In Pulse 6, we see price-conscious shoppers cross-checking product prices from multiple sources. With higher awareness levels, there is an uptake in the use of specialised price comparison platforms to complement relying on search engines, Amazon, social media, and word-of-mouth.

Consumers in the Middle East have a slightly higher preference for physical stores compared to shopping online via mobile phones and personal computers and for brand’s websites.

Sustainability and emerging technologies feature high on the list of generally young and tech-savvy consumers in the region.

Consumers rely on research and technology as they finalise their purchase decisions

of regional consumers research products online, using their phones in-store to compare products and determine if they are cheaper on the website.

use retailers’ apps on their mobile to compare products and use social media to view live or visual reviews before purchasing.

use search engines to research items, ranking it as one of the top three ways of researching products, while an equal number use Amazon (49%), and 41% use social media platforms.

rank sponsored ads on social media & adverts that directly link to offers and promotions among the top three most influential tools.

preferred ads with influencers and celebrities and traditional TV advertisements, ranking them as one of the top three advertising platforms.

Current shopping behaviour

- In-store shopping preferred and self checkouts gaining a foothold

- Brand websites are trusted

- Willingness to pay more for sustainable and local produce

- Hands on the latest tech products

- Strong preference for subscriptions

In-store shopping preferred and self checkouts gaining a foothold

Instore shopping has been dominant for frequent shopping in the last 12 months and preferred by 49% of regional consumers in the region, who have boosted self-check-outs in physical stores. More than 50% of respondents prefer using self-checkout because it is faster, has a more responsive touch screen and has a greater variety of payment options. Also, 42% of regional consumers use it as it enables them to purchase products directly from the aisle without the need to wait in long queues.

Brand websites are trusted

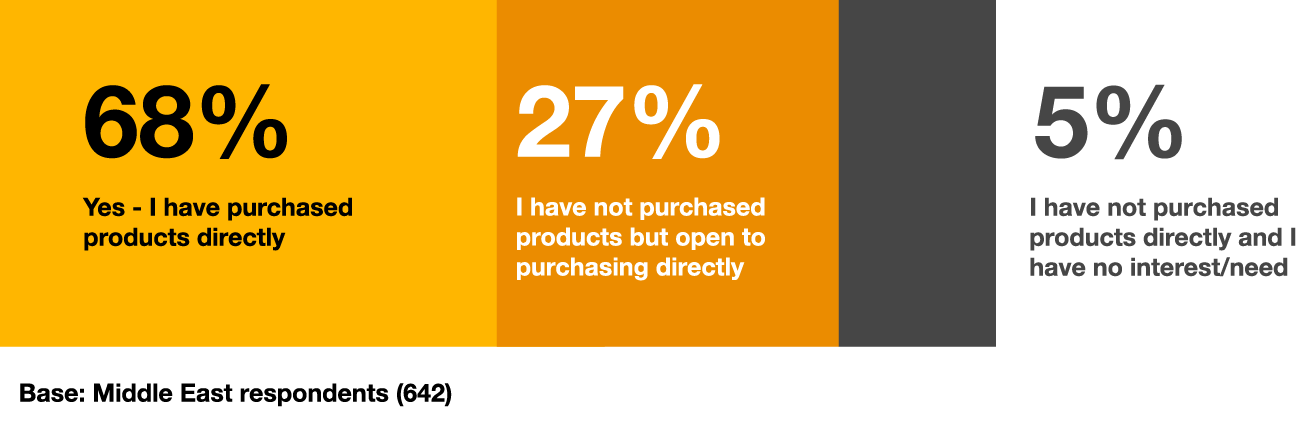

68% of survey participants directly purchased products from the brand’s website vs 63% of their global peers. Ensuring the authenticity of products is a key reason why 31% of regional consumers. More than half of our regional respondents have purchased food, beverages, clothes and accessories directly from the brand’s website, while more than 40% have purchased electronics, beauty and personal care products.

Thinking of products that you buy, have you ever purchased or considered purchasing them directly from the brand’s website?

