A leadership agenda

to take on tomorrow

24th Annual Global CEO Survey - Indonesia findings

Conducted in January and February 2021, the 24th Annual Global CEO Survey explores the views of 5,050 chief executives around the world on how they are reinventing their companies to mitigate global disruptions, such as the impact of COVID-19, and ensuring sustainable growth.

Indonesia CEOs predict a return to growth in 2021

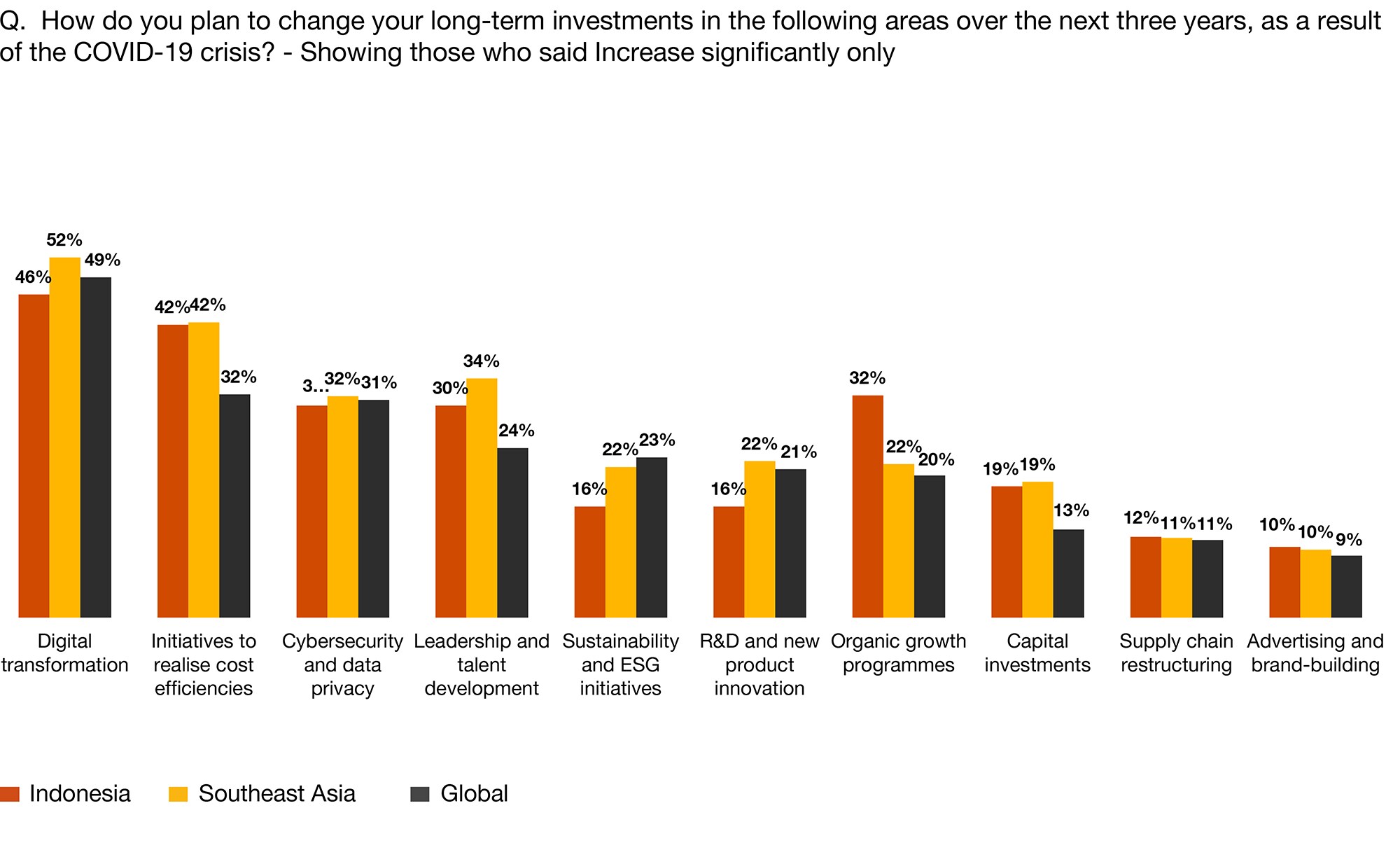

Indonesia CEOs are optimistic that the global economic will growth in the next 12 months, however the outbreak is still become the most concerned issues. Pandemics and other health crises is the #1 business threat for Indonesia CEOs. Furthermore, in line with Global level, 46% of Indonesia CEOs plan to increase their long-term investments in digital transformation and believes business should prioritising a skilled, educated and adaptable workforce. However, environmental impact in Indonesia is not a priority. Although Indonesia CEOs conscious about the ESG imperative (38%), but action plans lagging, only 22% of Indonesia CEOs have factored climate change into their strategic risk management activities, lower than global, most of region and country.

