Middle East consumers continue to become more confident about engaging in everyday activities that they took for granted before the health crisis– dining out, going to the gym, shopping at the local mall or just meeting up with friends. Our latest Global Consumer Insights Survey (GCIS) pulse, conducted in late 2021, shows that 53% of the region’s shoppers are optimistic about the economy, a significantly higher proportion than the global average of 37%.

At the same time, Middle East consumers are aware that economic uncertainties remain – not least, the threat of inflation. They are thriftily seeking out the best bargains and deals, both in-store and online. Despite this price-consciousness, they continue to prioritise sustainability when making purchasing decisions. Finally, as the region’s tech-driven transformation accelerates, they are also more concerned about their personal data security.

53% of Middle East consumers are optimistic about the economy

Despite this general optimism, this is not a return to previous norms. A range of factors, from mass remote working to tech-driven regional transformation, have changed and continue to affect people’s shopping habits and attitudes.

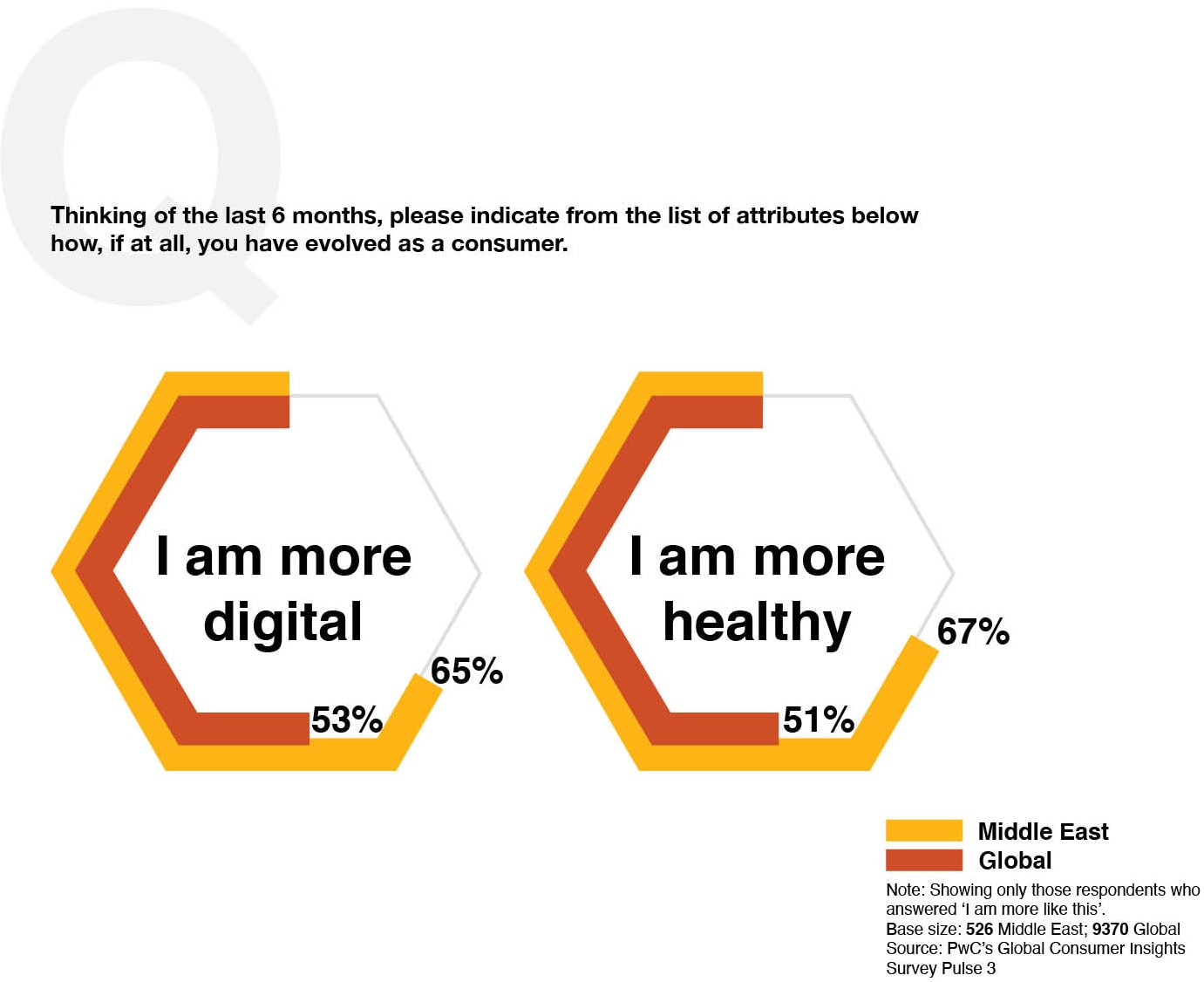

Overall, 65% of Middle East consumers see themselves as more digital than six months ago. With more time to focus on their health and wellbeing, 67% say that they are now also healthier and 66% agree that they have a good work-life balance. All a sign that the global events have prompted regional consumers to reconsider their priorities.

