Indonesia’s Fintech Lending

Driving Economic Growth through Financial Inclusion

PwC Fintech Lending Report

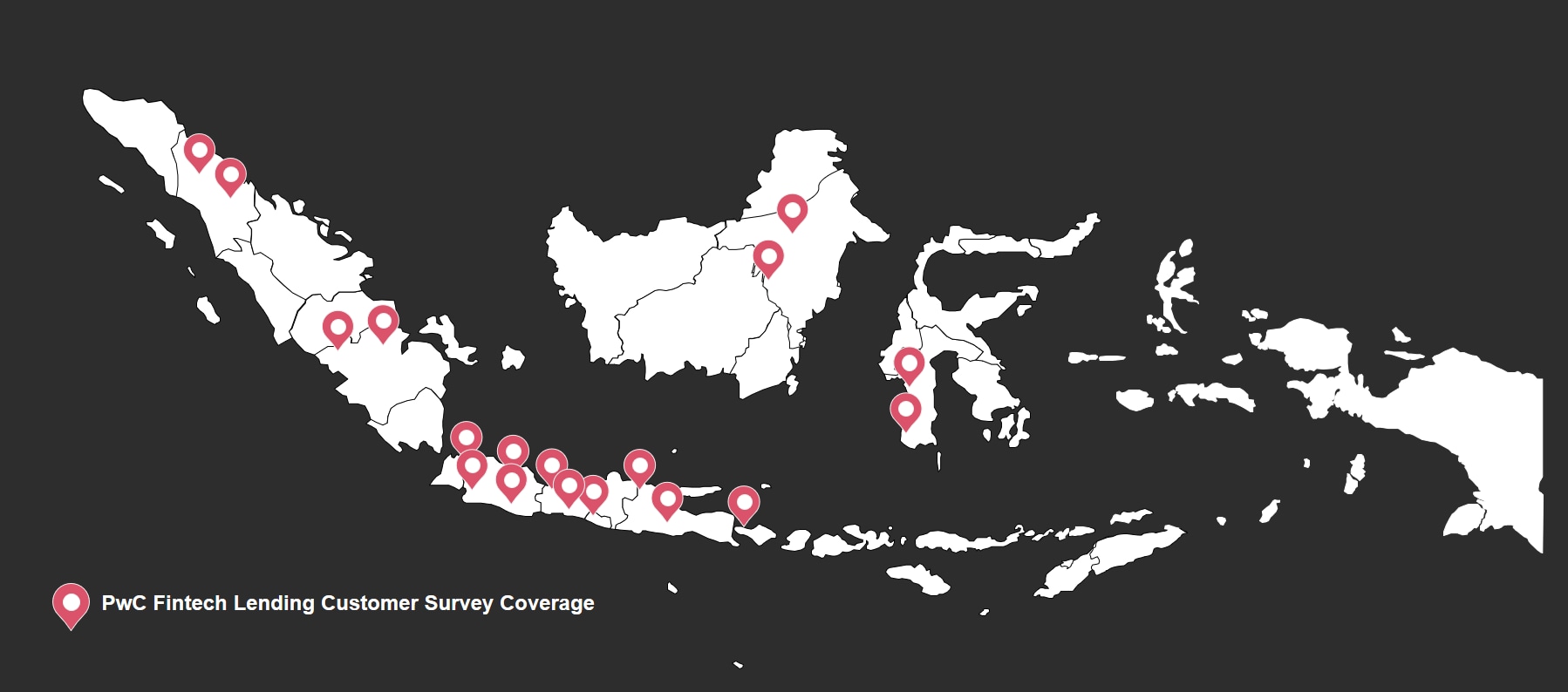

PwC’s 2019 Indonesia Fintech Lending report, to be unveiled in Q2 2019, reveals behaviour of over 2,800 customers in Indonesia. Their answers can help players to be more informed on how to position themselves for the future, while at the same time, help government to assess the impact of Fintech Lending to facilitate financial inclusion in Indonesia.

Key Insights

Driving economic potential through widening access to financing

According to PwC’s “The World in 2050: Will the shift in global economic power continue?”, Indonesia is projected to be the fourth largest economy. However, one of the key elements to leverage this economic potential is by facilitating better access to financing. Last year, Indonesia’s low loan disbursement per Gross Domestic Product (“GDP”) left 74% of the middle to lower1 individuals and 74% of micro, small and medium enterprises (“MSMEs”) with a lack of financing access.

Today, given the scale of how financing access can boost consumer spending and the widening effect that it has to facilitate economic growth across all segments of Indonesian society, better access to financing is a must.

Fintech Lending innovation as an enabler for better access of financing

Infrastructure and risk management have been one of the main reasons conventional lending providers having difficulties in providing credit access to untapped individuals and MSMEs.