A positive economic outlook

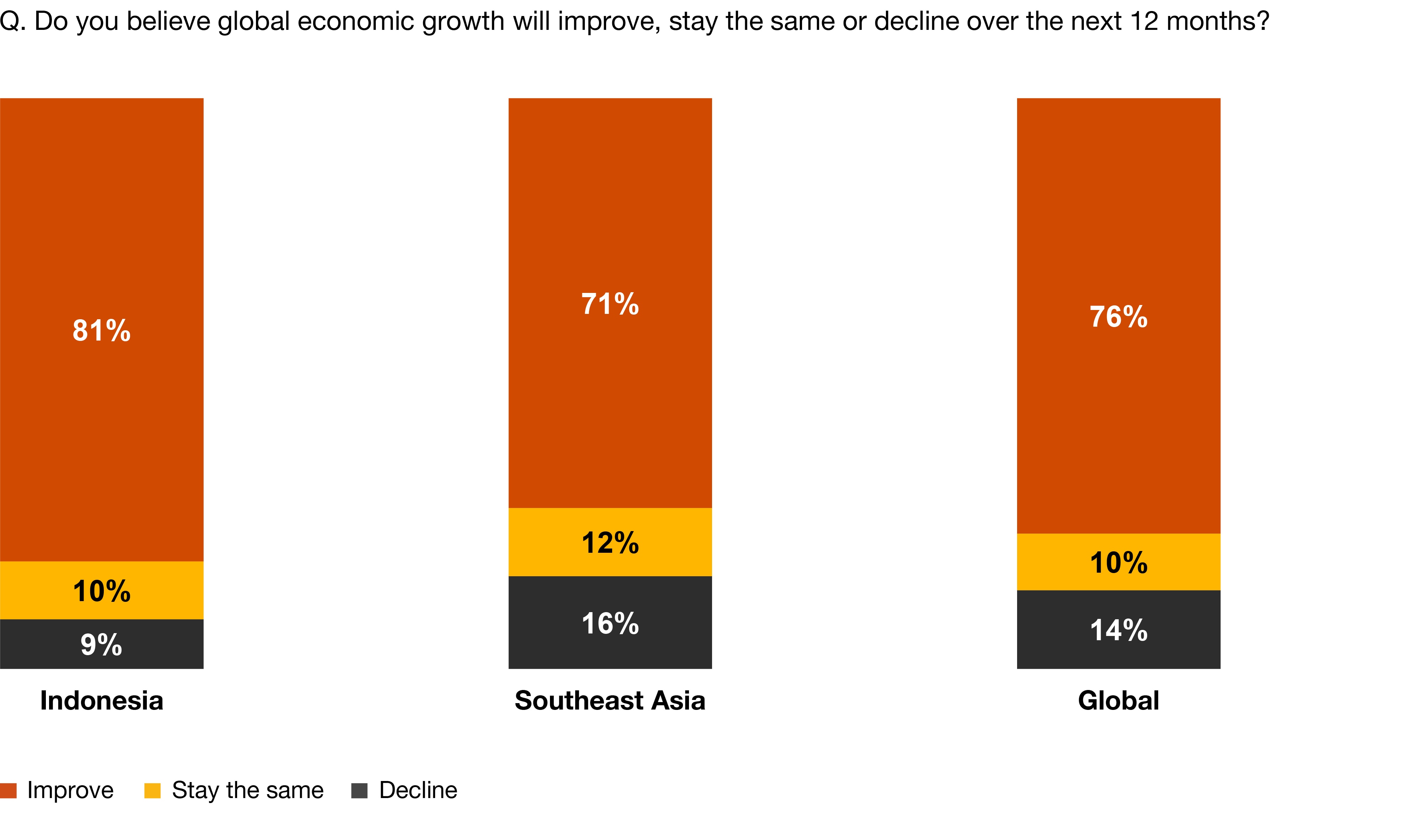

Despite the global economic turmoil experience in 2020 - due in part to the COVID-19 pandemic - 81% of Indonesia CEOs believe economic growth will improve in the next 12 months; this is similar at the global level at 76% and across our comparators with Japan at 67%, Australia 70%, and Southeast Asia and China at 71%.

