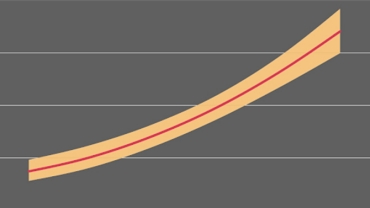

A recent study from PwC Netherlands reveals a striking correlation between a company’s solvency—its ability to meet long-term financial obligations—and the age diversity of its board. The wider the range of ages of the board members, the higher the company’s solvency ratio—to a degree. If the age diversity value (which is the coefficient of variation, or the standard deviation of board age divided by board average age) climbs too high, the solvency ratio starts to fall. In the companies studied, the optimum value, where the solvency ratio is at its highest, is 43. Companies with high solvency ratios are better able to reduce their exposure to risk, contributing to greater resilience, and while further research remains to be done to learn the precise causes of the correlation, the study suggests that age-diverse boards often approach financing more prudently, ultimately creating more value with less risk.

Boards with too much age diversity are rare in practice; almost none of the companies studied come close to the top of the “hill” shown in the first chart above. That’s because the average age of the board members is relatively high, and, at least from an age perspective, the boards are still quite homogenous. A central message to take from the study? Boards and C-suite leaders should consider making age part of their organisations’ diversity and inclusion agenda. Wider age diversity can mean more perspectives, more know-how and a broader network of resources.

Learn more about how age diversity can build resilience and create value.

Contact us