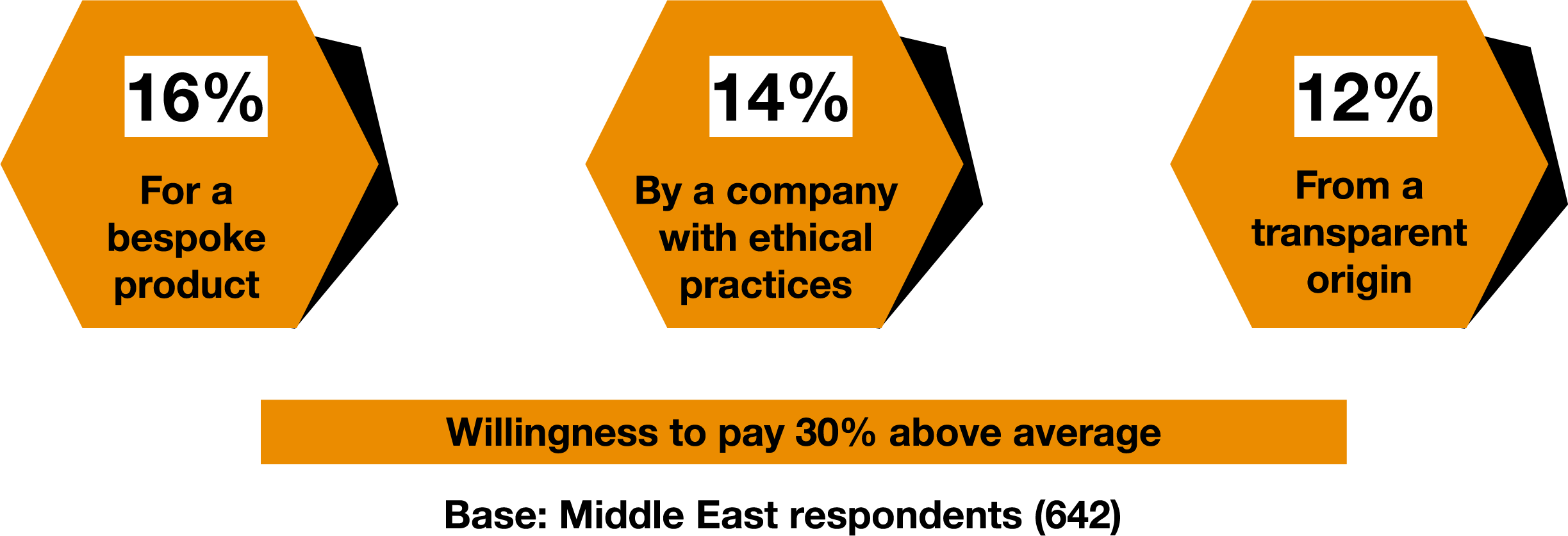

Willingness to pay more for sustainable and local produce

More than 20% of regional consumers would be willing to pay 11 -20 % above the average price for a product produced locally. 20% regionally and 15% globally are willing to pay the same percentage for products that have a lower carbon footprint or by a company with ethical practices such as supporting human rights or avoiding animal testing. 16% of consumers would pay more than 30% for a bespoke product, 14% for a product by a company with ethical practices, and 12% for a product from a transparent origin.