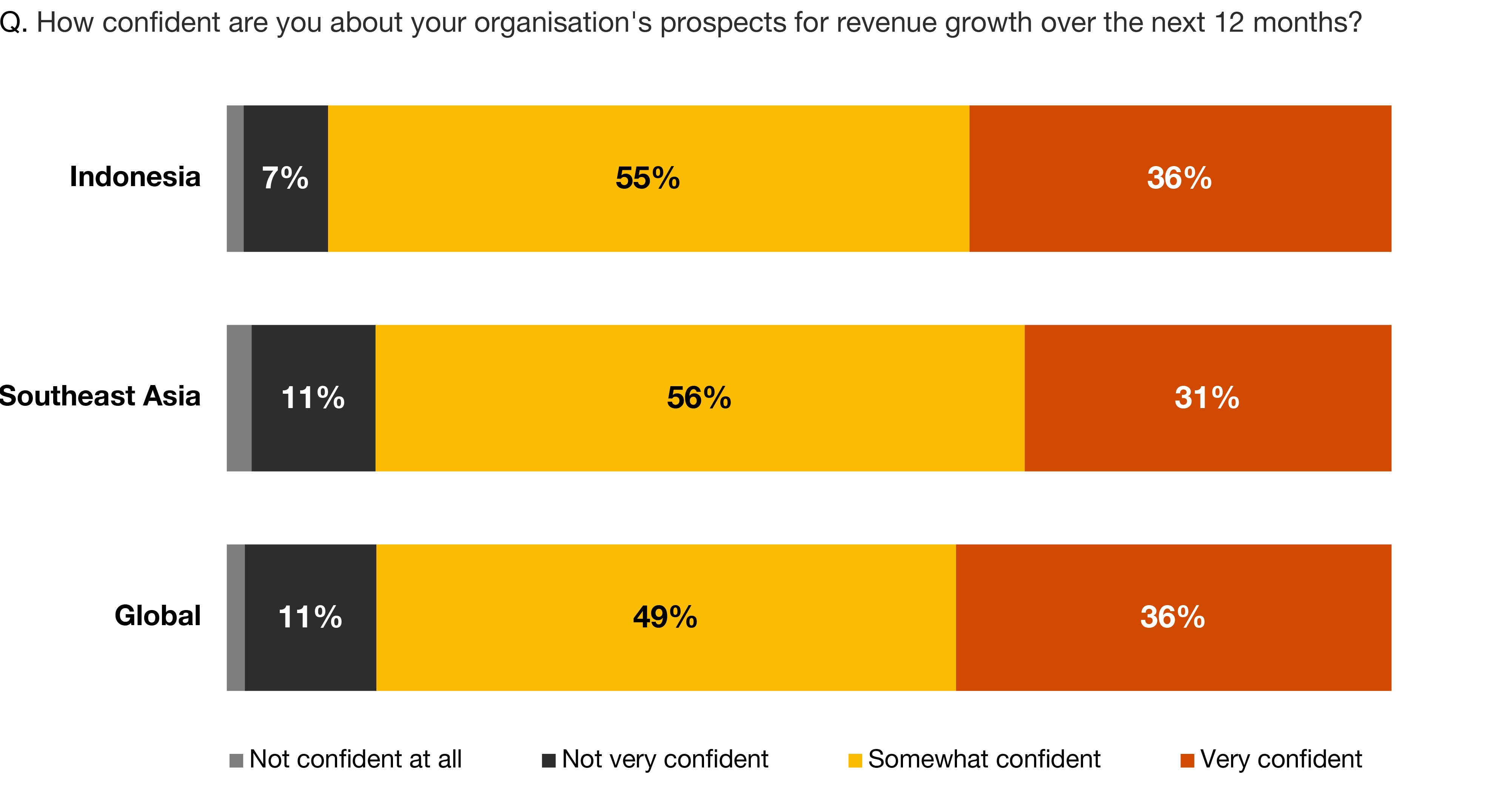

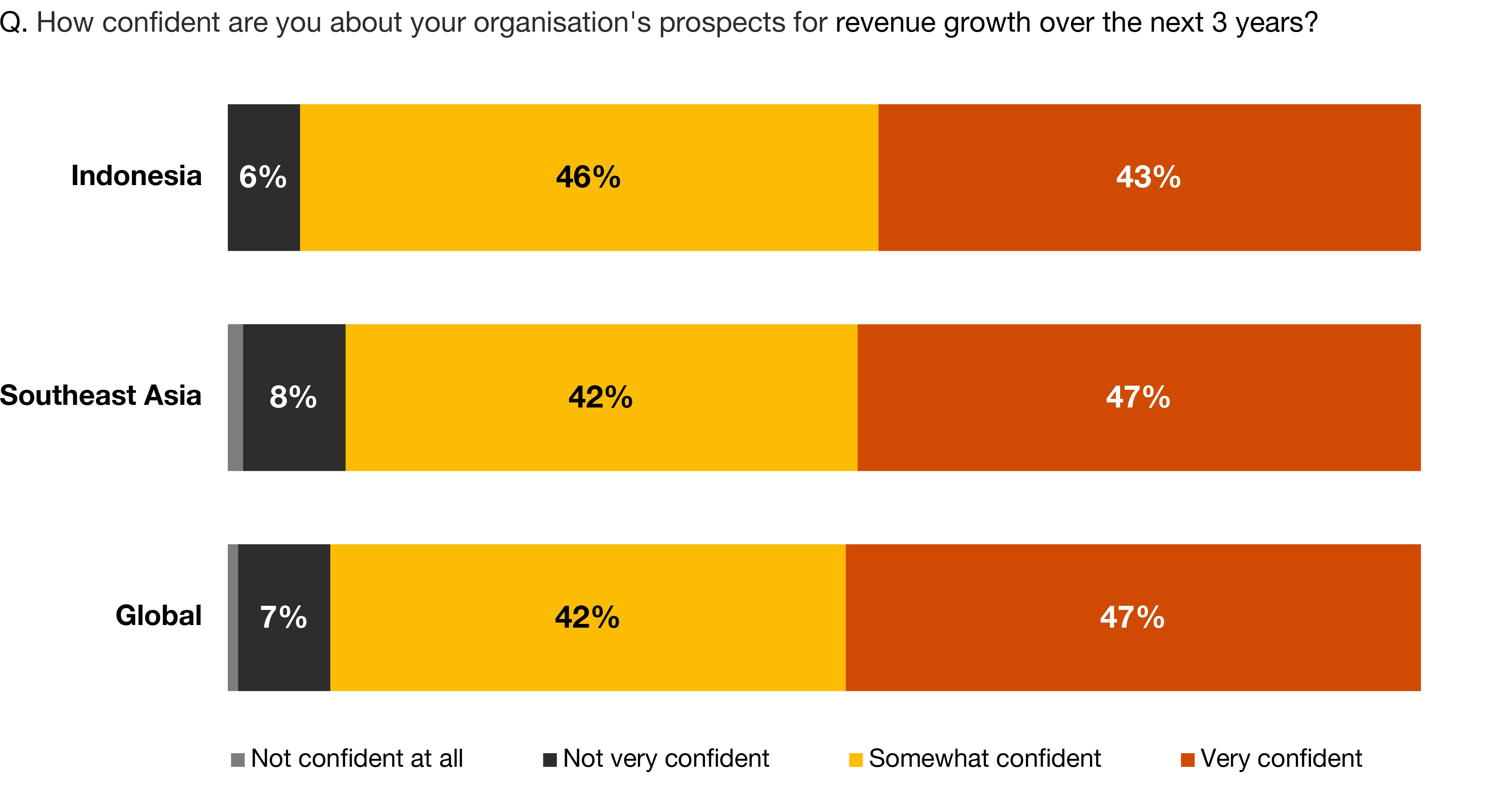

Indonesia CEOs’ optimism extends to their own company’s performance, with CEOs in Indonesia mirroring the global sentiment at 36% stating they are very confident about their own organisation's prospects for revenue growth over the next 12 months and 43% in the next three years (47% globally).

