How we help with entity governance and compliance

Entity governance and compliance

Governance and compliance missteps can be costly; and litigation, reputational damage and financial penalties can quickly derail your growth. Yet it’s challenging to keep up with regulatory changes and multinational governance and compliance requirements.

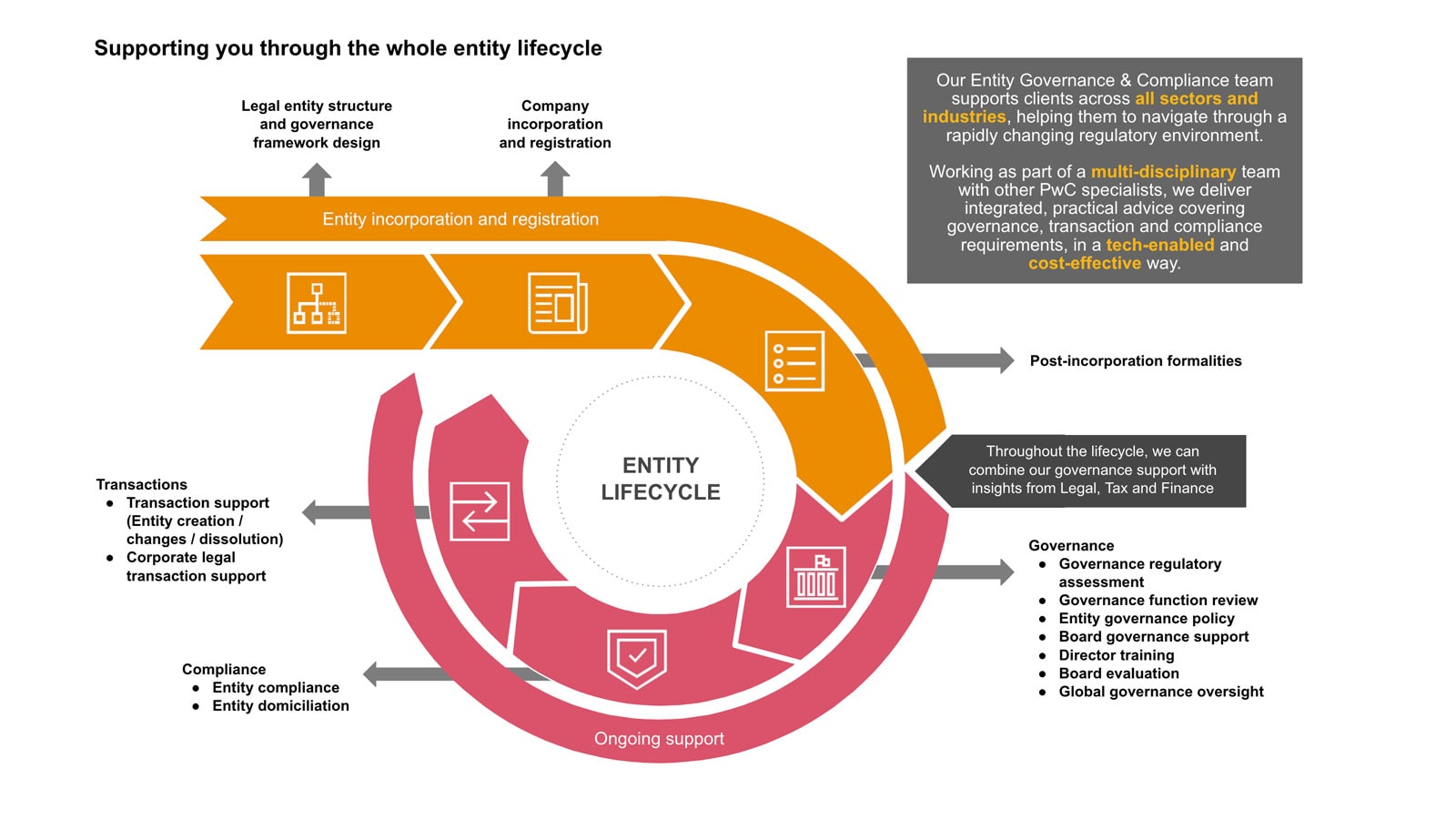

PwC can help. Our Entity Governance & Compliance practice works in concert with other PwC specialists, like tax and consulting experts, to give you practical, insightful full-scale advice on governance, transactions and compliance. Our tech-enabled approach connects you to a global network of governance experts, all focused on helping you navigate governance, transactions and compliance issues in a cost-effective way.