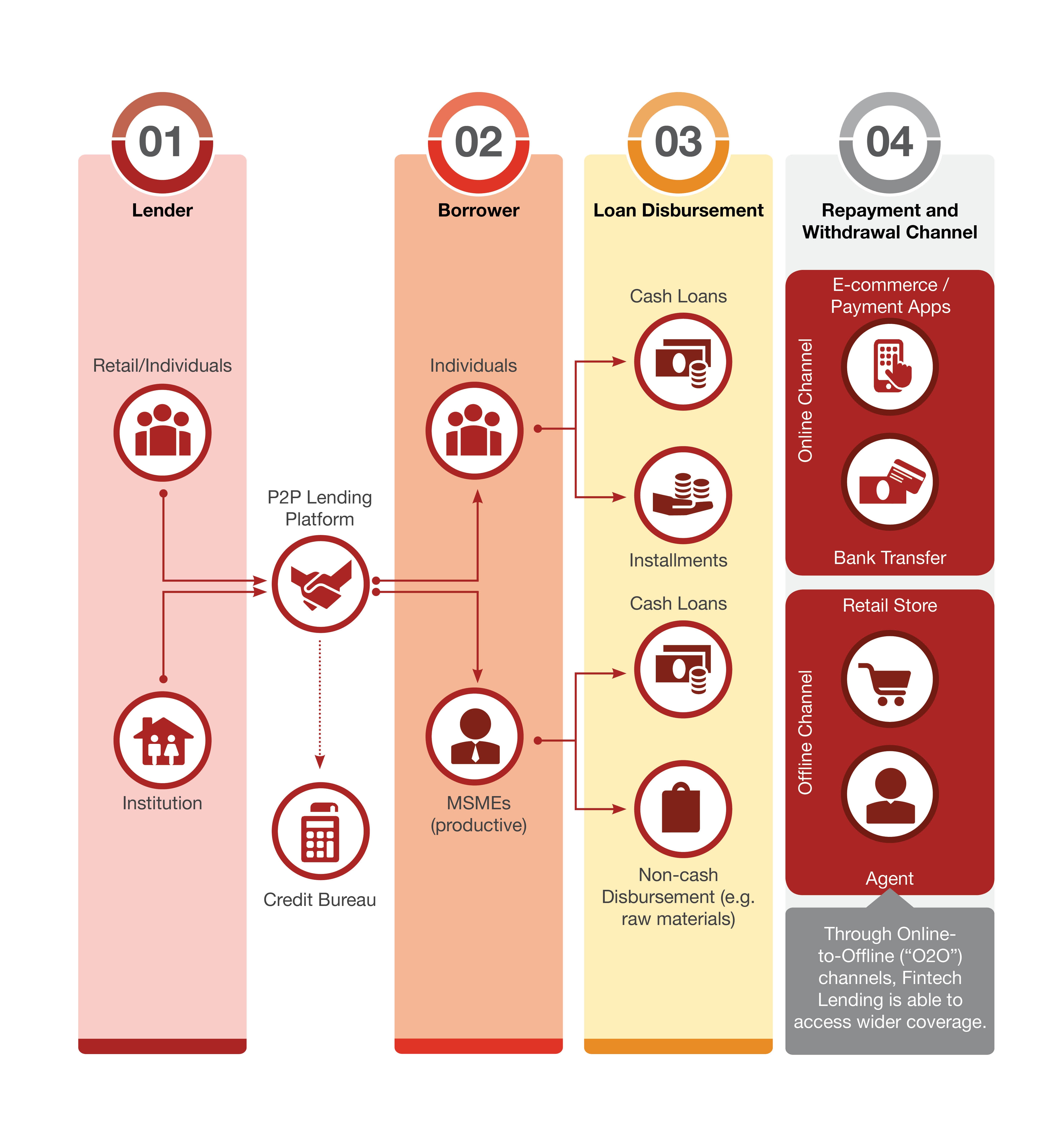

The rise of Fintech Lending has enabled wider coverage of previously untapped individuals and MSMEs.

Supported by technology, different business model (e.g. peer-to-peer vs. institutional-to-peer), productive vs consumptive) and innovative approach (e.g. offline to online “O2O”). Fintech Lending is able to match different risk appetites of lenders with different risk levels of borrowers.

As Indonesia shifts to innovative, technology-driven solutions to facilitate better access to financing, creating sustainable and conducive Fintech Lending ecosystem will become crucial.