60% of Middle East consumers consider themselves more eco-friendly

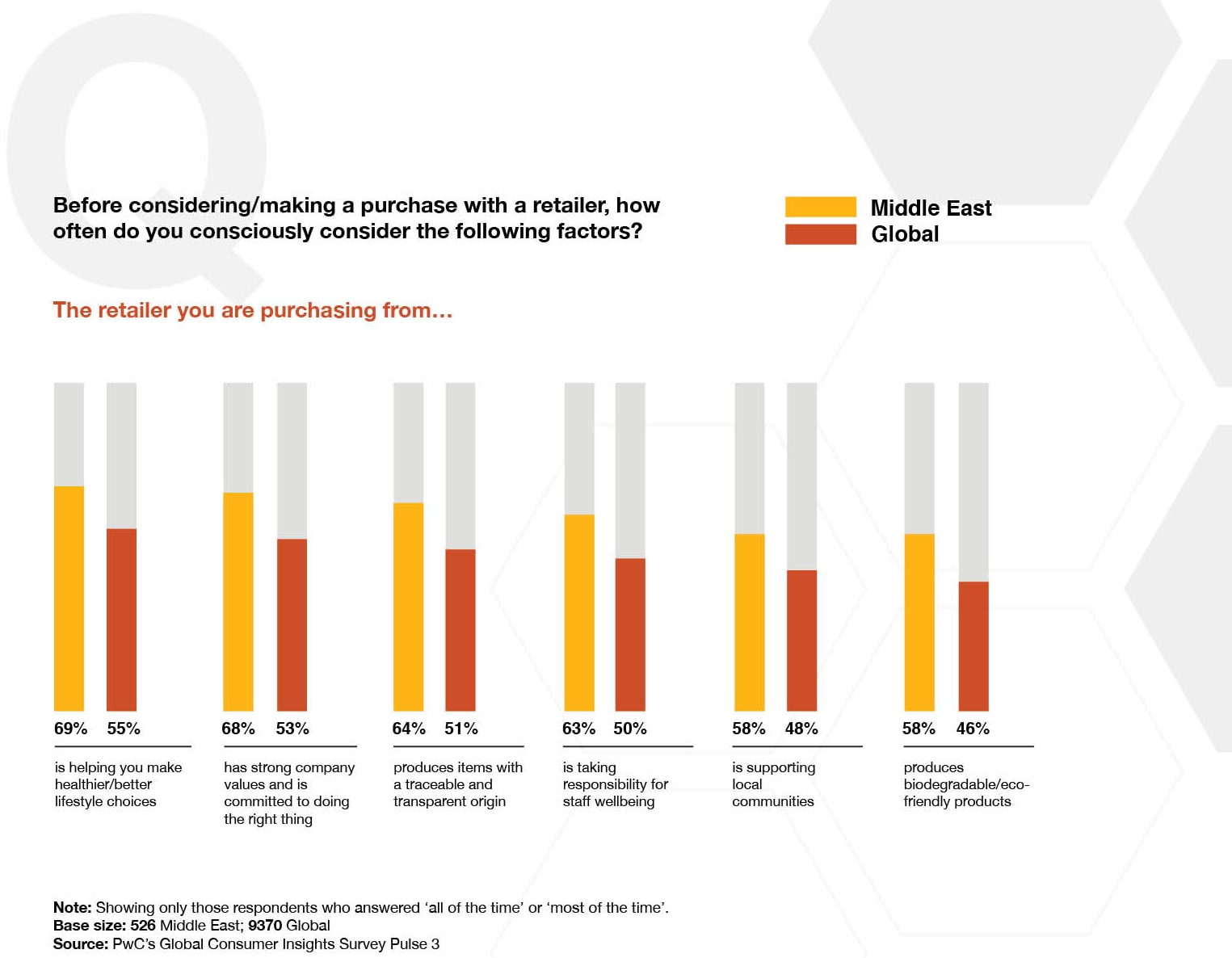

The same proportion consider sustainability factors when deciding what to buy. Both signs that Middle East shoppers are not just talking the talk on sustainability.

As an example, 53% say they always or very frequently buy eco-friendly or sustainable products when they shop in-store, well above the global average of 42%. Additionally, 68% of Middle East respondents say they purchase all or most of the time from companies with strong values; and 69% shop all or most of the time from retailers which help them to make better choices about their health and lifestyle.

