Helping you achieve financial returns whilst building your legacy and acting on your values

Impact Investing for Family Offices

Overview

By investing your wealth in a way that aligns with your deeply-held values you can lead the way in solving society's problems, build a great legacy for the future while also generating financial returns. How can you do this? Impact investing via your family office.

Download the guide PDF, 1.4mb

The opportunity for your family office

The headlong growth in impact investing is a good example of how financial assets can be used to make a positive difference to the world. For you as a wealth owner – and the family office managing your assets – the opportunities impact investing present are arguably greater than for any other type of investor. Yet they’re still largely untapped. Currently, family offices account for just 4% of the impact investors universe. Yet investing for a positive impact goes to the heart of many family offices’ culture and mission.

As a member of a family office, you may want to invest in ways that preserve wealth for future generations. But you also may want your investments to reflect your deeply-held values as well as building a legacy for the future.

By becoming actively involved in impact investing, your family office can achieve these goals. But while impact investing is a natural fit for family offices, most are still working out where to start – mulling over issues like how to source deals and measure impacts.

Your guide to impact investing built around your questions

In order to help you in this quest we’ve captured the questions that family office clients ask us most frequently about impact investing, and got some of our global leaders and subject matter experts to answer them in order to create a comprehensive and accessible how-to guide to impact investing for family offices.

To find out more, just click on the questions below. You’ll be glad you did. A new world of impact investing awaits.

- 1. Why should I consider impact investing?

- 2. What is the difference between impact investing, ESG investing, venture philanthropy etc.?

- 3. Who can advise me on impact investing? My current money managers don’t seem to know much about it.

- 4. How does impact investing fit into my current investment portfolio?

- 5. Where do I start? How do I design an impact investment strategy? How do I find impact investment opportunities to invest in?

- 6. Is there a different type of due diligence that needs to be put in place for impact investing?

- 7. How do I determine if the funds presented to me as impact investment opportunities are genuine in their impact objectives?

- 8. How do I ensure my values are truly aligned with impact investment opportunities on offer?

- 9. How do I measure and monitor the impact of my investments?

- 10. My family’s next generation keeps discussing impact investing. Is it a fad or something I should take seriously?

1. Why should I consider impact investing?

And for many family offices this question typically continues with ‘…when I can pursue more traditional mainstream investments that I already know how to manage, and then allocate proceeds to philanthropy in order to do good?’

The real question isn’t why would you consider impact investing – but why wouldn’t you? The reality is that every investment you make has an impact on wider society. The negative and unintended effects you’re generating may outweigh the positive impacts from your philanthropic activities. How would that sit with your family values?

By integrating impact considerations into all your investments, you can be sure that your net impact is in line with those values. Also, investors worldwide are increasingly recognising that it’s possible to combine a positive social and environmental impact with a financial return. Indeed, there’s growing evidence that the returns from investing in sustainable business models are just as good if not better than from traditional investments.

As a result, impact investing is growing rapidly, with US$715 billion now invested worldwide using impact criteria. The COVID-19 pandemic is expected to further increase the momentum, as the race to support those affected by the pandemic joins other positive goals, such as reducing carbon emissions and tackling social inequality.

Some of the most successful pioneers of impact investing are family offices, often reflecting the deeply held values and purpose that set them apart. Impact investing allows families to put those values into effect without necessarily compromising on financial returns.

Value creation by companies is often about creating profits for shareholders, while families use donations and philanthropy to give back. Family businesses can now create value – and gain a licence to operate – through purpose and impact. If a family office is investing in companies that inherently have a positive impact, those opportunities may be more likely to be successful in the long term.

As the impact investing universe grows and matures, there are more opportunities for families and family offices to take the plunge and get the best of both worlds – financial returns and a positive impact.

2. What is the difference between impact investing, ESG investing, venture philanthropy etc.?

And which should I pursue?

