Time is running short to prepare for new energy markets

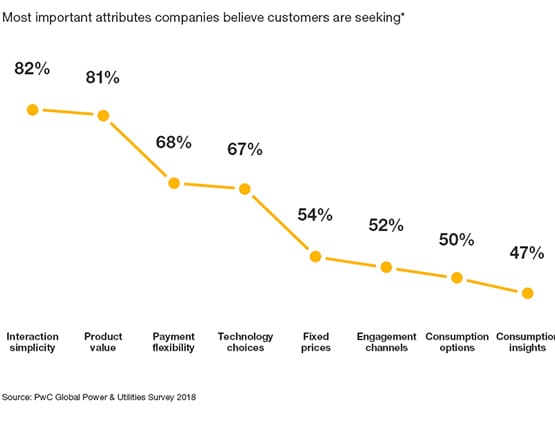

The global energy transformation is gathering pace, driven by the twin forces of changing customer expectations and rapid technological evolution. In response, companies must undertake a strategic shift to prepare for new energy markets.

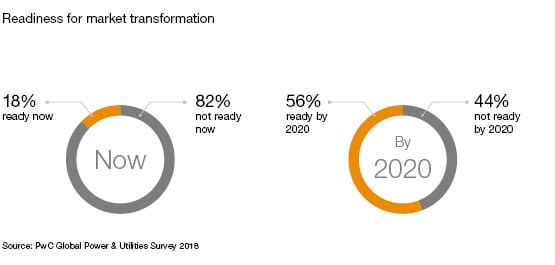

Yet 82 percent of utility executives in our latest Global Power & Utilities Survey say their company is not yet ready for the transformation. In the meantime, new players from outside the sector are sizing up opportunities in energy markets around the world.

To understand how companies are viewing this window of opportunity, we’ve canvassed over 115 industry leaders from 55 countries for their views on how these forces will affect energy markets. We’ve summarised our results across four key issues below.

The convergent effects of technological advances, policy measures, the growth of distributed generation, new forms of competition and changes in customer behaviour are transforming power markets around the world. While the pace of these changes varies from market to market, it is clearly accelerating at a speed beyond what leaders thought possible just a few years ago.

No component of the value chain – from upstream generation, through grid and network operations, to beyond the metre – will be unaffected. While there is an awareness that more agile business model thinking is needed for utilities to adapt to this changing environment, that awareness hasn’t necessarily translated into action. Only 18% of utility company executives say that their company is ready for market transformation. A further 38% expect their companies to be ready by 2020, which is to say, a slim majority of companies are expected to be prepared in two years.

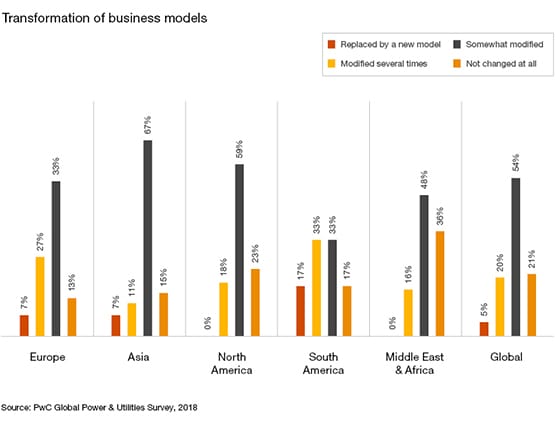

Back in 2015, in our last Global Power & Utilities Survey, only 26% of industry respondents thought that traditional power-sector company business models would serve them well into the future. Three years later, two-thirds (65%) of our survey participants say business model evolution is a strong driver of industry change, and the majority (79%) report some degree of business model change.

But the change seems incremental rather than fundamental. Only a quarter say that their company business model has changed significantly, in the form of either a move to a completely new model (5%) or by way of several modifications to the previous model (20%). Indeed, one in five (21%) report no change at all in their business model.

Many observers expect more innovation to occur in the utilities sector in the next 20 years than has occurred since the time of Thomas Edison. Consequently, companies need to think very differently about how to leverage innovation as a market enabler and as a key part of their wider enterprise strategy.

Our survey shows evidence of a shift in innovation focus taking place in the power utilities sector through the development of enterprise innovation initiatives that put innovation on a wider footing within the organisation. More than half (56%) of survey participants report that their company has been taking this approach for three years or more, and a further third (34%) have moved to this footing in the past three years. Only one in ten report no formal move in this direction yet.

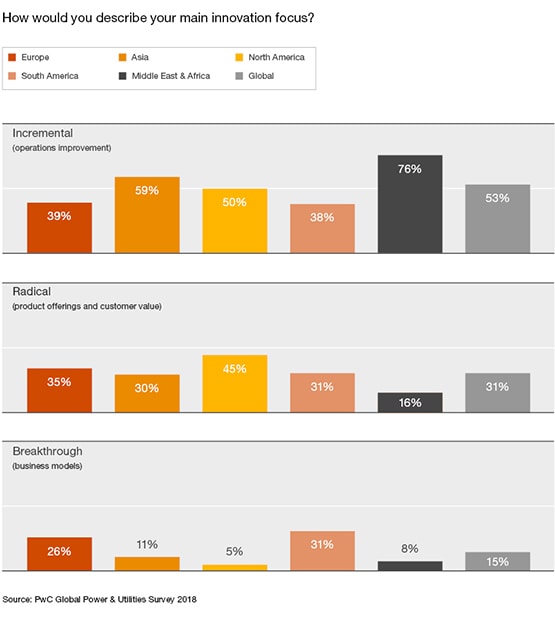

Despite this, a majority (54%) of our survey participants characterised their companies’ innovation efforts as still focused on incremental improvements in operations. However, a small but significant number (15%) are explicitly linking innovation to their business model strategy, and nearly a third (31%) are tying innovation explicitly into market-facing strategies concerning product development and customer value.

Many observers expect more innovation to occur in the utilities sector in the next 20 years than has occurred since the time of Thomas Edison. Consequently, companies need to think very differently about how to leverage innovation as a market enabler and as a key part of their wider enterprise strategy.

Our survey shows evidence of a shift in innovation focus taking place in the power utilities sector through the development of enterprise innovation initiatives that put innovation on a wider footing within the organisation. More than half (56%) of survey participants report that their company has been taking this approach for three years or more, and a further third (34%) have moved to this footing in the past three years. Only one in ten report no formal move in this direction yet.

Despite this, a majority (54%) of our survey participants characterised their companies’ innovation efforts as still focused on incremental improvements in operations. However, a small but significant number (15%) are explicitly linking innovation to their business model strategy, and nearly a third (31%) are tying innovation explicitly into market-facing strategies concerning product development and customer value.

Transforming your organisation for the future

What should companies do now to take advantage of the narrow window of opportunity for change? The temptation for companies grappling with the issues identified in our survey is to embark on a wholesale transformation initiative. But such efforts often fail, and tend to come in over budget and beyond the deadline. And, in the meantime, the outside environment has moved on and changed.

If companies are to transform successfully, they need to develop an ongoing mastery of change, in which adaptability feels natural to leaders and employees. But this continual adaptability and agility needs to be rooted in firm foundations.

Five issues emerge from our survey as key building blocks for power and utility companies: