Fraser Papers Inc. and Subsidiaries

CCAA Filing Information

Page last updated: August 17, 2011

This page is for information purposes only and you should consult your professional adviser if you have any questions or are uncertain as to your rights or obligations.

On June 18, 2009, Fraser Papers Inc. and all its subsidiaries ("the Companies") filed for protection from its creditors under the Companies' Creditors Arrangement Act ("CCAA") (the "Filing"). PricewaterhouseCoopers Inc. was appointed as monitor ("the Monitor") pursuant to the CCAA proceedings. A copy of the Initial Order of the Canadian Court is available in the Court Orders section of this website, as amended.

The Companies also filed for protection pursuant to Chapter 15 of the US Bankruptcy Code in the United States. Copies of the Chapter 15 material are available in the Chapter 15 sections of this website.

A Claims Order establishing a claims process was approved by the Court in July 2009. Pursuant to the Claims Order, the claims bar date was September 30, 2009, except in respect of employee and former employee related claims, where the claims bar date was October 30, 2009. If you have a claim resulting from a post-filing action taken by the applicants or if your employment was terminated after June 18, 2009, you may have a claim against the Company that is referred to as a "Restructuring Claim". If that occurs, you are required to file a Proof of Claim to the Monitor the earlier of 30 days from the date of the post-filing action or your termination or 14 calendar days after Plan Implementation as defined in the Companies’ Consolidated Plan of Compromise and Arrangement dated November 29, 2010 (the “Plan”). If you do not file a Proof of Claim with the Monitor within the required period, you will be claims barred and will not be able to file a claim at a later date or participate in the Plan. Please note that the change to the deadline for filing Restructuring Claims was approved by the Court on December 3, 2010.

On November 29, 2010, Fraser Papers Inc. and its subsidiaries (collectively, the “Applicants”) filed a consolidated plan of compromise and arrangement (the “Original Plan”) with the Ontario Superior Court of Justice (Commercial List) (the “Court”) in their restructuring proceedings under the Companies’ Creditors Arrangement Act (“CCAA”).

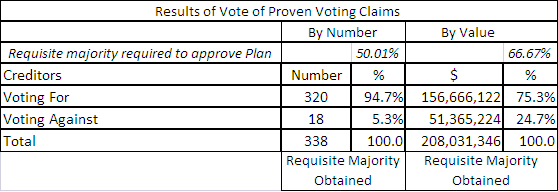

A meeting of creditors was held on January 10, 2011 to consider and vote on a resolution to approve the Original Plan. The requisite majority of creditors (by value) required to approve the Original Plan pursuant to the CCAA was not obtained and the Original Plan was rejected.

On January 27, 2011, the Applicants filed an amended consolidated plan of compromise and arrangement (the "Amended Plan") with the Court.

At a hearing on February 1, 2011, the Court accepted the filing of the Amended Plan and authorized the Applicants to, among other things, hold another meeting of their Affected Creditors on February 8, 2011 in Toronto, Ontario to consider and vote on the Amended Plan. The Amended Plan and associated meeting materials can be found in the Plan of Arrangement section of this website.

The Applicants and the Monitor held a number of conference calls in December 2010 in order to help Affected Creditors understand the Original Plan, the voting procedures and to provide a forum for questions to be asked of the Applicants and the Monitor regarding the Plan. The slide presentation from the Creditor Information Calls and recordings of the Creditor Information Calls are available in the Creditor Information Calls section of this website.

If you have any questions on the Amended Plan or the voting process, please consult the answers to frequently asked questions found in the Plan of Arrangement section of this website, or you may contact us at 416-815-5118 or 1-877-332-1688. This website will be updated frequently as new information becomes available.

Status of file as of August 17, 2011

Further to the termination of the CCAA Proceedings, the Monitor has completed its Twentieth and Final Report, a copy of which has been posted to the Monitor's Reports to Court section of this Website. As the proceedings have been completed and the Monitor has been discharged, no further information or updates will be posted to this website.

For information and updates on the status of the General Creditor Trust and future distributions, please visit the Fraser Papers Inc. General Creditor Trust Website.

Status of file as of June 23, 2011

In accordance with the terms of the Applicants’ Amended Plan of Compromise and Arrangement dated January 27, 2011 and the Sanction Order dated February 10, 2011, the Final Determination Date has now occurred and the Applicants’ CCAA Proceedings have been terminated. A copy of the Monitor's Second Certificate can be found on the Completion/Discharge section of the Monitor's website.

A final Monitor’s Report will be circulated to the Service List and posted on the Monitor’s website in due course.

Status of file as of May 25, 2011

At a Court hearing on May 20, 2011, the Canadian Court issued an Order:

- extending the Stay Period to the earlier of the CCAA Termination Date and August 31, 2011;

- granting the Monitor authority to undertake and complete the administrative functions and activities of the Applicants it deems necessary to complete the CCAA proceedings, including signing authority on behalf of the Applicants from the date of the resignation of Glen McMillan as Chief Restructuring Officer of the Applicants;

- directing the sole remaining Director to dissolve Fraser Papers Inc. by issuing a dissolution certificate on the CCAA Termination Date as defined in the Sanction Order;

- granting custody of the Applicant's corporate records to Brookfield on the CCAA Termination Date. Custody of the documents thereafter is to be addressed in accordance with section 225(1) of the CBCA; and

- requiring any residual property of Fraser Papers Inc. that is received by any person after the dissolution of Fraser Papers to be delivered to PwC for distribution by PwC in accordance with the Plan.