Hands on the latest tech products

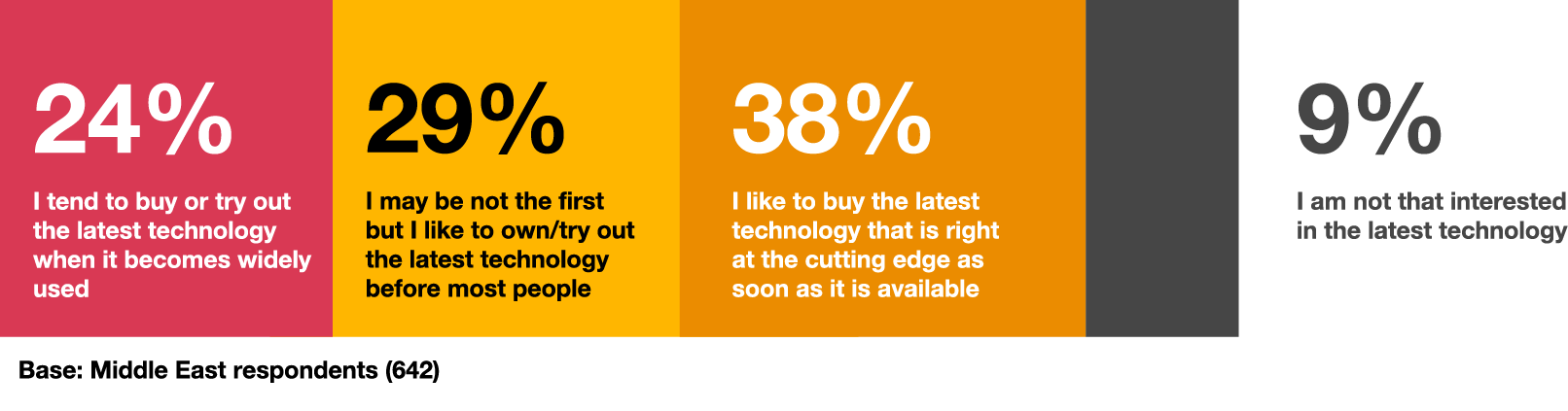

Living in a region that embraces advanced technology and is at the forefront of innovation, Middle East consumers are more likely to buy cutting-edge technology as soon as it is available.

The survey has revealed that 67% of Middle Eastern consumers would like to be the first to buy cutting-edge technology as soon as it is available and to try out the latest technology before most people - a trend is significantly higher than 48% of the global respondents.

Which of the following best describes your personal preference when it comes to technology?

