We unite expertise and tech so you can outthink, outpace and outperform

We unite expertise and tech so you can outthink, outpace and outperform

PwC's 29th Global CEO survey - Middle East findings

Middle East CEOs remain among the most confident globally. Enormous value is in motion across the region, backed by strong domestic momentum, rising capital inflows and an active deal environment. Business leaders are focused on long-term growth, scaling AI and building resilience to manage risk

Value in motion

The Middle East’s time to lead is now

Trillions of dollars are in motion as AI, climate and trade reshape global growth – setting the stage for a bold new economic future.

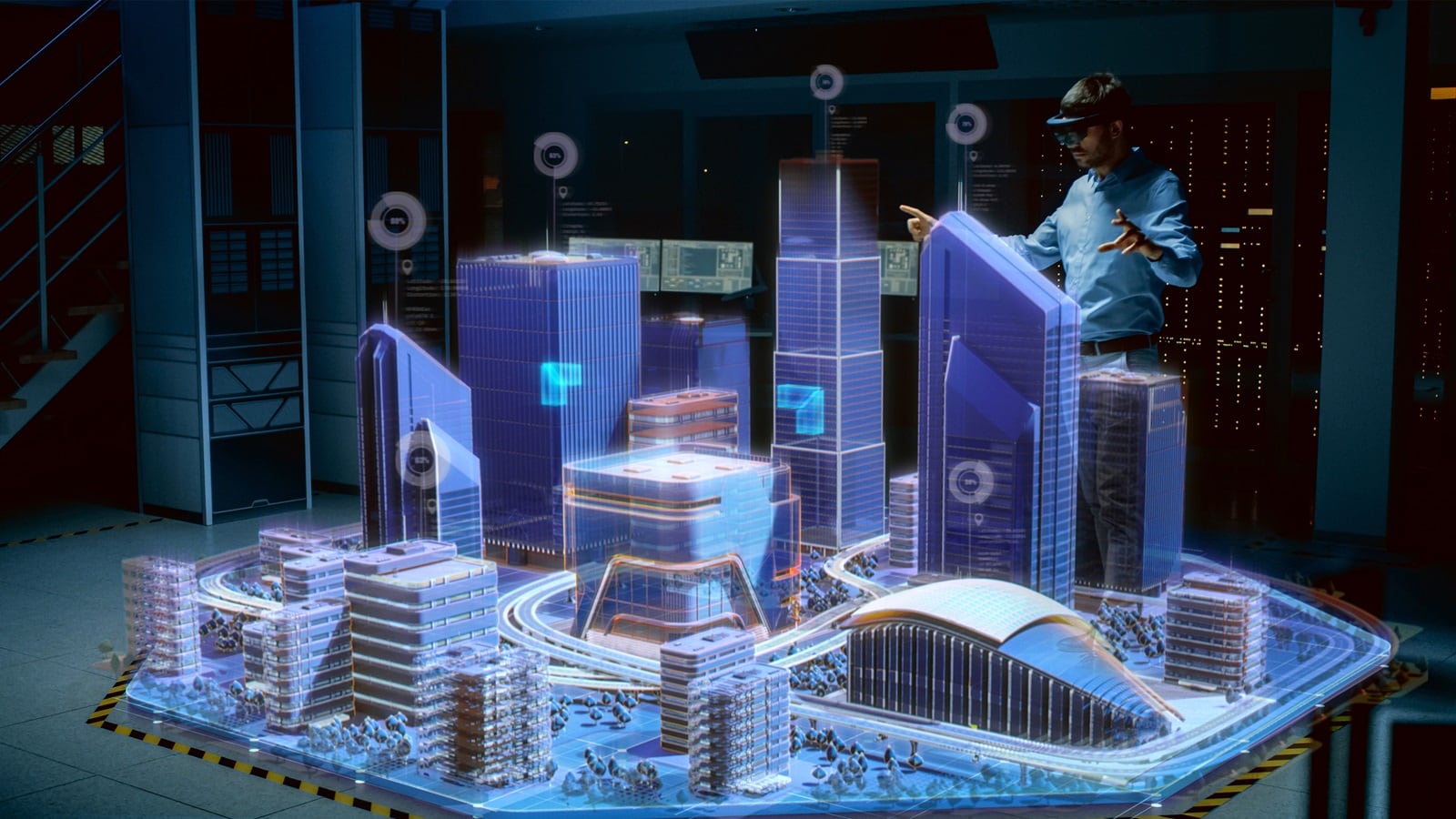

Tech powered

Explore human-led and tech-powered insights, delivering the latest thinking from across the Middle East technology landscape.

Transforming our Region: PwC’s 29th Global CEO Survey Middle East findings

We were delighted to be joined by colleagues and guests for this month’s edition of the Transforming Our Region webcast on Tuesday, 27 January, hosted by Stephen Anderson, Chief Strategy & Technology Officer, PwC Middle East.

Stephen was joined by Mona AbouHana, Chief Corporate & Network Officer; Jing Teow, Economics & Sustainability Partner; and Romil Radia, Regional Valuation Partner and Deals COO, PwC Middle East, who presented the key findings from PwC’s 29th Global CEO Survey: Middle East findings.

This year’s survey delivered our most comprehensive perspective to date, drawing on insights from over 300 CEO responses across 11 countries. It provided a clear view of the regional macroeconomic outlook, growth and investment priorities, AI-led transformation agendas, and leadership confidence amid rapid technological change and ongoing geopolitical uncertainty.

The message from Middle East CEOs was clear and compelling: confidence is rising, ambition is accelerating, and transformation is imperative to create long-term value.

Issues

Middle East businesses and governments are constantly adapting to change and uncertainty as a way of life.

Careers

PwC is all about you. Whether you're just starting out or are an experienced professional, your future starts here.

Media Centre

Keep up with our latest news and articles on current issues, check out the recent TV and radio interviews with PwC experts.