Why is the circular economy important for Southeast Asia?

The concept of a circular economy is gaining momentum in Southeast Asia, driven by the pressing issues of climate change and resource constraints. A circular economy is an economic model that looks beyond the traditional ‘take-make-dispose’ economy, and aims to minimise waste and resource consumption by transforming the production and consumption patterns of materials and products throughout their lifecycle.

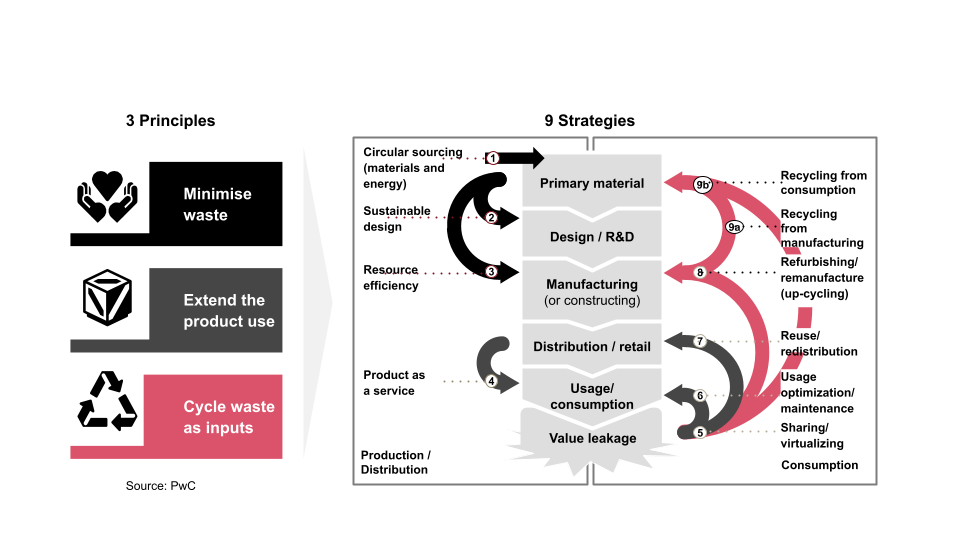

We see the circular economy as including three key principles, supported by nine corresponding strategies:1

As a solution, the circular economy proposes a new radically different way of thinking about economic activity - a way that also safeguards economic prosperity in the long term. A circular economy enables us to (re-)organise our economy as a continuous cycle where nothing is wasted and value creation is maximised. The circular economy represents a significant opportunity, as well as a challenge, for all stakeholders in the ecosystem. It is important for governments to lead the way in the circular transition, working closely with industry and the non-government sector.

What are the key challenges for the public sector in Southeast Asia in transitioning to the circular economy?

Complex regulatory environment

Transitioning to a circular economy involves multi-sectoral stakeholders and transformation along the supply chain. Although there is an emerging number of circular economy policy frameworks and roadmaps in Southeast Asia, the majority of existing regulations - such as fiscal and trade policies - are built based on assumptions of a linear economy.

Keeping pace with advancement of technology

Circular economy transition often requires new technology and innovation from upstream material sourcing and product design to downstream product distribution. In Southeast Asia, these innovations - such as enabling traceability and improving product circularity - may not be available or commerciable yet. In addition, regulations need to catch up with the pace and scale of these emerging technologies.

Inadequate capabilities and technical expertise

While ESG knowledge and education is emerging in Southeast Asia, there is limited capability and technical expertise in the circular economy within government departments and industry players. The Association of Southeast Asian Nations (ASEAN)'s Circular Economy Framework2 has encouraged region-wide cross-sectoral collaboration on knowledge and technology sharing in this area.

Unknowns around circular financing

Financing is a necessity for the scaling of circular economy solutions which are estimated to potentially bring US$324 billion economic growth in Asia.3 Yet, circular investments seem to be less attractive due to potentially long Return on Investment (ROI) and perceived / real risks related to innovative and first-of-their-kind solutions. Southeast Asia also faces another challenge to improve access to financing for Micro, Small and Medium Enterprises which are the backbone of the region’s economy, contributing to almost 45% of the region’s GDP.4 These factors - together with a lack of incentives - delay the circular-economy transition.

What are the roles for governments and the public sector in driving a circular transition?

Governments play a foundational role in creating an effective ecosystem for businesses and other stakeholders to transition to circularity.

Impact assessment

One of the first starting points is to do a baseline assessment on the impacts and opportunities. This includes assessing the impacts of the international policy environment and global circular transition on the regional / national / local economy. To ensure an inclusive approach, impacts of the circular transition on society - such as informal workers - should also be considered. It is also a good opportunity to understand how circularity can potentially help to achieve other environmental goals such as emissions reductions and biodiversity protection.

Barriers and enablers identification

Understanding the barriers and enablers to the identified circular economy opportunities are crucial to developing more targeted initiatives and a robust policy framework. For example, upskilling can help prepare the workforce to be ready for the circular transition.

Ambition and strategy development

Circular ambition, strategy and targets are essential to align stakeholders on the overall direction. Prioritisation of focus sectors which are most relevant to the country should ideally be part of the national circular strategy. Short, medium and long-term action plans should also be developed to clarify the resources required and the timeframe needed to achieve implementation.

Policy framework development

Policy and regulatory frameworks to enable a broad transition to the circular economy should be developed. It is also important to ensure such policy options are coherent and would help in addressing the relevant barriers including in the priority sectors. This covers not only the development of new regulations but also the adaptation of existing regulations to ensure there is an enabling environment for businesses to adopt circularity, such as waste taxes.

