Indonesia’s merger and acquisition (M&A) landscape has undergone significant shifts in recent years. PwC’s thought leadership, “Maximising M&A success with enhanced integration strategies,” combines insights from a survey of 40 Dealmakers across industries in Indonesia.

This publication offers actionable guidance on maximising value creation and driving sustainable growth in M&A transactions through integration planning and early synergy identification.

Doing the “right deal” needs to be followed by doing it right to achieve the intended outcome

There are four crucial aspects of the deal-making process that demand greater focus and deliberate decision-making from Dealmakers to enhance M&A success:

Dealmakers should align their deal objectives with their organisational strategy to capture optimal value capture and gain clear guidance on navigating the deal. In contrast, those pursuing opportunistic transactions risk achieving suboptimal returns.

M&A objectives of Dealmakers in Indonesia

in % of responses of 40 respondents, 2024

Dealmakers in Indonesia prioritise strategic positioning as their primary M&A objective, focusing on portfolio diversification and value chain or geographical expansion. Commercial objectives come next, centred on revenue growth through expanded market reach and new customer acquisition. Financial gains rank third, driven by investment returns and valuation improvement.

Selecting Targets with the right capability-fit

Dealmakers need to find the right Target that aligns with their capability advantage or gap, either by leveraging or enhancing the Acquirer’s capability to maintain a competitive edge in an evolving business landscape.

