AI-powered manufacturing, autonomous vehicles, algorithmic drug discovery, smart grids. These and other innovations are creating new sources of value and enabling new business models. The common factor? Semiconductors. The computing power and connectivity that underpin innovation across industries rely on rapid, relentless advances in silicon speed and efficiency.

Yet this is also a time of uncertainty and transformation for chipmakers. Export controls, restrictions on critical materials, and shifting trade alliances are redefining the semiconductor landscape even as technological innovation continues. Now more than ever, industry leaders need to take a forward-looking approach, not only to maintain near-term competitiveness but also to understand how a new phase of industry reconfiguration could set value in motion.

PwC’s ’Semiconductor and beyond’ report provides insights for both semiconductor demanders and suppliers by analyzing industry trends, demand across end markets, and the potential impact of emerging technologies

Demand analysis

The global semiconductor market is expected to grow at a compound annual growth rate (CAGR) of 8.6%, from around $627 billion in 2024 to more than $1 trillion in 2030. Overall end-market growth may be propelled by the transformative impact of AI across industries, while server and automotive market segments grow at the fastest pace.

- Automotive

- Server and network

- Home appliances

- Computing devices

- Industrial

Automotive

The car of the future may be more than just a mode of transportation – it may be a new form of home, a high-performance computer on wheels, seamlessly powered by semiconductors.

- With the electric vehicle (EV) market rapidly expanding, demand for electrified powertrains equipped with wide bandgap semiconductors such as silicon carbide (SiC) power semiconductors is likely to surge, expected to account for around 60% of the automotive power semiconductor market.

- By 2030, level 2+ autonomous vehicles are likely to account for around 70% of vehicles shipped. Enabling higher levels of autonomous driving significantly increases semiconductor content per car, from sensors to connectivity ICs, electronic control units (ECUs) and processors.

- Software-driven vehicles may emerge as a new standard. Enabling this accompanies architectural changes, with a central high-performance computer (HPC) and multiple ECUs playing as one. Semiconductors can become the blood, muscles and central brain of the vehicle.

Server and network

Since the surge of generative AI applications in 2022, the amount of data generated and processed has expanded at an exponential rate. Servers and network equipment will likely be a backbone of intelligence permeating applications around us, powered by the continuous advancements of semiconductors.

- With the rapid growth of data traffic over the next 5 years, semiconductors in the data center market may exceed $250 billion. As the demand for smarter, more efficient servers capable of handling massive data traffic grows, AI accelerators may account for more than 50% of semiconductors used in data centers.

- Increased demand for data centers also drives the network equipment segment, as switches and routers become smarter when equipped with computing chips.

- The telecommunication equipment market might not attract as much attention as the growth of data centers, but with the worldwide spread of 5G, the gallium nitride (GaN) RF semiconductor market is poised to grow at a CAGR of 10% until 2030, eventually powering around 90% of future base stations.

Home appliances

Although the home appliances market is relatively saturated, the drive for AI and the Internet of Things (IoT) is changing appliances to become even smarter and provide a new consumer experience, equipped with more chips. Moreover, new appliances are gaining more market traction, such as AR/VR and wearable devices.

- The traditional appliances segment is likely to grow with the integration of AI and demand for power-efficient appliances, leading to higher-performing application processors. The application processor market in appliances is likely to grow slowly but steadily, reaching around $26 billion in 2030.

- The smart home experience can bring a new standard to the user experience. With this trend, the connectivity IC market will likely increase, with appliances using diverse connectivity standards based on circumstances, to enhance efficiency.

- Wearable devices, including hearables, smartwatches, and VR/AR gadgets, now feature an array of sensors, unlocking innovative healthcare and entertainment experiences. While microphones have had a relatively higher proportion in the sensor chip market in wearables, the role of image sensors, magnetic field sensors, and emerging sensors may expand significantly.

Computing devices

Although previously considered relatively saturated compared to other applications, the smartphone and PC markets are now facing new opportunities, driven by the growing demand for AI-optimized products such as on-device AI solutions.

- As a leading application for advanced semiconductors, the smartphone and PC markets are likely to transform once again with the integration of neural processing units (NPUs). The market for AI-capable semiconductors in PCs and smartphones is projected to expand from $9–10 billion in 2024 to $40–43 billion by 2030, respectively.

- LPDDR, or low-power double data rate, which balances power efficiency with performance – critical for portable PCs and smartphones which cannot be charged all the time – is expected to continue evolving. It’s anticipated that it may achieve approximately a 50% improvement in power efficiency every 2-3 years.