The climate change challenge

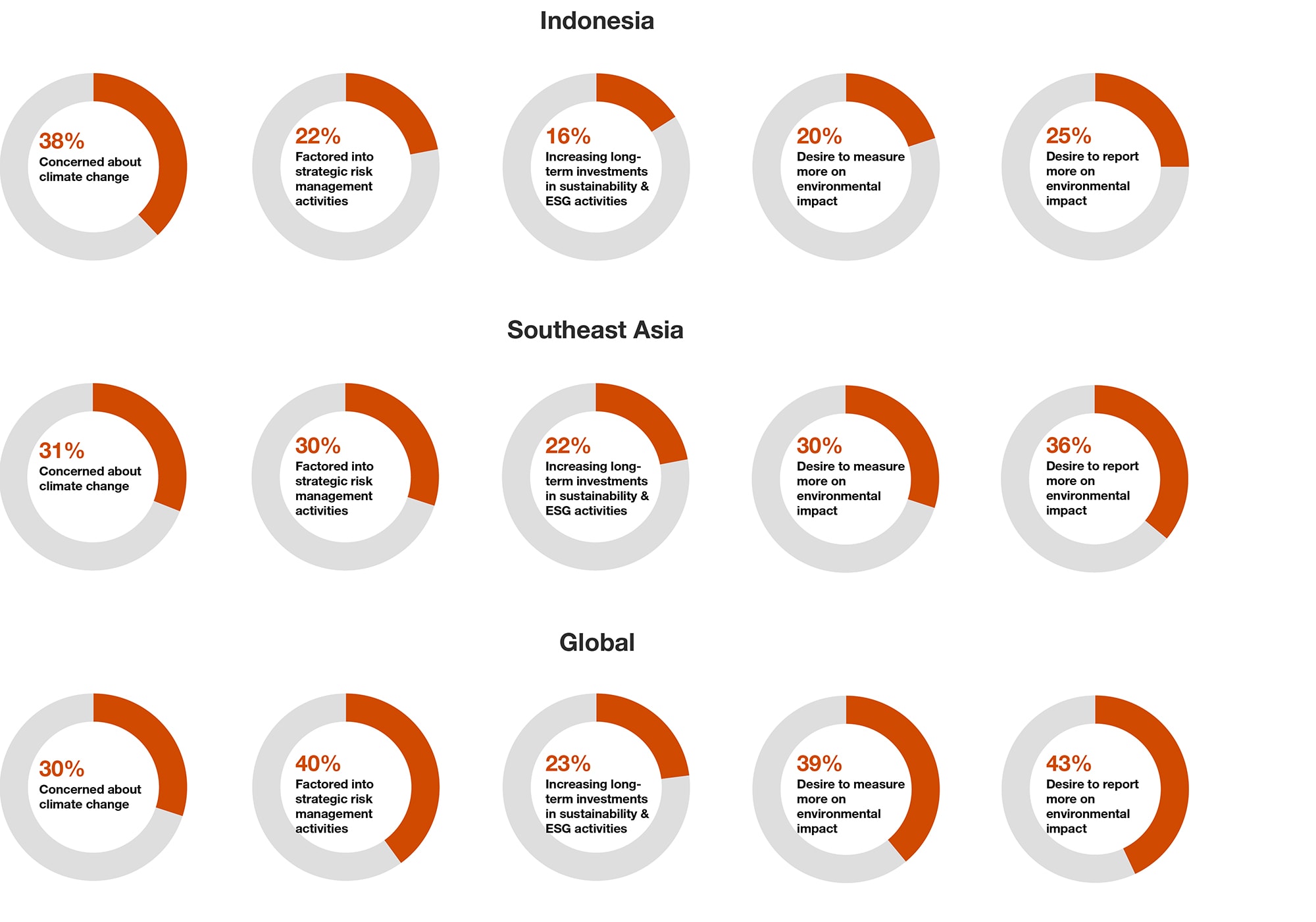

38% of Indonesia CEOs are extremely concerned about climate change (ranking 18th relatively in the list of 31 threats). This compares to 30% globally (9th), and 31% (24th) for Southeast Asia.

While a significant proportion of Indonesia CEOs are concerned about climate change, only 22% are factoring climate change into their strategic risk management activities, this compares to 40% globally, 49% for Japan and Australia, 30% for Southeast Asia, and 23% for China.

In terms of long-term investments, 16% of Indonesia CEOs are planning to significantly increase investment in sustainability and ESG initiatives by 10% or more over the next three years. This is on par with Japan and Australia but slightly below global (23%), China (24%) and Southeast Asia CEOs (22%).

Only 20% of Indonesia CEOs believe their organization should be doing more to measure environmental impact, compared to 39% globally, Japan (43%), , China (35%), Southeast Asia (30%) and Australia (29%).

A similar trend can be seen in reporting where 25% of Indonesia CEOs believe their organisation should be doing more to report on environmental impact, compared to 43% globally, 50% in Japan, China (37%), Southeast Asia (36%). Australia is closer to Indonesia’s sentiment at 27%.

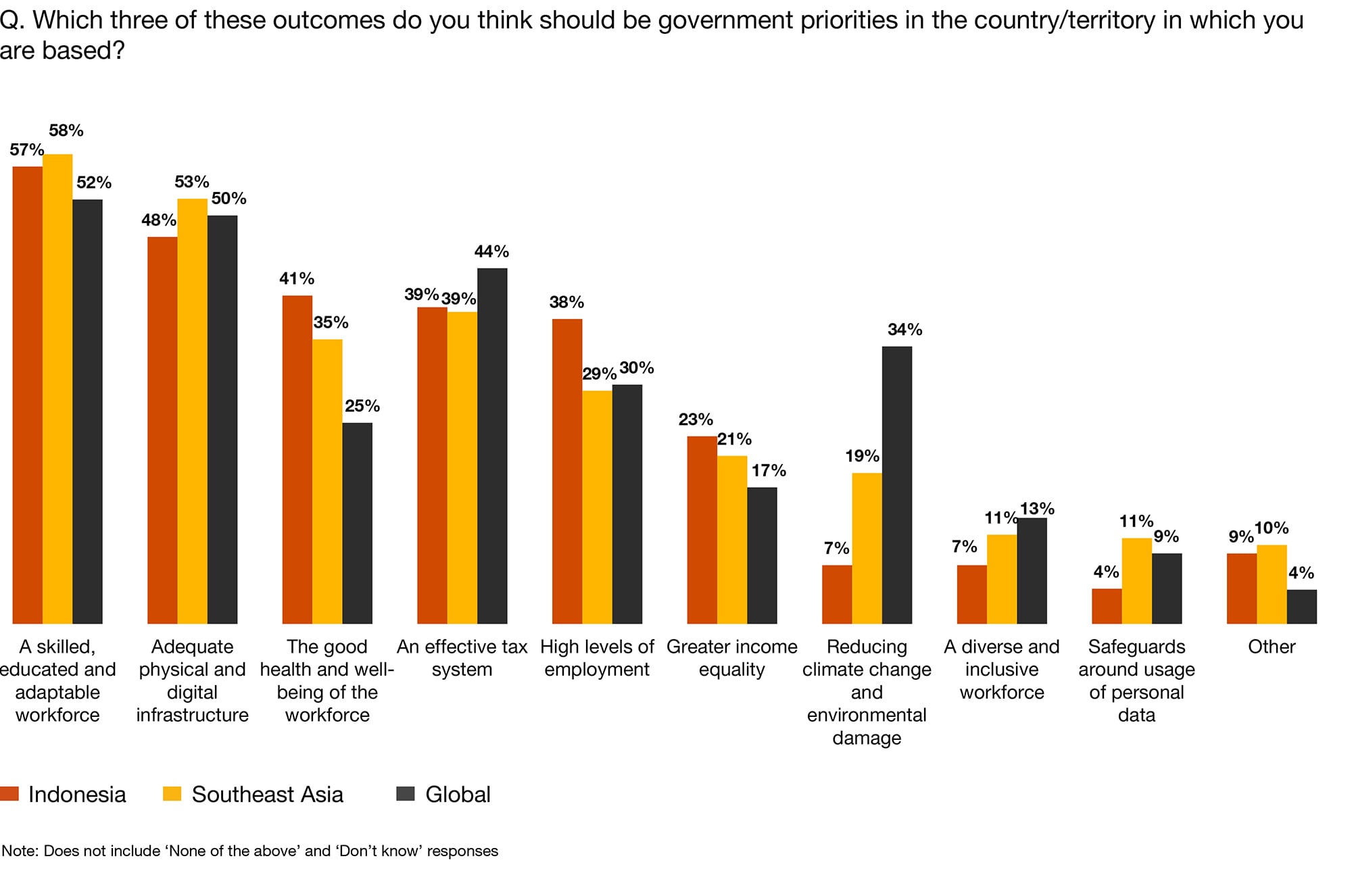

Only 7% of Indonesia CEOs think ‘reducing climate change and environmental damage’ should be a top three government priority in Indonesia, this contrasts with the global view (34%),China (34%), Australia (38%) and Japan (48%). Southeast Asia sits between Indonesia and the other comparators at 19%. The top three priorities for government selected by Indonesian CEOs were a skilled, educated and adaptable workforce (57%), adequate physical and digital infrastructure (48%) and the good health and well-being of the workforce (41%).