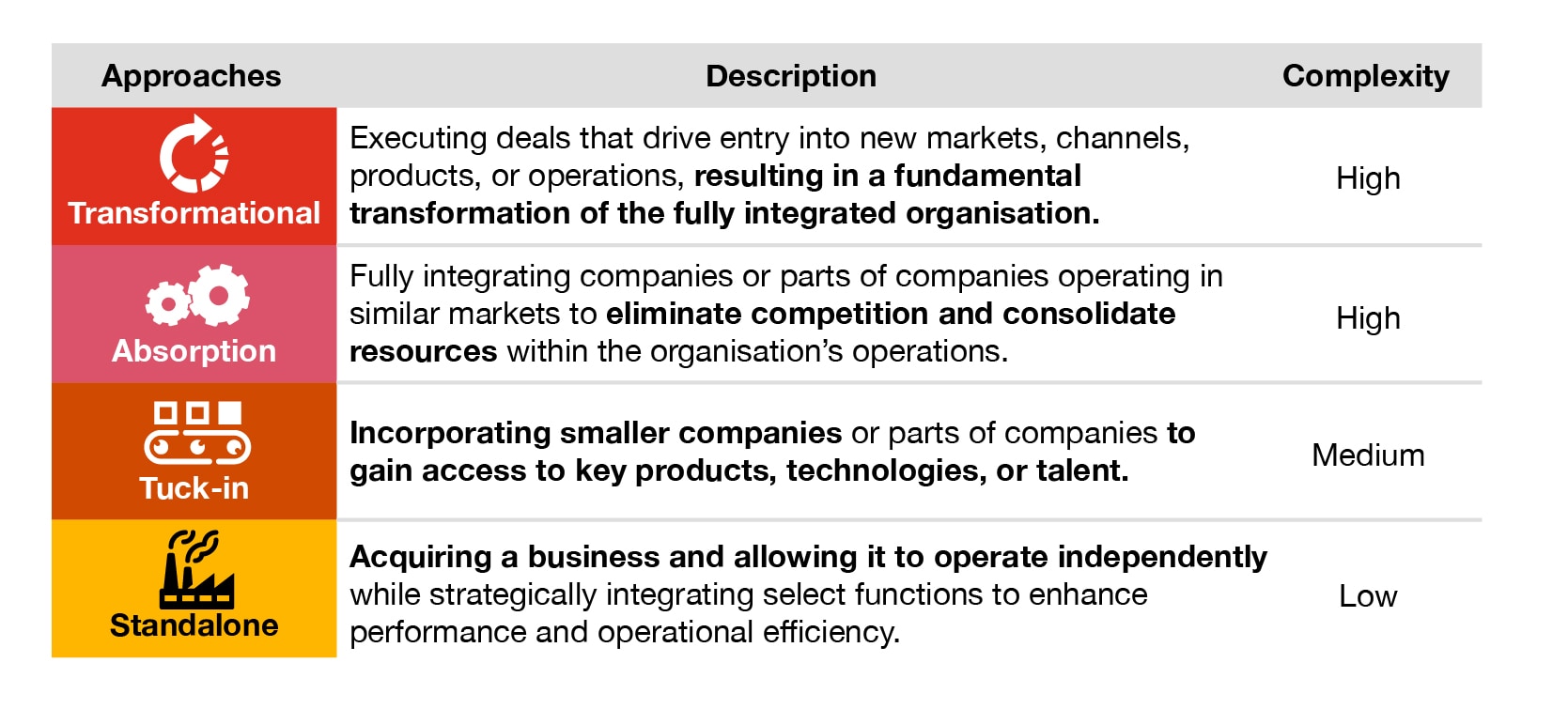

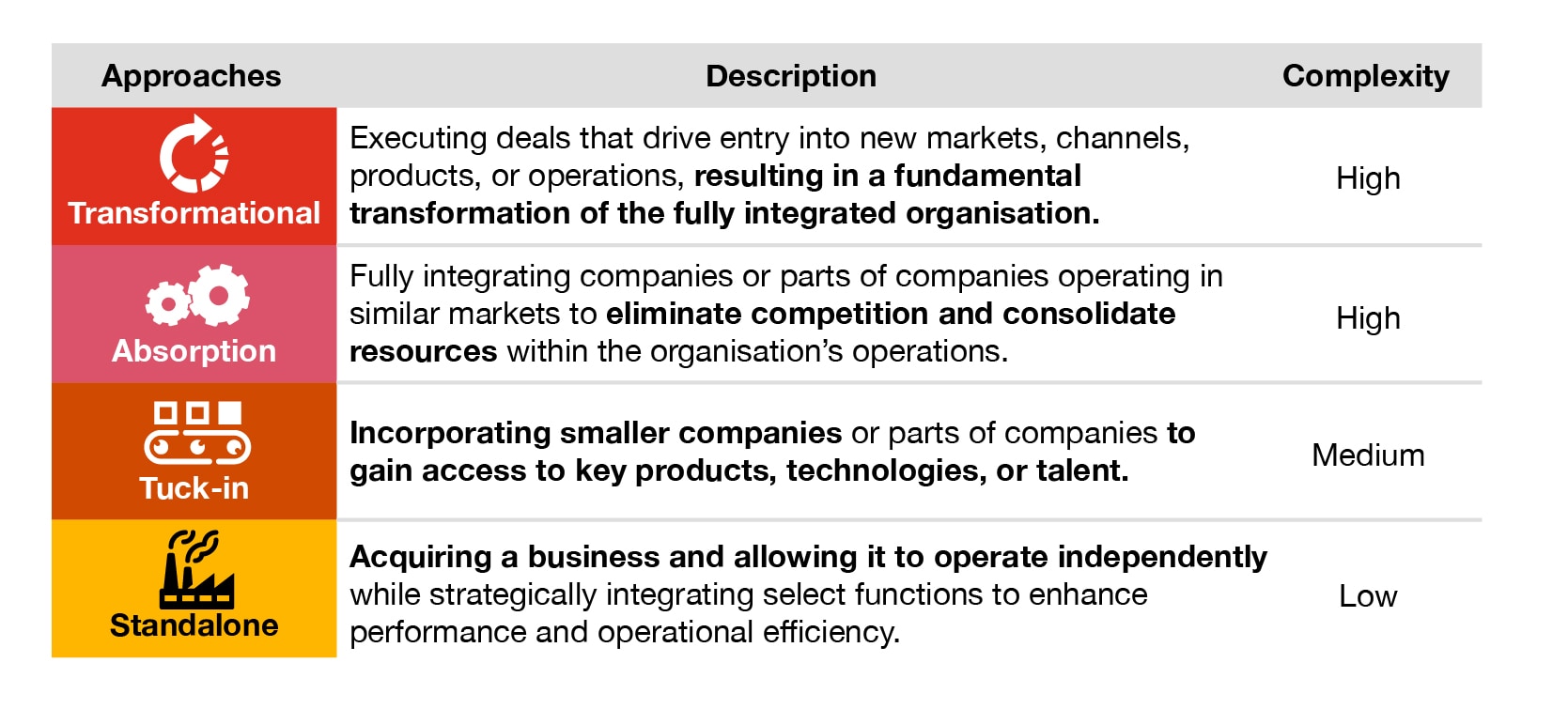

Types of M&A integration approaches

Understanding and selecting the right integration approach helps uncover the complexities and challenges early in the deal cycle.

There are four types of M&A integration approaches:

Understanding the complexity allows organisations to secure sufficient and suitable resources in the form of talent, time and financial investment.

Traditionally, due diligence primarily aims to identify gaps and dealbreakers by evaluating the Target’s baseline and assessing key areas against the Acquirer’s standards or expectations.

