{{item.title}}

{{item.text}}

{{item.title}}

{{item.text}}

IFRS 17, the globally standardised accounting model for all insurance contracts aimed at greater transparency and better preparedness to manage the surging quantum claims, will be effective come January 2023. It fundamentally changes the way in which insurers measure contracts, with profound effects on a range of business functions.

IFRS 17 implementation is, however, challenging for many insurers. As the effective date draws near, insurers continue to experience unforeseen roadblocks and delays in their IFRS 17 implementation programmes. A smooth transition to this new regulatory standard requires significant time and resources. Insurers need to take a strategic and carefully calibrated approach to effectively identify, improve and transform inefficient systems and processes to enhance performance.

PwC’s IFRS 17 Health Check Survey 2021: Asia Pacific, assesses how much progress insurers have made over the past year and how their challenges have changed. We also looked at other IFRS 17 implementation-related issues, including the level of board involvement, engagement with external stakeholders, IFRS 17 key performance indicators (KPIs) and potential changes in business strategy post-IFRS 17 implementation.

The expected duration of IFRS 17 implementation programmes has increased over the past year, from 3.5 to 3.8 years, especially for life insurers.

Ongoing and proactive project management during the design and construct phases is critical to successful and timely implementation.

The survey found that 75% of respondents have started communicating with external auditors on IFRS 17.

However, engagement with the board, investors, rating agencies and analysts are at mostly early stages. Engagement with these stakeholders should be accelerated to avoid any surprises.

Companies are expected to use a combination of new and existing KPIs to evaluate their business performance and make their management decisions under IFRS 17.

The majority of respondents are yet to start defining their IFRS 17 KPIs. Insurers are encouraged to identify, specify and communicate their IFRS 17 KPIs before the effective date.

Insurance executives expect to take about 3.8 years on an average to complete their IFRS 17 end-to-end implementation. The average expected duration is shorter for non-life insurers (3.4 years), when compared with life insurers (4.1 years) and composite insurers (3.9 years). The expected implementation timeline varied significantly between respondents, with 25% indicating that it will take them five years or longer to implement IFRS 17. This means one in four respondents expect to miss the 1 January 2023 IFRS implementation deadline.

Respondents also believe that it will take an additional 2.5 years (on average) after IFRS 17 implementation for their organisation to fully stabilise and return to business as usual. This timeframe remains unchanged from the previous survey conducted in 2020.

Generally, insurers have made progress in their implementation programme over the past year - a larger proportion of respondents (65%) reached the detailed design stage in 2021 compared to 56% in 2020.

However, progress made by insurers continue to vary significantly. While 27% of the respondents have started with detailed design, another 27% are at the construct and test. Over one in three (35%) have yet to start with detailed design and only a handful of respondents have already reached the transition (3%) and business as usual stage (3%).

Most respondents from the Philippines (80%) have yet to reach the detailed designing phase, as they have a later IFRS17 effective date of 1 January 2025 compared to the rest of territories surveyed - 1 January 2024 for Thailand and 1 January 2023 for the remaining territories, while Japan’s effective implementation date remains unconfirmed.

While a significant proportion of respondents are “mostly confident” (35%) or “very confident” (32%) that full implementation of IFRS 17 will be ready by the effective date, the proportion of respondents that are “mostly confident” has decreased from 41% to 35% over the year.

Despite the deferral in implementation deadline, insurers generally feel that they need more time to complete their implementation programme, especially life insurers. The expected duration increased by an average of 0.3 years from the previous survey (and 0.7 years for life insurers).

IFRS 17 implementation continues to be a long journey. Hence, detailed and careful project management is key in ensuring that IFRS 17 is implemented successfully by the effective date.

While it is encouraging to see that insurers have made some progress in their implementation programme over the past year, the overall confidence of insurers to fully implement IFRS 17 by the effective date has decreased. Respondents that have reached the transition or business as usual stage indicated that some aspects of data, systems, processes and controls might be outstanding by the effective date. This suggests that insurers are facing some delay in their implementation progress. Also, previously unidentified issues may start to surface as insurers proceed to detailed design, and construct and test phases.

Insurers are encouraged to work closely with their actuaries, accounting experts, external consultants, and vendors to push ahead with their implementation plan, and proactively plan for contingencies as they arise.

Our survey found that 30% of insurance executives plan to spend less than USD 5 million on their IFRS 17 implementation programme. Budgeted spending for each organisation is expected to be in line with the scale of operation. For insurers with an annual Gross Written Premium (GWP) exceeding USD10 billion, the respondents plan to spend over USD 50 million on their implementation programme.