A copy of the Court Order and the endorsement of Justice Morawetz can be found in the Court Order section of this website.

Status of file as of April 19, 2011

The Applicants have filed a Notice of Motion, returnable April 20, 2011, seeking:

- (1) an Order extending the stay of proceedings to the earlier of May 31, 2011 or the CCAA Termination Date (as defined in the Sanction Order of the Honourable Madam Justice Pepall dated February 10, 2011); and

- (2) an Order authorizing and directing Glen McMillan, the Chief Restructuring Officer of the Applicants to execute all necessary resolutions and documentation to terminate the following benefit plans:

- (i) The Fraser Papers Inc. Defined Contribution Pension Plans;

- (ii) The Fraser Papers Inc. Supplemental Employee Retirement Plan;

- (iii) The Fraser Papers Inc. Deferred Stock Unit Plan for Non-Employee Directors;

- (iv) The Fraser Papers Inc. Stock Option Plan;

- (v) The Fraser Papers Inc. Management Deferred Share Unit Plan;

- (vi) The FPS Canada Inc. Health and Welfare Plan and FPS Canada Health and Welfare Trust Fund; and

- (3)such other relief as court deems just.

The Applicants' Motion Material is available in the Motion Materials section of this website. The Monitor's Nineteenth Report is available in the Monitor's Reports to Court section of this website.

Status of file as of April 1, 2011

On March 18, 2011, the Applicants brought a motion before the Canadian Court seeking a Supplemental Vesting Order:

- (i) vesting in Twin Rivers Paper Company Inc. (the “Canadian Purchaser”) all of the Applicants’ right, title and interest in certain New Brunswick real property free and clear of certain encumbrances; and

- (ii) releasing and discharging certain additional claims and encumbrances against certain New Brunswick real property.

The Supplemental Vesting Order was being sought in connection with the Approval and Vesting Order of the Canadian Court dated April 6, 2010, which approved the sale of the Applicants’ Specialty Paper Business to the Canadian Purchaser and contemplated that the Canadian Purchaser may seek further Orders of the Canadian Court to address issues in respect of title to the New Brunswick real property after the Approval and Vesting Order was granted.

At the motion on March 18, 2011, the Canadian Court had concerns regarding notice of the Applicants’ motion record upon parties with a possible interest in certain mortgages that were to be released and discharged from title to certain of the New Brunswick real property and requested that additional evidence be filed with the Canadian Court to address such matters. The motion was adjourned to a date and time to be determined by the Canadian Court and will be held by teleconference.

The Applicants’ Motion Material in respect of this motion is available in the Motion Materials section of this website.

Status of file as of March 1, 2011

On February 25, 2011, the Monitor issued the Implementation Payment pursuant to sections 4.04 & 4.05 of the Applicants' Amended Plan.

In accordance with the Sanction Order issued February 10, 2011, withholding taxes have not been deducted from the Implementation Payment. Employees or former employees of the Applicants are required to declare the Implementation Payment as income in their 2011 income tax return.

The Implementation Payment has been distributed by regular mail. If you are an Affected Creditor with a Distribution Claim and have not received your Implementation Payment by March 11, 2011, please contact the Monitor at 1-877-332-1688 or FPclaims@ca.pwc.com.

Status of file as of February 16, 2011

On February 15, 2011, the Applicants closed the Transaction Agreement dated November 25, 2010. In accordance with its Sanction Order dated February 10, 2011, the Amended Plan of Compromise and Arrangement dated January 27, 2011 has now been implemented with a Plan Implementation Date of February 15, 2011. The Implementation Payment to creditors pursuant to the Amended Plan is expected to be distributed prior to February 28, 2011,

The closing of the Transaction Agreement concludes the restructuring. Information on the Creditors Trust will be available on this website shortly.

Any questions in respect of the Maine lumber mills should be directed to the mill. Questions with respect to the CCAA filing should still be directed to the Monitor or the Applicants legal counsel, ThorntonGroutFinnigan LLP.

Status of file as of February 14, 2011

At a court hearing on February 10, 2011, the Canadian Court issued:

- a Sanctioning Order approving and sanctioning the Amended Consolidated Plan of Compromise and Arrangement dated January 27, 2011, as amended since that date ("Amended Plan");

- a Trust Order approving the terms of the Creditor Trust Agreement among the Applicants and the trustee; and

- A Vesting Order granting approval of the Transaction Agreement dated November 25, 2010 ad authorizing the Applicants to execute and deliver all definitive documentation to permit the closing of the transaction contemplated by the Transaction Agreement.

At a court hearing in the United State Bankruptcy Court on February 11, 2011, the US Court issued an Order recognizing the Canadian Court Orders (above) and approving the Applicant's Amended Plan and Transaction Agreement.

The Monitor expects the sale to close on February 14 or 15, 2011.

Status of file as of February 8, 2011

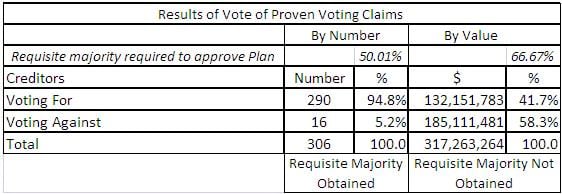

Pursuant to the Supplemental Meeting Order (issued and approved by the Canadian Court on January 31, 2011), a Meeting of Creditors was held at 10:00 AM on February 8, 2011 to consider the Applicants' Amended Consolidated Plan of Compromise and Arrangement, dated January 27, 2011 and subsequent amendments thereto (the "Amended Plan"). At the vote, the Amended Plan was approved by a sufficient majority of the voting Affected Creditors by value, as set out below.

The Communications, Energy and Paperworkers Union of Canada (the "CEP") and Morneau Shepell Ltd. (formerly Morneau Sobeco) ("Morneau") filed Duplicate Claims in the amount of $110,139,269 in respect of the NB Hourly Plan. At the Meeting of Creditors held on February 8, 2011 (the "February Creditors Meeting"), Morneau voted in favour of the Amended Plan, while CEP voted against the Amended Plan. Pursuant to paragraph 26 of the Meeting Order dated December 3, 2010, the votes of Duplicate Claims are only to be counted by the Monitor in the event that the votes in respect of the Duplicate Claims are not contradictory. As the votes filed by Morneau and CEP were contradictory, the vote in respect of the NB Hourly Plan was not counted by the Monitor or included in the tabulated results above. Additional information on the February Creditors Meeting will be provided in the Monitor's Eighteenth Report

Status of file as of February 5, 2011

The Applicants have filed a Notice of Motion, returnable February 10, 2011, seeking:

- a Sanctioning Order approving and sanctioning the Amended Consolidated Plan of Compromise and Arrangement dated January 27, 2011 as amended since that date ("Plan") on the assumption that the Plan is approved by the Required Majority of the Unsecured Creditor Class at the Meeting of Creditors to be held on February 8, 2011;

- a Trust Order approving the terms of the creditor trust agreement among the Applicants, as settler of the trust, and the trustee, PricewaterhouseCoopers Inc. ("Creditor Trust Agreement");and

- a Vesting Order granting approval of the transaction agreement dated November 25, 2010 among the Applicants as vendors and Plan proponents, and Brookfield Asset Management Inc. or its designate, as Plan sponsor (the "Plan Sponsor") (the "Transaction Agreement") and authorizing the Applicants to execute and deliver all definitive documentation to permit the closing of the transaction contemplated by the Transaction Agreement; and

- such further and other relief as the Court may deem just.

The Applicants' Motion Material is available in the Motion Material section of this website. The Monitor's Report will be posted to this website when available.

Status of file as of January 31, 2011

The Applicants have filed a Notice of Motion, returnable February 1, 2011, seeking a Supplemental Meeting Order from the Ontario Court:

- (i) accepting the filing of an Amended Consolidated Plan of Compromise or (sic)Arrangement concerning, affecting and involving the Applicants dated January 27, 2011 (the "Plan");

- (ii) authorizing and directing the Applicants to call, hold, and conduct a further meeting of their creditors, to consider and vote on the Amended Plan (the "February Meeting") on February 8, 2011;

- (iii) establishing the procedures as to the calling and conduct of the February Meeting and approving the February Meeting Materials;

- (iv) setting a date for the hearing of the Applicants' motion seeking a Order sanctioning the Amended Plan;and

- (v) such further and other relief as the Court may deem just.

The Applicants' Motion Material are available in the Motion Material section of this website. The Monitor's Report will be posted to this website when available.

Status of file as of January 10, 2011

Pursuant to the Meeting Order (issued and approved by the Canadian Court on December 3, 2010), a Meeting of Creditors was held at 10:00 AM on January 10, 2011 to consider the Applicants' Consolidated Plan of Compromise and Arrangement, dated November 29, 2010 and subsequent amendments thereto (the "Plan"). At the vote, the Plan was not approved by a sufficient majority of the voting Affected Creditors by value, as set out below.

The Monitor understands the Applicants and the DIP Lender are considering their next steps in light of the creditors rejection of the Plan. The scheduled Court hearing on January 12, 2011 has not been cancelled. An affidavit from the Applicants and an update report from the Monitor are expected to be filed shortly.

Status of file as of January 7, 2011

The Applicants have filed a Notice of Motion, returnable January 12, 2011, seeking:

- a Sanctioning Order approving and sanctioning the Consolidated Plan of Compromise and Arrangement dated November 29, 2010 as amended since that date ("Plan") on the assumption that the Plan is approved by the Required Majority of the Unsecured Creditor Class at the Meeting of Creditors to be held on January 10, 2011;

- a Trust Order approving the terms of the creditor trust agreement among the Applicants, as settler of the trust, and the trustee ("Creditor Trust Agreement");and

- a Vesting Order granting approval of the transaction agreement dated November 25, 2010 among the Applicants as vendors and Plan proponents, and Brookfield Asset Management Inc. or its designate, as Plan sponsor (the "Plan Sponsor") (the "Transaction Agreement") and authorizing the Applicants to execute and deliver all definitive documentation to permit the closing of the transaction contemplated by the Transaction Agreement; and

- such further and other relief as the Court may deem just.