- In the premium smartphone segment, the importance of cameras is growing, closely tied to advancements in semiconductors. Image sensors and image signal processors (ISPs) may undergo rapid innovation, enabling pro-like photo quality.

Industrial

Industries around us—including healthcare, agriculture, manufacturing, energy, and defense—are constantly evolving, driven by global demographic shifts, productivity improvements from new technologies, the rise of new products, and climate risks. Semiconductors can find their way deeper and deeper into more industries, driving efficiency and innovation across diverse industries.

- The medical and healthcare semiconductor market can reach $8.7 billion in 2030 with the expansion of medical service area from diagnosis & treatment to prevention and aftercare. Both traditional and new medical equipment may evolve with more, higher performance graphics processing units (GPUs), central processing units (CPUs) and biosensors.

- Power semiconductors are crucial to enable renewable energy growth. Especially for solar photovoltaic (PV), wind power and smart grids, which require high power, SiC can be a major player here.

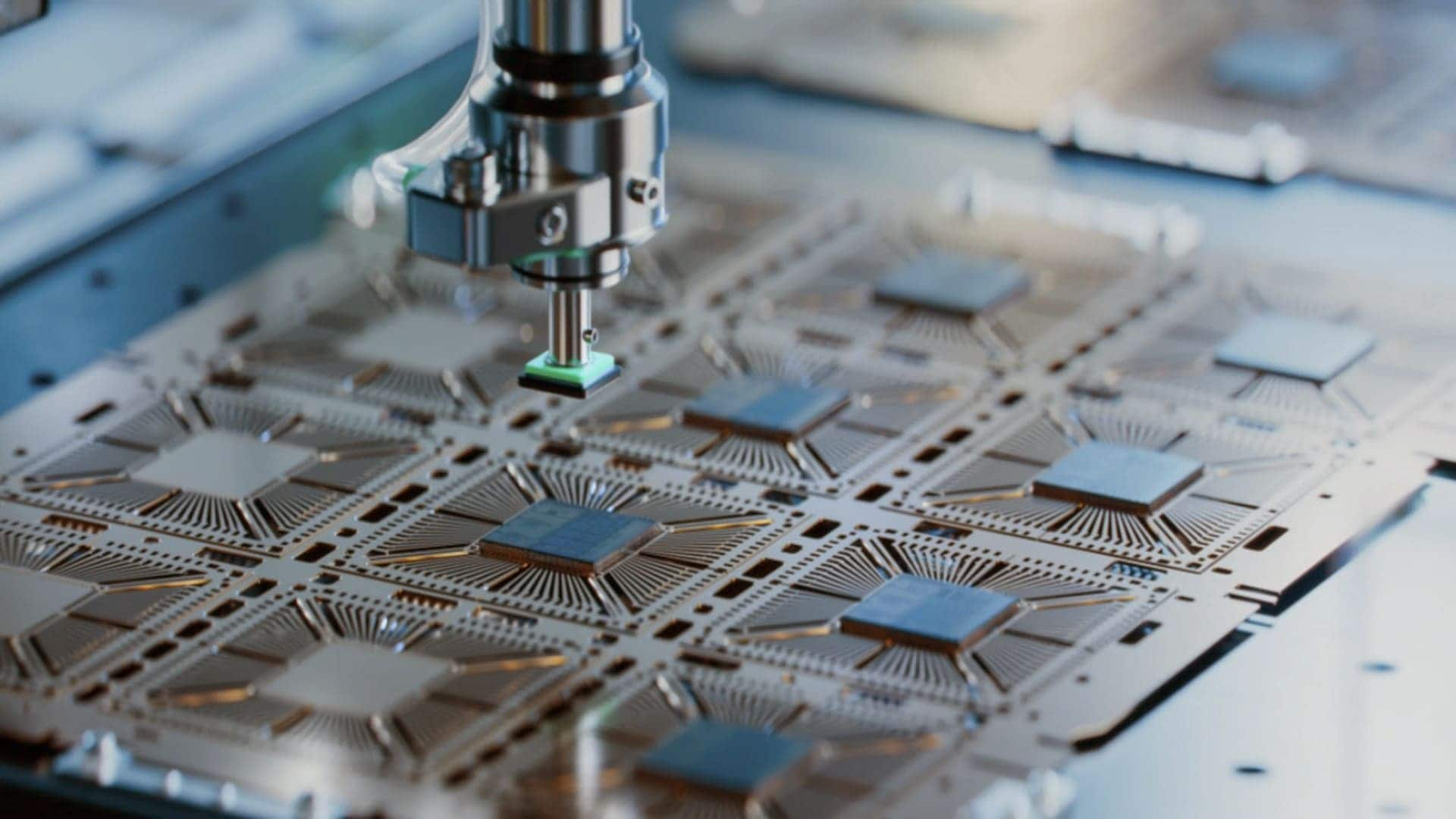

- Factories, agriculture, and aquaculture are shifting toward automation, which is enabled largely by various semiconductors that gather real-time data, connect, process, and actuate them.

- Semiconductors are actively integrated throughout the flow of defense. From training to radar detection, command, and counterattack, advanced GPUs, CPUs, application-specific integrated circuits (ASICs) and RF GaN may face increased demand to reduce human casualties and increase mission success rates.

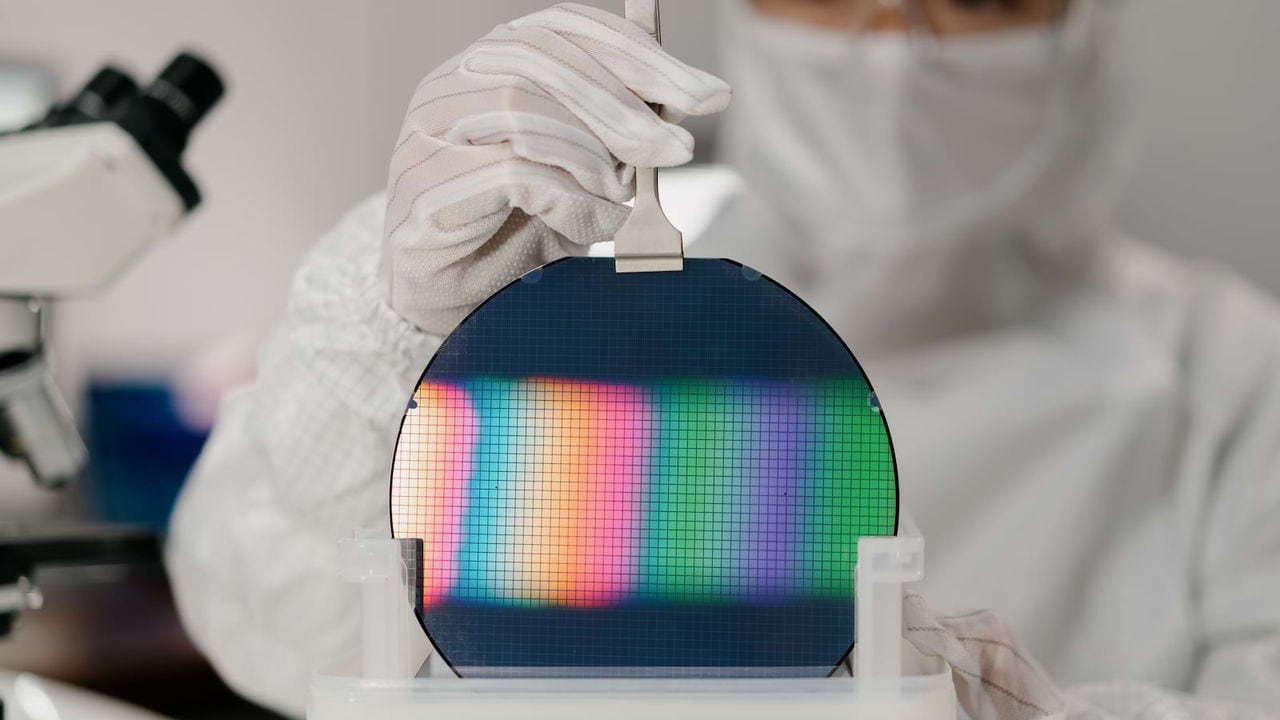

Supply analysis

What's next?

PwC has selected technologies likely to have a substantial relationship with semiconductors. Beyond 2030, with numerous technological innovations, semiconductors will likely remain a key component, while shifting their role. Advanced AI, driverless, humanoid robots, quantum computing and brain computer interface (BCI) are emerging with high potential and feasibility, raising questions for players to prepare beyond 2030.

You can read further about the new technological waves and what questions they bring for proactive readers in the semiconductor industry.