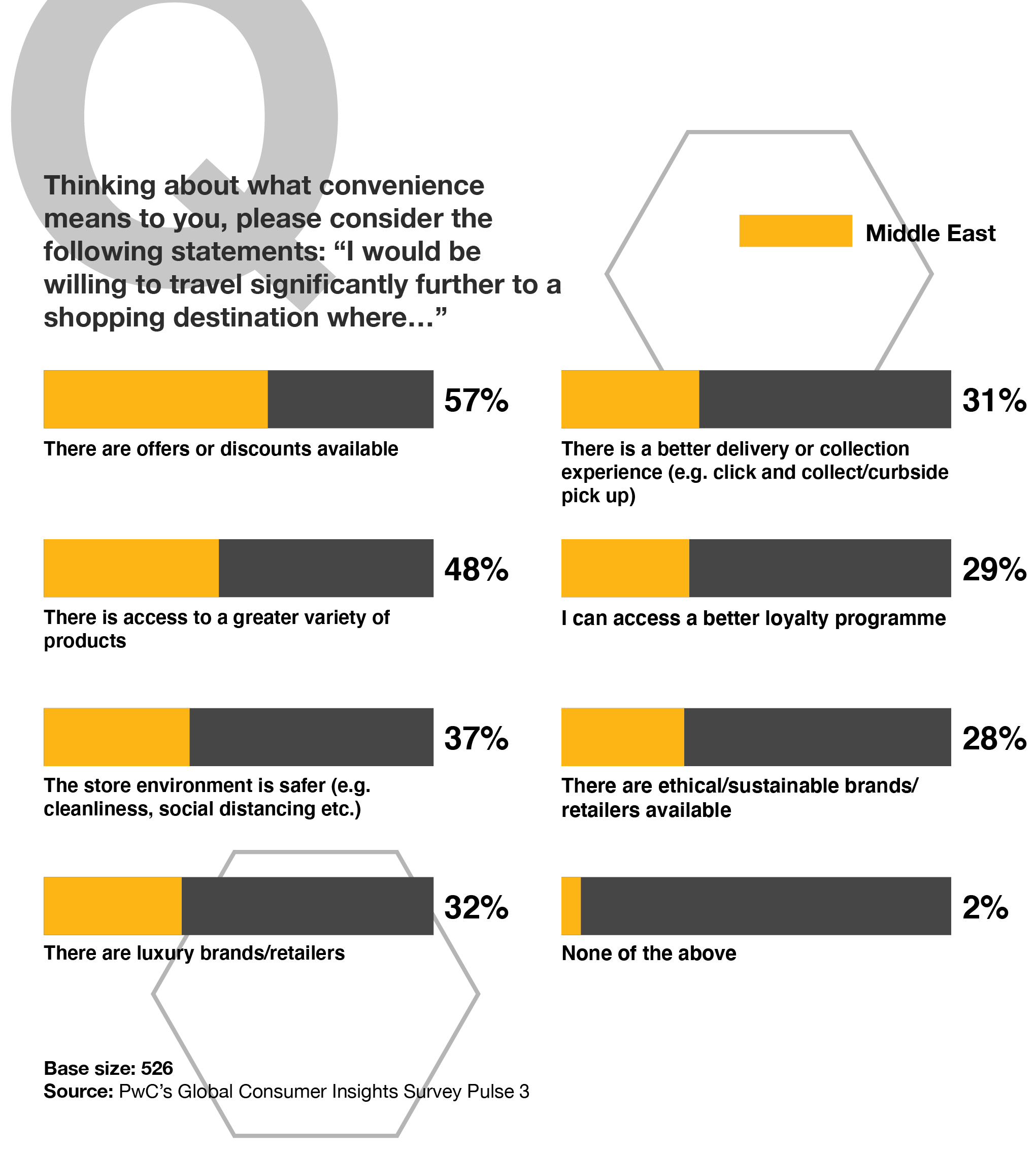

52% of Middle East consumers are more price oriented

Given the threat of rising inflation, Middle East consumers are acutely price-conscious and on the hunt for deals and bargains. 60% say they have become more focused on saving in the past six months and 57% of regional respondents are also willing to travel significantly further to a shopping destination that has offers and discounts available.

