PwC Middle East 2025 Capital Projects and Infrastructure Survey

A decade of transformation - the Middle East’s capital projects enter a new era

The 2025 CP&I Survey charts the region’s capital project evolution over the last 10 years - from bold national ambitions to tangible commitments. It explores the funding realities behind these goals, rising performance pressures and the growing demand for smarter planning, skilled talent and stronger governance. As digital solutions and technologies mature, we will see faster, more sustainable and at-scale outcomes. This report sets out a path for delivering the next wave of capital projects.

From ambition to commitments

The capital projects market is now entering a new phase defined by performance, accountability and private sector involvement. Governments are moving from announcing projects to delivering them, backed by regulatory reforms and better governance with an emphasis on long-term outcomes. New commitments like Saudi Arabia’s FIFA World Cup 2034, Expo 2030 Riyadh, Dubai 2040 Urban Master plan and net-zero pledges are aligning priorities across infrastructure, tourism, renewable energy developments and wider sustainability goals.

But with new ambitions come new challenges - rising expectations, shifting regulations and new layers of complexity for industry leaders.

This report draws on insights from over 100 capital projects and infrastructure specialists across the region, surveyed between December 2024 and January 2025. It explores the evolving dynamics of the sector, providing insights into where the market is headed and what it takes to deliver capital projects effectively.

Key findings

"Confidence in capital projects across the region remains strong, but the definition of success is evolving. Organisations are no longer measuring project health primarily by deadlines and budgets - they’re now prioritising financial returns, quality outcomes and long-term strategic impact. As investment appetite continues to grow, particularly in Saudi Arabia, the UAE and Qatar, so does the role of private capital, digital innovation, and collaborative partnerships. Industry leaders are shifting from vision to implementation - embracing new technologies, rethinking delivery models and redefining performance around resilience and efficiency."

