A report by PwC and the World Economic Forum shows how global carbon pricing could pay for itself while cutting emissions by 12%

Increasing Climate Ambition: Analysis of an International Carbon Price Floor

What would be the economic and environmental effects of introducing an international carbon price floor?

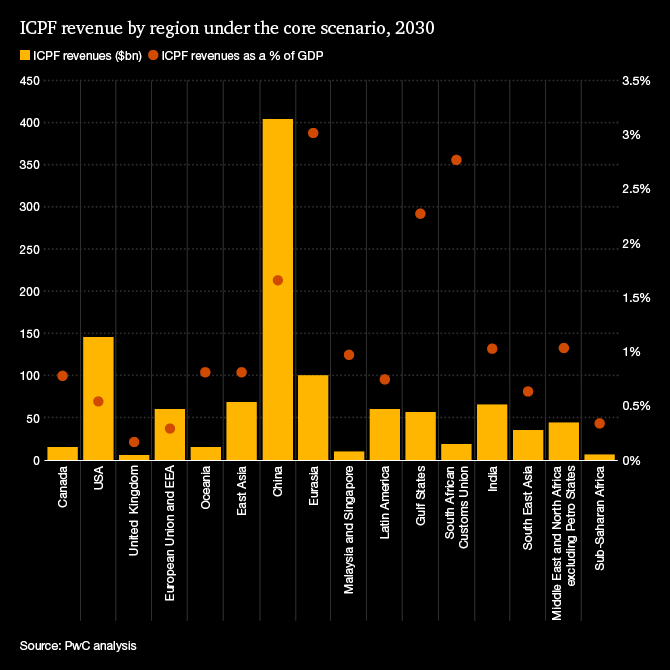

In this joint report with the World Economic Forum, we assess the impacts of international carbon pricing scenarios on economies and industries to help inform the debate and provide insights to governments, businesses and civil society looking for solutions for reducing carbon emissions. We also estimate the revenues raised through carbon pricing, which could be used to help manage the transition.

In June, the International Monetary Fund (IMF) put forward a framework to introduce an international carbon price floor (ICPF) that would set a price for emissions pegged to each economy’s stage of development, as a way to incentivise greater participation.

Carbon pricing is just one tool that will help governments and businesses transition to a net zero future. We hope this research will provide information that will be useful to public policymakers seeking to reduce global emissions in time to limit the worst effects of climate change on people and our planet.

"We found that introducing an ICPF could be done without severe economic damage to livelihoods and business, although the effects would be somewhat uneven across the world. The costs to society and business of failing to act are far greater. The political and technical challenges remain very significant, but we hope the research will encourage countries to consider pricing carbon in such a way that it scales up effort to reach net zero in time to limit the worst effects of climate change on people and our planet.”

Key findings

Download the full report. For a detailed explanation of the economic models that underlie the report, please refer to the PwC’s Technical addendum.

“There is a move towards collaboration and compromise in areas of taxation in the face of global challenges. We’ve seen it recently with the agreement around a minimum global tax for multinationals. Collective action on climate is complex but essential to limiting global warming to the Paris Agreement's goal of 1.5 degrees Celsius.”

Contact us

Andrea Plasschaert

Office of the Global Chairman, Director, PwC Switzerland

Tel: +41 79 599 9567