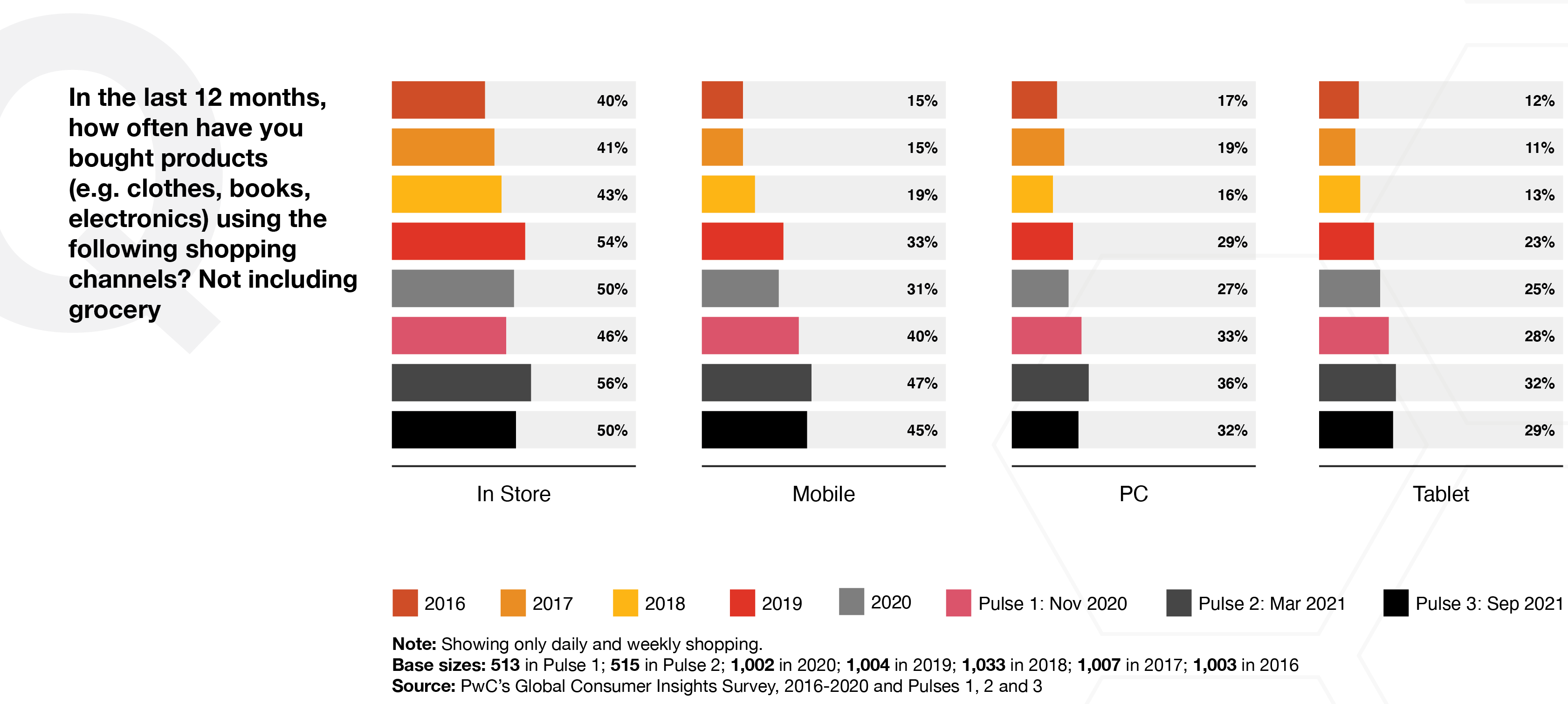

45% of Middle East consumers are using their mobile for frequent shopping

While smartphone shopping is at a historic high worldwide, regional consumers continue to visit physical stores ‒ 50% shop daily or weekly using this channel. This indicates that shoppers are still keen to experience products in person before making a purchase and consider shopping malls as a destination for spending time with their family and friends.

55% of Middle East consumers say a brand’s ability to protect their personal data affects how much they trust it

Consumers have become more protective of their personal data in recent months, amid rising worries about their exposure to online threats and scams. 68% of Middle East respondents said they are guarding their data more strictly than before, compared with a global average of 59%.