Market sentiment and strategic shifts in capital investment

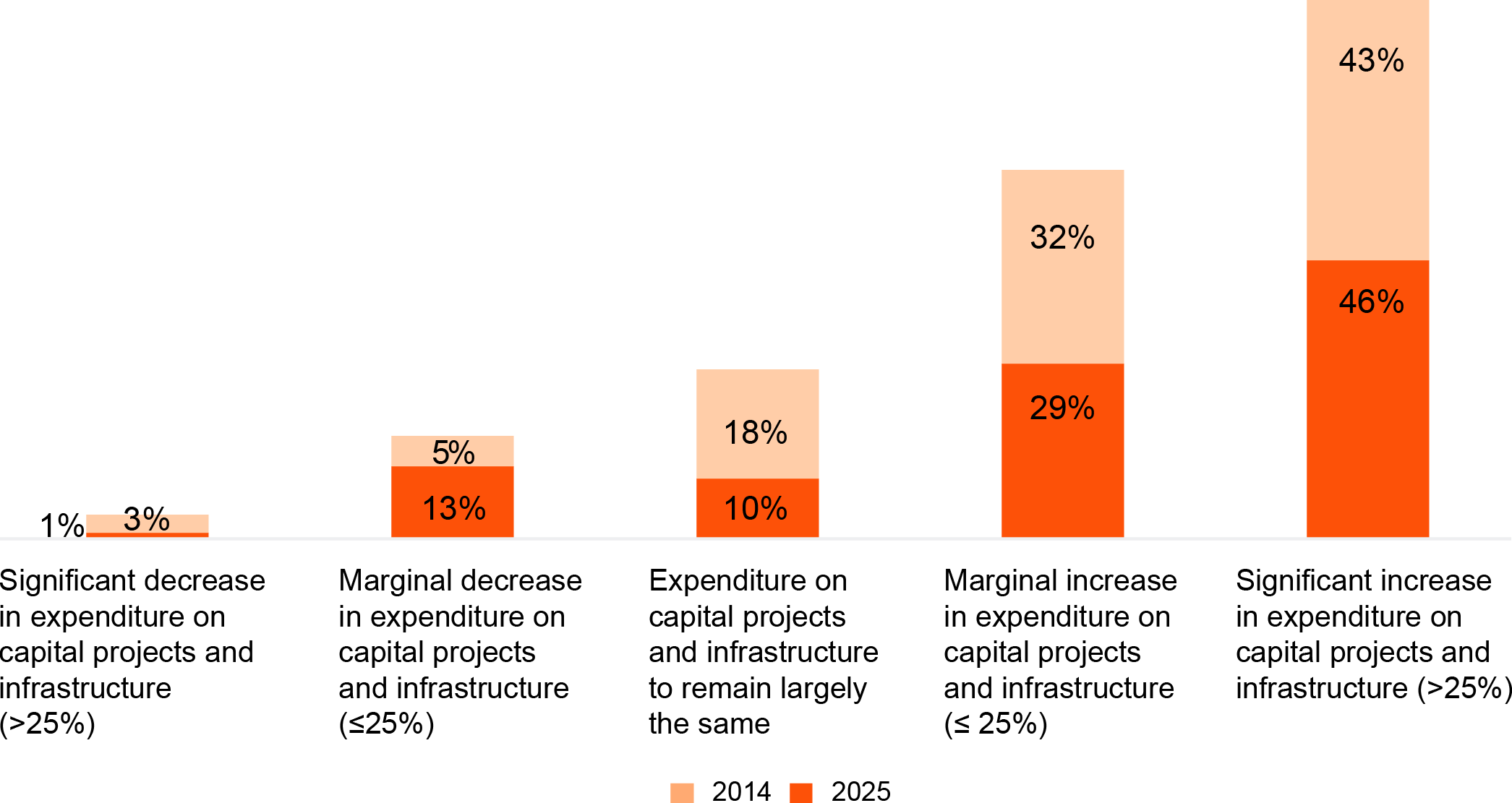

The outlook for capital projects and infrastructure investment in the Middle East remains strong, with industry leaders expressing confidence in sustained growth. Our survey indicates that 75% of respondents anticipate higher capital project spending over the next two years, mirroring the optimism seen in 2014.

Growth now relies more on private financing, with 80% of respondents considering it important for project delivery. This is a significant increase from 50% in our 2022 CP&I survey. Companies are balancing infrastructure expansion with financial sustainability, aligning projects with long-term economic strategies.

Investment priorities

In 2024, Saudi Arabia leads as the top investment market, with 78% of respondents citing it as a key investment destination. The Kingdom’s Vision 2030 agenda and ambitious giga-projects and commitments, including the FIFA World Cup 2034 and Riyadh Expo 2030, have made it a leading hub for large-scale infrastructure investment. The other key markets in the region that have regained investor confidence, reflecting emerging opportunities, include UAE (65%), Qatar (29%), Oman (20%) and Egypt (18%).

As investment in urban development and sustainable infrastructure grows, companies are seeking more efficient project delivery methods that uphold high-quality standards. With an evolving financial landscape and increasing complexity in project delivery, cost efficiency and quality improvements have become primary drivers of innovation.