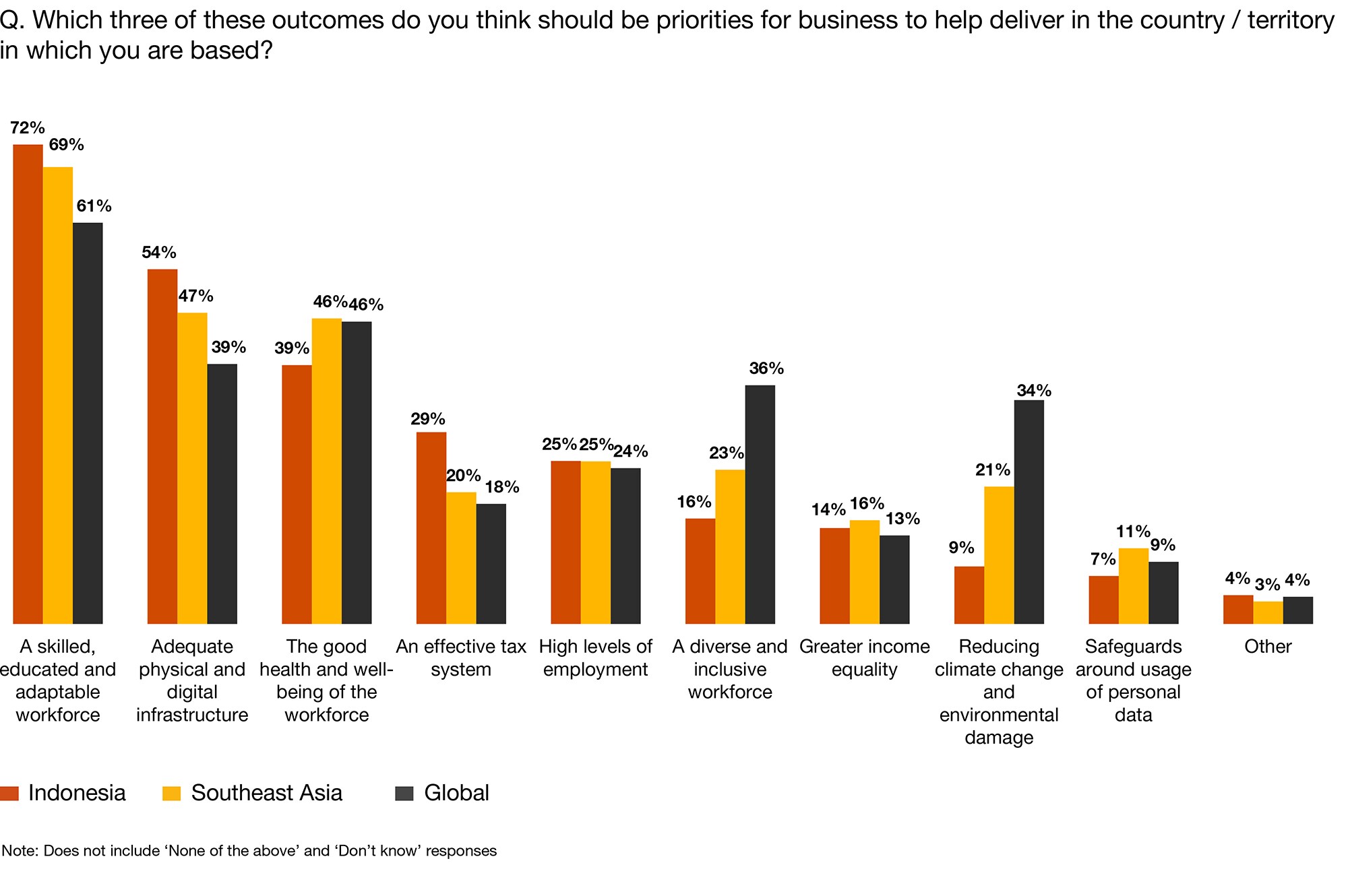

Similarly, only 9% of Indonesia CEOs think ‘reducing climate change and environmental damage’ should be a priority for business to help deliver, again in contrast with the global picture (34%), Japan (30%), China (31%), Australia (41%), and Southeast Asia (21%). Priorities selected as the top three outcomes for business to help deliver in Indonesia were: a skilled, educated and adaptable workforce, coming through very strongly at 72%, adequate physical and digital infrastructure (54%) and the good health and well-being of the workforce (39%). Meaning Indonesia CEOs were selecting the same priorities for both government and business.