Strong preference for subscriptions

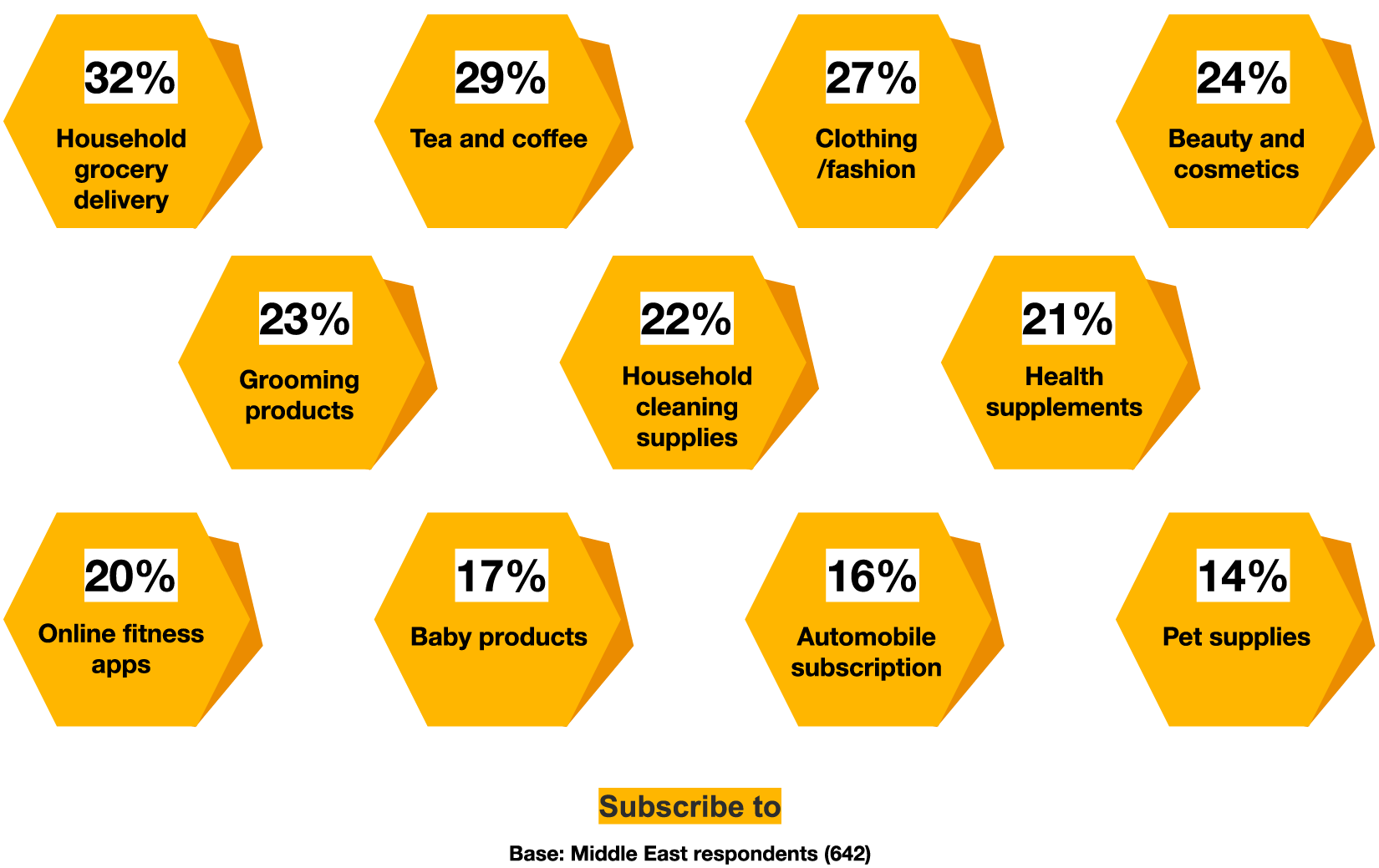

Our survey reveals that 32% of regional consumers (significantly higher than the 17% globally) subscribe to household grocery delivery services like fruit and vegetable boxes and meal kits. Cosmetics, wellbeing supplements, tea, coffee, cleaning supplies, grooming products, clothing services and online fitness apps are products and services that more than 20% of regional consumers currently buy using subscription services.

For more than 50% of regional consumers, subscriptions meant greater convenience and cost-effectiveness, while more than 40% said it enables them to try new products, personalise their buying, and maintain a consistent lifestyle routine.

Which, if any, of the following products/services do you currently buy using a subscription service?

Future trends

Instore vs Online: A best of both worlds

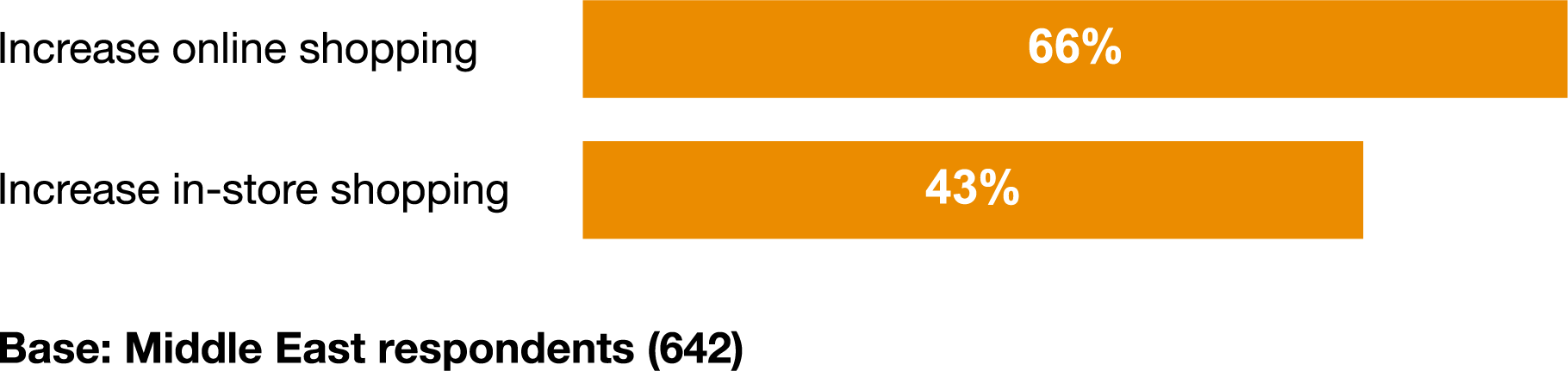

The Pulse 6 global survey has revealed that half of those polled intended to boost their online spending and continue shopping in physical stores over the next six months.

Consumers in the region will continue to seek the convenience of buying online with the confidence of buying in-store. They want the best of both worlds - the immersive experience of physical shopping as well as the convenience of online and are increasingly using digital technologies to make an informed purchase.

Looking ahead to the next 6 months, how will your customer behaviour change across the following activities?