According to the Global Impact Investing Network (GIIN), impact investments are made ‘with the intention to generate positive, measurable social and environmental impact alongside a financial return.’ GIIN adds that impact investing has four core characteristics:

- Intentionality, meaning the pursuit of impact is a driver

- The use of evidence and impact data in the investment design

- A commitment to managing impact performance

- A commitment to contributing to the growth of the industry

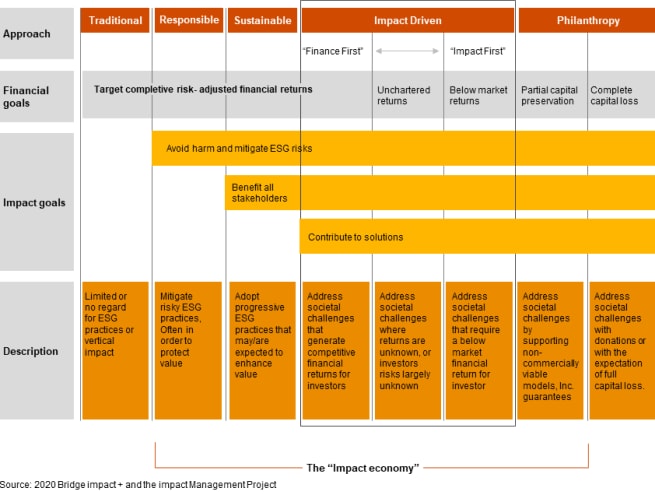

Impact investing is just one of a range of ways of investing aimed at creating a better world. While these all have their own definitions and characteristics, a great way to visualise them is as a spectrum of capital running from “traditional” for-profit investment at one end to philanthropy at the other, as shown below.

Within this spectrum, impact investment represents the “sweet spot” marrying the financial returns on the left with the positive impacts on the right. The positive impacts targeted often involve contributing to the UN Sustainable Development Goals (SDGs). According to the Business & Sustainable Development Commission (BSDC), achieving the SDGs could open up an estimated US$12 trillion in market opportunities across various sectors.

As you move towards the right on the chart, the specificity and intentionality around the impact increase, making it more definable and measurable. This doesn’t necessarily mean you’re creating more impact – but it does mean you have greater insight into it.

This is a key reason why impact investing is such a good fit for family offices.

While long-term financial returns are critical, investments are also increasingly expected to bring the family’s values to life. Impact investing can meet the needs of family offices because they can report specific, quantifiable, credible results both on the financial side and on the impact side.

3. Who can advise me on impact investing? My current money managers don’t seem to know much about it.

The rise of impact investing in recent years has fuelled an equally rapid expansion in sources of advice, widening the available choices of investment advisers. Today, many investment and financial advisers – ranging from major investment houses to specialist niche providers – claim to have experience and expertise in impact investing.

However, these claims need to be approached with two major considerations in mind. First, does the adviser actually have genuine expertise in this area, or are they just looking to sell impact investing products as an add-on to traditional for-profit strategies? And second, genuine or not, do the adviser’s areas of knowledge around impacts match the values and purpose that the family wants to put into effect? Lastly as this sector becomes increasingly regulated, do they understand the regulatory developments in this sphere (e.g. the implications and impact of the European Union Sustainable Finance Disclosure Regulation)?

When you do choose an adviser, what really matters is that they recognise and respect your motivation and can help you implement it. The right adviser might be one of your current money managers, or you may need a new one. Either way, they need to understand and appreciate those values – and be able to execute on them.

As with any hot topic, many people have a view on impact investing. If you were seeking any other kind of investment adviser, you would naturally carry out due diligence around their robustness, track record, sector knowledge and client base. You should apply just as much rigour with impact investing advisers. It shouldn’t be treated as “softer” or less commercial: governance and diligence remain critical.

4. How does impact investing fit into my current investment portfolio?

In the spectrum of investment strategies, impact investing sits mid-way between philanthropy and traditional investing, providing families and family offices with the opportunity to deliver both financial returns and societal impacts at the same time.

This positioning means impact investing touches all asset classes. To fit it into an existing portfolio, a family office might decide to start with a tranche of assets or a particular money manager. But whatever approach you choose, it’s important to look at impact investing in the context of the overall portfolio and asset allocation – not as a separate or different investment.

A complication that often arises when trying to fit impact investing into a family investment strategy and portfolio is that every family member has their own personal views, ambitions and priorities. Millennials who’ll be inheriting money in the near future may be more interested in investing in an impactful way, having grown up amid rising awareness of global environmental and social issues.