Explore our services

Governance

PwC can support your entire governance agenda, delivering the insights, processes and systems required to help you and your parent and subsidiary boards thrive.

We perform governance regulatory assessments against existing or future regulations, helping you to identify gaps in your governance infrastructure. Similarly, our governance function reviews can benchmark and assess your governance arrangements against local regulatory requirements and best practice, identifying any areas of focus or improvement required. Solutions may include designing and embedding Entity Governance Policies or the provision of training for directors, governance teams or key stakeholders.

On an ongoing basis, PwC specialists can help you strengthen your governance oversight through global board governance support, bespoke governance digital solutions and board evaluations.

Our Governance services in practice:

We recently helped a multinational industrial services group improve regulatory governance and stay on top of rapidly changing legislation. PwC reviewed the group’s existing regulatory framework and corporate governance reporting structure against the UK Wates Corporate Governance Principles, corporate criminal offence legislation and directors’ duties legislation. We also assessed the group’s readiness for anticipated legislative change. Our governance review highlighted the need for a more formalised governance approach, changes to the group’s delegations of authority, and a new governance role with responsibility over the entire organisation.

Transactions

We support every step in the legal entity transactions process, from entity creation and corporate changes to more complex intra-group transactions and corporate issolutions. Combining our global network of specialists with locally relevant governance and legal expertise, we help you to identify and manage the governance requirements of your transaction. This in turn, allows you to ensure that your transaction documents and filings remain compliant with local processes, requirements and timelines, and helps minimise risk.

With PwC by your side, you can navigate the governance complexities of group reorganisations / restructures, post-deal integrations, corporate simplifications and cash repatriations, and execute them with confidence. Using our bespoke technology solutions we can also automate and track the approval and execution process globally, giving you peace of mind and a clear audit trail around completion.

Our Transaction support in practice:

We recently assisted a global group with a European wide entity simplification programme.

PwC’s multi-disciplinary team of Governance, Corporate Legal and Tax specialists worked with management to design the steps required to implement the corporate simplification objectives. This included preparing all operating agreements and corporate approvals, designing the governance structure needed to execute the programme, and determining the relevant dissolution method for all target entities (liquidation, domestic merger, strike-off) using a risk based approach. Following completion, we reviewed the organisation’s approach to corporate governance and compliance, facilitating maintenance of the new structure and helping the business meet EU regulatory obligations moving forward.

Compliance

We help clients maintain, track and monitor the good legal standing of legal entities around the world, using an efficient, tech-enabled approach.

We support clients globally, with the maintenance of statutory registers and filings, project managing approval and filing processes for annual financial statements, responding to entity governance and compliance related queries, and providing clear document execution guidance and support to directors.

Clients gain comfort through KPIs and dashboard reporting, providing oversight, insight and continuous improvement on a global basis.

Our Compliance services in practice:

We act as the corporate secretarial service provider to a diversified global manufacturing company, with over 200+ entities across 40+ jurisdictions.

Reporting into the company’s chief legal counsel for corporate finance and transactions, we support the organisation with both corporate secretarial and corporate legal services. The relationship began with a detailed governance regulatory assessment to identify problem areas, fix any issues and help bring the group subsidiaries into good legal standing. We now help the organisation manage a detailed, global compliance calendar, staying attuned to potential issues and maintaining their central legal entity management database. Working together, we minimise risk and strengthen compliance.

Contact us

Jonathan Gibson

Entity Governance & Compliance Leader, PwC United Kingdom

Tel: +44 20 7213 8038

© 2017 - 2026 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.