The future of Fintech Lending: Entering the "Third Wave"

Indonesia is entering the “Third Wave”, redefining a more collaborative Fintech Lending ecosystem. The “First Wave” marked the unregulated era where players were testing out business models, compared to the “Second Wave” that marked the involvement of Otoritas Jasa Keuangan (“OJK”) to ensure customer protection by establishing distinction between legal and illegal Fintech Lending players. Therefore, differing from the earlier waves of Fintech Lending, the inauguration of a self-regulating organisation known as the Fintech Lending Players Association (“AFPI”) becomes the centre of collaboration between players and regulators. As this “wave” plays out, the future of industry will be determined by the ability to bridge different perspectives of key stakeholders in the ecosystem.

1.png)

2.png)

3.png)

4.png)

5.png)

Two Types of Fintech Lending Customers

Fintech lending improves the quality of borrowers’ live or business, which results in high retention rates

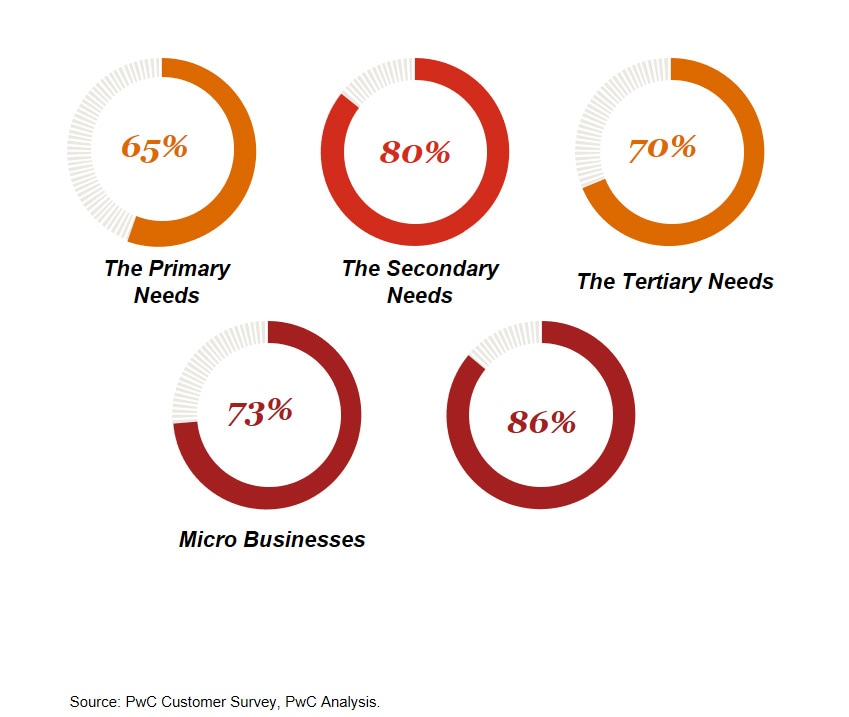

Borrowers have witnessed the impact of Fintech Lending in improving their lives / businesses, which results in high retention rates of Fintech Lending borrowers

With Indonesians becoming more adapted to digital technology, usage of Fintech Lending has grown to cover different needs, both in complementing supply chains through productive loans and supporting individual lives

through consumptive loans. The common purpose for productive loans is to supplement working capital and to finance asset purchases. On the other side, Fintech Lending aids consumptive borrowers by increasing their purchasing capability.

The impact from using Fintech Lending has resulted in indication of interest to continue using Fintech Lending again in the next 12 months with a 69% retention rate of consumptive loan borrower respondents, and a 90% retention rate of productive loan borrower respondents.

In the future, we expect players to provide more variety of loan products to match different needs of individuals”

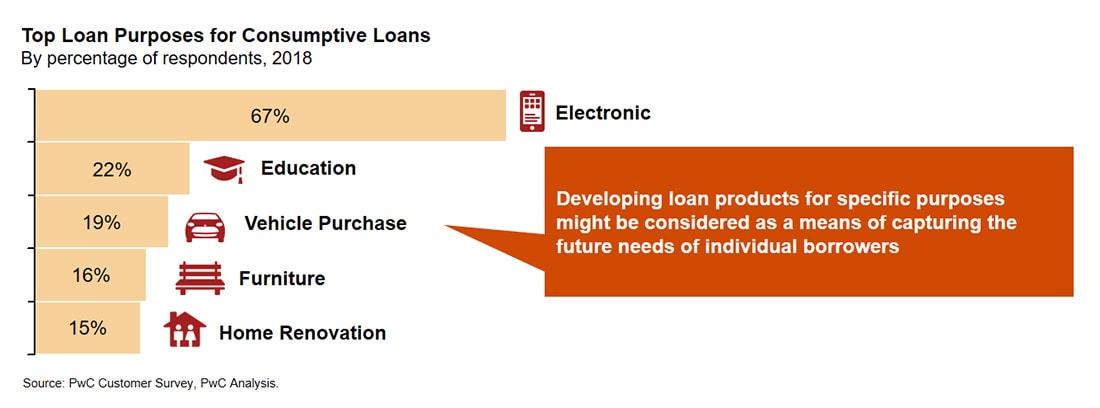

Although ‘Electronic Purchases’ are still the dominant purpose of Fintech Lending loans, players may consider providing other, more specific, loan products to cater to borrower expectations.