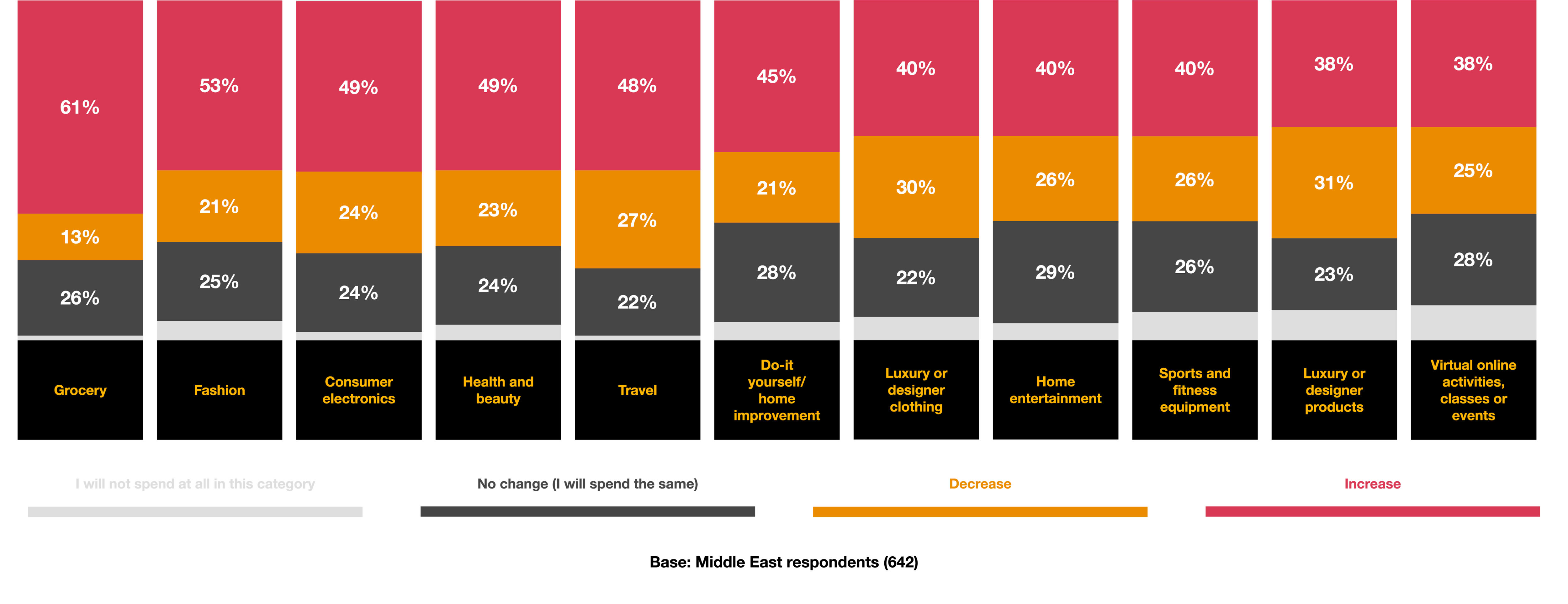

Essentials will remain a priority, a cautious approach for luxury purchases

Consumers are more willing to spend on essentials, around 61% of survey participants revealed that they were ready to spend more on groceries (compared to 47% in Pulse 5), while 53% would spend on fashion (compared to 40% in Pulse 5), and 49% on consumer electronics (compared to 36% in Pulse 5). Around 31% of respondents said they will decrease spending on luxury products, and 30% on designer clothes.

Thinking about your spending over the next 6 months, to the best of your ability, please describe your expectations on spending across the following categories:

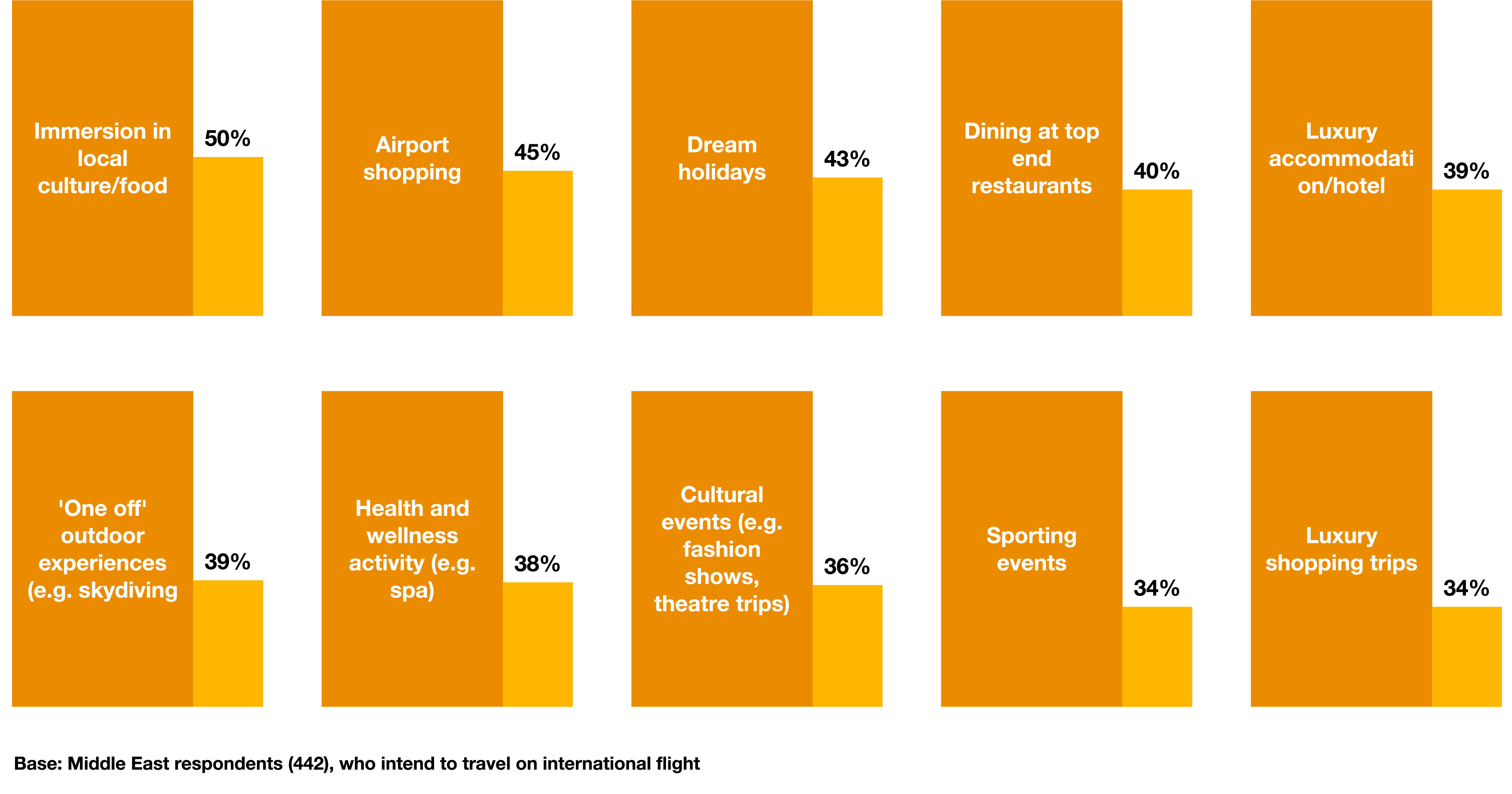

Bigger spend on travel: experiences count for the Middle Eastern consumer

The Pulse 6 survey reveals that 69% of survey participants from the Middle East are likely to travel on an international flight to a new destination. Regional consumers are spreading their wings to travel abroad more than their global peers (44%) and are more likely to take domestic flights (59% vs 47% globally). Also, they are more likely to take less frequent but longer journeys (51% vs 33% globally), as well as short trips for frequent getaways (62% vs 48% global). Key drivers for travel include immersion in local culture and food (50%), indulging in airport shopping (45%), experiencing a dream holiday (43%), and dining at top-end restaurants (40%).

Based on your intended international travel, which of the following are you planning to spend money on?

Consumer behaviour in the Middle East continues to evolve into a more informed, tech savvy group of shoppers, which signifies empowerment by digital transformation and a dynamic shopping landscape. It is important for retailers to accept these changes and reflect them in their strategies, products, and the overall shopping experience.

About the survey

This year, the global survey focused on 8,975 consumers in 25 countries and territories, including 792 respondents in the Middle East region.

The Pulse 6 Middle East findings included responses from 642 consumers in Egypt, Saudi Arabia and the UAE, split between 55% men and 45% women. 79% of the sample are in the 18-41 age group, the sample comprises 57% Millennials and 22% Gen Z respondents, reflecting the region’s young demographic profile, and around 77% are employed.