The Applicants' Motion Material is available in the Motion Material section of this website. The Monitor's Report will be posted to this website when available.

Status of file as of December 20, 2010

On December 16, 2010, the Applicants concluded the sale of the Gorham Mill to Counsel RB Capital, LLC.

Any questions in respect of the Gorham Mill should be directed to Counsel RB Capital, LLC. Questions with respect to the remaining operations of the Applicants or the CCAA filing should still be directed to the Applicants and/or the Monitor.

On December 17, 2010, the Court issued an Order amending paragraph 25 of the Meeting Order dated December 3, 2010 to clarify the treatment of the claims of 20 former members of the IBEW under the Plan of Arrangement and Compromise. A copy of the Order can be found in the Court Orders section of this website.

Status of file as of December 9, 2010

At a court hearing held on December 3, 2010, the Canadian Court issued an Order:

(i) accepting the filing of a Consolidated Plan of Arrangement concerning, affecting and involving the Applicants dated November 29, 2010 (the "Plan");

(ii) authorizing and directing the Applicants to call, hold, and conduct a meeting of their creditors, to consider and vote on the Plan (the "Meeting");

(iii) establishing the procedures as to the calling and conduct of the Meeting and approving the Meeting Materials;

(iv) setting a date for the hearing of the Applicants' motion seeking a Order Sanctioning the Plan; and

(v) approving the sale of the Gorham Mill and vesting the assets in the purchaser, Counsel RB Capital, LLC. The closing of the sale was scheduled to occur on December 8, 2010. The Monitor understands that the Asset Purchase Agreement was amended on December 6, 2010 to extend the closing to December 16, 2010.

On December 8 and 9th, 2010 the Monitor distributed a copy of the Plan and associated Meeting Materials to Affected Creditors in accordance with the Meeting Order. The meeting of creditors to consider and vote on the Plan will be held in Toronto at the Hyatt Regency Hotel at 10am (EST) on January 10, 2011. A copy of the Plan and associated Meeting Materials can be found in the Plan of Arrangement Section of this Website.

In order to help Affected Creditors understand the Plan, the voting procedures and provide a forum for questions to be asked of the Applicants and the Monitor regarding the Plan, conference calls will be held at the dates and times shown below (all Eastern Standard Time), using this dial in number: 1-866-223-7781. Affected Creditors will be asked which call they want to participate in (the answer is the Fraser Papers Information Call) and to provide their name or company name as provided in their proofs of claim. Due to the large number of participants, you are asked to dial in at least twenty minutes before the conference call time.

- Affected Creditors who are employees/former employees: Friday, December 17, 2010 @10:00 a.m. (in English)

- Affected Creditors who are trade creditors: Friday, December 17, 2010 @ 2:00 p.m. (in English)

- Affected Creditors who are employees/former employees: Monday, December 20, 2010 @ 10:00 a.m. (in French)

Status of file as of November 30, 2010

The Applicants have filed Motion Material, returnable December 3, 2010, seeking a Meeting Order from the Ontario Court:

- (i) accepting the filing of a Consolidated Plan of Arrangement concerning, affecting and involving the Applicants dated November 29, 2010 (the "Plan");

- (ii) authorizing and directing the Applicants to call, hold, and conduct a meeting of their creditors, to consider and vote on the Plan (the "Meeting") on December 20, 2010;

- (iii) establishing the procedures as to the calling and conduct of the Meeting and approving the Meeting Materials;

- (iv) setting December 22, 2010 as the date for the Canadian Court hearing of the Applicants' motion seeking a Order Sanctioning the Plan;and

- (v) such further and other relief as the Court may deem just.

The Applicants' Motion Material are available in the Motion Material section of this website. The Monitor's Report will be posted to this website when available.

Status of file as of November 24, 2010

At a court hearing held on November 22, 2010, the Canadian Court issued an Order approving the sale of the Gorham Mill and vesting the assets in the purchaser, M & M Consulting and Contracting LLC. The Monitor understands that the closing of the sale is scheduled on or around November 30, 2010.

At a Court hearing in the United States Bankruptcy Court on November 22, 2010, the US Court issued a Supplemental Order recognizing the Canadian Court Order (above) and authorizing and approving the sale of the Gorham Mill and related assets free and clear of all liens, claims and encumbrances.

The Canadian Court Order can be found in the Court Orders section of this website. The United States Court Order can be found in the Chapter 15 Court Orders section of this website.