People tend to use Fintech Lending forelectronics purchase because electronics are becoming the “new basic” need amongst borrowers.

However, there is potential for loan products with specific purposes such as vehicle purchases, furniture purchases and home renovations that Fintech Lending players could develop in the future.

This model of creating loan products with specific use cases could minimise “overleveraged” debt behaviour through collaboration with the product/ service providers, and reduce the amount of consumptive loans given for generic purposes.

Individuals have indicated that Fintech Lending has been useful for other purposes too, such as utilities payments, groceries purchases, vehicle purchases, or even home renovation.

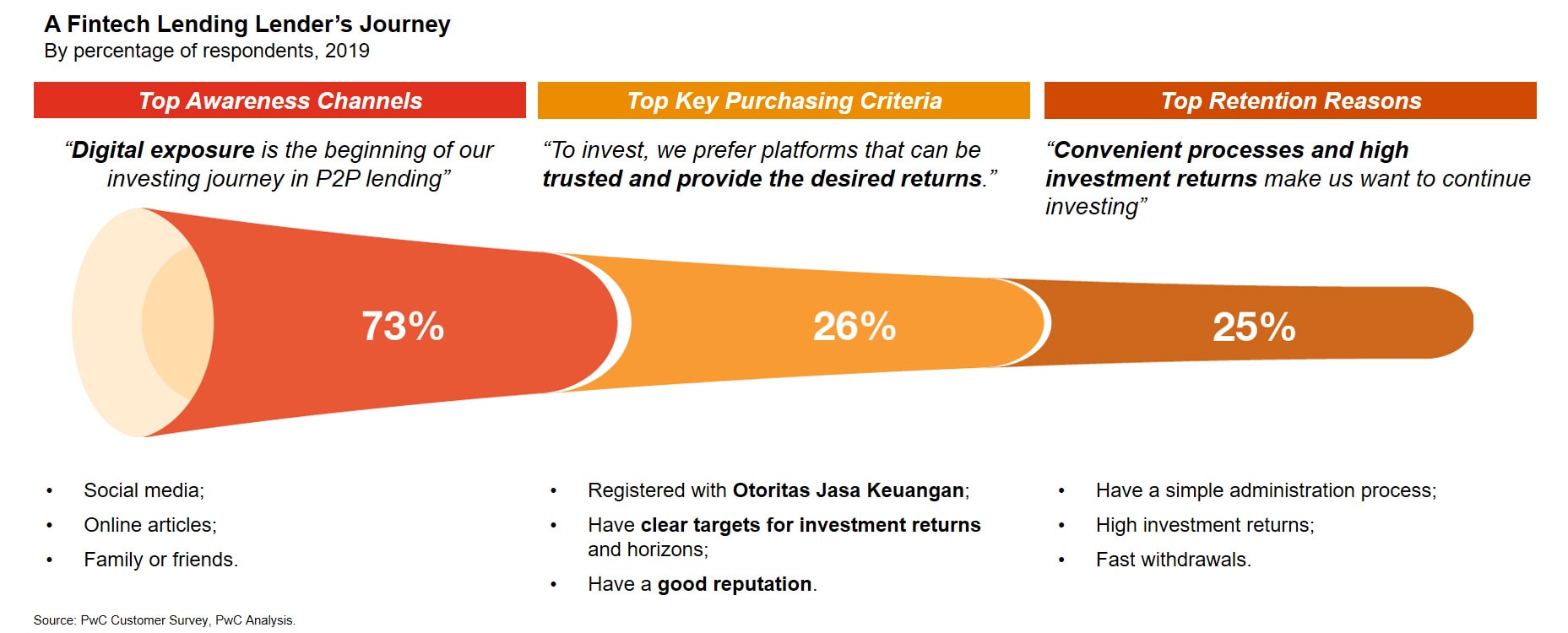

As a lender, we begin our journey through digital exposure and prefer platforms that are simple, trusted, and provide high returns

