On-Site Inspection and Internal Model Investigations

What is an On-Site Inspection / Internal Model Investigation?

The European Central Bank (ECB) has supervisory authority over significant institutions and exercises this via on- and off-site supervision. The goal is to create a detailed understanding of an institution’s business model, risk environment, internal control framework and governance. Each entity is supervised by a Joint Supervisory Team (JST), made up equally of members of the ECB and of the respective national competent authorities. Their supervision is either performed through On-Site Inspections (OSIs) or Internal Model Investigations (IMIs) – going ahead, we will use the term inspection to define both.

What does an On-Site Inspection or an Internal Model Investigation entail?

Common objectives of inspections are to provide a deep, structured analysis of an entity’s:

- risk exposure

- governance and internal control framework in regards to said exposure

- risk management process

- business model

- quality of balance sheet items

- financial situation as a whole

- compliance with regulatory requirements

On-Site Inspections usually focus on the risk management approach in a holistic manner, while Internal Model Investigations dive deeply into the methodology and assumptions behind models used by the entity to calculate own funds and other important performance indicators.

All supervisory authority exercises are individual, tailored exclusively to the entity in question. Areas with high risks or perceived low levels of internal control are subject to more vigorous supervision, proportionate to the size and business approach of each entity. Each inspection is geared towards solving problems not only facing the entity now, but in the future, as well, with direct pain points identified and a timeline set to solve the problems.

On-site supervision

Performed by Joint Supervisory Teams (JST) with members from the European Central Bank and national competent authorities

Common objectives

- appraise & determine the entity's level of inherent risk exposure as well as its risk culture

- appraise & determine the quality of the entity's governance & internal control framework in regard to its risk exposure

- appriase the control environment & risk management process, taking specific steps to ensure that faults are disocvered & effects on own funds are minimized

- appraise the business model, the quality of balance sheet items, as well as the financial situation of the inspected entity

- determine the entity's level of compliance with regulatory premises, as well as the use of internal models, especially when used to determine own capital requirements

Inspections and investigators are:

- Risk based: prioritizing areas with perceived higher risk or lower level of control

- Proportionate: scaled according to the size, business model, and risk environment of the entity

- Intrusive: detailed and thorough examination of an entity

- Forward looking: anticipating possible future developments

- Action-oriented: direct objectives are identified and fulfillment monitored by the supervisory team