Status of file as of November 16, 2010

The Applicants have filed Motion Material, returnable November 19, 2010, seeking an Order:

- (i) approving the sale transaction contemplated by an asset purchase agreement between Fraser N.H. LLC, as vendor and M & M Consulting and Contracting LLC, as purchaser dated November 3, 2010 and authorizing the applicants to execute and deliver all definitive documentation to permit the closing of the Purchase Agreement in accordance with the draft Order filed at Tab 3 of the Applicants Motion Record; and

- (ii) an Order vesting in M & M Consulting and Contracting LLC all the right, title, and interest in Fraser N. H. LLC in the Purchased Assets (as defined in the Purchase Agreement) free and clear of all liens, charges and encumbrances save and except the Permitted Encumbrances as defined in the Purchase Agreement, upon the closing of the transaction contemplated by the Purchase Agreement; and

- (iii) such further and other relief as the Court deems just.

The Applicants' Motion Material are available in the Motion Material section of this website. The Monitor's Report will be posted to this website when available.

Status of file as of November 1, 2010

The Applicants have filed motion material, returnable November 3, 2010, seeking an Order:

(i) extending the stay of proceedings to February 28, 2011;

(ii) authorizing and directing the Applicants to proceed in the preparation of a Plan of Arrangement on the basis of substantive consolidation of all Applicants; and

(iii) such further and other relief as the Court deems just.

The Applicants' Motion Materials are available in the Motion Materials section of this website. The Monitor's Report will be posted to this website when available.

Status of file as of September 29, 2010

On September 29, 2010, the Court issued an Order extending the CCAA stay period by seven days from October 29, 2010 to and including November 5, 2010. A copy of the Order can be found on this website.

Status of file as of September 28, 2010

The Applicants have advised the Monitor that the potential purchaser of the Gorham mill has advised the Applicants that it is unable to satisfy the financing condition under the Asset Purchase Agreement. Accordingly, the Applicants served the potential purchaser with the requisite notice of termination on September 28, 2010. It is the Monitor's understanding that the Applicants will continue to try to sell the Gorham facility on a going concern basis. In the meantime, the Gorham mill will be shut down indefinitely on or about October 13, 2010, subject to receiving acceptable orders from customers.

Status of file as of September 22, 2010

On September 20, 2010, the Applicants notified the service list and the Court that they and the potential purchaser of the Gorham mill had agreed to a Fifth Amendment to the Asset Purchase Agreement dated May 21, 2010, whereby the deadline for securing a financing commitment for the sale was extended to 11:00pm on September 22, 2010. The Monitor supports the short-term extension of the financing condition to preserve the ability of the assets to be sold as a going concern. A copy of the Applicants notification and the Fifth Amendment can be found in the Notices section of this Website.

Status of file as of August 24, 2010

At a court hearing held on August 12, 2010, the Court issued an Order approving the terms of a Settlement Agreement between Fraser Papers Limited ("Fraser US"), Fraser Papers Inc ("Fraser Papers"), Park Falls Operator LLC and Flambeau River Papers LLC; and authorizing Fraser US and Fraser Papers to complete the closing of the transaction described in the Settlement Agreement.

The Order issued by the Court also discharged all security interests of Fraser US, and any party claiming through Fraser US, in the Boiler (as defined in the Settlement Agreement) and released Fraser US and Fraser Papers from any further liability in connection with the Landfills from and after the Closing Date (as defined in the Settlement Agreement).

Status of file as of August 4, 2010

The Applicants have filed motion material, returnable August 12, 2010, seeking an Order:

(i) approving the terms of a Settlement Agreement between Fraser Papers Limited ("Fraser US"), Fraser Papers Inc. ("Fraser Papers") and Flambeau River Papers LLC and authorizing Fraser US and Fraser Papers to complete the closing of the transaction described in the Settlement Agreement ("Closing");

(ii) discharging all security interest of Fraser US and any party claiming through Fraser US, in the Boiler (as defined in the motion materials) upon Closing;

(iii) releasing Fraser US and Fraser Papers from any further liability in connection with the Landfills (as defined in the motion materials) upon Closing; and (iv) such further and other relief as the Court deems just.

The Applicant's Motion Material is available in the Motion Materials section of this website.

Status of file as of July 12, 2010

At a court hearing held on July 7, 2010, the Court issued an Order approving the sale of the Gorham Mill and vesting the assets in the purchaser, MB Growth Partners II, LP and/or such other person(s) it may designate as Designated Purchaser of the Purchases Assets. The Monitor understands that the closing of the sale is scheduled on or around August 31, 2010, assuming all outstanding conditions precedent are satisfied prior to that date.

At the July 7, 2010 hearing the Court also issued an Order extending the Stay of Proceedings to October 29, 2010, approving the offer solicitation process for the sale of the Applicants' two lumber mills located in Ashland and Masardis, Maine, amending the Initial Order, and appointing Andrew Diamond as Claims Officer in addition to Justice Ground. Copies of the issued Orders may be found in the Canadian Court Orders section of this website.

The Monitor understands that the Applicants intend to seek recognition of the Canadian Court Order and approval of the sale of the Gorham Mill at a court hearing in the United States Bankruptcy Court for the District of Delaware returnable on July 14, 2010.