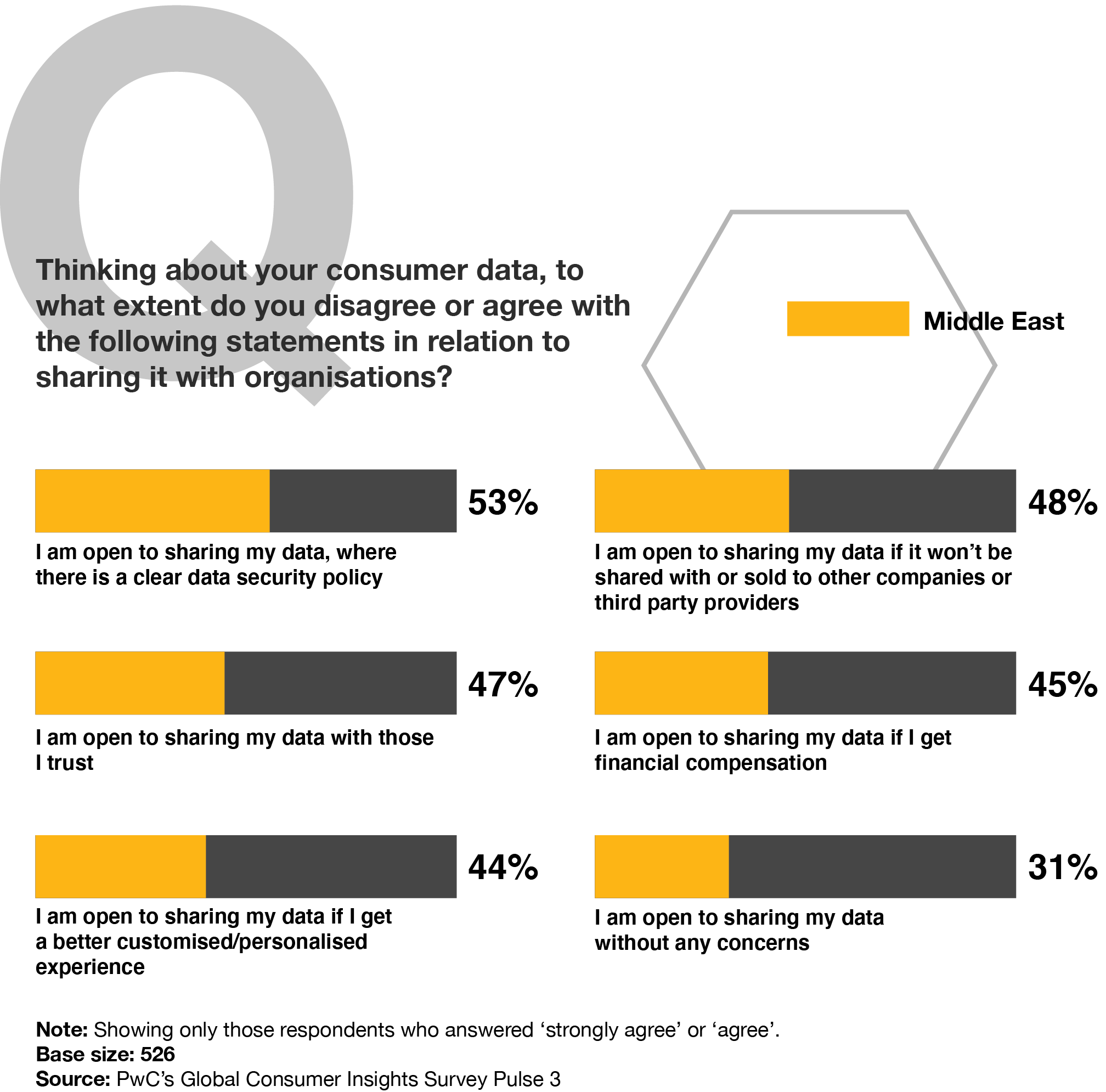

However, this general wariness about how companies manage their details does not amount to wholesale resistance. 53% of regional consumers are open to sharing their data, provided the recipient has a clear data security policy; and 48% will do so on condition that their data is not sold to other companies or third-party providers.

“A range of factors, from mass remote working to tech-driven regional transformation, have changed and continue to affect consumer shopping habits and attitudes, and it is now clear that those changes are here to stay.”

The global health crisis has permanently altered the Middle East’s consumer landscape

As the region moves forward, two facts are evident from this latest survey of consumer trends and attitudes in the Middle East. Firstly, consumer behaviour has inevitably been influenced by the global health crisis. Secondly, some of these changes have been “sticky”, in the sense that they are likely to become a permanent feature of the region’s consumer landscape.

For instance, we believe that consumer concerns about data privacy are here to stay, following the mass experience of enforced shopping online during lockdowns. Companies which ignore people’s anxieties about personal security risk losing customers to competitors. The regional findings also confirm that sustainability is now a critical factor in the purchasing decisions of a growing proportion of Middle East consumers.

However, it’s not only recent global trends that are having an impact on consumer behaviour — anxiety about rising prices is also driving Middle East consumers to hunt down the best bargains and deals.

About the survey

Since the 2021 Global Consumer Insights Survey, PwC has adopted a ‘pulse’ approach in order to remain attuned to changes in the worldwide landscape and connected to the behaviours of the global consumer.

This latest Pulse 3 of the Global Consumer Insights Survey includes responses from 526 consumers from the UAE, Saudi Arabia and Egypt. The respondents were at least 18 years old and were required to have shopped online at least once in the previous year.

This report references the Middle East findings of the following surveys:

Where we’ve included data from previous surveys, the base sizes are listed below the graph.

Contact us

Imad Matar

Partner, Transaction Services Leader, PwC Middle East

Tel: +966 (11) 211 0400 (ext 1501)