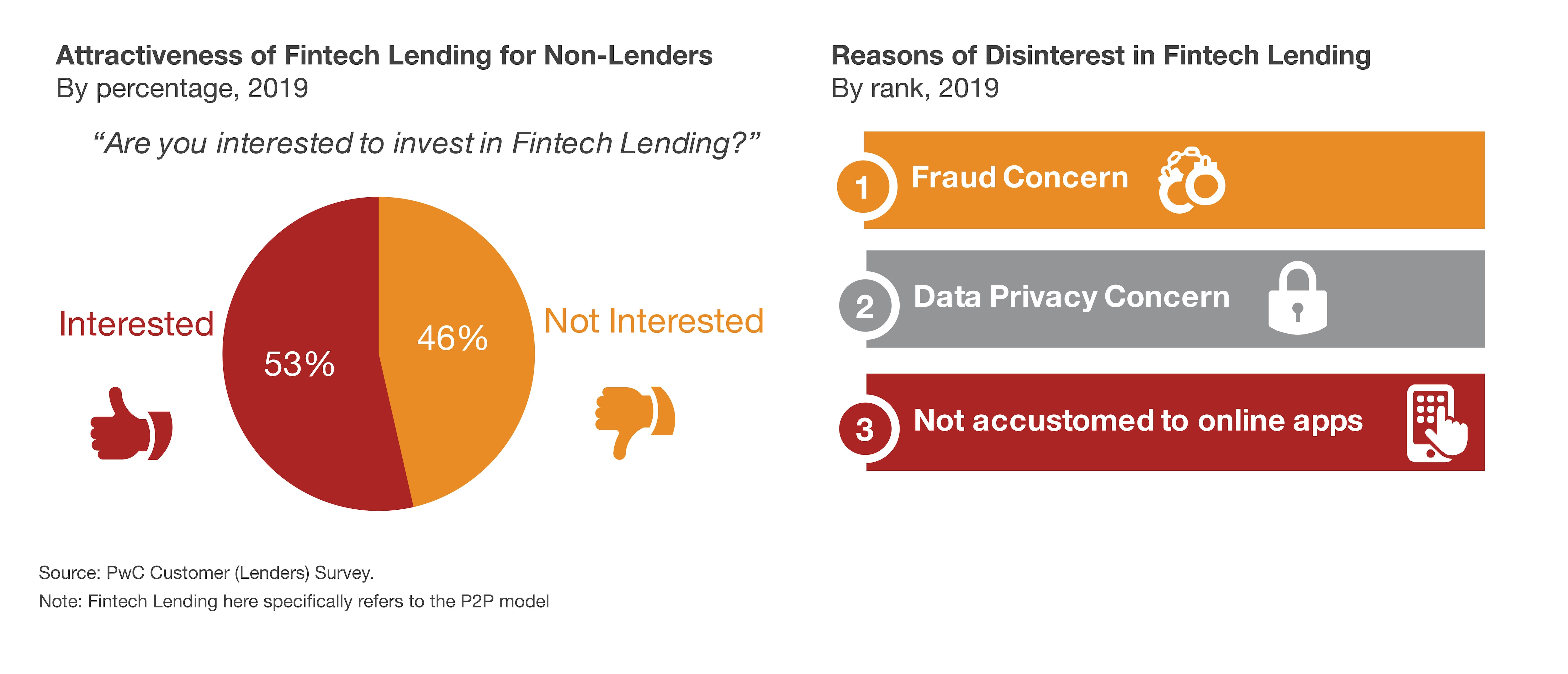

As potential retail lenders, we are hesitant to try Fintech Lending due to credibility concerns

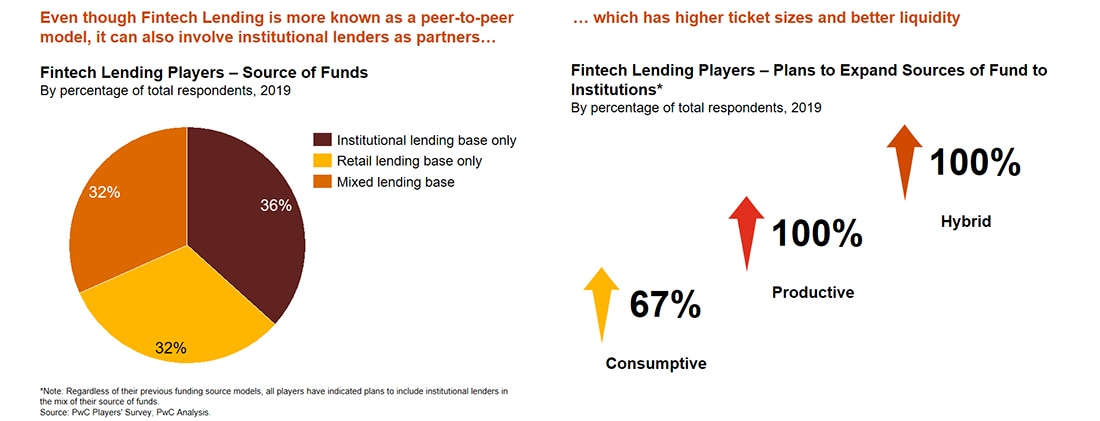

We believe that Fintech Lending is not merely Peer-to-Peer (“P2P”) with a shift towards Institutional-to-Peer (‘I2P’) model

Although most Indonesians know Fintech Lending as a Peer-to-Peer (“P2P”) model, some players have started or are beginning to shift into the Institutional-to-Peer (“I2P”) model. As demand for loans continue to increase, peer lending is unable to fulfil the needs of the borrowers, especially considering the seasonal behaviour of individual lenders that results in uncertain capital supply. Many players are starting to engage institutional lenders to support the growing demand for loans in the market. Institutional lenders are considered as a more stable source of funding due to their capabilities to provide higher ticket size and better cash liquidity. Thus, by having institutional lenders, players can serve more borrowers and expand their MSME coverage.