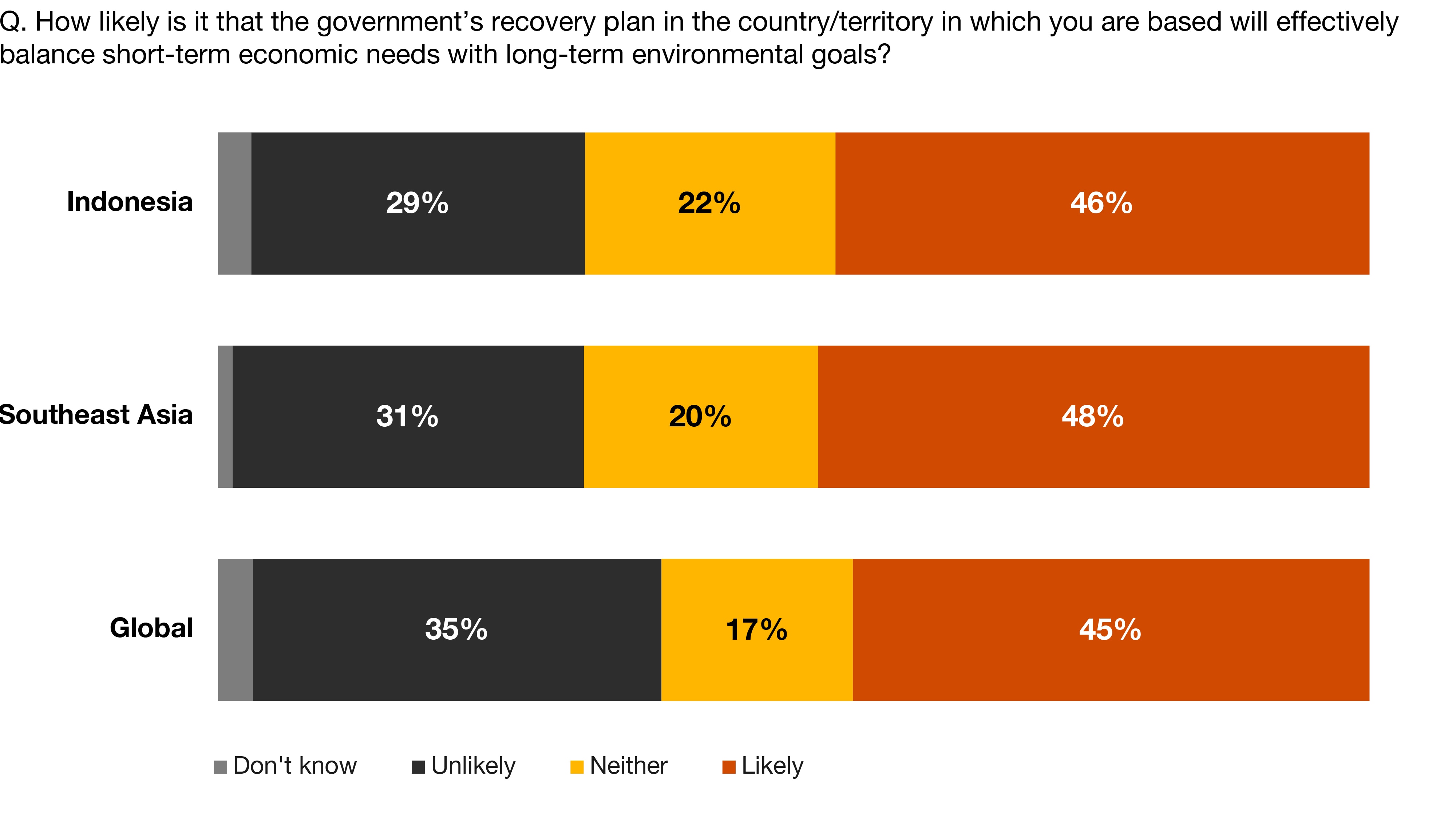

Indonesia CEOs’ confidence in their government’s recovery plan to balance economic needs and long-term environmental goals mirrors the global average. 46% said it was ‘likely’ these needs and goals would be effectively balanced as we see globally(45%). Similar levels are seen across Southeast Asia (48%), Australia (41%) and Japan (35%) But China CEOs are more confident in their governments’ ability to balance these priorities.

42% Indonesia CEOs believe their organisation should be doing more to measure organisational purpose and values. As noted above this is one of the top three areas of impact and value Indonesian CEOs believe their organisation should be doing more to measure. Chinese (42%) and Southeast Asia (36%) CEOs have similar proportions but we see lower comparisons globally (29%), in Japan (22%) and Australia (21%) with regards to more measurement of this area.

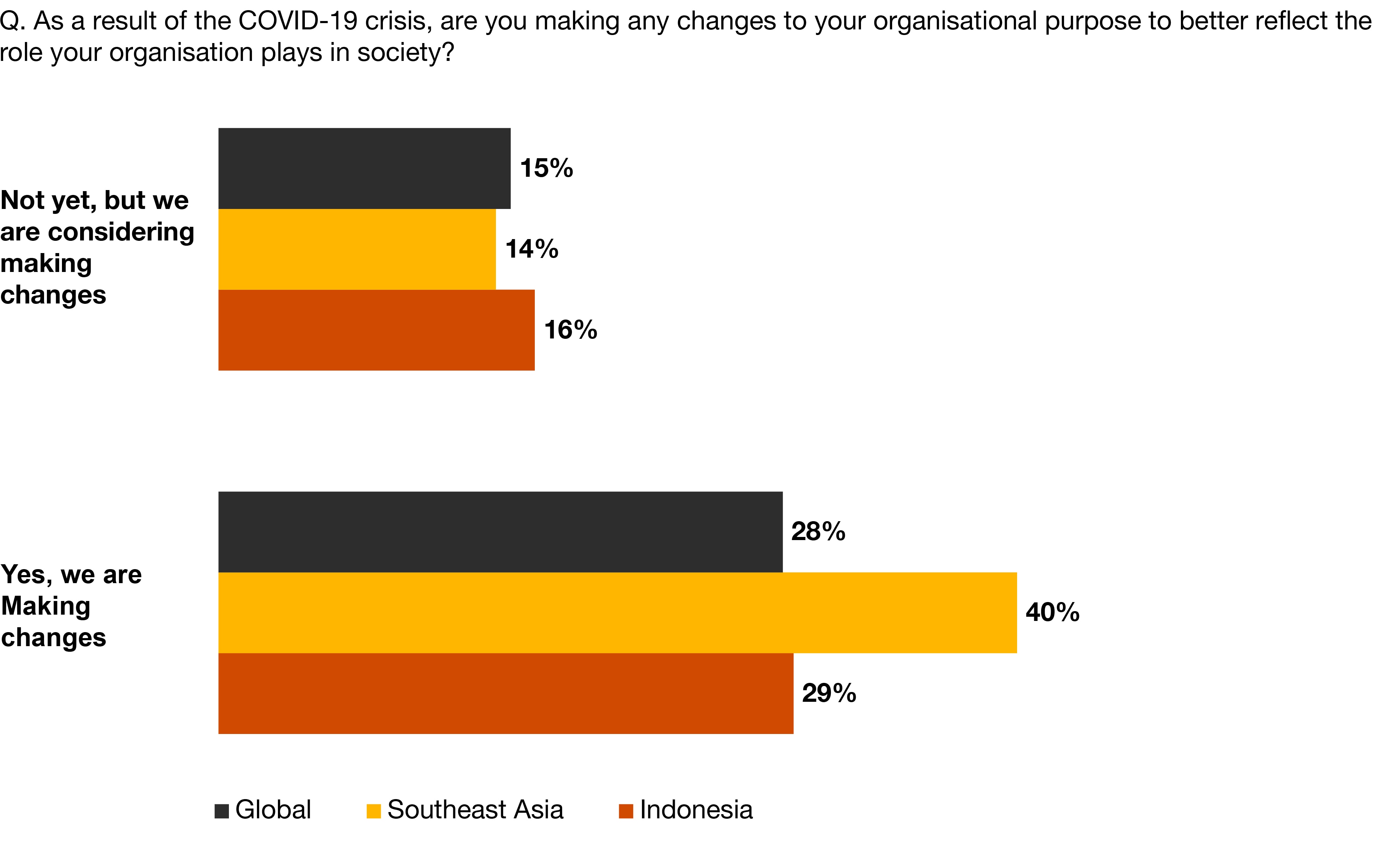

As a result of the COVID-19 crisis, 29% of Indonesia CEOs are making changes to their organisational purpose to better reflect their firm’s role in society, and 16% are considering making changes. This mirrors the global trend (28% and 15% respectively), but sits below the share of Chinese and Southeast Asia CEOs who are making changes (51% and 40% respectively).

