Predictions for 2019: Coming off the boil

Overview

In our first edition of 2019, we look ahead to the trends we expect to come to the fore in the global economy in the year to come. We have identified three themes for 2019:

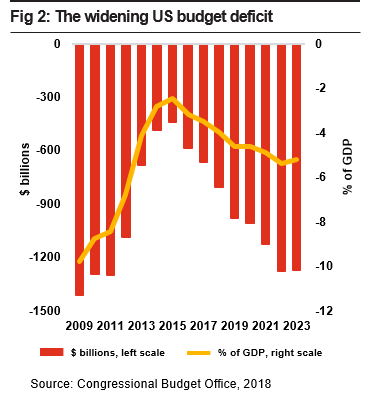

Global growth will slow. The global economy enjoyed a mini-boom between the end of 2016 and early 2018, when growth picked up in most major economies. This phase is now over, and in 2019 we expect the G7 economies to return to growth rates close to their long-run averages. In the US, the boost from fiscal stimulus is likely to fade, higher interest rates may dampen consumer spending and a strong dollar could continue to drag on net exports. We expect growth to moderate from an estimated 2.8% in 2018 to around 2.3% in 2019. In the Eurozone uncertainty relating to global trade tensions and Brexit will take a toll, while the European Central Bank is likely to offer less support to growth as its quantitative easing policy ends. Growth in China is also expected to slow relative to 2018. Although the government will try to ensure that the slowdown is minimal, the impact of US tariffs and the need to control debt levels are likely to result in at least a modest deceleration in growth in 2019. Emerging market currencies could come under periodic pressure from a strong US dollar, but this effect is likely to lessen later in the year, when we believe it will become more evident that the US economy is slowing.

Workers and wages will come to the fore. Labour markets in advanced economies are likely to continue to tighten, even if job creation slows. This may push up wages, but cause problems for businesses looking to fill talent shortages. In 2019 we expect unemployment rates to fall a little further in the US and Germany, where the rates of job creation have remained strong. But many other economies could show evidence of hitting structural floors. There is already evidence of this in Canada, where unemployment reached a 40-year low of 5.8% in late 2017 but has failed to fall any further, triggering an acceleration in wage growth. Other economies, such as the Netherlands, Denmark and Belgium are approaching their respective floors, with the pace of decline in joblessness slowing sharply. Assuming an orderly Brexit, by end-2019, the UK may also see unemployment flattening off at around current levels, though a disorderly ‘no deal’ could lead to a marked rise in unemployment.

Trade conflicts will deepen. We expect trade wars to continue in 2019. This is likely to generate further uncertainty for policymakers and businesses. The former will try to assess the impact of potential tariffs on growth and inflation, while the latter will attempt to mitigate the impact on their supply chains and customers. The main focus of tensions is likely to remain US-China trade, but there will always be the risk of this escalating into a wider trade conflict and businesses accordingly need to plan for different scenarios.

Global Economy Watch: Predictions for 2019 - Coming off the

Senior Economist Barret Kupelian gives an overview of our latest Global Economy Watch report - our predictions for 2019.

Senior Economist Barret Kupelian gives an overview of our latest Global Economy Watch report - our predictions for 2019.

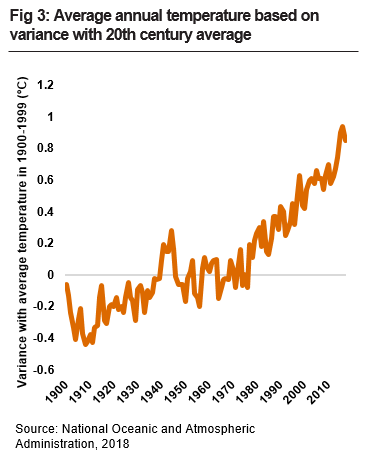

2019 will be one of the ten hottest years ever recorded

Global greenhouse gas emissions are generating record-breaking high temperatures around the world and also appear to be contributing to more frequent extreme weather events. Analysis by the World Meteorological Organisation (WMO) suggested that the global temperature level in 2017 was 1.1°C above the 1850-1900 pre-industrial average. This is more than halfway towards the ceiling of limiting warming to below 2°C relative to the pre-industrial average set under the 2015 Paris Agreement on climate change. According to an insurance firm, Munich Re, total disaster losses from climate-associated events in 2017 reached $320 billion, an inflation-adjusted record high.

Based on data collected by the WMO in its annual statement on the behaviour of the global climate, we expect 2019 to join 2017, 2016, 2015, 2014, 2013, 2010 and 2009 in the top ten of the hottest years ever. (Data for 2018 has yet to be published.)

Around 40 countries will see their workforces shrink

Thirty years ago, it generally required war or major civil unrest for a country’s working-age population to shrink. This occurred in only a handful of states, such as Liberia and parts of the disintegrating Yugoslavia. But in each decade since, the number of such economies has risen, to 16 in 1999 and an estimated 39 in 2018, due to ageing populations and below replacement fertility levels. According to World Bank data, seven of the G20 countries have declining workforces, in addition to other major economies such as Austria, Portugal and Spain. But the global nexus of the declining labour force remains Eastern Europe. It is possible to travel in a rough circle from Germany’s North Sea coast, moving south and east to the Aegean Sea off Greece, then swing north via Moscow and finally west to end in Germany’s Baltic Sea coast, passing through 23 countries, all of which have falling numbers of workers.

This circle is likely to widen further in 2019 to include the Netherlands, and possibly Belgium too. Having fewer workers is problematic for an economy. Productivity has to rise more quickly just to keep output flat. Government funding must be sourced from fewer contributors. And if the shrinking labour force is caused by an ageing society, there are more pensioners who need to be supported in their old age. We expect forward-thinking governments to spend more time considering how to keep their older workers in the labour force for longer in the coming years.

The UK will fall in the rankings of the world’s largest economies

The UK was considered to be the world’s fifth largest economy by the IMF in 2018 in US dollar terms at market exchange rates. Based on both the IMF’s forecasts and our main scenario projections, it is likely to be surpassed by two others in 2019: India and possibly also France. One of these changes may be permanent. India is the fastest growing large economy in the world, with an enormous population, favourable demographics and high catch-up potential due to low initial GDP per head. India is therefore all but certain to continue to rise in the global GDP league table in the coming decades as projected in our latest World in 2050 report. The UK and France, however, have regularly switched places over the past decade or two, owing to their similar levels of development and roughly equal populations. France’s improvement in 2019 will depend on the continued relative strength of the euro against the pound, but much depends on how Brexit turns out.

Further predictions for 2019

At the Women’s World Cup in France in June-July, the reigning champions, the US, defend their title. The hosts, England and Germany represent their biggest rivals.

Online shopping in the UK surpasses 20% of total retail sales for the first time. Internet sales have been rising steadily as a proportion of the total for years, typically setting a new record in each November to coincide with Black Friday/Cyber Weekend sales.

Elections are held in Africa’s two largest economies: Nigeria (February) and South Africa (May). But ongoing governance problems mean that we project growth in both countries in 2019 to be below their long-term average, at 2.5% in Nigeria and 1.6% in South Africa.

The US will record its longest-ever business cycle expansion in July 2019, when the period of growth that began in mid-2009 surpasses the length of the expansion that ran from 1991 until 2001. But this could come to an end in 2020 or 2021.