Partnerships with financial institutions are important, but the challenge comes from technology integration and compliance

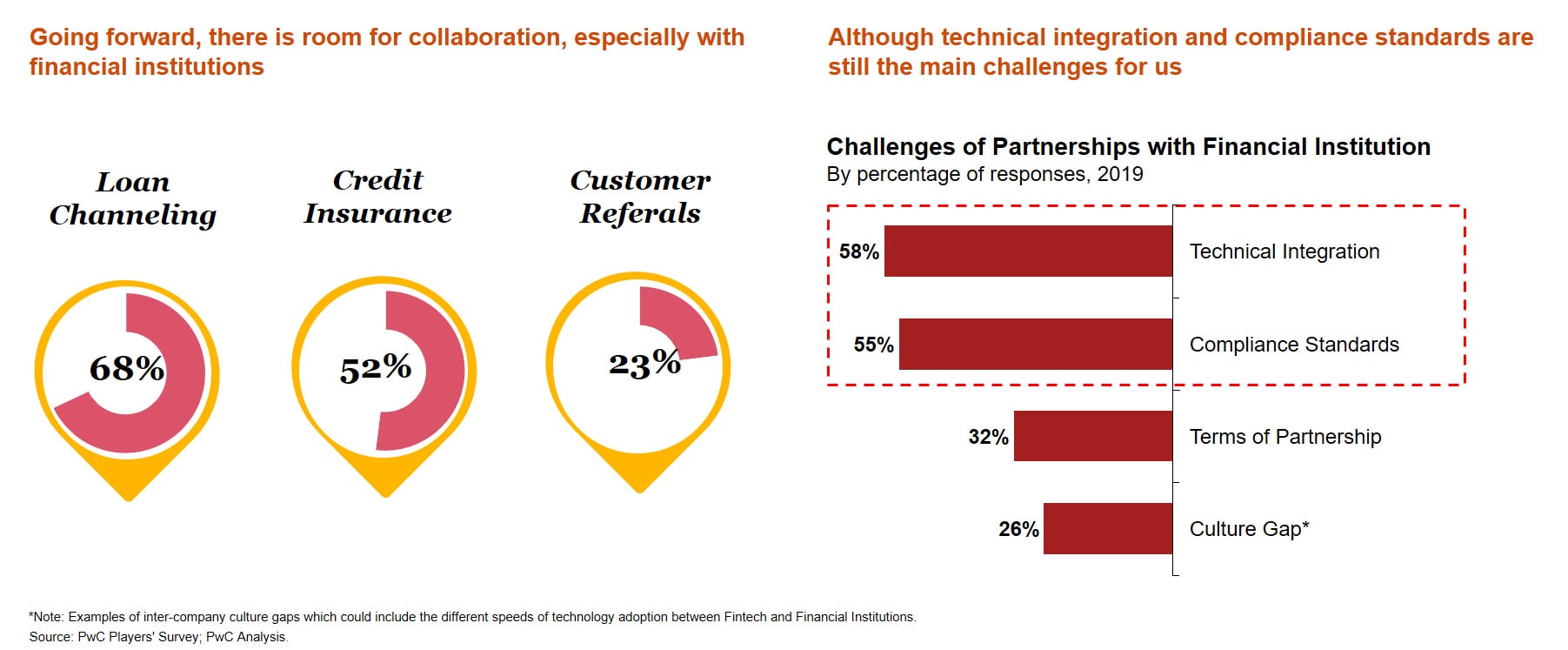

Approximately 76% of Fintech Lending platform respondents have collaborated with financial institutions through loan channelling, credit insurance, and customer referrals. As shown in Figure 44, the most common form of collaboration with financial institutions is in the form of “Loan Channelling”. Besides financial institutions, players also conduct partnerships with other companies (e.g. credit scoring, digital identification, etc.) that support their lending process in order to have better risk management and benefit from a shared infrastructure.

