint survey by PwC and the Urban Land Institute. Now in its 17th edition the survey provides an outlook on real estate throughout Europe for 2020 and the near-term.

Emerging Trends in Real Estate®: Europe 2020

Climate of change

Survey respondents remain resolute in their belief in real estate as an attractive investment asset class despite strong political and economic headwinds, according to the Emerging Trends in Real Estate, Europe 2020 survey.

Despite political uncertainty and rising construction costs, PwC still foresees an active European real estate market in 2020. Investors are drawing a significant amount of comfort from the central banks’ decision to maintain or cut interest rates – a notable change in direction from last year’s report and probably the biggest factor supporting the general levels of optimism that emerged from this years interviews.

With interest rates set to stay lower for longer and bond yields in many European countries in negative territory, PwC assesses that real estate income will retain its broad appeal to investors. Equity and debt are also expected to remain plentiful for most real estate sectors, the notable exception likely being retail which is still struggling in the face of online competition.

With a number of real estate sectors undergoing significant structural change, many interviewees regard investing in housing and hotels as a sound, defensive strategy at this point in the cycle, supported by long-term urbanisation and demographic trends.

As the Emerging Trends Europe survey has highlighted over the past few years, these sectors are at the forefront of the industry’s transformation into becoming a service industry. There is a recognition that the industry sector that funds, builds and operates the spaces in which we live, work and play, is starting to embrace complexity and respond to its role as part of society’s infrastructure.

Survey results suggest the industry believes that the enhanced complexity and operational risk that comes from embracing the ultimate end-user and their evolving demands is one worth taking to achieve target returns. The latest survey and interviews suggest a blurring of sector boundaries as part of a bigger investment picture in which mixed-use assets, improved transport connectivity, greater use of technology and smart mobility solutions are all seen as integral to the economic growth of Europe’s cities and the investment potential of its real estate.

Key findings

Political Risk

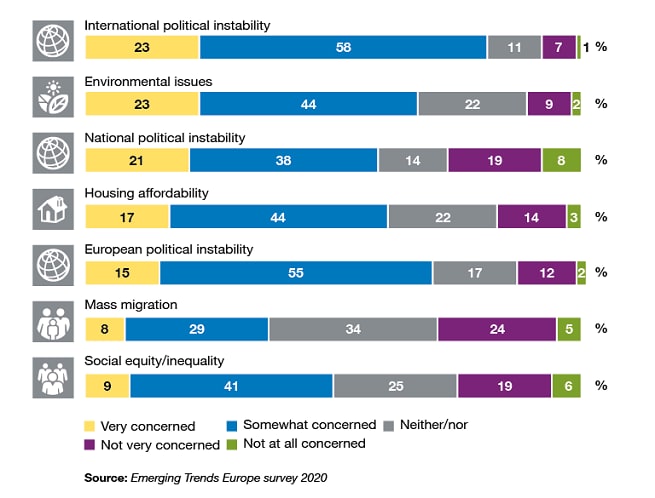

When it comes to social/political issues in 2020, international and European political instability are rated key concerns by 81 percent and 70 percent of survey respondents respectively. Nearly 60 percent are concerned about national politics – a sharp rise from last year.

The political backdrop to investment has been on the minds of Europe’s property leaders for years. The difference now is that political issues are acting as a drag on economic and real estate performance as well as business confidence.

Public policy on housing shortages across Europe is one such example. Industry concerns over housing affordability are rising, but the interviews also reveal widespread frustration at state and local authorities imposing rent controls as a way of dealing with housing affordability. In the eyes of many interviewees this is counter-productive, adding political risk to residential investment while not adding more housing which is mostly needed.

Interest rate boost

Some of the political and economic uncertainty clouding European real estate has been offset for some survey respondents by central banks’ move to maintain or cut base rates – a big boost for investment, albeit not yet for the underlying economy. “It is hard to express strongly enough what an extraordinary turnaround that has been. The cycle feels like it is going to go longer. Nothing seems to be overheating,” says a global investment manager.

Nearly three quarters of respondents expect short-term interest rates to stay the same or reduce in 2020, while the majority believe inflation will hold steady. In the eyes of most interviewees this monetary environment has reinforced real estate’s attraction relative to bonds and equities. As one private equity player says, “There’s not a significant enough slowdown in growth to really undermine the fundamental value proposition that real estate provides, given a negative interest rate environment.”

Leading logistics

The other side of the investment strategy is industrial / logistics, which continues to be of high interest for both investment and development reasons, driven by the continuing increase in online retail sales. There is still seen to be lots of room for growth in European e-commerce, where online sales penetration is lower than the UK, but catching up.

For last-mile logistics in particular, supply cannot keep up with demand, because in urban locations the sector is competing with other high-value uses, such as residential. Some investors think that pricing for existing industrial assets is too high. But few are avoiding the sector altogether. Instead, they are looking to build: industrial and logistics offer the best prospects for development, according to respondents.

But just as residential and industrial / logistics retain their consistently high Emerging Trends Europe rankings, retail remains at the bottom of the rankings in terms of both investment and development prospects.

Getting smart about mobility

Well-connected buildings and places have always been the most valuable, but as the mobility revolution takes hold, owners will have to think smartly about how their assets provide the best and most desired outcomes for the community – whether that be workers, residents, tourists and passers-by.

This is an emerging trend for the real estate industry, and one that will require a change of mindset to factor in the growing complexity of transport solutions into investment decision making.

These mobility trends have the potential to change which buildings and districts are seen as most valuable by real estate investors and developers. It is also likely to reinforce the attraction of mixed-use development, while challenging established principles around urban planning models.

| 2020 | 2019 | |

| 1 | Paris | Lisbon |

| 2 | Berlin | Berlin |

| 3 | Frankfurt | Dublin |

| 4 | London | Madrid |

| 5 | Madrid | Frankfurt |

| 6 | Amsterdam | Amsterdam |

| 7 | Munich | Hamburg |

| 8 | Hamburg | Helsinki |

| 9 | Barcelona | Vienna |

| 10 | Lisbon | Munich |

City rankings - Paris takes the lead

Emerging Trends in Real Estate, Europe 2020 has ranked the real estate markets in major European cities according to their overall investment and development prospects.

As we head into 2020, there is opportunity and caution driving Europe’s real estate industry with a focus on cities that offer liquidity and connectivity.

This year's top pick is Paris, noted by survey respondents as the most desirable market given its ability to attract capital of all kinds from around the world.

The 10 European cities expected to fare best in 2020 by survey respondents are a mix of larger, tried and tested markets, with German cities still dominating the top spots.

Contact us

UK and EMEA Real Estate Industry Leader, Partner, PwC United Kingdom

Tel: +44-7710-344-040