Delivering Deals in Disruption

Value Creation in Asia Pacific

Amid growing headwinds, doing deals in Asia Pacific has become more complex. Our report reveals that dealmakers are under more pressure than ever before to deliver value in disruption but plenty of opportunities exist to generate premiums.

The case for Value Creation as the priority

Close to half of deals analysed in Asia Pacific have destroyed value and/or underperformed their industry peers, based on Total Shareholder Returns (TSR). Dealmakers are under more pressure than ever before to deliver value in a time of disruption.

Deal volumes in Asia Pacific are growing in significance, with the region’s share of global Mergers and Acquisitions (M&A) continuing to increase over time, buoyed by sizable Private Equity (PE) dry-powder of ~USD$600+ billion.

However, the region is not without its market challenges: high inflation, elongated impacts of the pandemic, unique territory nuances, and increased regulatory scrutiny are driving highly variable returns.

In addition, executing deals in Asia Pacific is becoming more complex - they are often cross-region, with fragmented data quality, differing stakeholder needs, and variable sector maturities.

In Asia Pacific, buyers and divestors underperformed their industry peers over 24 months post-deal close

Asia Pacific is a fast growing region where markets have seen less consolidation and companies are typically less mature - there are disproportionately more ways to bring a Value Creation lens because of the degrees of transition and transformation happening across the region.

David Brown Asia Pacific Deals Leader, PwC ChinaValue Creation in Asia Pacific: an evolution

It is clear a new approach is needed - (re)enter Value Creation. Put simply we define Value Creation as:

- Taking a strategic approach to deal logic, as opposed to tactical, opportunistic, or risk-focused

- Being comprehensive and disciplined through the corporate lifecycle, well before and after the deal

- Grounded in underlying drivers of value through a capability lens

When Value Creation is closely linked to strategy, it yields positive outcomes. Buyers remorse is clear:

The Value Bridge: Bringing Value Creation to Life

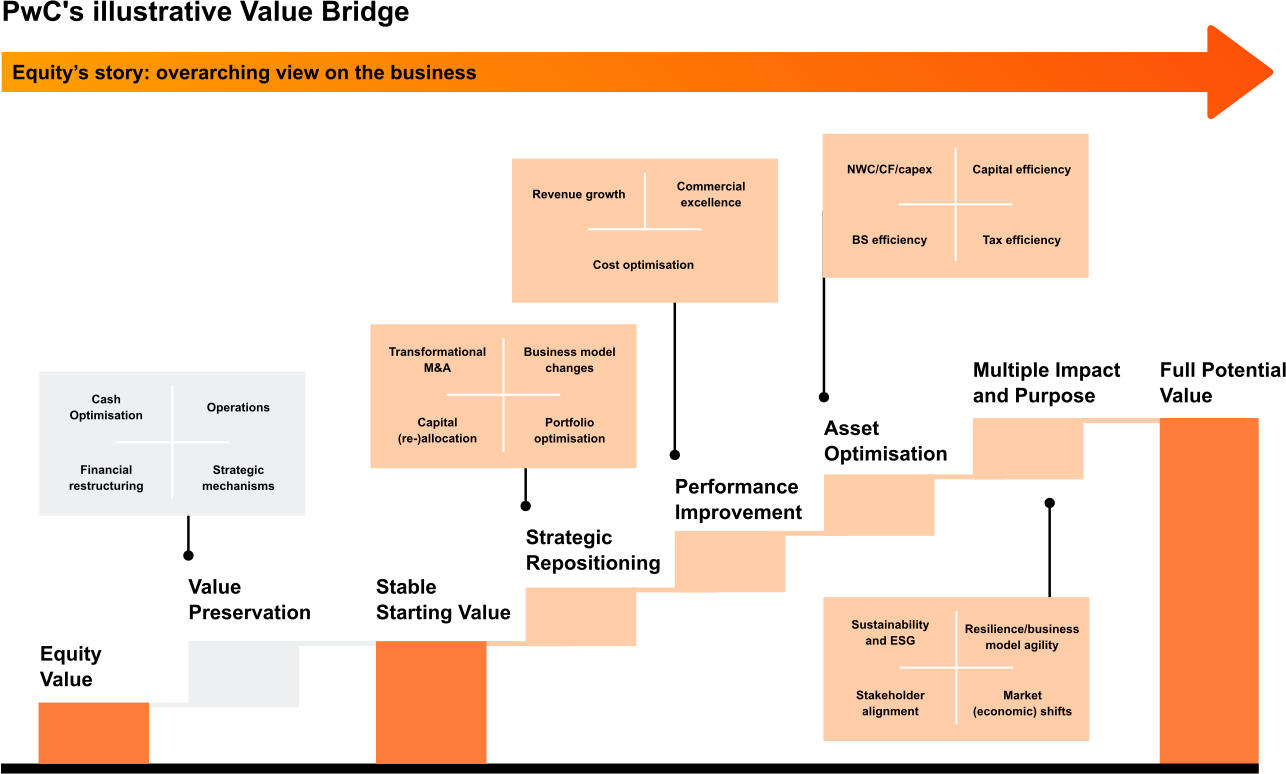

We know success today depends on structure, discipline and comprehensiveness - and consideration of the full suite of value drivers, not simply traditional elements of financial engineering and tactical synergies focused on cash flow. The better approach considers strategy, operations, tax and stakeholder alignment which together drive premiums and manage risks along the ‘Value Bridge’.

What’s next for dealmakers in Asia Pacific?

Asia Pacific remains the ‘sweet spot’ for global growth due to a range of factors - including burgeoning intergenerational wealth transfers, accelerated sector modernisations, growing intra-Asian trade flows and a nascent focus on Environment, Social and Governance (ESG) - which together present compelling Value Creation opportunities.

We are seeing many deal thematics emerge recently including ‘roll-ups’ in fragmented markets to build scale, carve-outs for large family businesses relevant to wealth transfer events, transacting as a catalyst to transform and innovate, and partial trade-sales and stakes to fund strategic expansions - particularly within Southeast Asia to manage regional political and supply chain tensions.

To activate these, we suggest six pragmatic responses for dealmakers to successfully drive Value Creation catering to Asia Pacific’s nuances:

Embed Value Creation early and do so holistically

Focus on capabilities that drive long-term, sustainable premiums

Commit time and effort to understand different cultures, business and market practices to shape people strategy

Continually uncover value from data and do so early

Use ESG to elevate premiums

Invest appropriately in integration to de-risk execution