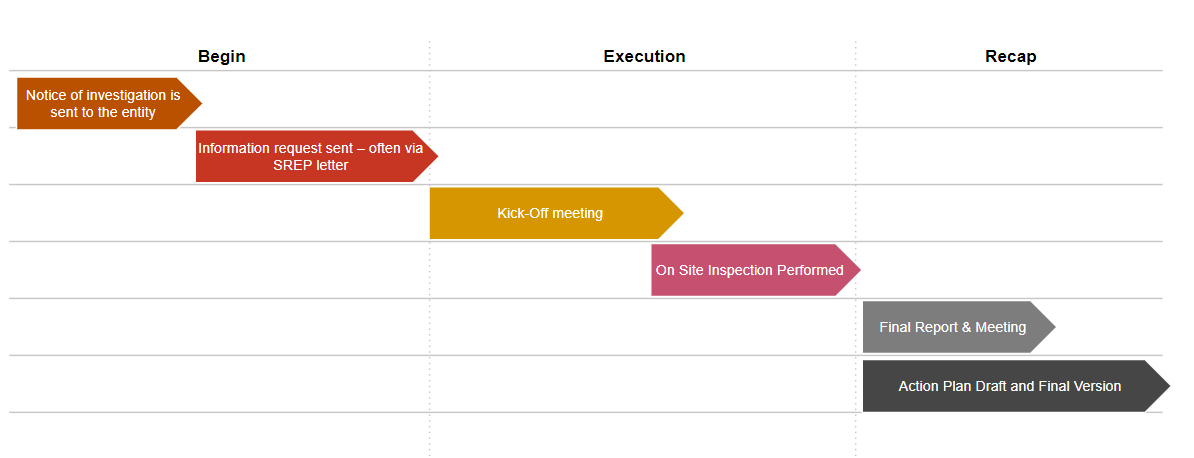

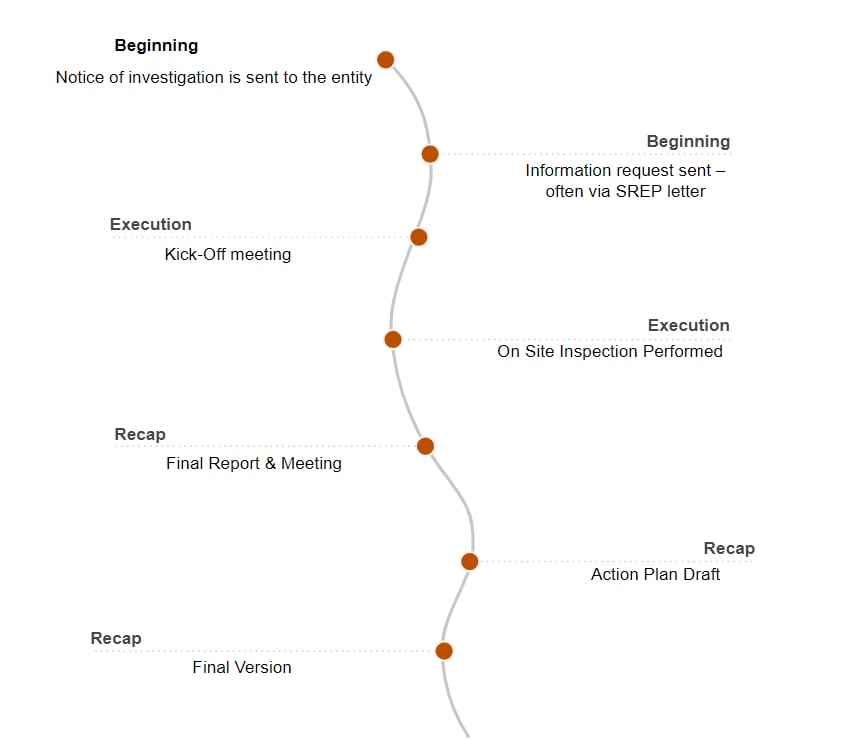

What is the timeline?

Every inspection starts with a written notice informing the entity of a supervisory exercise. This is then followed up with an information request, which encompasses the necessary requirements the supervisory team expects to be made available for them. They can range from office space to be made available, to an organisational chart of an entity, to process descriptions or data tapes.

After this data has been delivered, a formal kick off meeting is held, which marks the start of the inspection or investigation. Attending are the members of the supervisory team, the responsible entity teams including members of the management body and, optionally, members of the JST. The size and scope of the exercise is explained, while the entity usually gives a presentation on its structure, business model and strategy.

The inspection is now formally under way, with various techniques applied by the supervisory team. These can include:

- Observations, authentication of information and analysis

- Interviewing staff

- Procedural walkthroughs

- Sampling and inspecting

- Performing data checks

- Testing the models used

After the inspection has been concluded, a report is drafted and findings are discussed with the entity. Findings are categorized by the size of impact they have on an entity’s financial situation, level of own funds or own funds required by the supervising authority:

- F1: Low Impact

- F2: Moderate Impact

- F3: High Impact

- F4: Very High Impact

The draft gives the entity an opportunity to provide written feedback on various findings. The report is then finalised, and in case of OSIs either a draft follow-up letter that includes an action plan to address the findings that require action in the report or a draft decision which authorises immediate supervisory changes is written.

In the case of IMIs, a draft decision communicating the result of an application for a model approval or model change approval or model assessment is written and sent to the supervisory authority.

What services does PwC offer?

Our specialists are happy to advise you on the challenging process of OSIs & IMIs. PwC supports you in keeping an eye on the regulatory changes, taking strategic measures at an early stage and optimally designing your approach to supervisory exercises.

We can provide support before the first kick off meeting by coordinating the delivery of all required documents and data, preparing them for review and even finding and solving shortcomings before the supervisory authority does – giving you an edge in future discussions.

During the inspection we can act as project managers, coordinating the organisation and preparation of documents, interviews, and data. Our specialist teams are on hand to answer any and all questions posed by the inspectors, either in writing or verbally in interviews. After the inspection, we also provide follow up workshops with members of your team, to structure responses and to-do’s to the action items mandated by the supervisory team.

We also provide interview training to familiarise you with the situation of being asked challenging questions by the inspection team. Through our constant exchange with the ECB and the local banking supervisory authorities, we have an understanding of their expectations.

- Preparation

- Operative Execution (PMO)

- Operative Execution (Specialist)

- Interview training

Preparation

- Support in the compilation of all necessary documents and records required for the inspection

- Quality assurance on the documents and records to be prepared for supervision. We will work out possible critical issues and - if necessary - prepare them within the framework of a presentation

Operative Execution (PMO)

- Support in the organization and implementation of an on-site inspection process

- Support in the preparation of documents for interviews

Operative Execution (Specialist)

- Answering specialist questions before and during the inspection (also by PwC's specialist departments) and preparing them in writing

- Participation in interviews with the supervisor

- Follow-up of workshops with auditors and supervisors (structuring of further procedure, to-dos, lessons learned, etc.)

Interview training

- Teaching of overarching rules of conduct in the examination

- Training of interview partners

Contact us - we will be happy to work with you on the preparation and execution of any inspections.

Contact us