Featured

Global Reframing Tax Survey 2025: Middle East findings

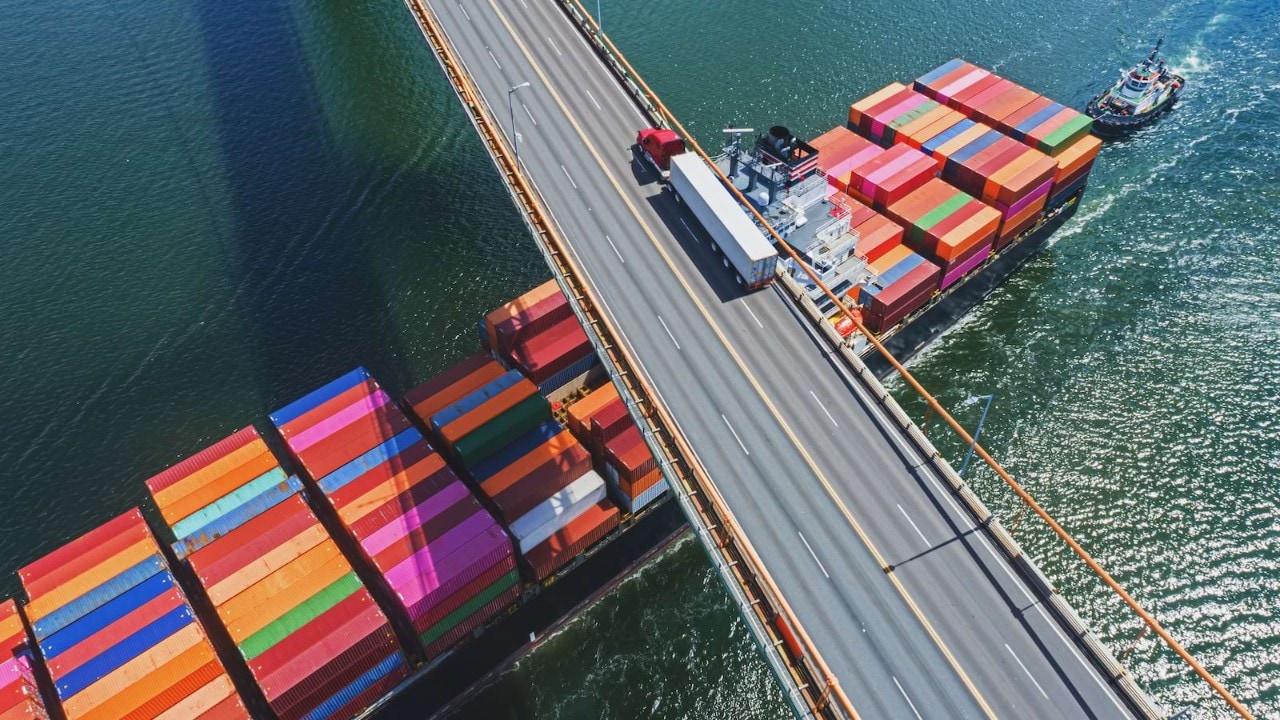

As tax functions face increasing complexity and rising expectations, organisation leaders in the region are rethinking their operating models to drive greater agility and impact. The Middle East findings of the Global Reframing Tax Survey 2025 explore the growing need for a smarter, more connected tax function - one that acts as a strategic, value-adding partner across the value chain.