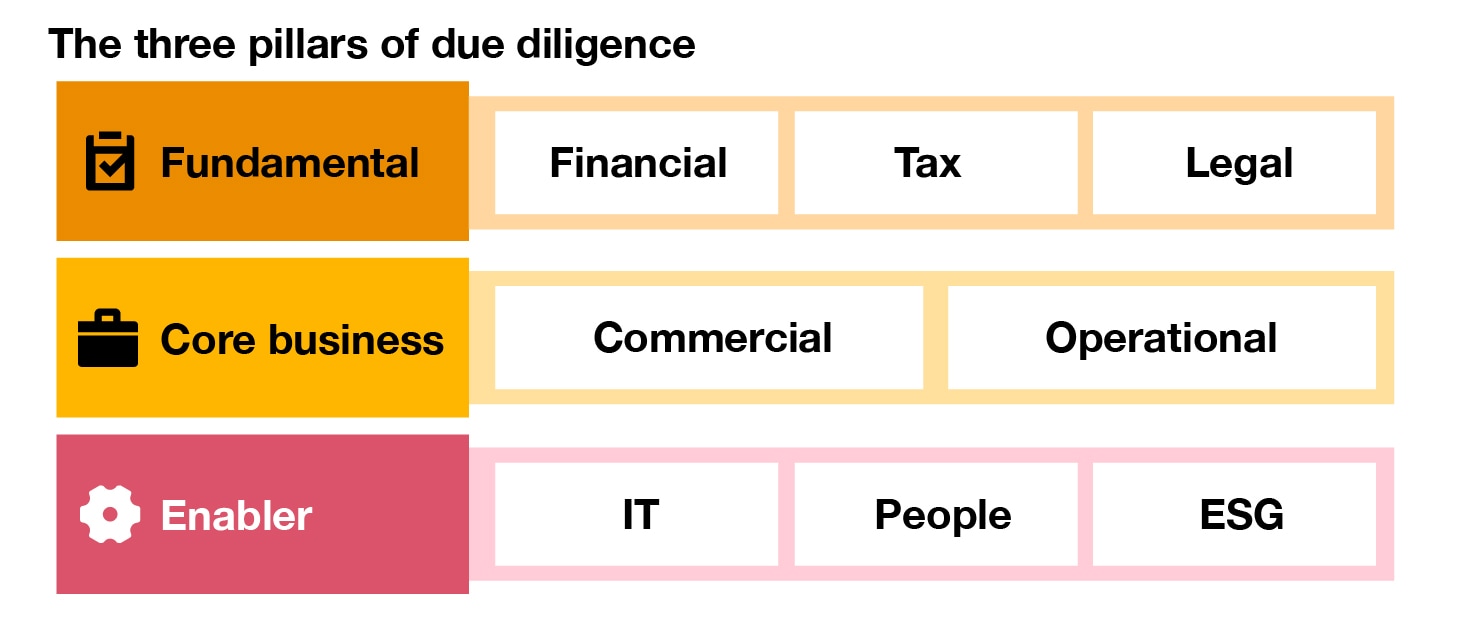

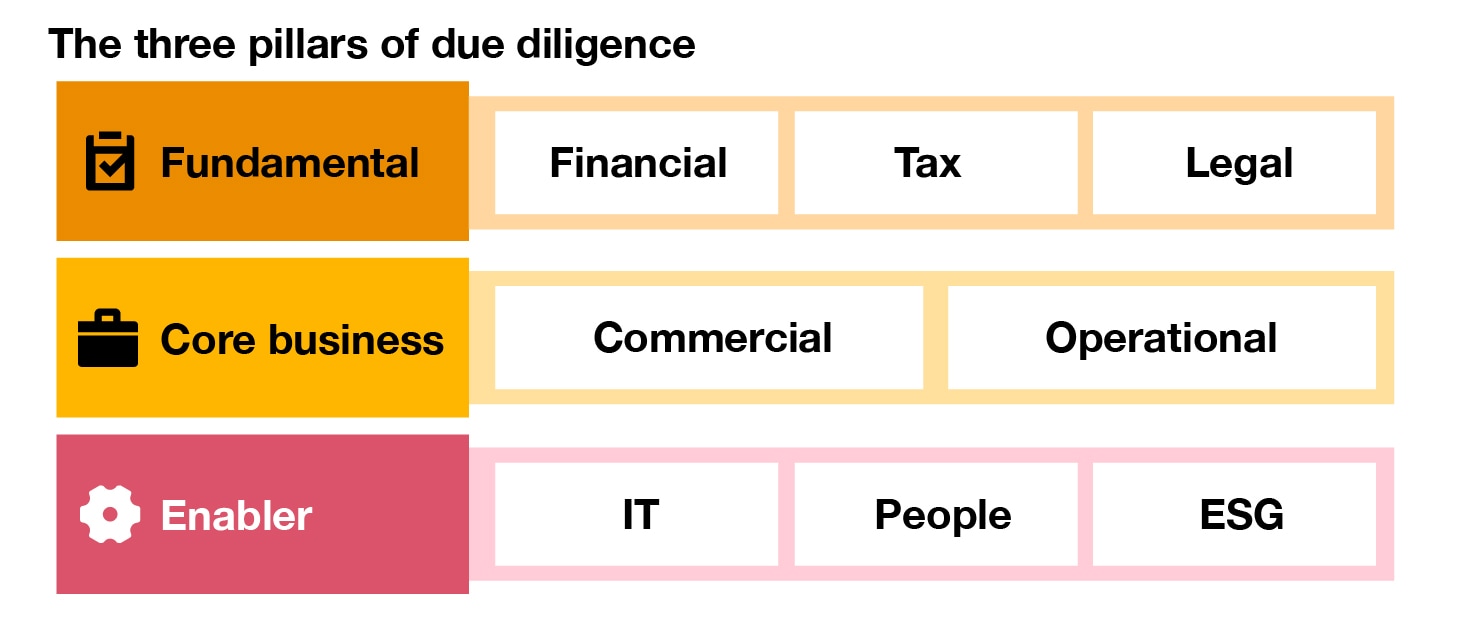

Due diligence can be categorised into three main types: fundamental, core business and enabler. Each type primarily provides insights as follows:

Successful Acquirers leverage due diligence to enhance M&A outcomes by uncovering synergy levers and integration pathways, providing initial understanding and assessment on the potential area of value creation and planning to mitigate integration risks.

Due diligence objectives of Dealmakers in Indonesia

in % responses of 40 respondents, 2024

The majority of Dealmakers in Indonesia still predominantly leverage due diligence findings to identify valuation adjustments and validate the Targ et’s business. There is additional value for them to unlock by broadening the due diligence scope beyond the fundamentals—placing greater emphasis on core business and enabler due diligence and deepening the analysis to include initial synergy identification and understanding integration complexity.