Growth expected in digital transformation, but concerns around speed of technological change remain

46% of Indonesia CEOs expect double digit growth (10% or more) in digital transformation over the next three years. This in line with the global average (49%), Southeast Asia (52%) and Australia (42%), but exceeds the level of proposed investments in both Japan and China (31%).

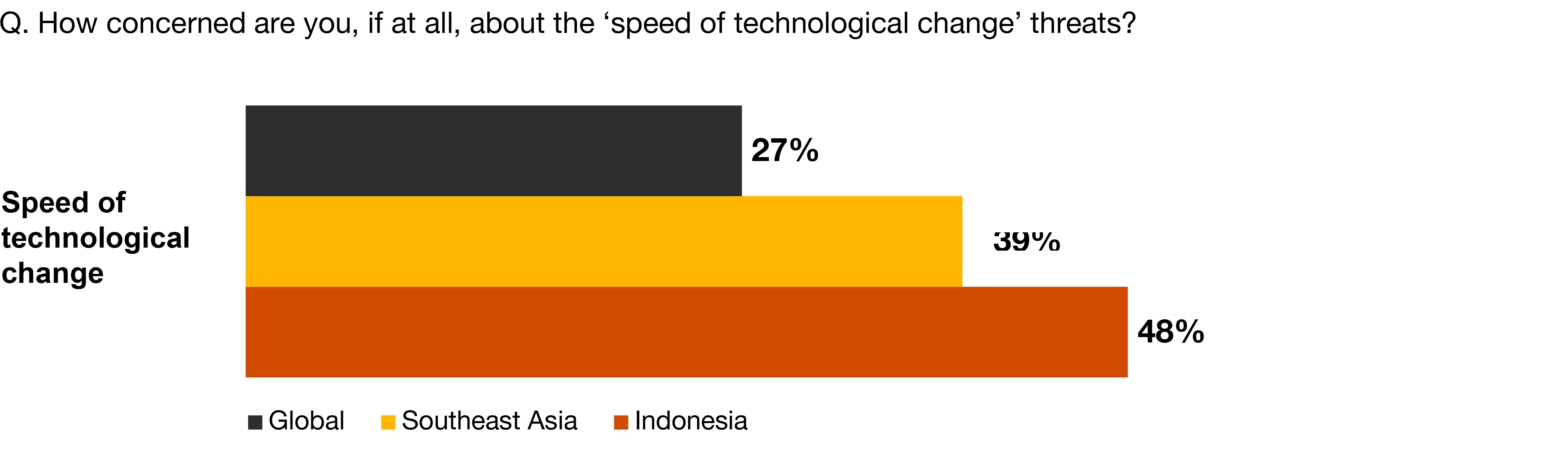

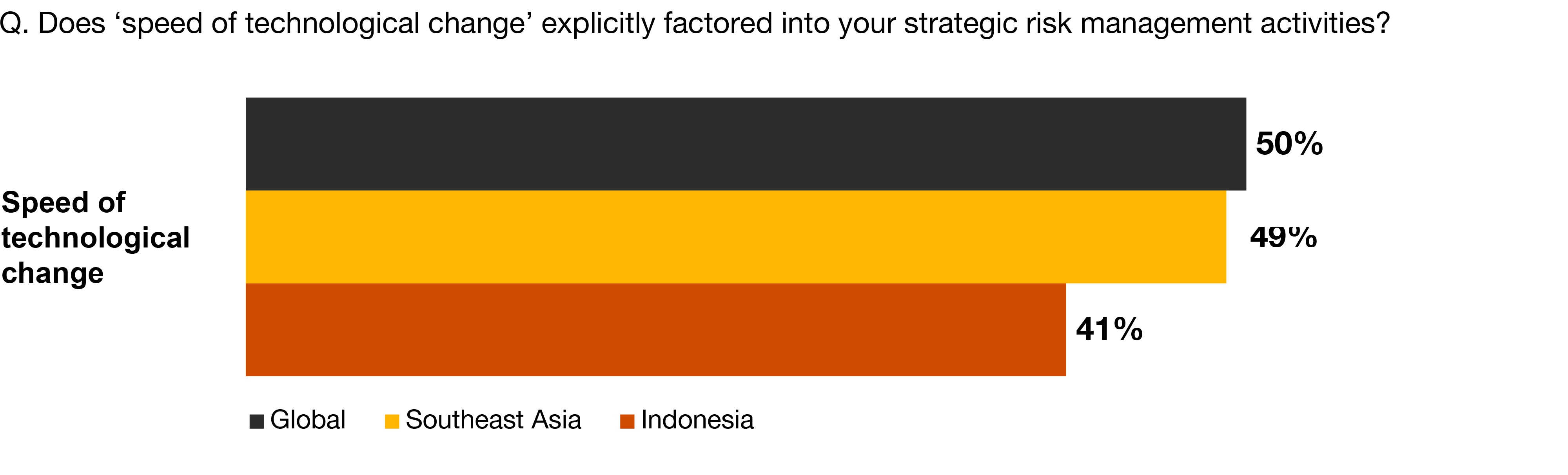

Despite this, 48% of Indonesia CEOs are extremely concerned about the threat posed to organisational growth prospects due to the speed of technological change (ranked joint 6th in order of extreme concern), this compares to 27% globally (14th). Indonesia CEOs are not alone in their concern, 48% of Japan CEOs also sharing this concern (ranked 2nd).

41% of Indonesia CEOs have also factored speed of technological change into their strategic risk management activities.

While 42% of Indonesia CEOs are extremely concerned about cyber threats, similar to the global average of 47%, this threat is 15th in their order of concern rather than 2nd as we see globally. CEOs in Japan (48% 3rd), Southeast Asia (51% 4th) and Australia (53% 1st) are also more concerned on average. In contrast, China CEOs seem much less concerned, with only 14% stating they were extremely concerned about cyber threats (26th).

And while 42% of Indonesia CEOs are concerned about cyber threats, only 33% have factored such threats into their strategic risk management activities, compared to 59% globally. Southeast Asia (50%) Japan (58%) and Australia (77%) all display a higher rate of cyber security awareness in risk management activities. Again, this contrasts with China CEOs, with only 23% factoring cyber threats into their risk management.