We are optimistic about the Fintech Lending industry, as there is large demand across Indonesia

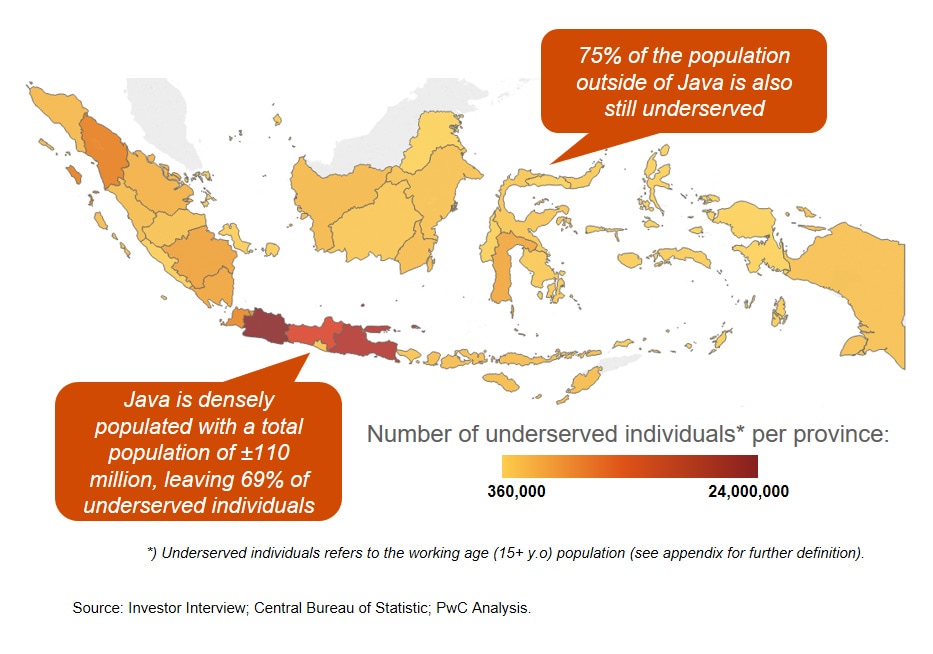

Investors are optimistic about Fintech Lending in Indonesia given the country’s large underserved market.

Indonesia has become an attractive market for Fintech Lending investment, attracting both local and regional venture capitals. Most investors claim that the attractiveness is due to the market potential from unmet demands of a large underserved population, which can be matched by each of the players’ respective value propositions. Looking at Fintech Lending’s untapped markets, most investors in Indonesia (as well as regional) are confident about Fintech Lending’s growth for at least the next three years. In terms of accumulative total loan disbursed, most investors are optimistic for a 200-700% compounded annual growth in the next three years compared to 638% growth from March 2018 to March 2019. While confidence is high, investors within the sector also shared their views on potential risks for the future of the industry. However, Investors continue to believe that Fintech Lending can create value for Indonesia’s underserved markets when supported by agile business models and favourable regulations.

We see Fintech Lending’s potential in fulfilling our objectives, whether they be financial or strategic returns