About 50% of insurers that had a view on their actual costs indicated that their actual costs will exceed initial budgets. This is an increase from the 2020 survey result where 35% of the respondents expected to exceed their budgeted spend.

It is interesting to note that 32% of respondents have no clear view of their IFRS 17 programme budget yet, and 38% have not yet assessed actual spend against budgeted spend.

IFRS 17 implementation requires a significant resource commitment as insurers are expected to spend on new technology to implement new systems, and external actuarial and accounting experts to ensure a smooth implementation process.

It is evident that more insurers expect to exceed their initial budget as compared to last year. Unforeseen challenges arising in detailed design and construct and test phases are leading to lengthening project timelines and greater uncertainty in spending requirements for the entire implementation programme.

Insurers can gain a better understanding of their IFRS 17 implementation programme cost by having a good understanding of IFRS 17 requirements and by monitoring the project plan and progress closely. In addition, insurers will need to engage with all related parties (e.g. actuarial and accounting experts, external auditors, consultants, vendors, etc.) frequently to identify and resolve issues before moving on to the next stage of implementation.

Respondents indicated skill/talent (21%), technology (19%) and time (17%) constraints as the top three IFRS 17 implementation challenges.

As seen in the 2020 survey results, skill/talent constraints continue to be a top challenge for the insurers. This year we noted a shift away from actuarial modelling methodology and data challenges to technology and time constraints as insurers are operationalising their methodology decisions.

The majority of respondents (70%) indicated ‘practical challenges in implementing accounting decisions’ as the most concerning aspect of technical accounting. Other aspects that are of less concern are judgement and technical accounting decisions (13%), interpretation uncertainty (13%), and presentation and disclosures (3%).

Insurers continue to face skill and talent constraints. In particular, accounting, actuarial and IT professionals with IFRS 17 experience are in high demand, and insurers may face difficulty in recruiting and retaining such professionals.

As insurers progress in their implementation journey and enter into the detailed design stage, they may face challenges in implementing their technical accounting decisions resulting in project delays. Insurers should accelerate the upskilling of their employees and obtain additional external support where needed to remain on course for a successful and timely IFRS 17 implementation.

Almost 90% of respondents shared that the awareness around IFRS 17 has been created amongst their board members and 42% said their board is involved in regular monitoring of IFRS 17 project plans and progress. However, only 33% of the respondents indicated that board training on IFRS 17 has been conducted, with only 25% having discussed the estimated financial impact of IFRS 17 on their statement of comprehensive income and statement of financial position.

Respondents indicated that their board’s top areas of interest around IFRS 17 include the financial performance impact (92%), implementation costs (67%), plans and progress updates (67%) and compliance (61%). Areas of less priority are operational impact (42%), management information/KPIs (42%), IT impact (33%), tax impact (28%) and change management (25%).

Whilst a significant number of respondents indicated that the financial performance impact (92%) as one of the board’s top areas of interest, a much smaller proportion of respondents (25%) indicated that financial impacts have been discussed with the board.

The survey results point at the gap between the level of board's involvement and their area of interest. The board’s involvement in the IFRS 17 implementation programme is crucial as IFRS 17 is expected to have a financial impact on the insurer’s profits and shareholders’ equity. This would influence how business strategies and KPIs are set. Generally, the boards appear to be in the awareness stage, rather than being fully immersed into IFRS 17 implementation details.

The IFRS 17 implementation status and its financial and business implications should feature on the board’s agenda.

Our survey indicated 75% of respondents have started discussing their IFRS 17 programme with their external auditors. However, very few respondents have started communicating with their investors (6%) and rating agencies (3%).

Of the respondents who started communication with their external auditors, 80% of the respondents have engaged their auditors on key accounting topics, with only 20% of the respondents having their external auditors involved in the broader IFRS 17 implementation process.

The top three topics discussed with their external auditors are: IFRS 17 accounting methodology, accounting policies and areas of management judgement (71%), actuarial and accounting model baselining (14%), and audit of the selected transition approach (10%). Other topics less discussed are: review of management’s IFRS 17 pro forma presentation, disclosures and the supporting chart of accounts (5%), and design adequacy of key financial controls that will be directly relied on for the purpose of the 2023 audit (0%).

More than 40% of respondents shared that they have started the proactive assurance process. Over 90% of the respondents are looking to engage with their external auditors before the effective date to look at their transition approach and methodology in detail.