30% of Indonesia CEOs plan to increase investment significantly in cyber security and data privacy over the next three years as a result of the COVID-19 crisis, this mirrors the global average of 31%. Similar proportions of Australia (37%) and Southeast Asia (32%) CEOs are also planning significant investment in this area, but a smaller proportion in Japan (13%) and China (17%).

The proportion of CEOs that believe their organisation should be doing more to measure cyber security and data privacy is lowest in Indonesia (22%). This compares to 36% globally, Australia (27%), Japan (28%), Southeast Asia (34%) and China (38%).

Not dissimilar to the global average of 9%, only 4% of Indonesia CEOs believe the government should place safeguards around usage of personal data as one of their top three priorities. Japan (4%), Australia (5%) and Southeast Asia (11%) CEOs hold a similar view, but 31% of China CEOs do believe this should be a top government priority.

Concern over pandemics, and policy uncertainty

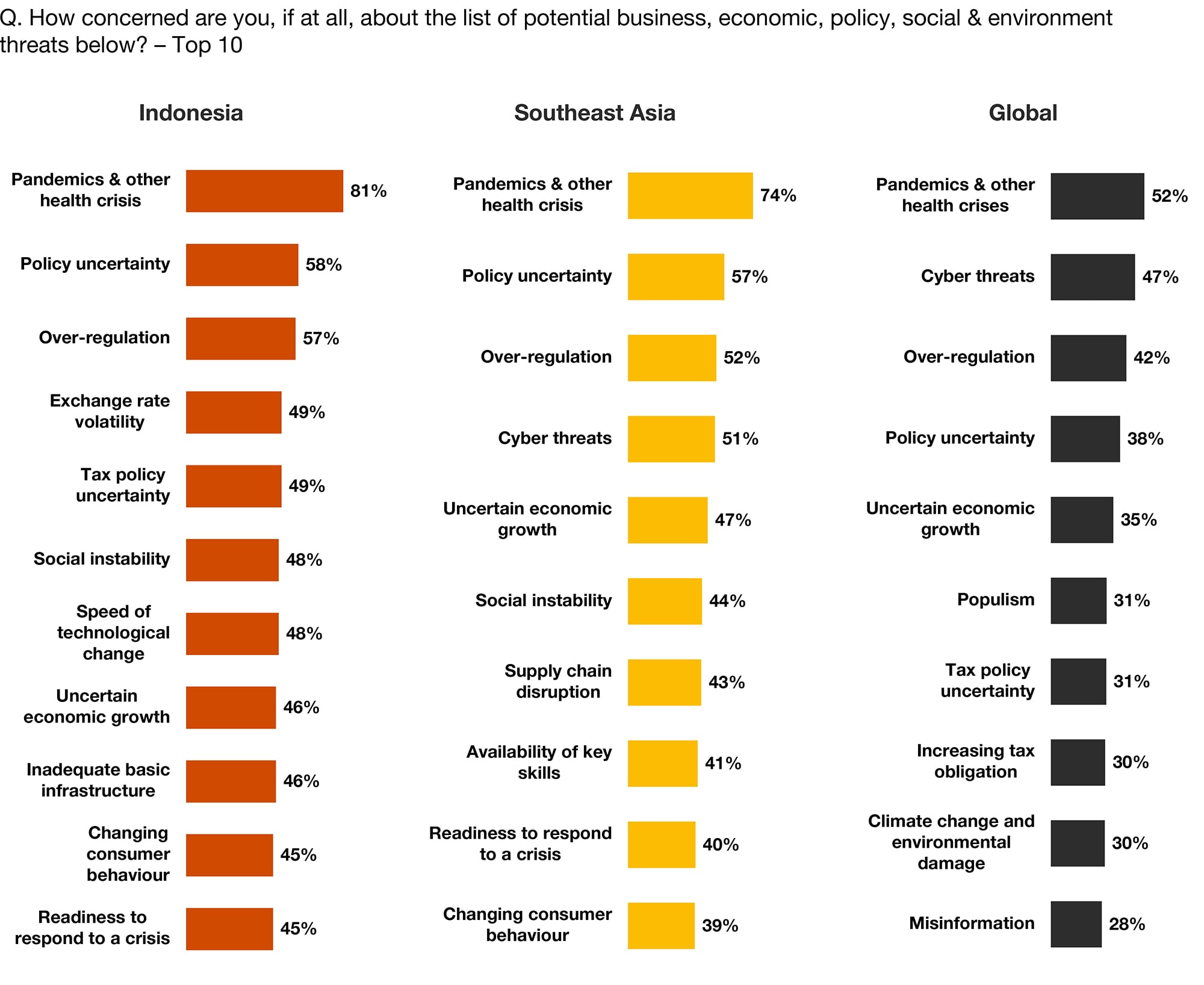

Indonesia CEOs are undoubtedly concerned about the threat of pandemics and other health crises - 81% stated they were ‘extremely concerned’ about this threat (compared with 52% globally and 74% within Southeast Asia).

Beyond pandemics, policy uncertainty and over-regulation are among the top three concerns for Indonesia CEOs (as with Southeast Asia). Policy uncertainty is an extreme concern for 58% of Indonesia CEOs, greater than the global average of 38%, China (24%), Japan (27%), and Australia (36%). Similarly, over regulation is of extreme concern for 57% of Indonesia CEOs, 52% of Southeast Asia CEOs, notably higher than the global average of 42%.

Extreme concern concerning tax policy uncertainty among Indonesia and Southeast Asia CEOs is also above the global average, with 49% of Indonesia and 38% of Southeast Asia CEOs stating extreme concern, against 31% globally; and 49% of Indonesia CEOs are also extremely concerned with exchange rate volatility, compared with only 21% globally.

Watch the replay of our launch event

The Chairman of the PwC Network, Bob Moritz, together with leading CEOs from around the world engaged in an hour-long interactive session where the survey’s key findings were revealed. Find out how businesses can deliver sustained outcomes and build trust in the context of the pandemic, digital disruption and the changing nature of society and the environment.

The event is hosted by CNBC Catalyst, a commercial division of CNBC.

"This last year has seen significant challenges for businesses, both in Indonesia and globally. However, CEOs are indicating that opportunities are also coming out of the Covid-19 pandemic – and one of these has been the accelerated pace of digitalisation. Many CEOs are therefore taking this opportunity to reassess their business strategies, understanding the need to be agile in preparation for the challenges as well as the opportunities to come. The importance of developing a sustainable business has never been clearer, with ESG (Environmental, Social and Governance) concerns being high on the agendas of CEOs in Indonesia and globally. Understanding these issues and addressing them through your organisation’s strategy will help you to achieve the trust that will drive sustained outcomes for your business."

Contact us