Early synergy identification

Dealmakers face increasing pressure to generate greater value from their transactions, making it essential to identify synergies early in the deal process. This approach facilitates stakeholder buy-in and alignment while incorporating synergy-enabling factors into the agreement, ensuring these factors remain actionable post-signing.

Synergy assessment timeline across deal phases among Dealmakers in Indonesia

in % of responses from 40 respondents, 2024

Sources: Dealmakers in Indonesia Survey Data (based on 40 respondents), PwC Analysis

Most Dealmakers in Indonesia start synergy assessments early in the deal cycle, typically during the deal screening and due diligence phases. However, many still complete the synergy assessment only after closing the deal.

Emphasis on revenue synergies

Traditionally, cost synergies were prioritised for their clear and measurable benefits. Today, the Dealmakers also recognise revenue synergies as powerful drivers of sustainable growth and competitive advantage.

Synergy areas pursued by Dealmakers in Indonesia

in % of responses from 40 respondents, 2024

Dealmakers in Indonesia are aligned with this shift, with the majority prioritising revenue synergies for their significant long-term impact, while leveraging cost synergies for immediate gains.

Early integration planning

Early integration planning is critical as it establishes the foundation for post -closing success by creating a clear integration roadmap and identifying risks upfront. This proactive approach ensures an efficient integration process, avoids delays and maintains operational stability during the transition.

Integration timeline across deal phases among Dealmakers in Indonesia

in % of responses from 40 respondents, 2024

Sources: Dealmakers in Indonesia Survey Data (based on 40 respondents), PwC Analysis

Three core aspects of integration

When planning for integration, Dealmakers must consider these three integral components— business processes, IT, and people—as they form the backbone of operational continuity and are crucial for aligning the operating models of the Target and Acquirer.

Business processes drive how the business operates, people part covers the organisation and personnel who execute the business process, and IT ensure seamless business process system collaboration and connectivity across entities.

Integration timeline across deal phases among Dealmakers in Indonesia

in % of responses from 40 respondents, 2024

Resource allocation for effective integration

Successful integration requires a deliberate allocation of talent, time and finances to balance the demands of the deal with ongoing business operations effectively. Without proper management, this can strain resources, leading to misaligned priorities, reduced morale and delayed integration milestones.

Integration spending comparison between Global Dealmakers and Dealmakers in Indonesia *1)

In # of responses and % of contribution

Sources: Transact to Transform: PwC’s 2023 M&A Integration Survey; Dealmakers in Indonesia Survey Data (based on 40 respondents), PwC Analysis.

Call to action for Dealmakers: Actions to pave the way to M&A success

The five key takeaways on how to maximise deals value through integration:

Doing the “right deal” needs to be followed by doing it right to achieve the intended outcome

There are four crucial aspects of the deal-making process that demand greater focus and deliberate decision-making from Dealmakers to enhance M&A success:

Four crucial aspects of the deal-making process

Deals intention

Align transaction purpose and strategy.

Dealmakers should align their deal objectives with their organisational strategy to capture optimal value capture and gain clear guidance on navigating the deal. In contrast, those pursuing opportunistic transactions risk achieving suboptimal returns.

M&A objectives of Dealmakers in Indonesia

in % of responses of 40 respondents, 2024

Dealmakers in Indonesia prioritise strategic positioning as their primary M&A objective, focusing on portfolio diversification and value chain or geographical expansion. Commercial objectives come next, centred on revenue growth through expanded market reach and new customer acquisition. Financial gains rank third, driven by investment returns and valuation improvement.

Selecting Targets with the right capability-fit

Dealmakers need to find the right Target that aligns with their capability advantage or gap, either by leveraging or enhancing the Acquirer’s capability to maintain a competitive edge in an evolving business landscape.