Early stage involvement of external stakeholders will minimise late changes in methodology, control design and transition approach, thus saving time and cost. External auditors should also be engaged in the review of systems and data, processes and controls, actuarial models and disclosures. This will enable insurers to recognise and mitigate risks and issues early in the IFRS 17 design and implementation process. Only a handful of insurance executives indicated that they have started engaging with rating agencies, analysts and investors on IFRS 17 related matters.

Insurance executives are encouraged to engage their external auditors to ensure there is an early review of technical positions. Involvement of these key stakeholders should not be neglected, as their assessments of IFRS 17 financial results will directly impact the perceived value of insurance companies. Rating agencies, analysts and investors need to be proactively engaged on the availability of early indicators on IFRS 17 financial impacts (e.g. impact on future profitability, impact on ability to pay dividends, etc.), expected timeline for communication of IFRS 17 financial impacts, and availability of IFRS 17 KPIs.

About 40% respondents indicated that their management have started identifying and specifying KPIs. Of these, 43% expect Contractual Service Margin (CSM) to be one of the key KPIs and another 43% do not have a clear view yet.

Of the life insurers surveyed who have started work on IFRS 17 KPIs, 67% do not have a clear view whether Embedded Value (EV) reporting will be replaced by CSM reporting, while the remaining 33% expect to perform both EV and CSM reporting after the effective date.

Generally, respondents indicated that GWP would not be significantly impacted under IFRS 17, while the rest of the KPIs (i.e. combined ratio, value of business, IFRS 4 profit, adjusted operating profits, cash type metrics, revenue and other measures) would be impacted more significantly under IFRS 17.

A large proportion of respondents do not have a clear view of the extent to which currently used KPIs (e.g. IFRS 4 KPIs) will change under IFRS 17, possibly because the majority of the insurers surveyed are yet to start detailed work on their IFRS 17 KPIs. However, 50% of the respondents indicate that IFRS 17 will be the main basis for driving their organisations’ business strategy.

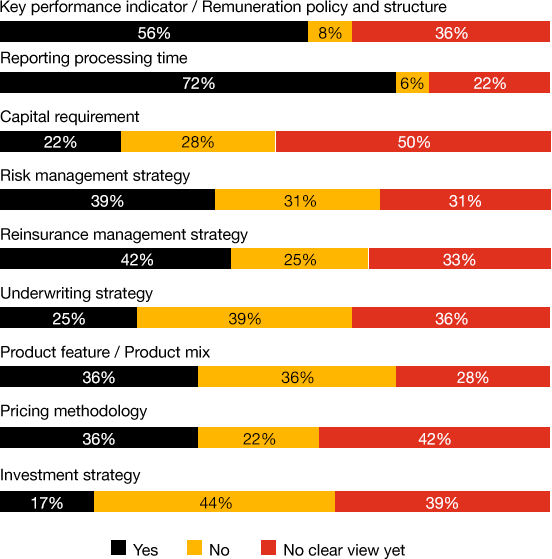

Beyond business strategy, a vast majority of respondents have not started thinking about how IFRS 17 will affect their risk management, investment strategy, pricing methodology, product feature, product mix, underwriting strategy, reinsurance management strategy, and capital requirement.

KPIs are used by companies to measure and evaluate business performance. The specification of KPIs have far-reaching implications on system implementation, management information reporting, external stakeholder (i.e. external auditors, rating agencies, analysts and investors) communication, market consensus and remuneration strategy.

Given the importance of KPIs, insurers are encouraged to start identifying, specifying and communicating their IFRS 17 KPIs as soon as possible.

The first edition of the IFRS 17 Health Check Survey: Asia Pacific was published in May 2020, provided insights into IFRS 17 implementation approaches, progress made and challenges faced. In this second edition, we received survey responses from 37 insurance executives across eight territories, including Singapore, Australia, Hong Kong, Japan, Malaysia, New Zealand, Philippines, and Thailand, in the Asia-Pacific region. The responses, between 10 to 31 May 2021, were from a range of small, medium and large life insurers (30%), non-life insurers (49%), composites (19%) and reinsurers (3%). Of all the respondents, 57% are PwC audit clients.

Asia Pacific John Dovaston, Asia Pacific Financial Services Leader |

||

Australia |

China |

Vietnam |

Indonesia |

Japan |

Korea |

Malaysia |

New Zealand |

Philippines |

Singapore |

Taiwan |

Thailand |