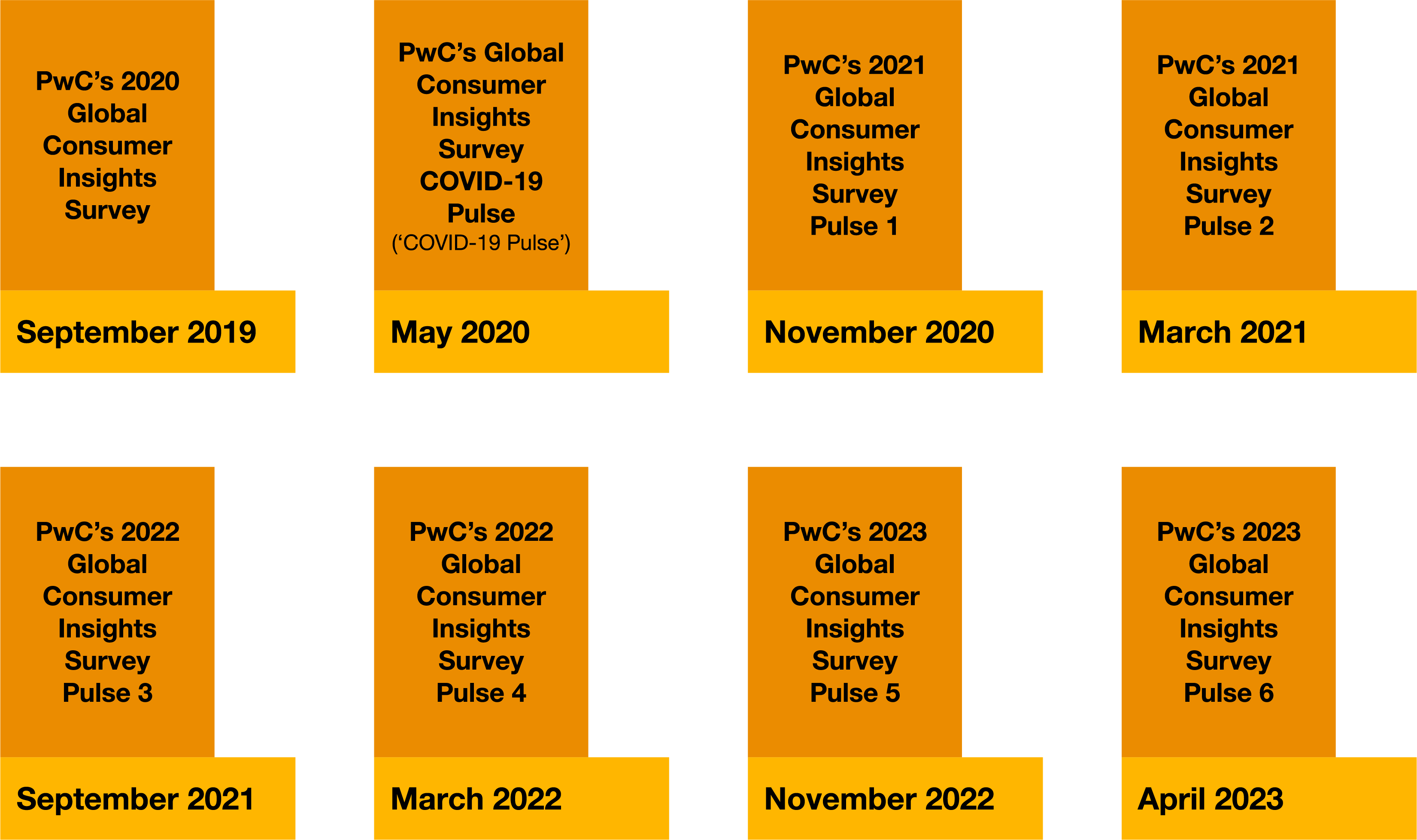

This report references the Middle East findings of the following surveys:

Contact us

Roy Hintze

Maye Ayoub

Global Consumer Insights Survey 2023| Middle East findings – Pulse 6

Empowered by technology, a more aware Middle Eastern consumer doesn’t hesitate to make informed choices

الاستطلاع العالمي لآراء المستهلكين: نتائج منطقة الشرق الأوسط - الإصدار السادس

بفضل التمكين التكنولوجي، بات مستهلك الشرق الأوسط على دراية أكبر بالسوق ولا يتوانى عن اتخاذ خيارات مدروسة