That said, it’s not just millennials driving the rise of impact investing: the current generation is eager to leave a positive legacy. So impact investing presents a fantastic opportunity to unite all generations of the family behind common ideas and values, by bridging the experience of the previous generation with the passion of the upcoming one.

It follows that to fit impact investment into the family portfolio, the family must come to an agreement over issues like where they want to sit on the investment spectrum, what impact themes the family will look to achieve, and how those themes will be selected. It’s also important to remember that impact investing and more traditional investments are not mutually exclusive: it’s perfectly possible to have both side-by-side in the same family portfolio.

5. Where do I start? How do I design an impact investment strategy? How do I find impact investment opportunities to invest in?

When considering moving into impact investing, your first step should be to decide what’s important to you as a family. The starting-point for any impact investment strategy should be to agree on a statement of family values underpinned by clear, qualified principles. Reaching this agreement among all family members isn’t easy, and often requires help from an experienced external facilitator. But once you’ve created your values statement, you will have a very valuable resource, setting out what the family stands for and bringing everyone together on the same page.

The family values statement will be your compass in guiding investment decisions, because it provides a basis for identifying the impact theme or themes to focus on – be it clean water, climate change, education, clean energy or something else.

Building a portfolio that delivers the targeted impact may take several iterative actions to get from where you are today to where you want to be. You might start – for example – by making an investment in a fund linked to a purpose-based index, or in some specific impact funds. You could then use this experience as a stepping-stone and think through directionally where to go. The key is that adopting impact investing is an evolution, not a revolution.

Having decided what problem(s) to target, and having become comfortable with the process, you’ll be well-placed to develop a coherent investment strategy and related structure for the family office. You’ll then be able to work with your external network and chosen advisers to find more impact investing opportunities, while applying appropriate due diligence.

The whole process of screening and selecting impact investments can be visualised as a funnel. It starts at the wide end with many potential opportunities, which are then narrowed down through filtering for factors like type of assets, alignment with your values and early-stage or late-stage. You can then zero in on their specific potential to create impact.

6. Is there a different type of due diligence that needs to be put in place for impact investing?

And who does that?

The specifics of the due diligence applied to impacts should match the structure of the investment and the way the impact is to be pursued. For example, a direct impact investment in a new market or a start-up focused on a specific problem may require a different diligence process from one involving buying into a fund or selecting a specialist fund manager. But in each case, the approach should be consistent with that applied to a traditional investment.

For family offices conducting due diligence on impact investments, there’s an increasing amount of information and guidance available in the public domain. If investors are looking to ‘DIY’ this process for themselves, a good starting-point might be The Impact Management Project, which showcases industry best practice and case studies on its website. However, if you’re looking to invest fairly large amounts, you’ll probably want individualized help with the due diligence.

As with financial due diligence, you might decide to carry out some of the initial work on impacts in-house, but then outsource the deep dive to an external specialist to give you an expert third-party perspective. This would ideally involve working with an experienced impact investment adviser who can help you get a better understanding of the investments and their impact dimensions. This closely mirrors the approach often taken with traditional investments – further underlining that there’s less difference than people often assume between due diligence processes focused on the impact and financial perspectives.

7. How do I determine if the funds presented to me as impact investment opportunities are genuine in their impact objectives?

The risk of “greenwashing” – companies or funds claiming impact credentials that they don’t actually merit – is a key concern in impact investing. Avoiding this risk requires rigorous measurement and reporting of tangible impacts, ideally supported by independent verification. At the early stages of assessing an opportunity, useful benchmarks include the UN Sustainable Development Goals and the five dimensions of impact created by the Impact Management Project.

The optimal impact measures and key performance indicators (KPIs) will vary depending on the industry. If you’re considering an investment in renewable energy, you’re likely to look at KPIs like installed capacity and the kind of energy that the renewable generation will replace. In healthcare, you’ll likely look at the extent to which the business’s activities are delivering better health outcomes. Similarly, for an education investment, you’ll focus on the quality of the education and whether it’s being delivered to the people who need it most.