Project performance under pressure: From delivery delays to strategic execution

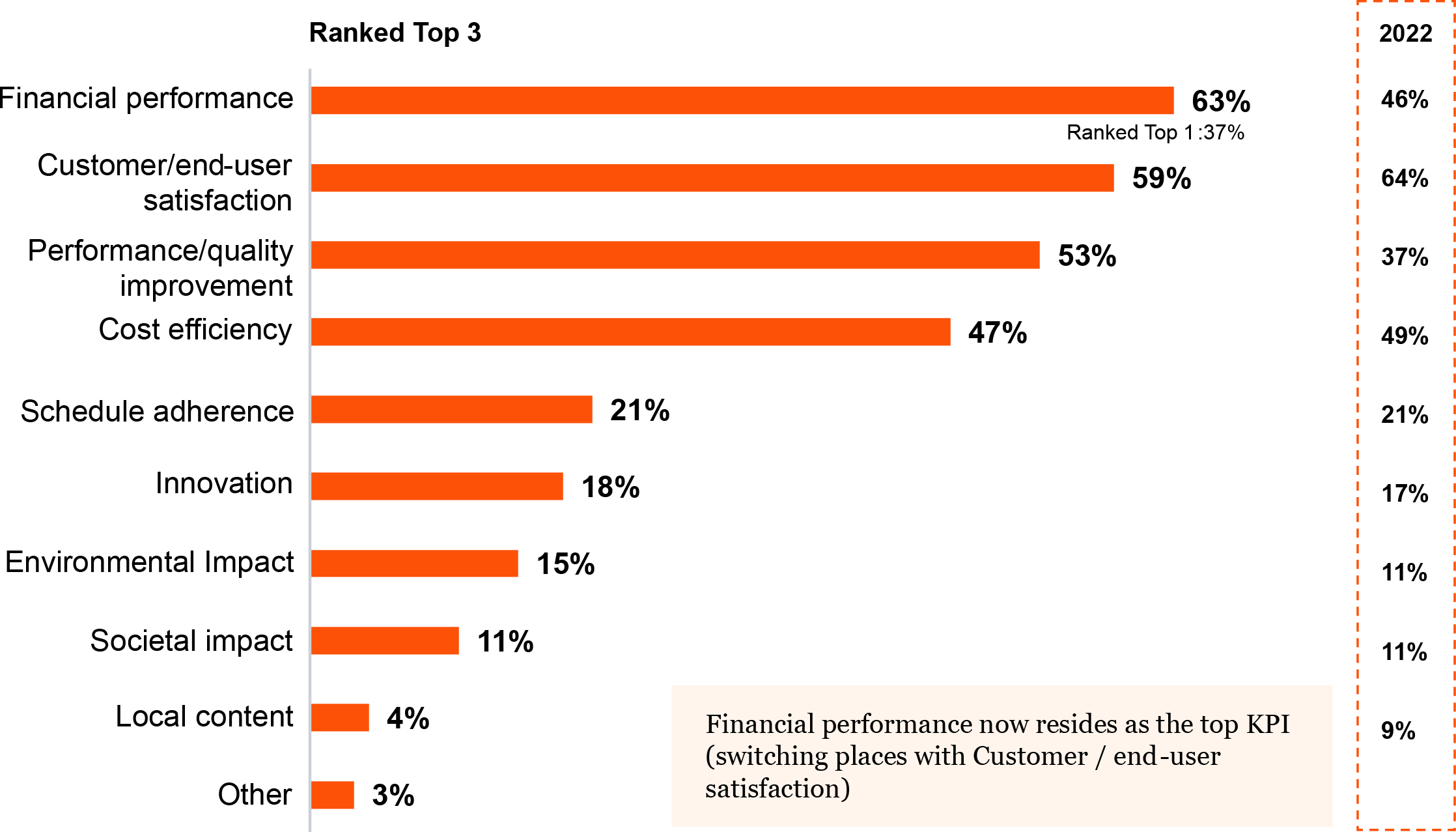

Project performance is crucial for maintaining investor confidence, especially in capital-intensive regions like the GCC. Effective capital allocation and disciplined project execution show investors that resources are being deployed strategically to maximise returns and manage risks. The 2025 CP&I survey reflects this, with an increasing focus on financial returns in measuring the health and performance of projects. Respondents identified financial performance, customer/end user satisfaction and performance/quality improvement as the top three KPIs for measuring project performance and health.

Programme delays and cost overruns continue to be common challenges across projects. The underlying causes of these issues have evolved, driven by shifts in the market landscape and increasing project complexity.

Despite reporting cost and time overruns, many respondents still view their projects as healthy - reflecting a broader, more business-oriented definition of project success. Rather than judging project performance solely by budgets or timelines, organisations are increasingly measuring project success based on financial performance, product quality and stakeholder satisfaction. In many cases, particularly in large, complex projects, delays and overruns are absorbed or justified by changes in scope, evolving requirements, or long-term strategic value and project health is ultimately judged by the project's ability to deliver commercial, operational, and/or reputational outcomes — not just whether it was completed on time or on budget. These challenges are hence regarded as inherent risks to be managed and mitigated rather than entirely avoided.

Skills for project success

Sentiment remains high regarding investing and retaining talent.

However, there is a shift in skills required for development. Respondents identify leadership, problem solving and decision making as crucial for high-performing teams. This marks a further move from vision/strategic thinking to implementation.

Funding and finance: Bold ambition meets capital reality

Despite optimism and positive trends in forecasted capital projects expenditure, funding remains increasingly complex, with 28% of respondents expecting capital constraints to negatively impact their projects in the near term. As ambitions grow, so too does the imperative to rethink how projects are funded, delivered and sustained.

To unlock capital, we must first unlock confidence. The Middle East can lead in capital project delivery by aligning funding with execution through integrated public-private investment, regulatory support, and operational efficiency. Success depends on strong funding strategies, clear capacity analysis, and a shift in focus from ambition to delivery, ensuring projects are viable, impactful, and bankable.

From tools to transformation

As giga-projects grow and stakeholder demands rise, companies must transition from fragmented technology adoption to comprehensive digital integration. Technology should be viewed as a strategic tool for performance, funding and talent. Success depends on integrating data from legacy systems and on-premises servers into unified hybrid-cloud platforms that combine BIM, AI-driven analytics and real-time IoT telemetry to support design, construction and operations. Enterprise-wide transformation, not tool-centric deployment, will define future success, evolving isolated projects into unified ecosystems.

Our survey shows higher adoption of office-based technology solutions than site-based solutions, yet scaling office uptake and accelerating site adoption are still vital to unlock the significant value at stake.

Technology adoption is set to accelerate on average, 25% of respondents plan to roll out new solutions in the next 12 months, led by fully integrated data platforms (40% planning uptake) and virtual/augmented-reality collaboration tools (37%).

Managed services: Enabling operational agility

Organisations face increasing pressure to meet complex regulatory demands, deliver at speed and innovate, all while maintaining efficiency. Managed services provide technology-powered operational support for core business functions, combining expertise, advanced tools and strong delivery models to address dynamic challenges.

Our survey shows that the adoption of managed services is increasing rapidly in the region. Currently, 49% of respondents use managed services and a further 25% plan to adopt them within the next year.

This growing interest is driven by three primary factors:

Looking ahead: Key takeaways for industry leaders

Capital project delivery must evolve rapidly in response to shifting industry demands, economic fluctuations and technology disruptions. Our survey shows performance is now tied more closely to financial returns, customer satisfaction and quality - reflecting a shift in how success is measured. The next decade will be defined by how effectively organisations leverage technology, governance and financial discipline to deliver complex, high-impact projects.