Financing

Implementing circular economy solutions often requires more capital and investments due to changes in operating models and new technology implementation. Financial incentives such as tax exemptions or subsidies are key to driving the adoption of the circular economy, particularly where the ROI is uncertain or on a longer-term horizon. It is also crucial to enable new innovations through sufficient R&D investments as well as to ensure long-term scalability through funding pilot projects.

Awareness and education

Governments can roll out campaigns to promote awareness and educate stakeholders in the circular-economy ecosystem. The campaigns can cover the benefits, emerging policies and the stakeholders’ roles. These can encourage consumers to make informed choices on their consumption behaviours and drive businesses to transition.

Various policy options for governments to encourage a circular economy

There are various policy options and drivers to encourage a circular economy. Often, the development of these policy options would involve multiple cross sectoral agencies, considering the scale and extent of potential impacts.

Extended Producer Responsibility (EPR) policies

- EPR or product stewardship policies place the responsibility for environmental impacts of products throughout the product life cycle on producers

- These policies require the creation of new systems for waste collection, processing and re-utilisation

- This can be a complex process involving the set up of new governance mechanisms, price points, and reverse logistics

Waste management policies that encourage circular economy practices

- Applying a circular economy lens to waste management involves considering how waste can be minimised and how materials can be recovered and diverted from landfill

- Waste management policies which incorporate circular principles will consider the hierarchy of different solutions and the benefits for value recovery and emissions reductions

Product policies that support circular practices

- Support circular practices relating to the design, manufacture, distribution or import of specific products and materials

- The European Union (EU) will be the first to implement advanced product policies, with a design criteria for packaging as well as mandatory rates of recycled content

Fiscal policies that incentivise circular economy practices

- Fiscal policies include taxes, incentives and spending policies that incentivise circular practices. Examples include waste-to-landfill levies, tax exemptions for companies providing circularity-enabling technologies, automation capital allowances, and investment in R&D.

National circular economy policies

Holistic policies which highlight the benefits of a circular transition (environmental, economic, social), key economic sectors to target, any potential trade-offs to mitigate against, including actions and targets for key sectors to begin a transformation

Public procurement policies

Setting circular-economy aligned requirements for public purchasing stimulates the market for circular products and services

Public procurement guidelines as a reference point for the private sector to set similar guidelines for their supply chain

Strategy and regulatory framework developments on the circular economy in Southeast Asia

In Southeast Asia, we are starting to see a bigger push from government agencies and regulators towards circular transition in the form of strategies, roadmaps and regulatory frameworks. These include regional and national circular frameworks, roadmaps and policies, waste management policies as well as EPR policies. There appears to be a strong focus, particularly on waste management and EPR policies in the recent regulatory developments across the region.

As the region begins to implement and enforce the EPR requirements, particularly on plastic packaging and e-waste, the regulatory framework landscape may continue to evolve to embed lessons learned and accommodate the unique challenges to the region. Below is a non-exhaustive list of such developments on circularity that will impact a range of sectors:

How can PwC support our public sector clients in their circular transition?

At PwC, we use the following steps to support our public sector clients in developing and delivering a circular transition strategy.

Re-imagine

- How are enabling technologies, regulations and customer demands around circularity changing?

- What are the impacts and costs of inaction?

- What are the circular opportunities across sectors?

Choose

- How fit-for-the-future are your circular strategy and prioritised sectors?

- What is your circular ambition for the future?

- What are key differentiating capabilities you can leverage to become circular and which capabilities do you need to develop?

Enable

- Which capabilities do you need to focus on to materialise your circular strategy?

- What initiatives / investments are required to build these capabilities?

- Which policy frameworks and stakeholder collaboration is required to enable a circular transition?

Plan / launch pilot

- What is the financial impact of the circular transition?

- What does the execution roadmap and immediate action plan look like?

- What are the critical enablers that need to be in place?

- How to create national / sectoral wide buy in for the circular transition?

- Which initiatives should be piloted?

Monitor and expand

- How are sectoral initiatives tracking against the targets and KPIs?

- What are the barriers and challenges in implementing the circular initiatives?

- What support is required to have a seamless circular transition?

- Which initiatives should be scaled up to achieve the national / sectoral-wide target?

References

1. PwC, “The road to circularity”, 2019

2. ASEAN, “Framework for Circular Economy for the ASEAN Economic Community”, 2021.

3. Economic Research Institute for ASEAN and East Asia, Industry 4.0 Empowering ASEAN for the Circular Economy, 2018.

4. ASEAN, Resilient and Inclusive ASEAN, 2023.

5. ASEAN, “Framework for Circular Economy for the ASEAN Economic Community”, 2021.

6. Republic of Indonesia, THE NATIONAL MEDIUM-TERM DEVELOPMENT PLAN FOR 2020-2024, 2020.

7. UNDP, Circular Economy Strategies for Lao PDR, 2017.

8. Economic Planning Unit, The Twelfth Malaysia Plan 2021-2025 (Twelfth Plan), 2021.

9. National Economic and Development Authority, PHILIPPINE ACTION PLAN FOR SUSTAINABLE CONSUMPTION AND PRODUCTION (PAP4SCP), 2020.

10. PwC Philippines, Highlights of the Extended Producer Responsibility Act, 2022.

11. SG Green Plan, Singapore Green Plan 2030, 2021

12. National Science and Technology Development Agency, BCG Model, 2021.

13. Vietnam Briefing, Vietnam’s Circular Economy: Decision 687 Development Plan Ratified, 2022

Contact us

Partner, Workforce Transformation, PwC South East Asia Consulting, PwC Singapore

Tel: +65 9660 5011

International Development Leader, South East Asia Consulting, PwC Singapore

Tel: +65 9750 3775