In each case, breaking impacts down in ways specific to the investment provides a clear view of how tangible the impact is. This comes back to the core principles of any type of due diligence – having clear criteria and a disciplined process – and then applying these to impact investments in the same way as you’ve done historically with for-profit investments. But with impact investing, the criteria and process must be grounded in a clear understanding of your values and mission.

PwC helps clients to select fund managers based on their impact credentials, by applying a process founded on three pillars. First, their intentionality to create impact, demonstrated through their people, processes and strategy. Second, their capacity to measure, monitor and report on impact. And third, their track record, which we’ve found can vary widely. Those three pillars provide a solid basis for an informed choice.

8. How do I ensure my values are truly aligned with impact investment opportunities on offer?

The first step towards aligning your family’s values with your impact investments is to agree what those values are. This may not be easy as upon deeper discussion, a family’s seemingly united front sometimes crumbles. One example of divisions within a family is when some members see family investments as purely financial while others see them as part of the family’s identity and legacy.

This divergence is hardly surprising, given that every family member has their own unique situation, interests and priorities. For large families with a substantial amount of wealth, it can take at least a year to bring everybody into agreement on a core statement of family values. But the effort is worth it, as this statement of values provides a basis for identifying shared priorities in terms of impacts, and then for assessing investment opportunities to deliver those impacts.

After achieving consensus on impact goals, the next step is putting the right governance and decision points in place to establish whether opportunities being considered are consistent with those goals.

9. How do I measure and monitor the impact of my investments?

To keep track of the impacts of your investments, it’s important to set up an impact measurement framework that’s closely aligned with your investment strategy. This will enable you to monitor and report on the progress being made towards the impacts you’re setting out to achieve. Since there is currently a lack of generally accepted frameworks and standards for measuring non-financial impacts, it’s really up to you to develop a framework that works for you and your family.

At PwC, the framework that we’ve developed for measuring impacts focuses on inputs, outputs, outcomes and impacts. Inputs are the resources and money you put into an activity or business, while outputs are the immediate things that emerge as a result. So, with an education investment, the inputs would typically include finance for teaching materials and resources, and the costs of employing teachers and developing curricula. The outputs would be the delivery of education and the number of people who can access it.

Moving beyond outputs, the outcomes would be around how much the education level and capability of the learners have changed. These then feed into the impacts, which would be about what those people can do that they couldn’t before, and how that affects their ability to get better jobs or deliver enhanced outcomes for society. This framework takes us all the way through the chain of cause and effect from applying resources to the resulting changes at a societal level.

Using specialist impact investors can also help deliver specifically-targeted impact measurement beyond that available from most mainstream investment managers.

Visit our Total Impact Measurement and Management site for more information.

10. My family’s next generation keeps discussing impact investing. Is it a fad or something I should take seriously?

The growing use of impact investing by family offices is being driven by a timeless motivation for families: the desire to leave a lasting legacy and make a positive difference to society by putting their family values into effect. Impact investing is also here to stay for investors in general. Sustainable investments are – by definition – aligned with societal needs, meaning they’re more likely to be successful and outperform in the long term.

Within these overall shifts, wealthy families’ long-standing motivation to help others means that – for them – focusing on impacts is more of an evolution than a revolutionary new departure. Also, over the next two decades we’ll see about US$3.4 trillion of wealth pass to the upcoming millennial generation4. This cascade of wealth coincides with intensifying pressure to tackle major global issues like environmental degradation and social inequality, and ongoing growth in the opportunities to invest in sustainable solutions.

The next generation who can seize these opportunities have grown up in a world characterised by unprecedented awareness and communication about how to address global problems. These new leaders will shape their families’ investment goals for many decades to come. They’re already taking the reins, and the handover will accelerate – fostering a continuing rebalancing of portfolios towards impact investments.

The message is clear. impact investing reflects deeply held values, mission and purpose that are as old as families themselves. This consistent motivation is amplified among the upcoming generation – a change that has coincided with a dramatic expansion in the mechanisms available to make a positive difference through investments.

4 UBS/PwC Billionaire Insights, 2018

Our experts

Jonathan Flack

Global Private Leader, PwC United States

Belinda Sneddon

Managing Director, US Family Enterprise Advisory Services, US, PwC United States

Jo Kelly