Why it matters

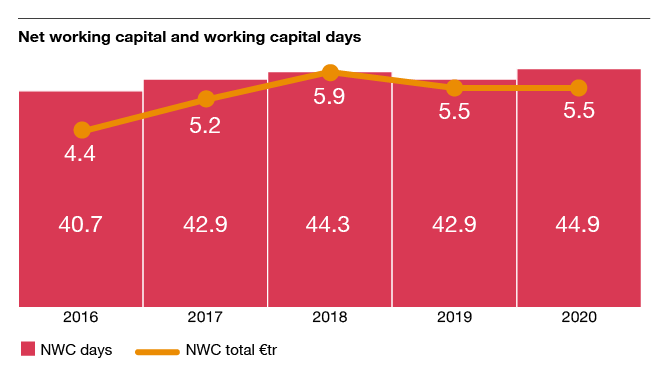

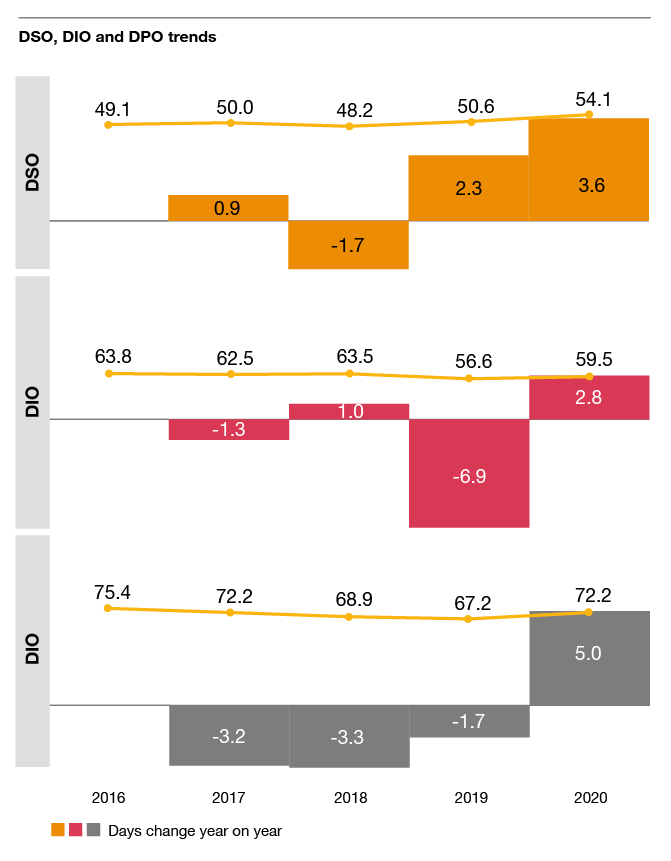

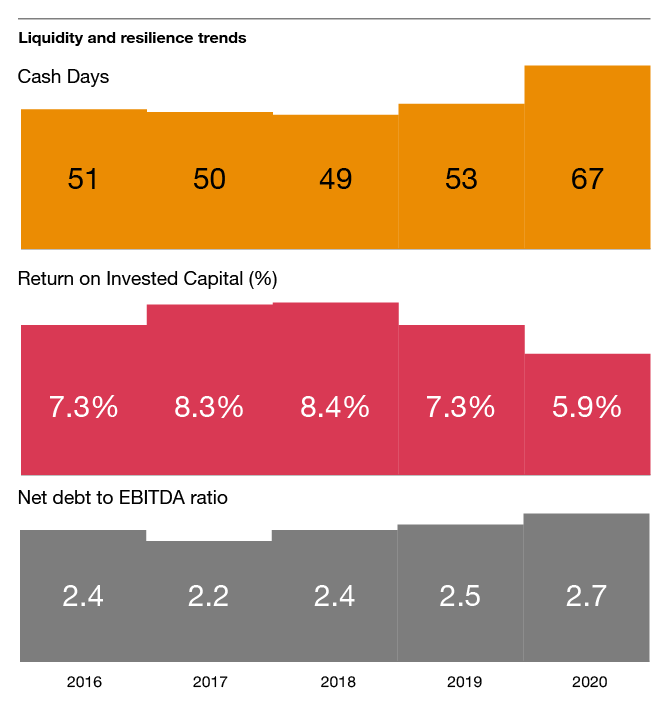

Net working capital (NWC) days reached a five-year-high in 2020, driven by the shock and uncertainty of the COVID-19 pandemic. While many of the spikes in working capital had unwound by mid-2021, the ending of government support, elevated levels of debt and ongoing supply chain disruption all mean that capital efficiency has to be front of mind as we go into 2022.

What’s the story?

The pandemic exposed the slow reaction of supply chains to external shocks, leading to a significant rise in NWC. This lack of agility in adapting working capital levels to disruptive external events is a concern as we face continued challenges in the global supply chain. The heightened complexity and lack of visibility over most supply chains also mean that the move from ‘just in time’ to ‘just in case’ planning in order to manage supply risk may bring further working capital challenges. That is why 65% of executives in our survey named working capital efficiency as the main objective for change management and restructuring activities.

We can help you to

- identify and realise cash and cost benefits across the end-to-end value chain

- improve operational processes that underpin the working capital cycle

- implement digital working capital solutions and data analytics

- achieve cash conservation in crisis situations

- create a 'cash culture' and upskill the organisation to adapt to the current situation

- roll-out trade and supply chain financing solutions

- create short-term cash flow forecasting and related action plans

- stand up surge teams and resolve backlogs

Contact us