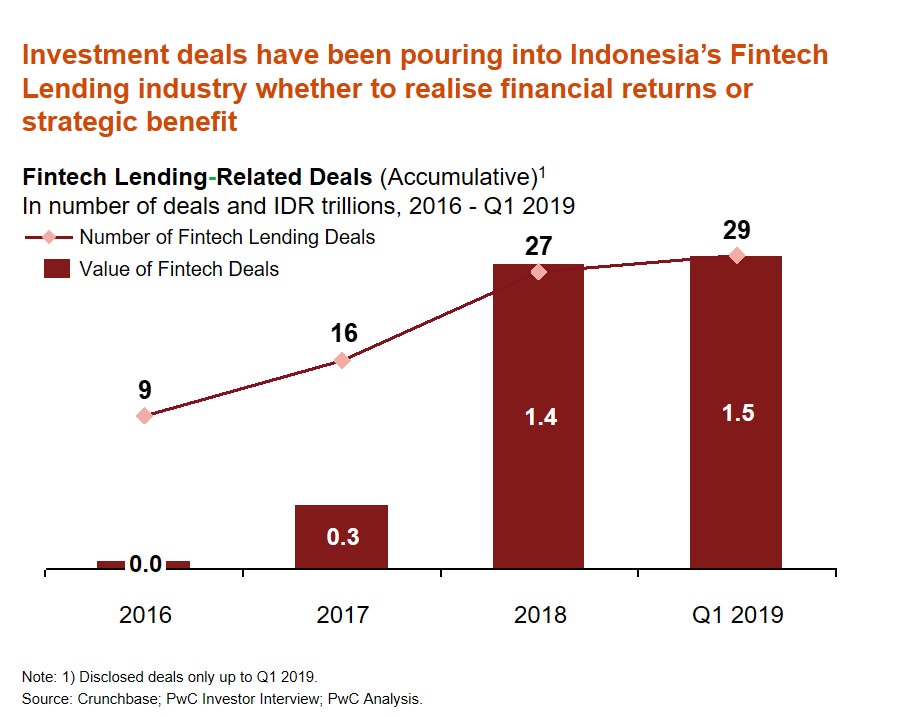

Indonesia’s Fintech Lending industry has been witnessing its fastest growth in terms of investment deals since 2016. Total investment funds increased by 376% from 2017 to 2018, with a record of funds raised at IDR 1.5 trillion during the first quarter of 2019. This level of enthusiastic investments demonstrate the potential of the industry to provide not just financial but also strategic returns to investors. Active investors within the Fintech Lending sector are mostly venture capital firms, which mainly consist of Institutional Venture Capital (‘IVC’) and Corporate Venture Capital (‘CVC’). IVCs are financially driven in their investment-style, and would typically invest in Fintech Lending players with the main goal of realising financial gains from their investments. Comparatively, CVCs approach to investing would lean more towards strategic investing due to their nature as investment arms of a company or larger institutional group. Beyond financial returns, CVCs will also look at how the Fintech Lending platforms can complement the ecosystem of their group. Typically, financially driven investors are willing to invest in hopes of achieving their financial return objectives, which is done through investing on start-ups with growth potential, resulting in an eventual increase of their valuation. On the other hand, strategic investors want to realise synergies, including access to new technology and/or access to new markets.

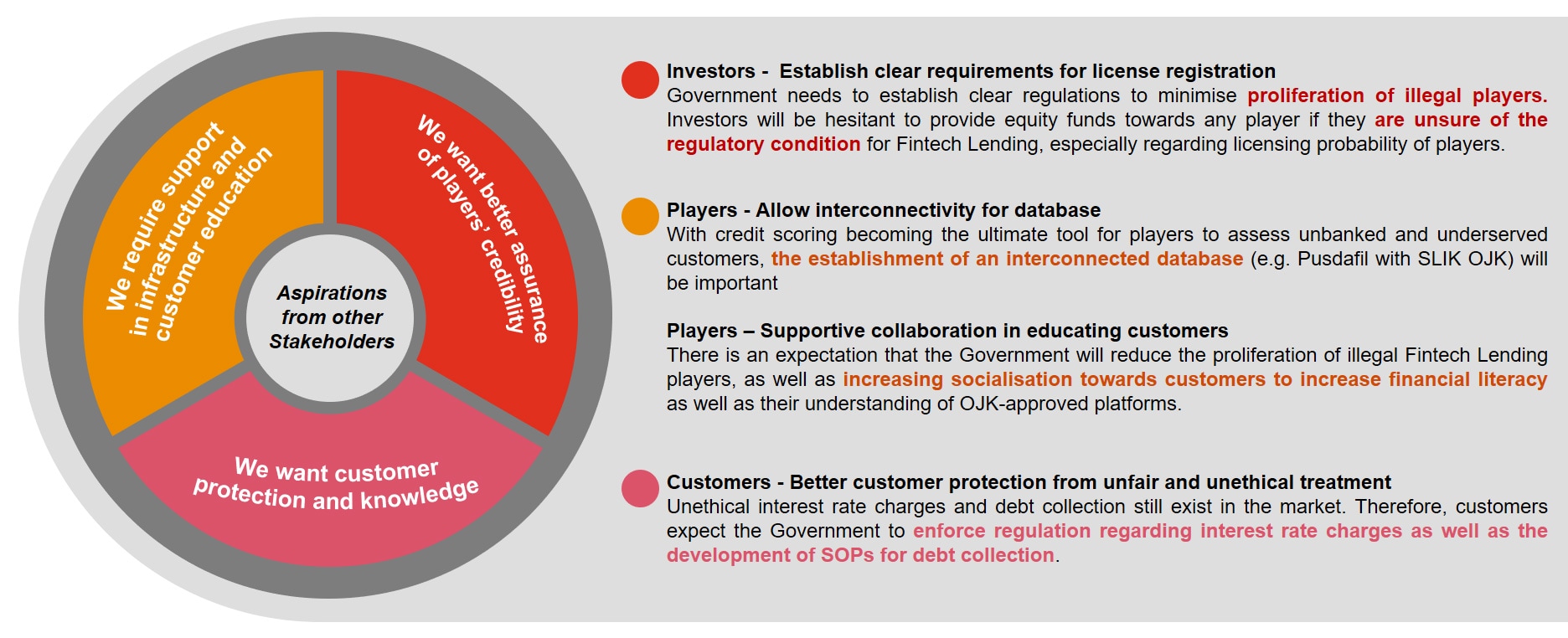

The main aspirations from other industry stakeholders toward the Government to foster a better Fintech Lending ecosystem