Cost and quality have long been the benchmarks for supplier selection, but recent supply shocks mean that supplier reliability must now be a major consideration.

Businesses must be able to effectively address changing market needs while becoming faster to respond to and recover from potential bottlenecks.

Success in this new world requires a more holistic selection framework.

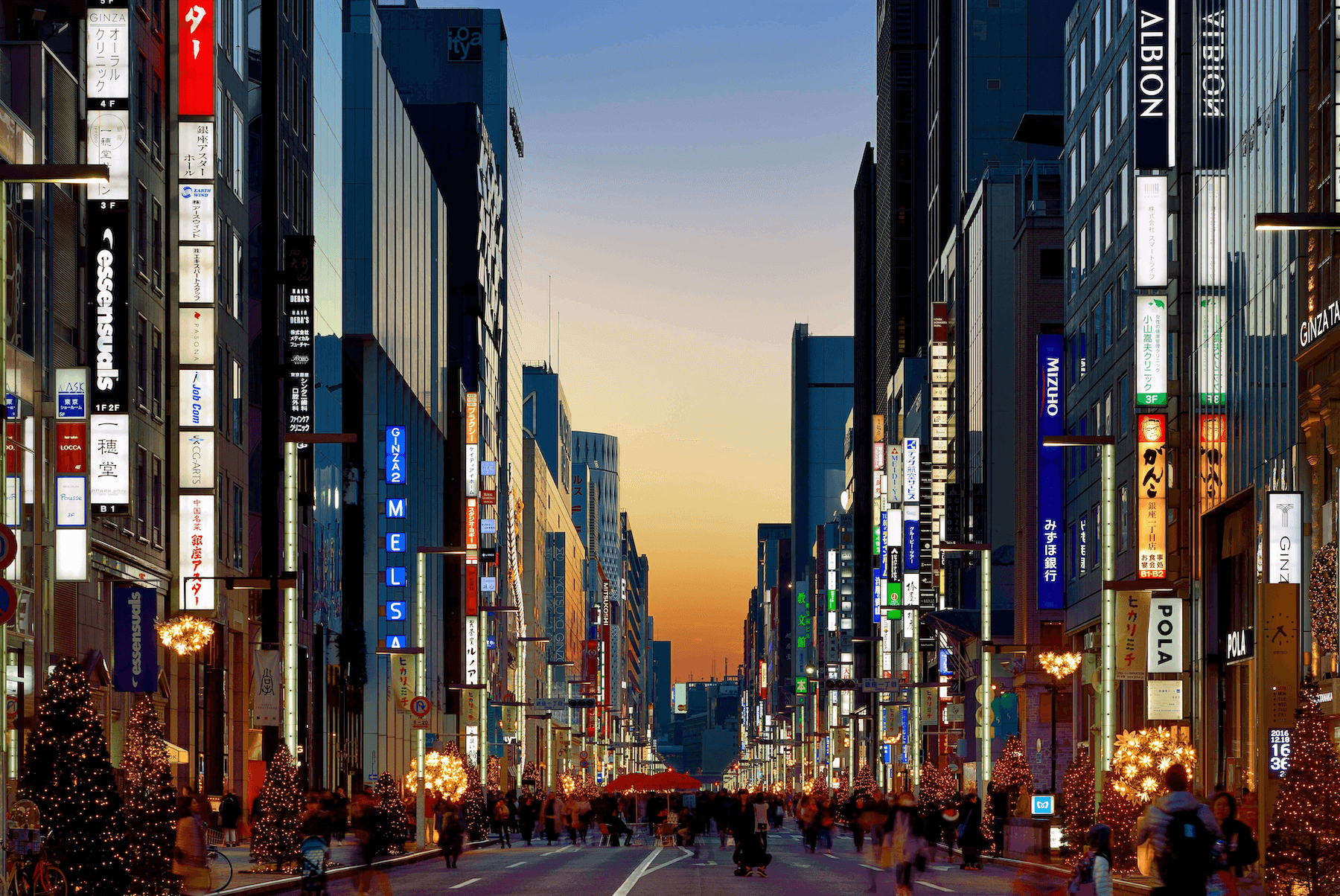

How multinationals can choose the right suppliers

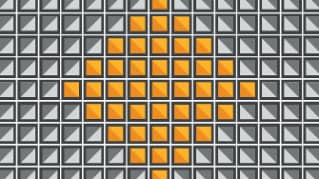

Supplier performance assessment:

can the supplier offer a competitive solution?

Supplier reliability assessment:

what is the supplier’s exposure to and visibility of key risks?

Learn more about partnering with the right suppliers here