Status of file as of July 5, 2010

The Applicants have filed motion material, returnable July 7, 2010, seeking an Order:

(i) extending the stay of proceedings to October 29, 2010;

(ii) amending the Initial Order to replace all references to Brookfield Asset Management Inc. as DIP Lender with BAM US, to replace all references to Amended DIP Term Sheet to DIP Loan agreement; and to confirm that the DIP Charge secures all amounts owing to BAM US at any time under the DIP Loan Agreement, in place of Brookfield Asset Management Inc.;

(iii) approving the sale of the Gorham Mill as contemplated in an asset purchase agreement between Fraser N.H. LLC ("Fraser Gorham") and MB Growth Partners II LP or its designated affiliates;

(iv) vesting in MB Growth, upon closing of the transaction contemplated in the Purchase Agreement, all the right, title and interest of Fraser Gorham in the Purchased Assets (as defined in the Purchaser Agreement) free and clear of all liens, charges and encumbrances except the Permitted Encumbrances as defined in the Purchase Agreement;

(v) establishing a process for the solicitation of offers for the Applicants' lumber mills located in Maine and outlining the terms of such process;

(vi) approving the appointment of Andrew Diamond as Claims Officer in this proceeding in addition to the Honourable John D. Ground; and

(vii) such further and other relief as the Court deems just.

The Applicant's Motion Materials and the Monitor's Report are available in the respective sections of this website.

Status of file as of June 14, 2010

The Monitor understands that the Applicants intend to seek approval of an extension of the stay of proceedings (which currently expires July 9) and approval of an asset purchase agreement in respect of the Gorham, New Hampshire facility at a court hearing on or about July 7, 2010. The Applicants' motion materials, when served, will be available on this website. The Monitor will issue a report in connection with this motion after the Applicant's materials have been served.

Status of file as of May 4, 2010

On April 30, 2010, the Applicants concluded the sale of the Thurso Mill to Fortress Specialty Cellulose Inc.

Any questions in respect of the Thurso Mill should be directed to Fortress Specialty Cellulose Inc. Questions with respect to the remaining operations of the Applicants or the CCAA filing should still be directed to the Applicants and/or the Monitor.

Status of file as of April 29, 2010

At a Court hearing on April 28, 2010, the Court issued an Order Amending the CIT Term Sheet and CIT DIP Charge.

Also, on April 28, 2010, the Applicants concluded the sale of the Specialty Papers Business to Twin Rivers Paper Company Inc. As a result, the Specialty Papers Business is now a stand-alone business, no longer owned by the Applicants. Any questions in respect of the ongoing Specialty Paper Business should be directed to Twin Rivers. Questions with respect to the remaining operations of the Applicants or the CCAA filing should still be directed to the Applicants and/or the Monitor.

A copy of the Applicant's motion material can be found in the Motion Materials section of this website.

Status of file as of April 27, 2010

The Applicants have filed motion material, returnable April 28, 2010, seeking an Order amending the Amended and Restated Order of the Court issued July 15, 2009 as thereafter amended with respect to the Amended CIT Term Sheet and CIT DIP Charge, and an Order providing such further and other relief as may be required in order to give effect to the relief sought.

Status of file as of April 14, 2010

At a court hearing held on April 13, 2010, the Court issued an Order approving the sale of the Thurso mill and vesting the assets in the purchaser, Fortress Specialty Cellulose Inc. The Monitor understands that the closing of the sale is scheduled on or around April 30, 2010.

A copy of the Order issued by the Court and the Endorsement of Justice Pepall are available in the Court Orders section of this website.

Status of file as of April 12, 2010

On April 9, 2010, the Monitor filed its Eleventh Report to the Court in support of the Applicant's request for final approval of the sale of the Thurso assets and a vesting Order. The Monitor's Eleventh Report to the Court is available in the Monitor Reports section of this website.

Status of file as of April 9, 2010

The Applicants have filed motion material, returnable April 13, 2010, seeking final approval of the sale of the Thurso assets, authorization to execute and deliver all definite documentation to permit the closing of the Purchase Agreement as defined in the Applicant's Motion Record, and an Order vesting in the purchaser, Fortress Specialty Cellulose Inc. all the rights, title and interest of the Applicants as Vendors in the assets being sold.

Status of file as of April 8, 2010

At a court hearing held on April 6, 2010, the Court issued an Order approving the sale of the Specialty Paper Business and vesting the assets in the purchaser, Twin Rivers Paper Company Inc.. The Court also issued an Order extending the Stay of Proceedings to July 9, 2010, increasing the authorized DIP financing amount and amending the Initial Order. Copies of the issued Orders may be found in the Canadian Court Orders section of this website. The Monitor understands that the closing of the sale of the Specialty Paper Business is now scheduled to be by the end of April 2010. Motion materials filed by the Applicants pursuant to the April 6, 2010 court hearing and the Monitor's Tenth Report to the Court are available in the Canadian Court Motion Materials and the Monitor Reports section of this website.

The United States Bankruptcy Court for the District of Delaware approved the recognition of the Canadian Court Order and the sale of the U.S. assets at a court hearing on April 7, 2010.

The Monitor understands that the Applicants intend to seek approval of the sale of the Thurso mill and a vesting order at a court hearing on or about April 13, 2010. The Applicants' motion materials, when served, will be available on this website. The Monitor will issue a report in connection with this sale motion after the Applicant's materials have been served.