Types of M&A integration approaches

Understanding and selecting the right integration approach helps uncover the complexities and challenges early in the deal cycle.

There are four types of M&A integration approaches:

Understanding the complexity allows organisations to secure sufficient and suitable resources in the form of talent, time and financial investment.

Due diligence

Beyond validation.

Traditionally, due diligence primarily aims to identify gaps and dealbreakers by evaluating the Target’s baseline and assessing key areas against the Acquirer’s standards or expectations.

Due diligence can be categorised into three main types: fundamental, core business and enabler. Each type primarily provides insights as follows:

Successful Acquirers leverage due diligence to enhance M&A outcomes by uncovering synergy levers and integration pathways, providing initial understanding and assessment on the potential area of value creation and planning to mitigate integration risks.

Due diligence objectives of Dealmakers in Indonesia

in % responses of 40 respondents, 2024

The majority of Dealmakers in Indonesia still predominantly leverage due diligence findings to identify valuation adjustments and validate the Targ et’s business. There is additional value for them to unlock by broadening the due diligence scope beyond the fundamentals—placing greater emphasis on core business and enabler due diligence and deepening the analysis to include initial synergy identification and understanding integration complexity.

Synergy

Unlocking value creation opportunities.

Early synergy identification

Dealmakers face increasing pressure to generate greater value from their transactions, making it essential to identify synergies early in the deal process. This approach facilitates stakeholder buy-in and alignment while incorporating synergy-enabling factors into the agreement, ensuring these factors remain actionable post-signing.

Synergy assessment timeline across deal phases among Dealmakers in Indonesia

in % of responses from 40 respondents, 2024

Sources: Dealmakers in Indonesia Survey Data (based on 40 respondents), PwC Analysis

Most Dealmakers in Indonesia start synergy assessments early in the deal cycle, typically during the deal screening and due diligence phases. However, many still complete the synergy assessment only after closing the deal.

Emphasis on revenue synergies

Traditionally, cost synergies were prioritised for their clear and measurable benefits. Today, the Dealmakers also recognise revenue synergies as powerful drivers of sustainable growth and competitive advantage.

Synergy areas pursued by Dealmakers in Indonesia

in % of responses from 40 respondents, 2024

Dealmakers in Indonesia are aligned with this shift, with the majority prioritising revenue synergies for their significant long-term impact, while leveraging cost synergies for immediate gains.

Integration

Delivering value capture.

Early integration planning

Early integration planning is critical as it establishes the foundation for post -closing success by creating a clear integration roadmap and identifying risks upfront. This proactive approach ensures an efficient integration process, avoids delays and maintains operational stability during the transition.

Integration timeline across deal phases among Dealmakers in Indonesia

in % of responses from 40 respondents, 2024

Sources: Dealmakers in Indonesia Survey Data (based on 40 respondents), PwC Analysis

Three core aspects of integration

When planning for integration, Dealmakers must consider these three integral components— business processes, IT, and people—as they form the backbone of operational continuity and are crucial for aligning the operating models of the Target and Acquirer.

Business processes drive how the business operates, people part covers the organisation and personnel who execute the business process, and IT ensure seamless business process system collaboration and connectivity across entities.

Integration timeline across deal phases among Dealmakers in Indonesia

in % of responses from 40 respondents, 2024

Resource allocation for effective integration

Successful integration requires a deliberate allocation of talent, time and finances to balance the demands of the deal with ongoing business operations effectively. Without proper management, this can strain resources, leading to misaligned priorities, reduced morale and delayed integration milestones.

Integration spending comparison between Global Dealmakers and Dealmakers in Indonesia *1)

In # of responses and % of contribution

Sources: Transact to Transform: PwC’s 2023 M&A Integration Survey; Dealmakers in Indonesia Survey Data (based on 40 respondents), PwC Analysis.

Call to action for Dealmakers: Actions to pave the way to M&A success

The five key takeaways on how to maximise deals value through integration:

Michael Goenawan

Radju Munusamy

Fabio Kusuma

Triono Soedirdjo