Taking this journey with you

Middle East - How to do Business Guides

Taking this journey with you

Our comprehensive tax and legal guides to doing business in the Middle East contain all you need to know about setting up or expanding in the region.

The guides are written and researched by experts from our Middle East TLS network, making this PwC’s flagship inward investment initiative, advising companies as they enter, launch and grow across international markets."

doing business in the middle east

Our How to do Business Guides facilitate global growth

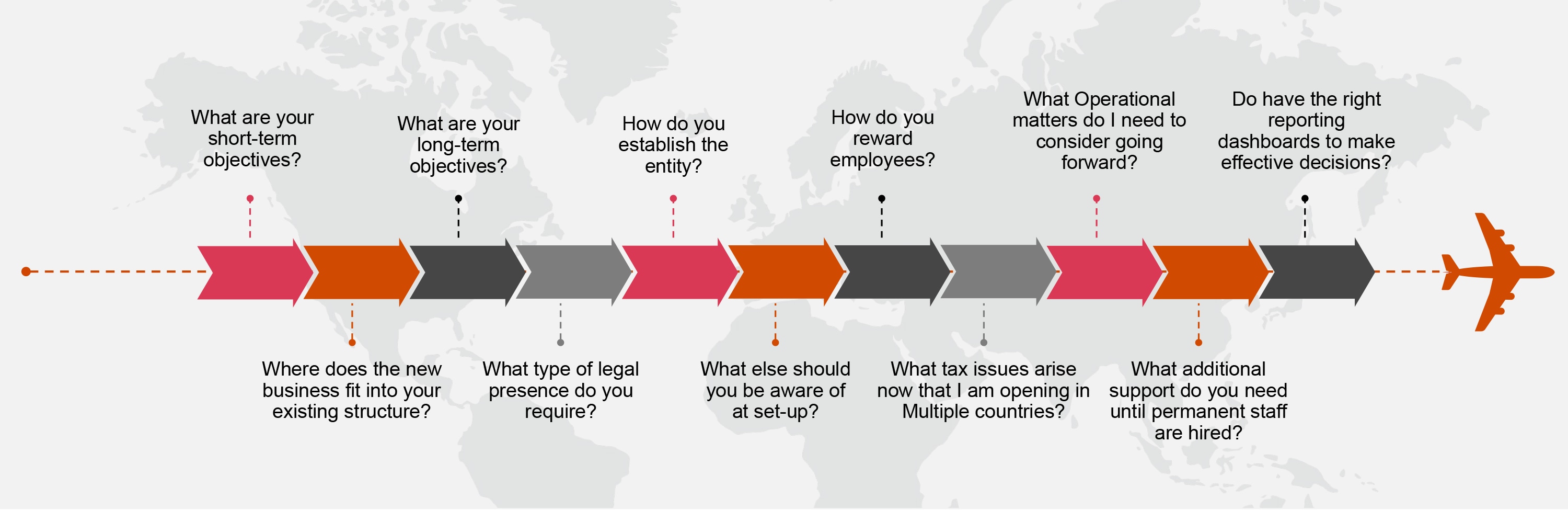

We want to enable clients to focus on business development and growth and have one point of contact in their journey to achieving these goals. As part of PwC Middle East’s regional aims we are here to provide local market experts across multiple disciplines such as tax, legal, accounting, assurance, and consulting.

We want to be your trusted advisor for international development, assist you in navigating the unknown, share insights and create a long term partnership that enables your business to establish a strong presence here in the region.

Our services include

Prior to entering a new Middle East market, PwC offers comprehensive assessment to identify clients needs and address relevant legal and regulatory implications which might be encountered during the business journey and help clients build the framework of their business.

Key benefits

- A single point of contact for the Middle East

- Link to local market experts across multiple disciplines such as tax, legal, accounting, assurance, and consulting

- Navigate the unknown and share insight

- Provide a sounding board to plan the journey

- Become a trusted advisor for international development

- Enable clients to focus on business development and growth

How PwC's network of specialist advisers support your journey

Contact us