On March 26, 2010, Paliare Roland Rosenberg Rothstein filed a Notice of Appearance advising that they would be representing the Committee of Salaried Employees and Retirees from Quebec in respect of certain aspects of the CCAA proceedings.

Status of file as of March 28, 2010

On March 16, 2010, the Applicants filed Motion materials in support of a Motion to amend the Court Order dated February 24, 2010 to reflect the revised closing date for the Asset Purchase Agreement and to correct certain typographical errors.

At a Court hearing on March 22, 2010, the Court issued an Order approving amendments to the Court Order dated February 24, 2010 and amendments to the Term Sheet for Global Agreement annexed as Appendix A to the February 24, 2010 Court Order.

Status of file as of March 10, 2010

The Monitor understands that the Applicants intend to seek final court approval of the Specialty Paper Business asset purchase agreement, the Global Agreement and a Vesting Order (all as defined below) from the Canadian courts on April 6, 2010 and from the US Court on April 7, 2010. The Applicants intend to serve motion materials on or about March 30, 2010, in support of this motion. The Monitor will issue a report after the motion materials have been served.

Status of file as of February 26, 2010

On February 19, 2010, the Applicants filed motion material to extend the Stay of Proceedings to April 9, 2010 and to either (i) authorize and direct the Applicants to amend the APA as necessary to extend the Termination Date of the APA and to re-attend before Court within thirty (30) days to seek final approval of the APA or (ii) to authorize the Applicants to commence an orderly liquidation of their assets, if the main conditions precedent of the APA had not been satisfied or agreements in principle had not been reached to satisfy the main conditions precedent prior to the Court hearing on February 24, 2010.

The Monitor filed its Ninth Report to the Court on February 22, 2010 and filed a Supplement to its Ninth Report on February 23, 2010 in support of the Applicants' requests.

At a court hearing on February 24, 2010, the Court issued an Order approving (i) the Global Agreement Term Sheet (an agreement in principle to satisfy the main conditions precedent of the APA) entered into by the Applicants, Communications, Energy and Paperworkers Union of Canada and The Province of New Brunswick, (ii) an amendment of the APA to extend the termination date to March 31, 2010 and (iii) an extension to the Stay of Proceedings to April 9, 2010.

A copy of he Global Agreement Term Sheet is appended to the Order of Justice Pepall dated February 24, 2010.

Status of file as of February 10, 2010

The existing Stay Period in Fraser Papers CCAA proceeding expires on February 26, 2010. As outlined in the Monitor’s 8th Report to the Court, no other offers to purchase the specialty papers business were received pursuant to the court approved sales process and, as a result, the sales process has now been terminated. The Monitor has been advised that if the conditions precedent under the Brookfield Asset Management Inc. asset purchase agreement (“APA”) are satisfied by February 24, then at a court hearing on February 24, the Applicants (Fraser Papers) intend to seek final approval of the APA, a vesting Order (conditional upon closing) and an extension of the existing Stay Period.

If the conditions precedent under the APA are not satisfied by February 24, and the Applicants and the Monitor do not believe that such conditions are likely to be satisfied, then on February 24, the Applicants will not seek approval of the APA, will advise the Court that no sale of the business as a going concern is possible and will seek alternate relief.

The Monitor understands that the Applicants intend to serve motion materials on or about February 19, 2010, which may include evidence in support of either alternate relief to be sought on February 24.

The Monitor will issue a report after the motion materials have been served.

Motion materials and the Monitor's Report will be posted on this website, when available.

Status of file as of February 2, 2010

As of January 26, 2010 (which was the extended deadline for third parties to submit letters of intent with respect to the purchase of Fraser Papers specialty papers business), no third party letters of intent had been received. As a result and in accordance with the Bid Process approved by the Court on December 10, 2009, Fraser Papers has now terminated the Bid Process. Fraser Papers is now working to clear the conditions precedent in respect of the offer submitted by Brookfield Asset Management Inc. ("BAM") with a view to closing the transaction as quickly as possible. If the conditions precedent get cleared, Fraser Papers will be seeking court approval of the proposed sale to BAM.

A report by the Monitor providing additional information with respect to the Bid Process is posted below.

Status as of December 11, 2009

On December 10, 2009, the Court issued an Order i) authorizing the Applicants to enter into and execute an asset purchase agreement (the “Sale Agreement”) with Brookfield Asset Management Inc. for the sale of the Specialty Paper Business; ii) approving the Bid Terms and authorizing and directing the Applicants and the Monitor to implement the Bid Terms, to effect the process for soliciting any other offers for the sale of the Specialty Papers Business; and iii) approving an extension of the Stay of Proceedings to February 26, 2010.

If any party is interested in acquiring the Specialty Paper Business of the Applicants, please contact Eric Castonguay of PwC at (416) 815-5094.

Status as of December 9, 2009

On December 7, 2009, the Monitor filed its Sixth Report to the Court in support of the Applicants request for approval of a sales process in respect of the Specialty Paper Business and an extension of the stay of proceedings to February 26, 2010. The Court will consider these requests at a hearing scheduled for 10:00 a.m. on December 10, 2009.

