{{item.title}}

{{item.text}}

{{item.text}}

Imagine a financial reporting compliance function that keeps pace with the rapid changes of businesses, one that exceeds the ever-increasing stakeholder expectations, while proactively addressing the constantly changing risk profiles. PwC has re-imagined financial reporting compliance in a way that reduces total cost of compliance and helps turn risks into rewards

As leading organizations evaluate their financial reporting compliance programmes, we find that they hope to be aligned with strategic and compliance objectives that deliver quality but are right-sized for their environment. They also seek to leverage the rise of digital transformation initiatives in order to address business changes and technological advances.

If you're thinking about a similar journey, consider these three areas.

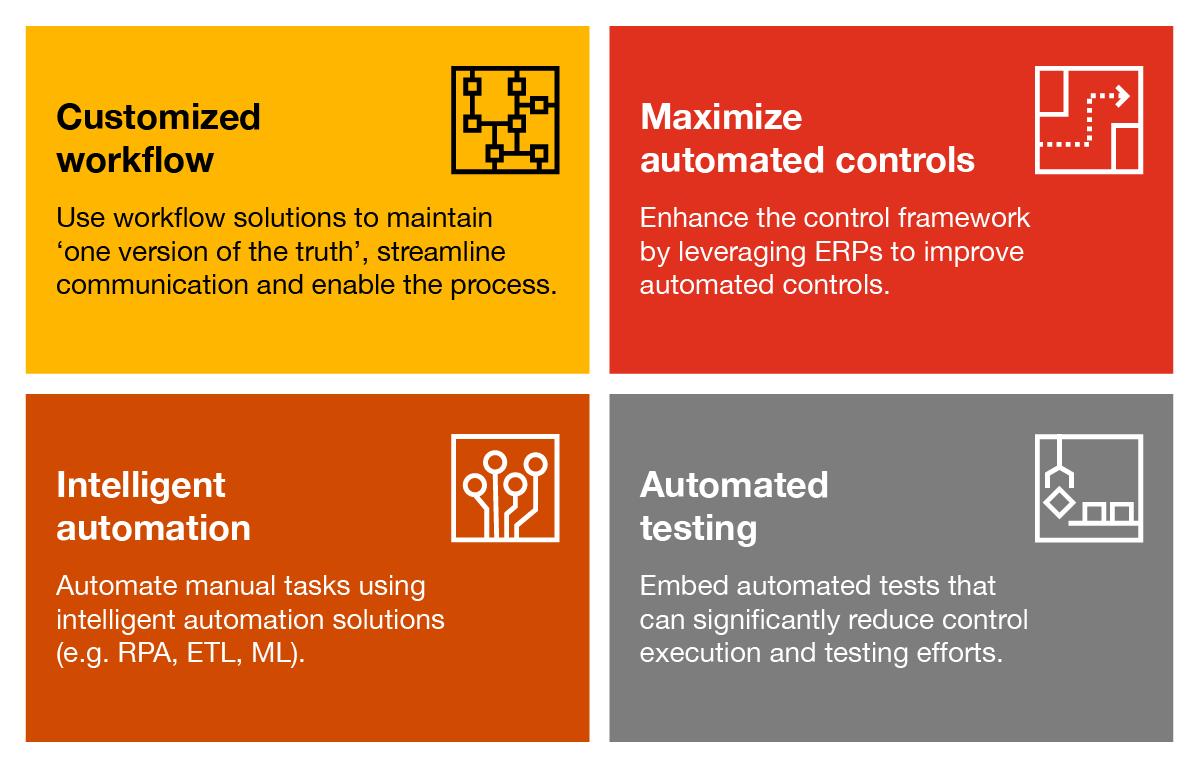

Innovative technology can improve the quality of your financial reporting compliance programme, make it more cost effective, and deliver insights. But are you wondering where to start? Our financial reporting compliance team helps you leverage our Intelligent Controls solution along with our experience to transform risk into reward. Our Financial Reporting Compliance Digital Experience solution combines:

Compliance experience that brings value in all we do—from analytics-based risk assessments using PwC’s Financial Reporting Compliance Scoping Central accelerator that drives better scoping decisions, to high quality efficient testing, to risk mitigation solutions and solving for complex deficiency issues.

Digitally upskilled, compliance-minded resources, when and where you need them, which include our efficient and cost effective acceleration centers located in five countries across the globe and a key component to enabling our 24*7 Financial Reporting Compliance Test Factory accelerator—incorporating technology and automation every step of the way.

Innovative technologies such as intelligent automation software like RPA, machine learning and artificial intelligence; and Financial Reporting Compliance Works—PwC’s proprietary Financial Reporting Compliance workflow solution and component of the Enterprise Control product suite—a cross system analytics solution that helps companies assess risks within their enterprise system data.

A right-sized, scalable Financial Reporting Compliance programme that delivers quality at a lower cost:

*Estimate based on our experience

A digitally transformed partner that:

A client-centric solution, leveraging industry experience and regulatory insights, that delivers:

Combine compliance expertise and technology-enabled solutions to drive quality and balance cost within your SOX program allowing internal resources to focus on higher risk, strategic activities

{{item.text}}

{{item.text}}