Status as of December 4, 2009

The Applicants have filed motion material, returnable December 10, 2009, to extend the stay of proceedings to February 26, 2010 and to commence a sales process with respect to the Specialty Paper Business.

Status as of December 3, 2009

On December 2, 2009, the Court issued an Order approving, among other things, the extension of the Stay Period to December 11, 2009.

Status as of November 27, 2009

On December 2, 2009, the Companies will be seeking a one week extension of the Stay of Proceedings to December 11, 2009. The Companies intend on filing material later this week in respect of a longer term extension of the Stay of Proceedings.

Status as of October 22, 2009

On October 22, 2009, the Court issued an Order approving an extension of the Stay Period from October 23, 2009 to December 4, 2009.

The Court also issued orders with respect to representative legal counsel appointed to represent the current members and former members of the CEP, USW and all other current and former employees. The claims bar date for all employee related claims was also extended to October 30, 2009.

Status as of October 21, 2009

On October 20, 2009, the Monitor filed its Fifth Report to Court in support of the Applicants’ request for an extension of the Stay of Proceedings and to provide the court with updates on various matters.

Status as of October 13, 2009

On October 9, 2009, the Court issued an Order approving an extension of the Stay Period from October 15, 2009 to October 23, 2009 – this order was necessary due to the judge not sitting in the week of October 13 to 16.

Status as of September 17, 2009

On September 17, 2009, the Court issued an Order appointing Davies Ward Phillips and Vineberg (“Davies”) as representative counsel for employees, former employees and beneficiaries not otherwise represented. A copy of this order is attached below and more information can be obtained from Davies’ web site. Current and former employees who are/were members of a union are being represented by their respective unions’ legal counsel and are therefore not being represented by Davies.

The Applicants and the Monitor agreed to extend the Claims Bar Date as it relates only to Claims asserted by, or on behalf of, current and former employees against the Applicants or the Directors to October 23, 2009. The Applicants and the Monitor are recommending that the Court grant a further extension of the Claims Bar Date for those types of Claims only, to October 30, 2009. The Claims Bar Date of September 30, 2009 continues to apply in respect of all other Claims, and has now expired.”

Status as of September 10, 2009

On September 8, 2009, the Court issued an Order approving i) the process for the determination of the value of the SERP participants’ claims; and ii) amending the Initial Order and Claims Order.

Status as of September 9, 2009

On September 3, 2009, the Monitor filed its Fourth Report to Court, in support of the Applicants’ motion dated September 8, 2009, to provide the Court with information pertaining to the (i) requests for appointment of representative counsel for unrepresented employees and retirees (ii) the process for determination of the value of SERP participants’ claims; (iii) status of the Applicants’ operations; and (iv) requests for amendments to the Initial Order and Claims Order.

Status as of August 7, 2009

On August 7, 2009, the Monitor sent to each known creditor of the Applicants a Proof of Claim Package. If you believe that you have a Claim against any or all of the Applicants and/or its current or former Directors you must file a Proof of Claim form with the Monitor. All Proofs of Claim for Claims arising prior to June 18, 2009 must be received by the Monitor before 5:00 pm (Eastern Standard Time) on September 30, 2009 (the “Claims Bar Date”), unless the Monitor and the Applicants agree in writing or the Court orders that the Proof of Claim be accepted after that date. All Proofs of Claim for Restructuring Claims, arising out of the restructuring, repudiation or termination after June 18, 2009 of any contract, lease or other agreement, whether oral or written, by any of the Applicants must be received by the Monitor before 5:00 p.m. (Eastern Standard Time) on the date which is the earlier of thirty (30) calendar days after the event giving rise to the Restructuring Claim or seven (7) calendar days prior to the date fixed by the Court for voting upon a Plan (the “Restructuring Claims Bar Date”).

Proofs of Claim must be received by the Monitor by the Claims Bar Date or the Restructuring Claims Bar Date or your claim will be forever barred and extinguished and you will not be entitled to participate in any Plan.

Status as of July 16, 2009

On July 15, 2009, the Court approved an Order approving a extension of the Stay Period and approving the claims process.

The Monitor mailed Proof of Claim Document Packages to all known creditors of the Applicants'.

For companies that had a claim against the Applicants a process was established to submit their claims and the Claims Bar Date (September 30, 2009) has now passed and all other claims are now barred and extinguished forever.

Status as of July 14, 2009

On July 14, 2009, the Monitor filed its Third Report to Court to provide the Court with information pertaining to the Applicants' operations during the Stay Period, the Applicants' proposed claims process, the Monitor's activities during the Stay Period and to support the extension of the Stay.

Status as of July 8, 2009

The Applicants intend to seek an extension of the stay of proceedings as well as approval for a claims process at a hearing on July 15, 2009.

Status as of June 30, 2009

On June 30, 2009, Madam Justice Pepall issued an order prohibiting the Applicants to make past service contributions or special payments in respect of its pension plans, in addition to other requested relief.

Status as of June 18, 2009

The Companies obtained Stays of Proceedings.

This Web site will be updated as information becomes available.

For more information, please contact: Michelle Pickett.